This 12-page note studies gas power plant generation profiles, across 10 of the largest gas plants in Australia, at 5-minute intervals, comparing 2024 versus 2014, amidst the rise of wind and solar. Ramping renewables to c30% of Australia’s electricity mix has not only entrenched gas-fired back-up generation, but actually increased the need for peakers?

Australia’s electricity demand has increased at 0.9% per year in the past decade, reaching 273 TWH in 2023. 46% is still powered by coal, while 17% comes from gas.

Australia’s renewables generation has increased. Wind power generation has ramped 3x from 4% of Australia’s grid in 2013 to 12% in 2023, while solar has ramped 8x from 2% to 16%. For the data, please see our overview of each country’s grid mix.

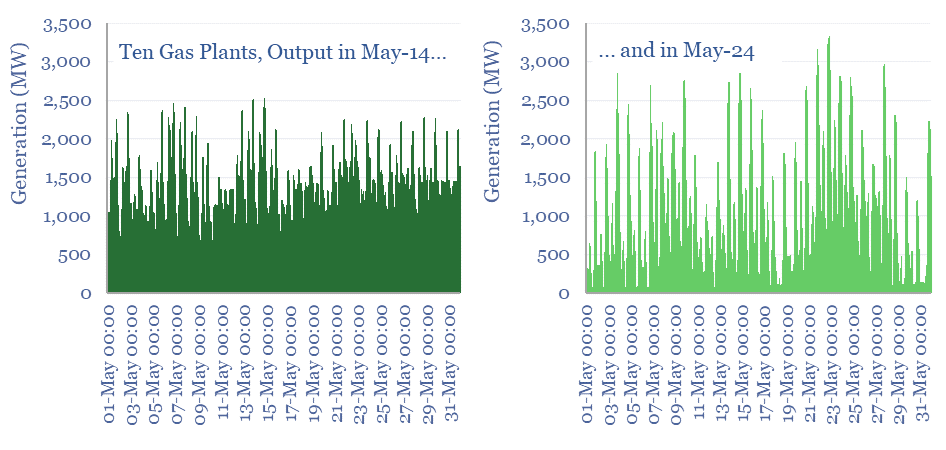

So, what has happened to gas power plant generation profiles amidst the rise of renewables? To answer this question, we have tabulated 5-minute by 5-minute generation data, from AEMO, for ten of the largest gas power plants in Australia, in 2014 and 2024.

Gas is clearly backstopping the volatility of solar, per pages 2-4.

Hence, we have drawn five conclusions about the utilization rates of gas turbines, generation in MWH and capacity requirements in MW on pages 5-9 of the report (1-2 key charts support each conclusion).

Utilization rates have fallen at baseload gas generation facilities, which is inflationary. But utilization rates have increased at peaker plants.

It looks challenging to fully replace the flexibility of these gas turbines with grid-scale batteries, for the reasons on pages 9-10.

Conclusions, predictions and implications are summarized on page 11.

Power grids are truly amazing in their complexity, but tend to get over-simplified in energy transition roadmaps. In the words of Ludwig Wittgenstein, “don’t think, but look”.

Wittgenstein was probably not talking about gas power plant generation profiles. Yet our data show how ramping renewables have entrenched pre-existing gas turbines in the grid in Australia — similar to other analysis we have conducted in California, the UK and Europe — and arguably require c30% more peaker plants than a decade ago.