Energy transition technologies are often envisaged to follow S-curves: rapidly inflecting, then reaching 100% market adoption. However, this 17-page report argues electric vehicles will more likely saturate at 15-30% of sales in 2025-30. Electric vehicle sales were already at 15% of global vehicle sales in 2023. So what would the more limited EV upside mean for energy and materials?

Electric vehicle sales have recently endured negative news flow. Hence, we have already been forced to revise down our global EV sales forecasts, in June, by 20-25% for 2025-30. The weakness has impacted auto-makers, lithium markets and other materials, as shown on pages 2-3.

So, will EV sales start reaccelerating, or conversely, could they even flatline? The bulls in this debate will point to S-curves, arguing that EV sales are inflecting upwards. But is this really the right conceptual model for EV adoption, for the reasons explored on pages 4-5?

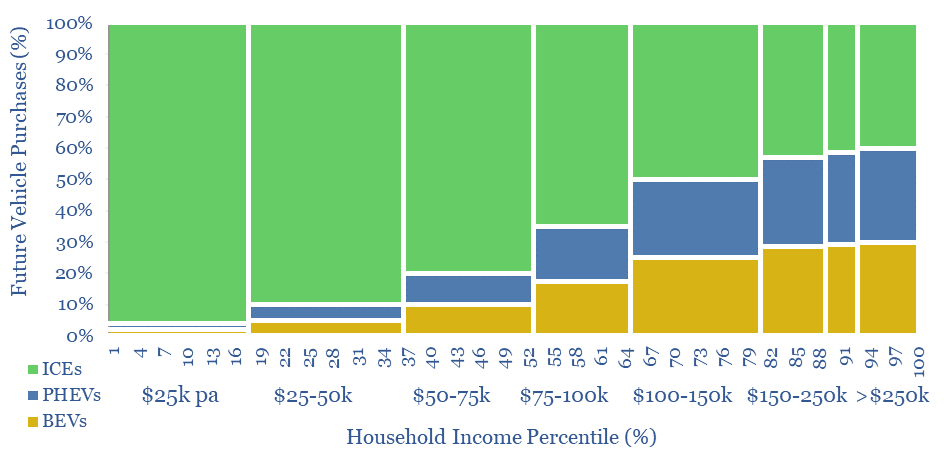

Affordability remains the major barrier for EV adoption in our view. Hence we have gathered data into the distributions of incomes across the developed world, and the distributions of EV costs, on pages 7-8.

Climate attitudes are another barrier for EV adoption. Last year, it was reported that 40% of Americans would not give $2 per month to avoid the worst impacts of climate change. The most relevant survey data into climate attitudes are compiled on pages 9-10.

Hence, we have attempted to model the saturation point for electric vehicles among developed world vehicle purchasers, on pages 11-13.

Market saturation for electric vehicles would have extreme implications across energy and materials markets. Some examples are given on pages 14-15.

Revisions to our numbers are finalized on pages 16-17, across electric vehicles, ICE vehicles, oil demand, the electricity demand of EVs, lithium demand, and with implications across new energies.