HJT solar modules are accelerating, as they are efficient and easy to manufacture. But HJT could also be a kingmaker for Indium, used in transparent and conductive thin films (ITO). Our forecasts see primary Indium demand rising 4x by 2050. Indium is 100x rarer than Rare Earth metals. It could be a bottleneck. This 16-page note explores the costs and benefits of using Indium in HJT solar, and who benefits as solar evolves?

Solar energy is a semiconductor technology and thus it evolves quickly. Last year, we saw interest accelerate in TOPCon cells. This year, interest is accelerating in heterojunctions (HJT), due to even higher efficiency and simpler manufacturing (as explained on page 2).

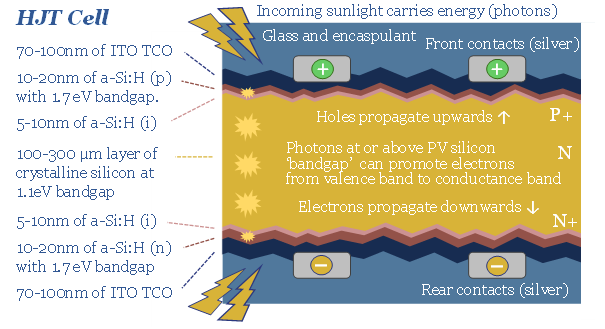

What is an HJT solar cell? The purpose of pages 3-4 in the PDF is to explain how HJTs work, concisely, using numbers, so that a reasonably science-literate decision maker can understand key advantages versus incumbent solar cells that comprised 80-90% of modules sold in 2019-21.

The very short answer is that HJTs benefit from conjoining different semiconductors, with different bandgaps, to capture more energy across the spectrum of incoming light. The higher bandgap semiconductor is amorphous Si:H. But it has low conductivity. And thus, for current to reach the electrical contacts, a transparent conducive oxide (TCO) thin film is needed. The most common TCO is ITO. ITO is 74% Indium (page 5).

What demand for Indium in HJT solar, and what will HJT solar do to total global Indium demand? There are scenarios where HJT solar cells could absorb 1-4x total global primary indium production. Modelling the energy transition is an exercise in minimizing overall ridiculousness. Hence our own models and assumptions are on pages 6-7.

How is Indium produced for ITO thin films and HJT solar cells? We describe the supply chain, including the association with zinc refining, and discuss Indium costs ($/kg), Indium energy use (MWH/kg) and Indium CO2 intensity (kg/kg) on pages 8-10.

Do Indium costs detract from solar? Some commentators argue that high cost materials, energy-intensive materials or CO2-intensive materials count against ramping up solar. Indium is a very high cost, energy intensive and CO2 intensive material. But the numbers on pages 11-12 show that HJT solar designs repay these costs about 10-100x over.

Will Indium be a bottleneck for HJT solar? The rise of HJT solar cells is compared with other bottlenecks in our solar bill of materials, quadrupling global demand for Indium, while using double the silver of incumbent solar cells. Bottlenecks are contrasted on page 13.

Leading producers of Indium? Indium could be a large bottleneck. Excitement over HJTs is also accelerating at a time when Indium prices are relatively low and many industrial metals are unloved in 2023’s macro environment. We have screened 35 indium producers. Eight listed companies are discussed on pages 14-16.