-

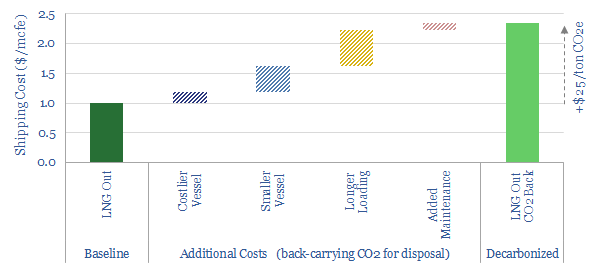

Decarbonized gas: ship LNG out, take CO2 back?

This note explores an option to decarbonize global LNG: (i) capture the CO2 from combusting natural gas (ii) liquefy it, including heat exchange with the LNG regas stream, then (iii) send the liquid CO2 back for disposal in the return journey of the LNG tanker. There are some logistical headaches, but no technical show-stoppers. Abatement…

-

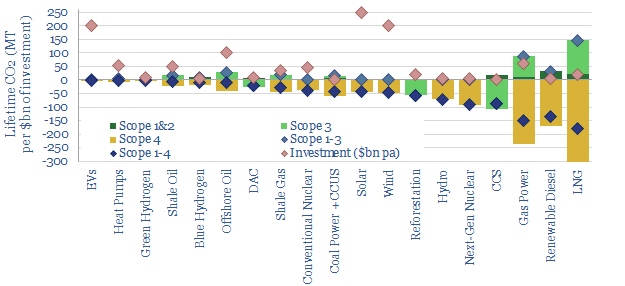

Scope 4 emissions: avoided CO2 has value?

Scope 4 CO2 emissions reflect the CO2 avoided by an activity. This 11-page note argues the metric warrants more attention. It yields an ‘all of the above’ approach to energy transition, shows where each investment dollar achieves most decarbonization and maximizes the impact of renewables.

-

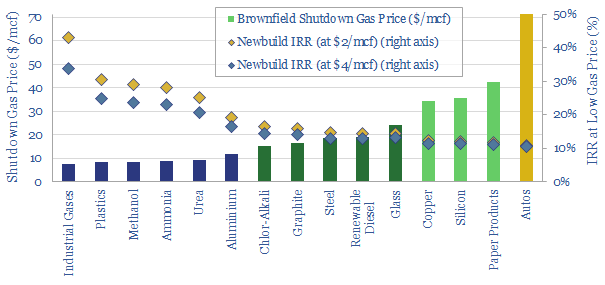

Gas diffusion: how will record prices resolve?

Dispersion in global gas prices has hit new highs in 2022. Hence this 17-page note evaluates two possible solutions. Building more LNG plants achieves 15-20% IRRs. But shuttering some of Europe’s gas-consuming industry then re-locating it in gas-rich countries can achieve 20-40% IRRs, lower net CO2 and lower risk? Both solutions should step up. What…

-

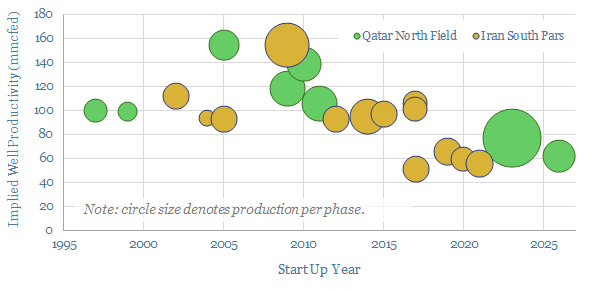

North Field: sharing the weight of the world?

The North Field is now the most important conventional energy asset on the planet. It produces 4% of world energy, 20% of global LNG and aims to ramp another 50MTpa of low-carbon LNG by 2028. But what if Qatar’s exceptional reliability gets disrupted by unforeseen conflict with Iran?

-

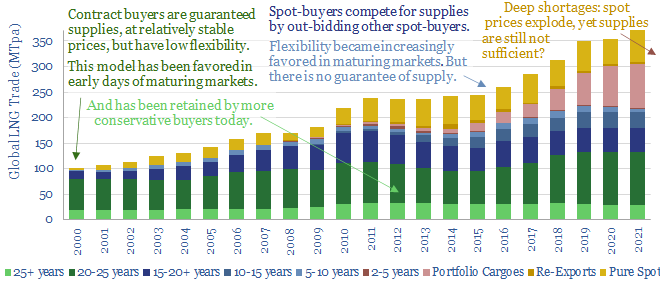

Energy security: the return of long-term contracts?

Spot markets have delivered more and more ‘commodities on demand’. But is this model fit for energy transition? Many markets are now short, causing explosive price rises. Sufficient volumes may still not be available at any price. This note considers a renaissance for long-term contracts.

-

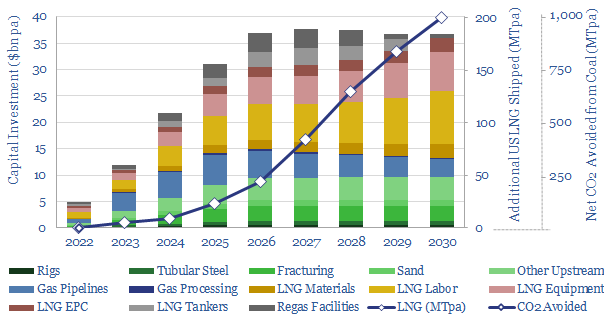

US LNG: new perceptions?

Perceptions in the energy transition are likely to change in 2022, amidst energy shortages, inflation and geopolitical discord. The biggest change will be a re-prioritization of US LNG. At $7.5/mcf, there is 200MTpa of upside by 2030, which could also abate 1GTpa of CO2. This 15 page note outlines our conclusions.

-

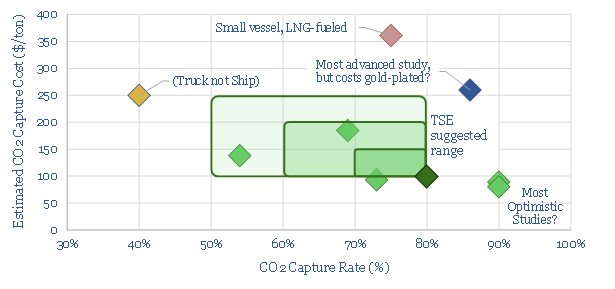

Carbon capture on ships: raising a sail?

CCS is adapting to go to sea. 80% of some ships’ CO2 emissions could be captured for c$100/ton and an energy penalty of just 5%, albeit this is the best case within a broad range. This 15-page note explores the opportunity, challenges, progress and who might benefit.

-

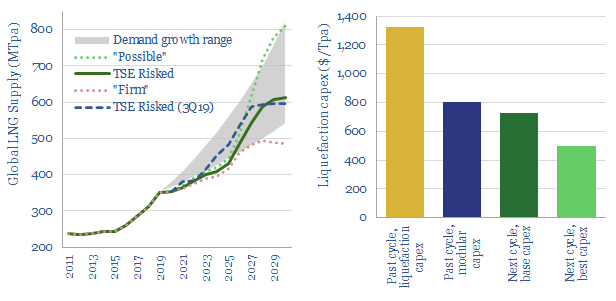

LNG in the energy transition: rewriting history?

A vast new up-cycle for LNG is in the offing, to meet energy transition goals, by displacing coal. 2024-25 LNG markets could by 100MTpa under-supplied, taking prices above $9/mcf. But emerging technologies are re-shaping the industry, so well-run greenfields may resist the cost over-runs that marred the last cycle.

-

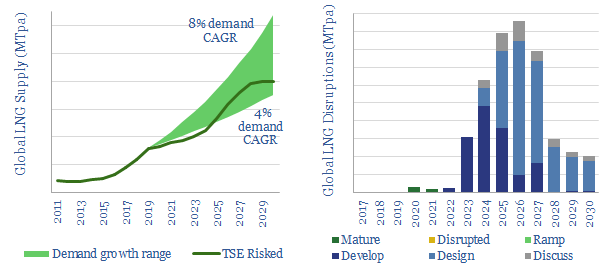

LNG: deep disruptions?

There is now a potential 100MTpa shortfall in 2024-26 LNG markets. The current COVID-crisis will likely cause a further 15-45MTpa of supply-disruptions (delays in 2022-24, deferrals in 2024-7). This 6-page note draws out our top insights from looking line-by-line through 120 LNG projects.

-

Ten Themes for Energy in the 2020s

We presented our ‘Top Ten Themes for Energy in the 2020s’ to an audience at Yale SOM, in February-2020. The audio recording is available below. The slides are available to TSE clients.

Content by Category

- Batteries (87)

- Biofuels (42)

- Carbon Intensity (49)

- CCS (63)

- CO2 Removals (9)

- Coal (38)

- Company Diligence (91)

- Data Models (821)

- Decarbonization (159)

- Demand (110)

- Digital (58)

- Downstream (44)

- Economic Model (200)

- Energy Efficiency (75)

- Hydrogen (63)

- Industry Data (275)

- LNG (48)

- Materials (81)

- Metals (74)

- Midstream (43)

- Natural Gas (146)

- Nature (76)

- Nuclear (23)

- Oil (162)

- Patents (38)

- Plastics (44)

- Power Grids (123)

- Renewables (149)

- Screen (112)

- Semiconductors (30)

- Shale (51)

- Solar (67)

- Supply-Demand (45)

- Vehicles (90)

- Wind (43)

- Written Research (347)