Neodymium is a crucial Rare Earth metal, used in permanent magnets for the ramp-up of wind turbines and electric vehicles. The market is small, growing rapidly. This could create opportunities, as bottlenecks and cost-inflation need to be kept in check. Hence this short note outlines our ‘top ten facts’ on the neodymium market.

(1) What is neodymium? Neodymium is the 60th element in the Periodic table, a rare-earth element, in the Lanthanide series. The most important use of Neodymium is in alloys with iron and boron, creating tetragonal crystals of Nd2Fe14B, which are some of the strongest permanent magnets known to mankind, capable of lifting over 1,000x their own weight. The alloy was discovered independently, by GM and Sumitomo, in the early 1980s.

(2) How are neodymium magnets used? These magnets are used in electric motors, generators (especially wind turbines) and other electronics (especially computer hard drives, audio equipment, and the accelerometers in cell phones). For example, each Toyota Prius might contain 1kg of neodymium (some vehicles use as much as 2.5kg), and a wind turbine might contain 125kg per MW of capacity (some direct-drive generator designs use 600kg/MW). These have been crucial themes in our recent research, as cost-inflation and bottlenecks need to be avoided (see below).

(3) Physics: How are magnets measured? The strength of a magnet is measures in Teslas. Specifically, a magnetic field with 1 Tesla’s strength will exert 1 Newton of force on a particle with 1 coulomb of charge that is moving perpendicular to the magnet at 1 meter per second. This is due to fundamental electro-magnetic laws of the Universe, such as the Lorentz Force Law. Ferrite magnets’ magnetic fields typically peak out at 0.5-1.0 Teslas, and this is for very large and heavy magnets. Nd2Fe14B magnets can have magnetic fields of 1.0-1.4 Teslas. They can also have very dense magnetic fields, of 200-440kJ/m3, making them compact. Finally, they are relatively “permanent” magnets, resisting demagnetization up to 750-2,000kA/m competing magnetic fields and temperatures up to 310-400ºC.

(4) The neodymium market? There are seventeen rare earth elements. Data here are opaque. Hence what follows is some simple ballparking, triangulating between online sources and technical papers. The global market for rare earth oxides is about 160-240kTpa in 2020, worth around $4bn per annum. Of the metals in these ores, c20% comprises the Neodymium market. Around 50kTpa of the Rare Earth ores are likely to be used to make 140kTpa of permanent magnets (the other components are not Rare Earths), worth as much as $14bn per year. The largest Rare Earth component in permanent magnets is Neodymium, comprising 27% by mass of Nd2Fe14B magnetic material. Overall, our best guess for neodymium market demand in 2021 is around 20-30kTpa. Total demand for Rare Earth Oxides is seen growing at 4% per annum by CRU. Nd-Pr is seen growing at 7% per annum. Roskill sees demand for permanent magnets in EV power-trains increasing at 17.5% per annum from 2021 to 2030. Total demand for these materials could thus rise 3-10x by 2050, among the fastest growth rates of any commodities in the energy transition research (chart below).

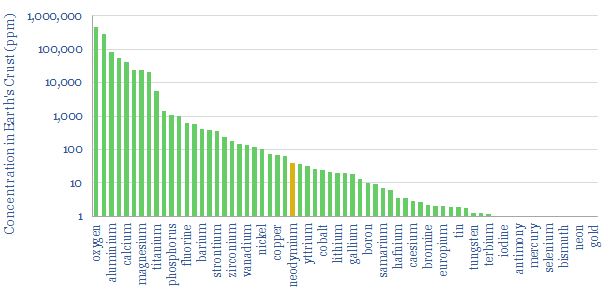

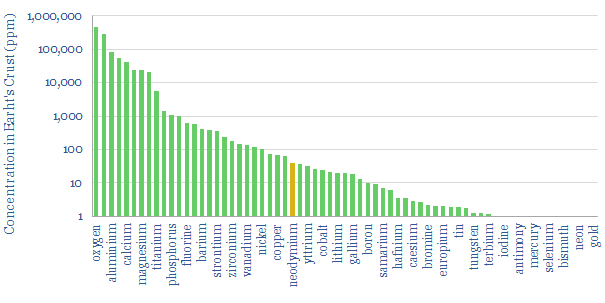

(5) Global reserves of Rare Earth metals have been estimated at 120MT by the USGS, equivalent to a 600-year reserve life. In turn, this might imply as much as 24MT of neodymium reserves, if neodymium comprises 20% of all Rare Earths. However, reserves of neodymium, specifically, have been more conservatively estimated at 8MT in other sources. Nevertheless, this still implies a c300-year reserve life at today’s current rate of production. The material’s total abundance in the Earth’s crust is 38mg/kg (38ppm). And this is actually “high” (chart below). For contrast, copper is 66pm, cobalt is 25ppm, lithium is 20ppm, uranium is 2pm, platinum is 0.004ppm and gold is 0.003ppm. This all suggests that there is no shortage of Neodymium in the Earth’s crust, only a possible shortage of projects to extract and upgrade it economically from high-grade ores.

(6) How is it produced? The two main ores for Neodymium are monazite and bastnasite. Neodymium comprises 10-18% of these minerals by mass. The ore is mined, crushed, screened, leached, precipitated, calcined, and then chemically separated and precipitated (e.g., using nitric acid) in order to produce Neodymium oxides with 99% purity. This is not dissimilar to other materials value chains that have crossed our screen, such as lithium, uranium or copper, and similar models could be translated across.

(7) Where is it produced? Output from Rare Earth mines runs at around 160-240kTpa, of which c20% is neodymium. c60% of global output is from China, primarily six state owned enterprises. Other large producers include Australia and Myanmar. Non-Chinese mine output has been increasing since 2015. But the mined materials are still largely refined in China, which supplies c85% of total refined rare earth production. As usual, this creates the Catch 22 of whether China’s decarbonization needs to go hand-in-hand with the West’s, or whether this is even possible without accelerating inflation even more so (note below).

(8) What does it cost? Neodymium prices have run around $60-70/kg in 2017-20. Prices have risen sharply in 2021 to around $160kg. Again, our nemesis of inflation is rearing its ugly head…

(9) What is the CO2 intensity? Carbon-accounting for rare earth materials is complex, because many materials are co-produced. Hence it is debatable how to allocate CO2 emissions across these different materials. One study estimated 12kg of CO2 emitted per kg of neodymium oxide (here), while another found 66kg of CO2 per kg of neodymium oxide (here). You can compare and contrast these CO2 intensities with other materials in our granular data-file of global CO2 emissions below.

(10) Which companies? China is the world’s largest producer of rare Earth materials, mining over 100kTpa, and refining c80% of global supply. Companies are also ramping up outside of China. One of the largest producers is MP Materials (NYSE-listed), which operates the Mountain Pass mine on the Nevada-California border, supplying and processing 15% of the world’s Rare Earths in 2020 (of which 11.5% is neodymium). Lynas Rare Earths (listed in Australia and the US) recently agreed to construct a 5kTpa rare earths separation plant in Texas, which will yield 1.25kTpa of neodymium-praseodymium, sourced from ores in Western Australia. Rare Element Resources is developing the Bear Lodge project, which comprises 18% neodymium by weight. Texas Minerals is progressing the Round Top Rare Earths project, of which 7% is neodymium. Finally, many of the uranium companies that have crossed our recent screens also co-produce Rare Earths, while we like this theme as we also see nuclear projects re-accelerating (uranium screen and uranium note).

Further research. We hope you have enjoyed this short note on the neodymium market. To receive our research as we send it out, then you are very welcome on our distribution list.