Polyurethanes are elastic polymers, used for insulation, electric vehicles, electronics and apparel. This $75bn pa market expands 3x by 2050. But could energy transition double historically challenging margins, by freeing up feedstock supplies? This 13-page note builds a full mass balance for the 20+ stage polyurethane value chain and screens 20 listed companies.

Polyurethanes are elastic and foam-able polymers, formed when diisocyanates combine with polyols. Specifically, a diisocyanate has the symmetrical chemical structure O=C=N-R1-N=C=O. (That N=C=O ‘cyanate’ group is also referred to as a ‘urethane’). Similarly, a di-ol (the simplest polyol) has the structure H-O-R2-O-H. Key chemistry on page 2.

Global demand for polyurethanes will be around 25MTpa in 2023 and treble by 2050, including for insulation, electric vehicles, power electronics, data-centers underpinning the rise of AI and in consumer applications, from Indian mattresses to European Mamils. Our outlook on these different uses of polyurethane is on pages 3-5.

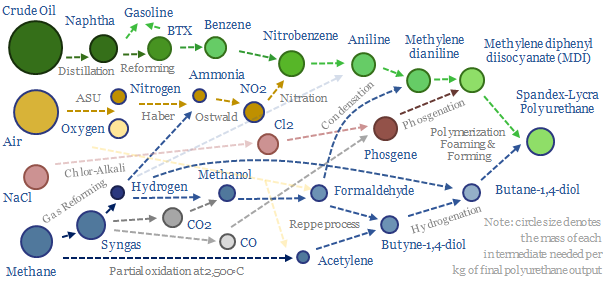

How is polyurethane made? Producing polyurethanes is a 20+ stage process, starting with oil and gas. The real work behind this note is to build up a full mass balance across this production process, so that we can map the amount of different input materials per kg of finished polyurethane products (pages 6-7).

What are the costs of polyurethane? The production costs of polyurethane will tend to average $2.5-3.0/kg at $65/bbl oil and $6/mcf input gas. Sensitivities to input oil and gas prices, and costs of decarbonization via using low-carbon hydrogen are broken down in our model here and discussed on pages 7-8.

Will the energy transition deflate feedstock costs for polyurethane? Our answer is emphatically yes, although the extent varies by geography, timing matters, and the answer also depends on the integration of producers (i.e., what input materials do they consume). Some polyurethanes can benefit from low-carbon hydrogen or directly absorb CO2. This is all mapped on pages 9-10.

Who are the leading companies in polyurethanes? 20 large and listed companies control c80% of the total global polyurethane market, and the five largest companies control half of the market. We have screened polyurethane producers, and mapped their exposure to growing markets and deflating feedstocks on pages 11-13.