“The key to climate change is not in the air, it’s in the ground. As a no till farmer, I’m doing my part… If [the carbon market] grows it will enact change. Farmers will change their practices”. These were the comments of an Iowa farmer that has now commercialized $330,000 of carbon credits from conservation agriculture. The case study shows how the carbon market is causing CO2-farming to expand and advance.

The opportunity farming carbon into soils?

We recently discussed the importance of agricultural carbon sequestration on the ‘Business of Agriculture’ podcast. This is one of the largest and lowest cost carbon sinks on the planet, albeit one that is mired in policy-controversies. (link here, video below).

To summarize, the organic carbon content of agricultural soils has fallen from c4% in pre-industrial times to around 1-2% today, due to mechanized agriculture, across the world’s 3bn acres of croplands. A practice called conservation agriculture restores soil carbon, through no till practices, crop rotations and cover-cropping (note below).

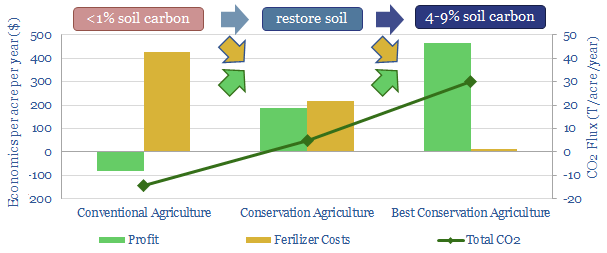

The economics can be transformational, increasing crop yields by 10-30%, while also cutting input costs by 50-80% (model below). Moreover, at a $35/ton CO2 price, a mid-West farmer could make more money farming carbon than farming corn.

Two side consequences are that we expect a vast uptick in activity to measure soil carbon (screen of companies below), while the global fertilizer industry could be disrupted, as some adoptees of conservation agriculture have been able to cut their fertilizer usage by 50-100% (screen also below).

Selling carbon credits from agriculture: a case study?

Another recent episode on the Business of Agriculture illustrated a detailed case study of how Conservation Agriculture is being adopted, resulting in the commercialization of carbon credits (link here, video below). Our own summary follows.

The podcast features Kelly Garrrett, a fifth-generation farmer in Iowa, whose family farms 6,300 acres, growing corn, soybeans, winter wheat and 420 beef cows. Mr Garrett states “The key to climate change is not in the air, it’s in the ground. As a no till farmer, I’m doing my part… If [the carbon market] grows it will enact change. Farmers will change their practices”. This claim may sound exaggerated, but note that all of the words soils store around 2,500bn tons of carbon, which is 3x more than the world’s atmosphere (sources and sinks data below).

Specifically, a group of carbon brokers, Nori, and an agricultural trade body, Xtreme Ag, have certified that Mr Garrett’s farm has sequestered an average of 1.15 tons of CO2 per acre per year, from 2015-2019, across 3,800 acres of the farm (For context, we estimated a lower bound of 1T of CO2 per acre per year in our own numbers into conservation agriculture).

The certification included reviewing the farm’s FSA records, crop insurance records and the use of no till, cover cropping and crop rotations. Hence, 22,000T of carbon is deemed to have been captured over this period, through conservation agriculture. These certified carbon credits are now being sold.

e-Commerce company, Shopify, the purchased 5,000 tons of the carbon credits, to offset the CO2 from their Black Friday sales in 2020, at a price of $15/ton. Additional buyers have recently bought 2,620 credits so far in 2021, but have not agreed to be named publicly. If Mr Garrett sells all 22,000 tons of carbon credits at $15/ton, that is $330,000 of income.

Supply and demand: an increasing source of carbon offsets?

A carbon price is expanding conservation agriculture. The ability to monetize carbon has led Mr Garrett to expand his focus on carbon farming. Another c3,300 acres across his farm is thus being transitioned to this carbon-restoring practice. Hence Mr Garrett plans to re-assess additional carbon capture on the farm, again through Nori, in 2022, when the additional carbon credits from 2020-22 will be sold.

A carbon price is increasing carbon absorption in soils. The ability to monetize carbon credits has also directly led Mr Garrett to explore new technologies that can sequester additional CO2 per acre. For example, Locus Ag commercializes a microbial additive called Rhizolizer Duo, which increases soil health, and thus increases both soil carbon (24% increase in root mass for corn crops) and crop yields (8-10bu/acre for corn). Acreage that sequesters 1T CO2 per acre per year can be trebled to sequester 3T CO2 per acre per year, Locus claims. More examples are featured on the Locus website

Conclusions: agriculture and the road to net zero?

Our own roadmap to ‘net zero’ assumes that restoring the carbon content of degraded agriculture soils can sequester 4bn tons of CO2 per year, at the bottom of the CO2 cost curve (below). The case study above shows the model is beginning to work in practice, and capable of snowballing.

We consider companies that can improve agricultural productivity and carbon sequestration potential to be among the non-obvious opportunities to drive the energy transition (screen below).