-

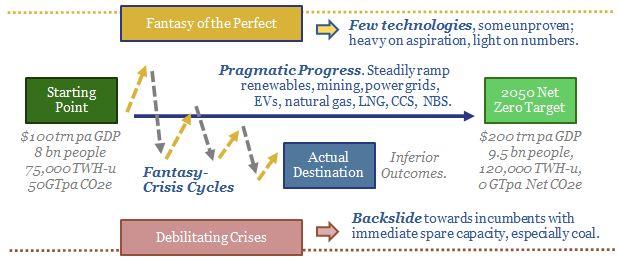

Energy transition: the fantasy of the perfect?

This 14-page note explores an alternative framework for energy transition: what if the fantasy of the perfect consistently de-rails good pragmatic progress; then the world back-slides to high-carbon energy amidst crises? We need to explore this scenario, as it yields very different outcomes, winners and losers compared with our roadmap to net zero.

-

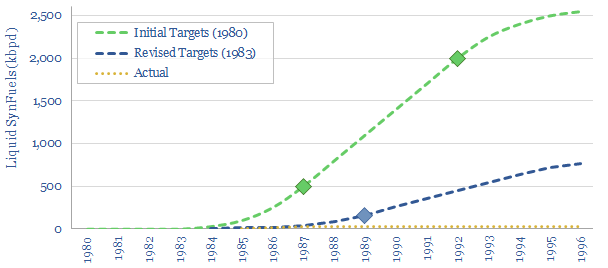

Energy policy: unleashing new technologies?

Does policy de-risk new technology? This 10-page note is a case study. The Synthetic Fuels Corporation was created by the US Government in 1980. It was promised $88bn. But it missed its target to unleash 2Mbpd of next-generation fuels by 1992. There were four challenges. Are they worth remembering in new energies today?

-

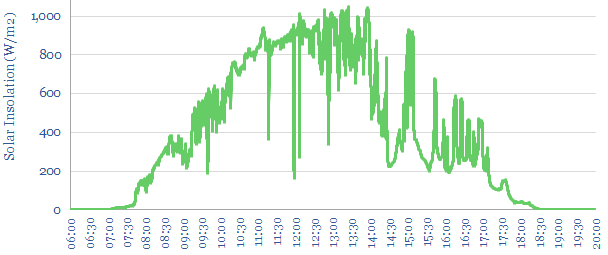

Solar volatility: tell me lies, tell me sweet little lies?

This 20-page note quantifies the statistical distribution of short-term volatility at solar power plants. Solar output typically flickers downwards by over 10%, around 100 times per day. Can industrial processes truly be ‘powered by solar’? What are the best opportunities to buffer the volatility and what are their costs?

-

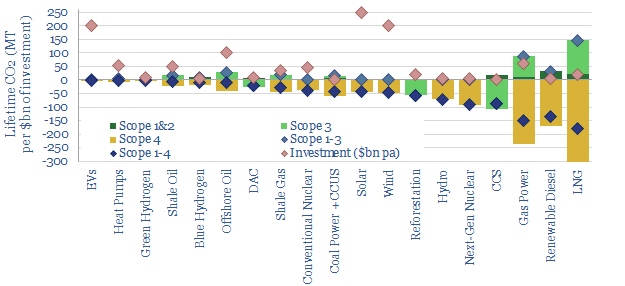

Scope 4 emissions: avoided CO2 has value?

Scope 4 CO2 emissions reflect the CO2 avoided by an activity. This 11-page note argues the metric warrants more attention. It yields an ‘all of the above’ approach to energy transition, shows where each investment dollar achieves most decarbonization and maximizes the impact of renewables.

-

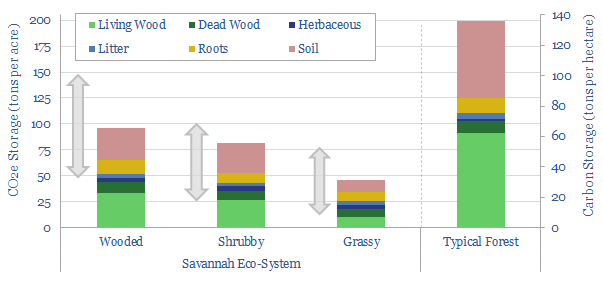

Savanna carbon: great plains?

Savannas are an open mix of trees, brush and grasses. They comprise up to 20% of the world’s land, 30% of its CO2 fixation, and their active management could abate 1GTpa of CO2 at low cost. This 17-page research note was inspired by exploring some wild savannas and thus draws on photos and observation.

-

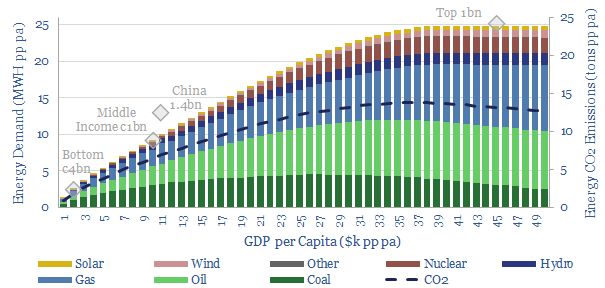

Energy shortages: priced out of the world?

Deepening energy shortages in 2022-30 could devastate low-income countries, geopolitically isolate the West, and de-rail decarbonization. This 13-page note evaluates the linkage between energy consumption and income over the past half century and quantifies what a ‘just transition’ would look like.

-

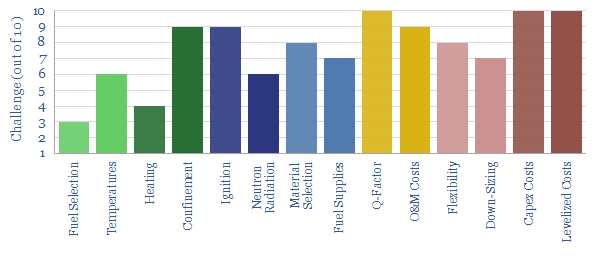

Nuclear fusion: what are the challenges?

Nuclear fusion could provide a limitless supply of zero-carbon energy from the 2030s onwards. The goal of this 20-page note is simply to understand the challenges for fusion reactors, especially deuterium-tritium tokamaks. Innovations need to improve EROI, stability, longevity and costs.

-

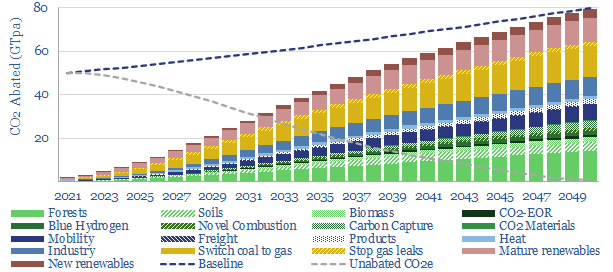

Decarbonizing global energy: the route to net zero?

This 18-page report revises our roadmap for the world to reach ‘net zero’ by 2050. The average cost is still $40/ton of CO2, with an upper bound of $120/ton, but this masks material mix-shifts. New opportunities are largest in efficiency gains, under-supplied commodities, power-electronics, conventional CCUS and nature-based CO2 removals.

-

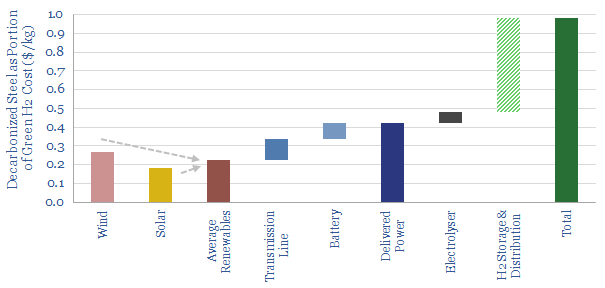

Green steel: circular reference?

Steel explains almost c10% of global CO2. Hence 2021 has seen the world’s first green steel, made using green hydrogen. Yet inflation worries us. At $7.5/kg H2, green steel would cost 2x conventional steel. In turn, doubling the global steel price would re-inflate green H2 costs. This note explores inflationary feedback loops and other options…

-

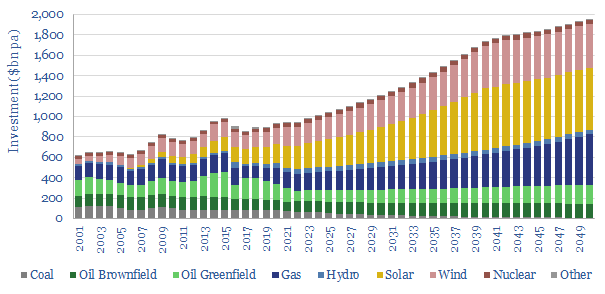

Is the world investing enough in energy?

Global energy investment in 2020-21 has been running 10% below the level needed on our roadmap to net zero. Under-investment is steepest for solar, wind and gas. Under-appreciated is that each $1 dis-invested from fossil fuels must be replaced with $25 in renewables. Future capex needs are vast.

Content by Category

- Batteries (85)

- Biofuels (42)

- Carbon Intensity (49)

- CCS (63)

- CO2 Removals (9)

- Coal (38)

- Company Diligence (88)

- Data Models (808)

- Decarbonization (158)

- Demand (106)

- Digital (52)

- Downstream (44)

- Economic Model (196)

- Energy Efficiency (75)

- Hydrogen (63)

- Industry Data (270)

- LNG (48)

- Materials (79)

- Metals (70)

- Midstream (43)

- Natural Gas (146)

- Nature (76)

- Nuclear (22)

- Oil (162)

- Patents (38)

- Plastics (44)

- Power Grids (119)

- Renewables (149)

- Screen (110)

- Semiconductors (30)

- Shale (51)

- Solar (67)

- Supply-Demand (45)

- Vehicles (90)

- Wind (43)

- Written Research (342)