A new wave of direct air capture (DAC) companies has been emerging rapidly since 2019, targeting 50-90% lower costs and energy penalties than incumbent S-DAC and L-DAC, potentially reaching $100/ton and 500kWh/ton in the 2030s. Five opportunities excite us and warrant partial de-risking in this 19-page report. Could DAC even beat batteries and hydrogen in smoothing renewable-heavy grids?

Direct air capture (DAC) aims to pull CO2 out of atmospheric air in order to mitigate climate change caused by the greenhouse effect.

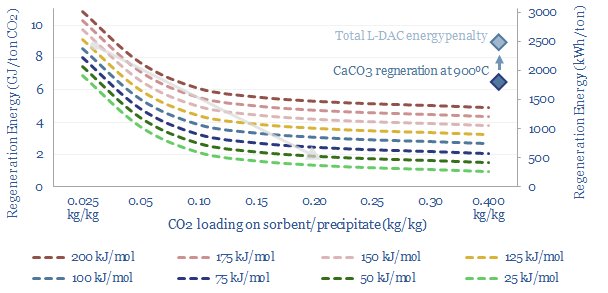

Historically, we have found DAC challenging to de-risk, due to high costs and high energy penalties, which are quantified on pages 2-4.

But the physics of DAC suggest that next-generation sorbents could deliver $100/ton costs and 500kWh/ton energy use (page 5).

Liquid DAC (L-DAC) uses alkali solvents to react with ambient CO2, and has gained prominence through Carbon Engineering and Occidental. Advantages and challenges of L-DAC are reviewed on page 6.

Solid DAC (S-DAC) uses sorbents to react with ambient CO2. Advantages and challenges of S-DAC are reviewed on page 7.

Next-generation sorbents are where we see the greatest potential for DAC to improve in the future. Exciting numbers on page 8.

Passive DAC and mineralization are two further options to lower the costs of blowing air and compressing CO2 for disposal (pages 9-12).

Can DAC demand shift to backstop renewables? Interestingly, we think the costs and energy penalties of decarbonizing hydrocarbons with DAC could be materially less than via green hydrogen (page 13).

Can DAC costs get to $100/ton? Our DAC economic model captures the capex costs, utilization rates, energy use, energy cost and opex that would be needed (pages 14-15).

Leading DAC companies have trebled in number over the past five years, concentrating around the next-generation opportunities above. Highlights from our DAC company screen are on pages 16-19.