-

Green Hydrogen Economy: Holy Roman Empire?

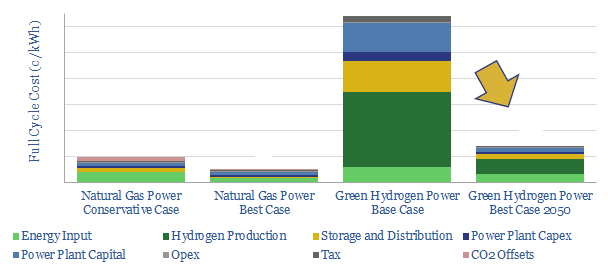

We model the green hydrogen value chain: harnessing renewable energy, electrolysing water, storing the hydrogen, then generating usable power in a fuel cell. Today’s costs are very high, at 64c/kWh. Even by 2050, our best case scenario is 14c/kWh, which elevates household electricity bills by $440-990/year compared with decarbonizing natural gas.

-

Ten Themes for Energy in the 2020s

We presented our ‘Top Ten Themes for Energy in the 2020s’ to an audience at Yale SOM, in February-2020. The audio recording is available below. The slides are available to TSE clients.

-

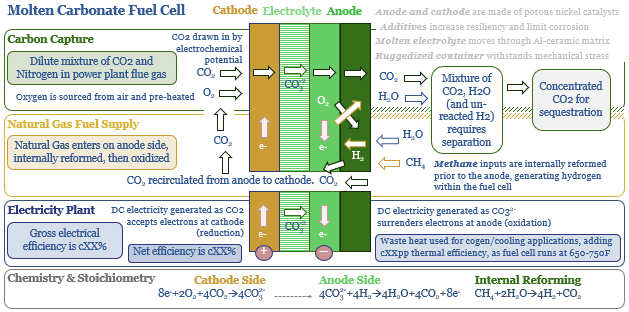

MCFCs: what if carbon capture generated electricity?

Molten carbonate fuel cells (MCFCs) could be a game-changer for CCS and fossil fuels. They capture CO2 from combustion facilities; while at the same time, generating electricity from natural gas. The first pilot plant is being tested in 1Q20, by ExxonMobil and FuelCell Energy. Economics range from passable to phenomenal.

-

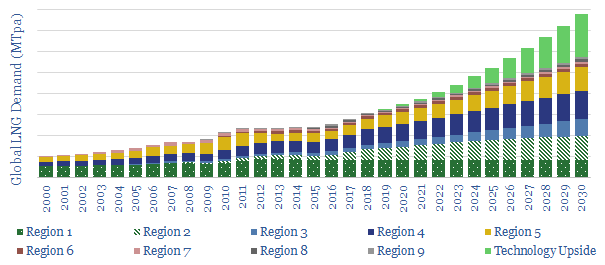

The Ascent of LNG?

This note outlines 200MTpa of potential upside to consensus LNG demand, due to emerging technologies, in power and transportation. LNG use could thus compound at an 8% CAGR to 800MTpa by 2030, justifying greater investment in unsanctioned LNG projects.

-

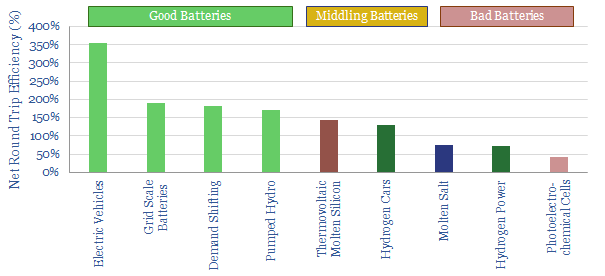

Good Batteries vs Bad Batteries?

A “good battery” enhances the efficiency of the total energy system. A “bad battery” diminishes it. Hence we have quantified battery quality, ranging from 3.5x efficiency gains for EVs to c30% efficiency losses for grid-scale hydrogen. This distinction must not be overlooked in the world’s quest for cleaner energy.

Content by Category

- Batteries (87)

- Biofuels (42)

- Carbon Intensity (49)

- CCS (63)

- CO2 Removals (9)

- Coal (38)

- Company Diligence (92)

- Data Models (822)

- Decarbonization (159)

- Demand (110)

- Digital (58)

- Downstream (44)

- Economic Model (200)

- Energy Efficiency (75)

- Hydrogen (63)

- Industry Data (275)

- LNG (48)

- Materials (81)

- Metals (74)

- Midstream (43)

- Natural Gas (146)

- Nature (76)

- Nuclear (23)

- Oil (162)

- Patents (38)

- Plastics (44)

- Power Grids (124)

- Renewables (149)

- Screen (112)

- Semiconductors (30)

- Shale (51)

- Solar (67)

- Supply-Demand (45)

- Vehicles (90)

- Wind (43)

- Written Research (347)