Nature based solutions to climate change are among the largest and lowest cost options to decarbonize the global energy system. Looking across 1,000 pages of our research and over 200 data files, this short note summarizes the opportunity.

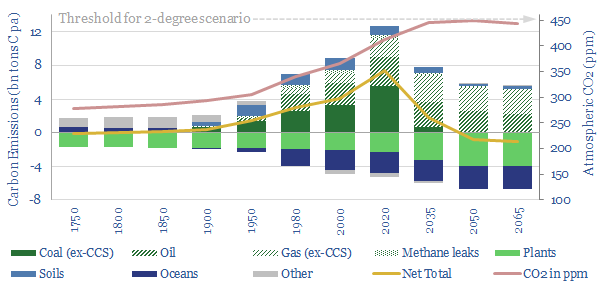

Manmade CO2 emissions currently exceed 40bn tons per year, which is equivalent to 11.6bn tons of carbon. This is part of a ‘carbon cycle’. For example, 120bn gross tons of carbon are fixed every year through photosynthesis, which naturally sequesters 2.3bn net tons of carbon from the atmosphere. Decarbonization models should consider the entire carbon cycle, to find the most economic route to reach ‘net zero’ CO2 by 2050, while limiting atmospheric CO2 below 450ppm (2C).

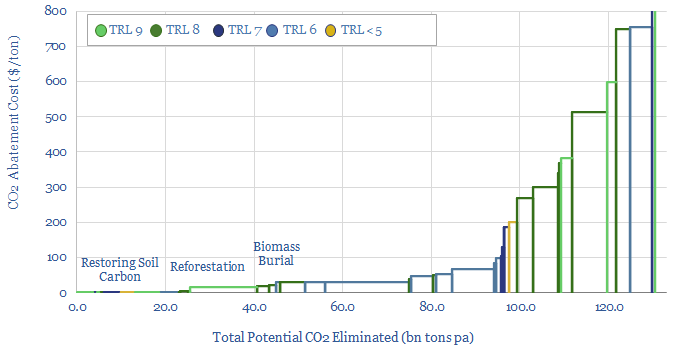

Decarbonizing fossil fuels with nature based solutions can be much more economic than displacing them with alternatives, we find, based on all of our research, data and models into the energy transition (cost curve here).

Low costs decarbonization matters for consumers. As an example, the average developed world household currently spends $750-950 per year on heating, emitting 2.6T of CO2. No one wants to stop heating their homes. But we do want to stop the CO2 emissions. The most economic option is to use an efficient natural gas boiler, then carbon-offset the natural gas with nature based solutions. This would raise a typical household heating bill by $50 per year. Conversely, the bill would rise by $600-2,600 per year, if relying solely on renewables, biogas or hydrogen (chart below). Similarly attractive conclusions hold for decarbonized gas in the power sector.

Reforestation is the largest nature based opportunity, with potential to absorb 15bn tons of CO2 per year, across 3bn incremental acres (8% of the world’s land mass), as outlined in our recent deep-dive note. These CO2 offsets must be verified using advanced technologies and we have screened exciting companies in this space. They must also be safeguarded using corporate balance sheets, to guarantee that CO2 is genuinely offset. The costs of forest-based CO2 credits will be between $10-50/ton, in our models.

Soil restoration is the second nature based opportunity, with potential to sequester another 3-15bn tons of CO2 per year, using a growing agricultural practice called conservation agriculture. Economics can be exceptional. If CO2 credits are sold at $20/ton, the best farms would make more money farming carbon than crops. This matters as one third of the atmosphere’s post-industrial CO2 derives from degradation of soil carbon. Fertilizer demand would also halve in this scenario.

The need for land is one of the largest pushbacks on nature based solutions, addressed using granular data in our recent note. Our numbers only assume forests will sequester 5T of CO2 per acre per year. But CO2 offsets can be uplifted to 15-25T per acre per year via planting faster-growing grasses, and then burying the biomass (data here). This would save 8x more CO2 per acre than present attempts to displace fossil fuels in the biofuels industry. Precision engineered proteins could also free up 485M acres in the US alone.

Another option is to push into the world’s 11bn acres of arid or semi-arid land, by irrigating deserts, possibly using desalination technology. Unfortunately, the numbers do not work in the most arid deserts, where each ton of CO2 absorbed by new trees would require >300 tons of water, cost >$500/ton of CO2 and emit >0.4 tons of CO2 (below right). An additional 100mm of rainfall-equivalents could, however, green marginal lands for $60-120/ton of CO2 costs. There is historic precedent from Israel’s Negev desert (below left). The best opportunity we can find uses produced water from the Permian basin

A final option is to extend the opportunity into oceans, which are 2.5x larger than all the world’s land. Although these methods and their consequences are less clear-cut.

None of this is to exonerate industrial companies from reducing emissions and improving their energy efficiency. Opportunities to do this remain a core focus in our research, and in our models of the energy transition.

Energy companies can uplift their margins by 15-25% by selling CO2 credits alongside their fuels to yield ‘decarbonized fuels’, both for oil products and for natural gas. Together with CO2 reductions and leading technologies, we find companies can uplift their valuations by 50% as they move their businesses to ‘net zero’.

It is fully possible to meet the world’s energy needs in 2050, even as aggregate global demand almost doubles from today’s levels, while also achieving ‘net zero’ CO2 within the confines of 450ppm. Our models foresee c90Mbpd of long-term oil demand (still equivalent to 1,000 barrels per second) and 400TCF of natural gas (3x growth on 2019 levels) in a fully decarbonized energy system.