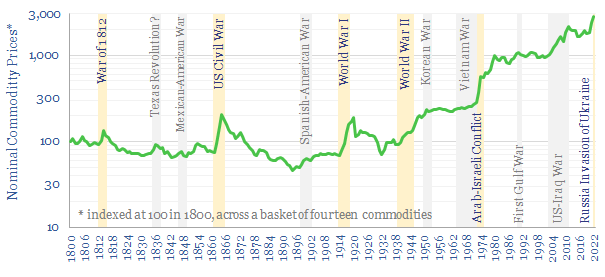

What happens to commodity prices during conflicts? This 10-page note charts how fourteen commodities were affected, across a dozen conflicts, going back to 1800. During major conflicts, 95% of commodities saw higher prices. The average commodity doubled. A strong role is implied for commodities hedging portfolios and even entire nations against conflicts.

Supply-demand models for global energy and materials have long worried us. We think the world has under-invested in energy by $1trn since 2016, portending 2-6% global energy shortages from 2024-30.

This is assuming everything goes right. What is not factored into our numbers is the possibility of a catastrophic disruption to global supply chains. News flow in 2023 seems to provide a constant ominous rumbling.

Hence the purpose of this report is to gather data into how global conflicts have impacted commodity markets in the past, using our database of very long term historical commodity prices, which covers fourteen commodities – energy, materials, manufactured goods and agricultural products – going back to 1800.

There were five major global conflicts during this time period: the War of 1812, the US Civil War, World War I, World War II and a global shock in 1973-74 at the height of the Cold War.

During these five major conflicts, 95% of commodities saw higher prices, and the median commodity price rose by 110% from pre-conflict annual trough to mid-conflict annual peak (page 3).

No two conflicts were the same. However, a pattern across all of the conflicts is that the commodities seeing the most supply disruption also saw the highest price eruptions. Disrupted commodity prices often rose 2-10x. Examples and implications are on pages 4-6.

Another form of disruption is that conflicts tend to suck in attention, people, energy, materials, capital and other resources. Impacts on the prices of manufactured goods are discussed on page 7.

What implications for decision-makers in the energy transition and beyond? Our own perspectives on protecting portfolios, and even entire nations, are discussed on pages 8-10.