Search results for: “\"oil price\" \"oil prices\"”

-

Very long term historical commodity prices and disruptions?

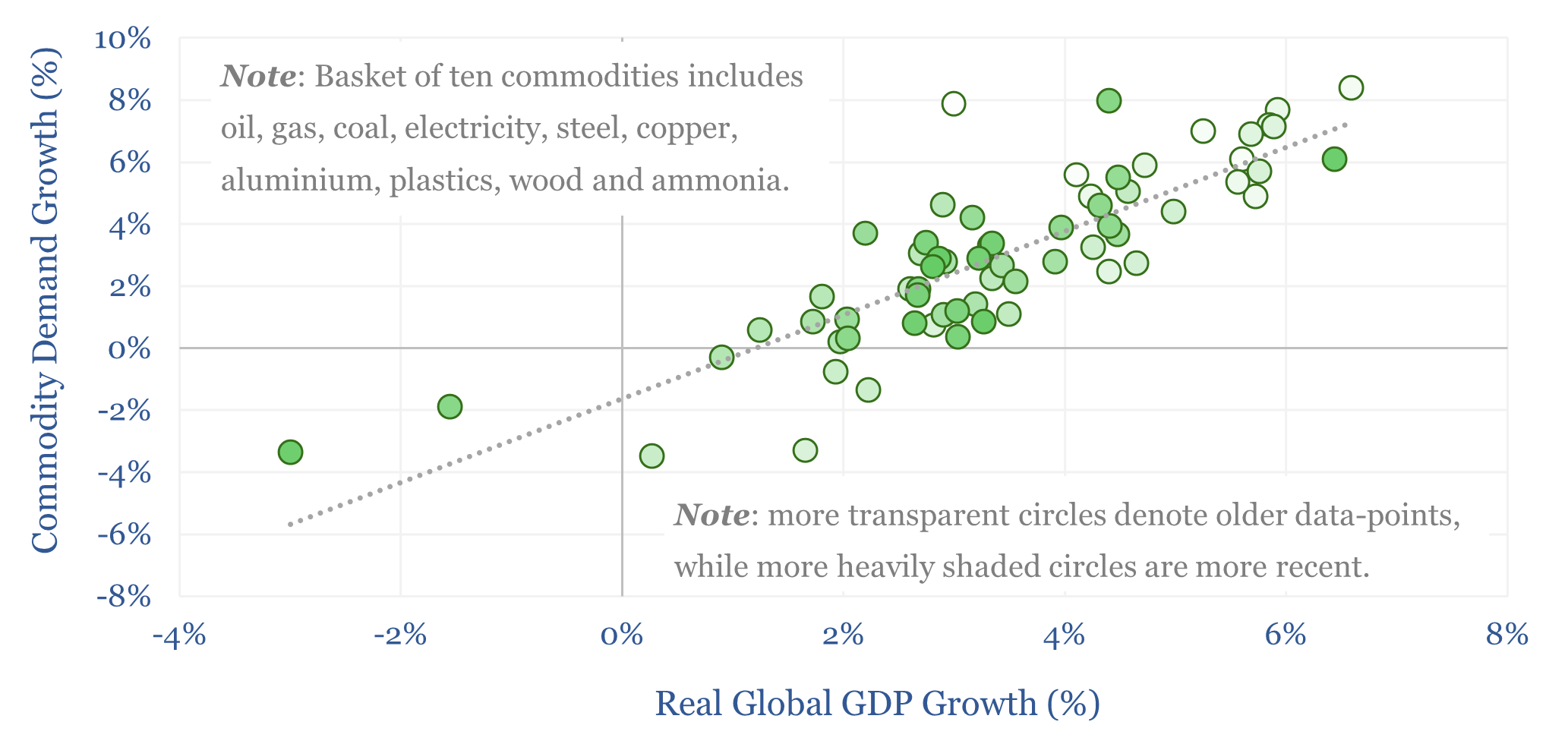

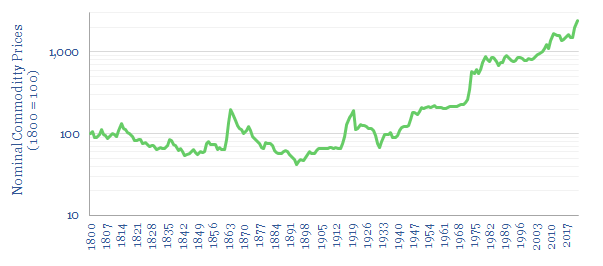

This data-file aggregates long-term historical commodity prices back to 1800, predominantly in the US, using academic records and census data. Historical commodity prices generally fell 30-70% in the 19th and early 20th century, punctuated by supply disruptions due to wars, then rose by 12.5x from 1945 to the present day.

-

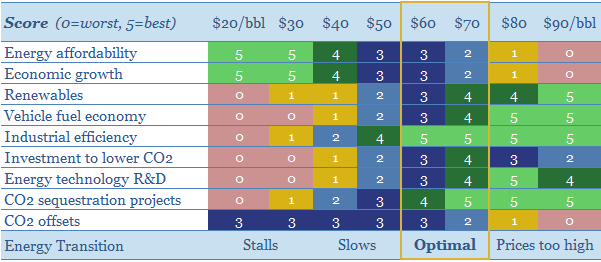

What oil price is best for energy transition?

It is possible to decarbonize all of global energy by 2050. But $30/bbl oil prices would stall this energy transition, killing the relative economics of electric vehicles, renewables, industrial efficiency, flaring reductions, CO2 sequestration and new energy R&D. This 15-page note looks line by line through our models. We find stable, $60/bbl oil is ‘best’…

-

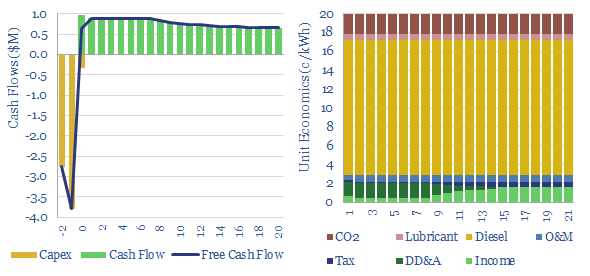

Diesel power generation: levelized costs?

A multi-MW scale diesel generator requires an effective power price of 20c/kWh, in order to earn a 10% IRR, on c$700/kW capex, assuming $70 oil prices and c150km trucking of oil products to the facility. Economics can be stress-tested in the Model-Base tab.

-

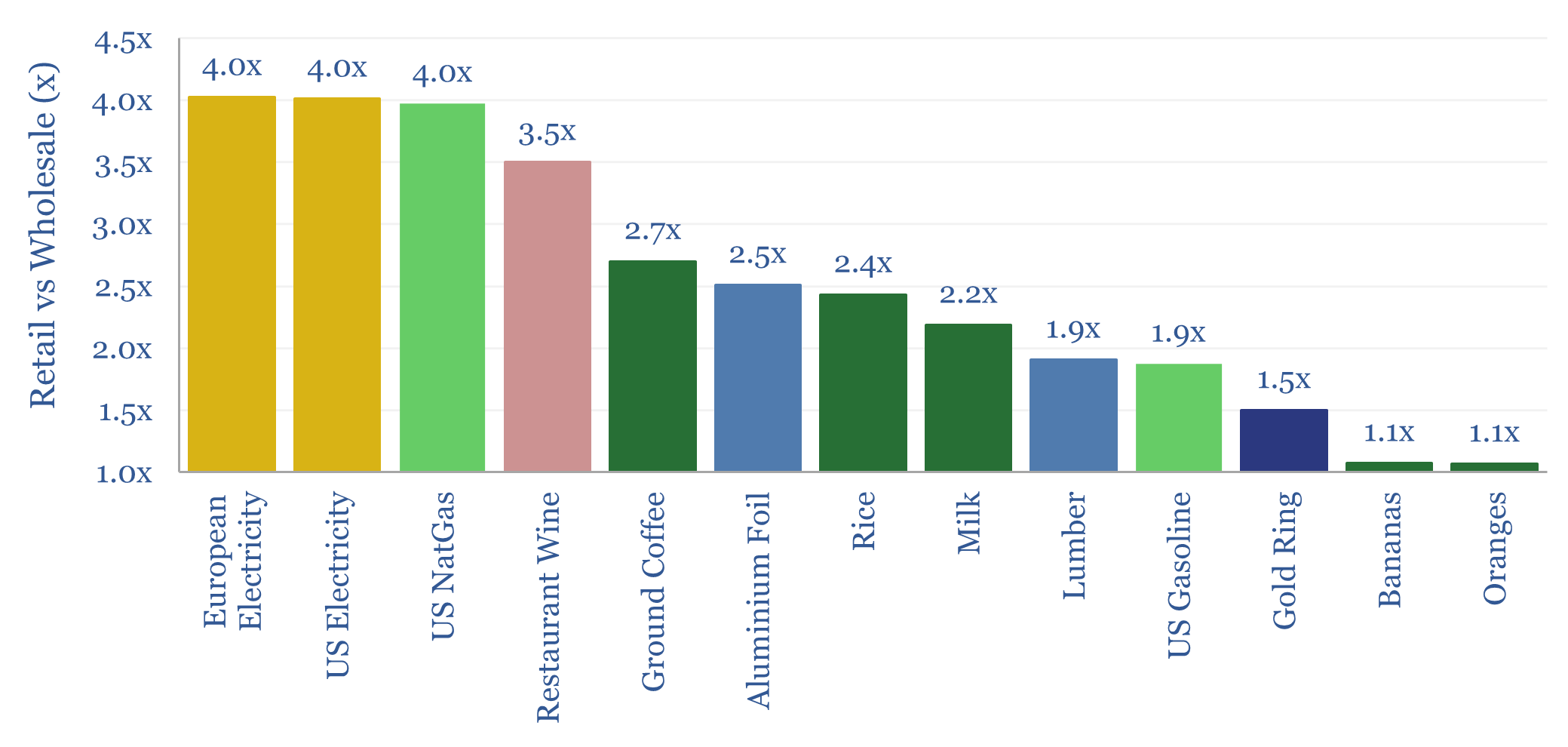

Residential energy prices: reasons for optimism?

Residential energy prices tend to run 4x higher than underlying wholesale energy prices. This is a very wide margin, as by contrast, typical commoditized products in supermarkets are usually only marked up by about 2x, compared to their wholesale prices. Today’s data-file compares retail prices vs wholesale prices across a dozen different categories. A remarkable…

-

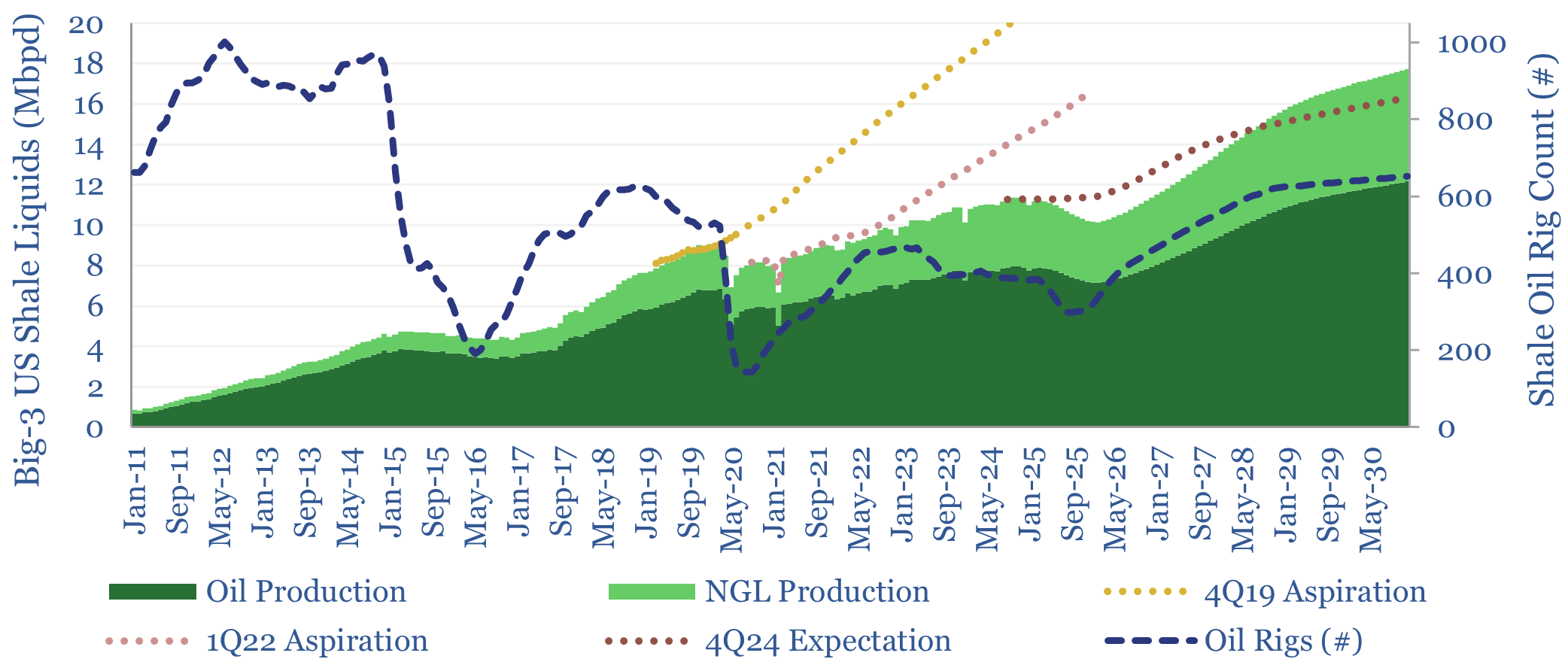

US shale: outlook and forecasts?

This model sets out our US shale production forecasts by basin. It covers the Permian, Bakken, Eagle Ford, Marcellus/Utica and Haynesville, as a function of the rig count, drilling productivity, completion rates, well productivity and type curves. The data-file was last updated in May-2025, revising liquids growth negative in 2025-26, which in turn tightens US…

-

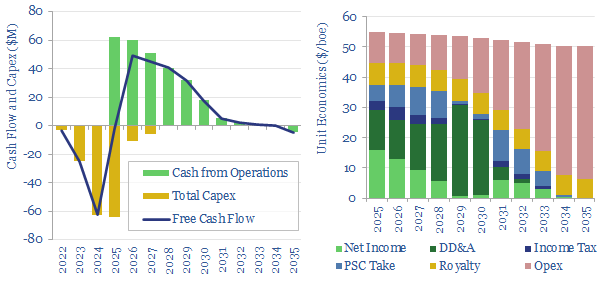

Offshore oil: marginal cost?

What is the marginal cost of offshore oil and gas? This data-file captures a small project, off Africa, with $15/boe development cost, $15/boe opex, 70% fiscal take. Break-even is at $35-45/bbl. But a $90/bbl forward curve may be needed for definitive go-ahead.

-

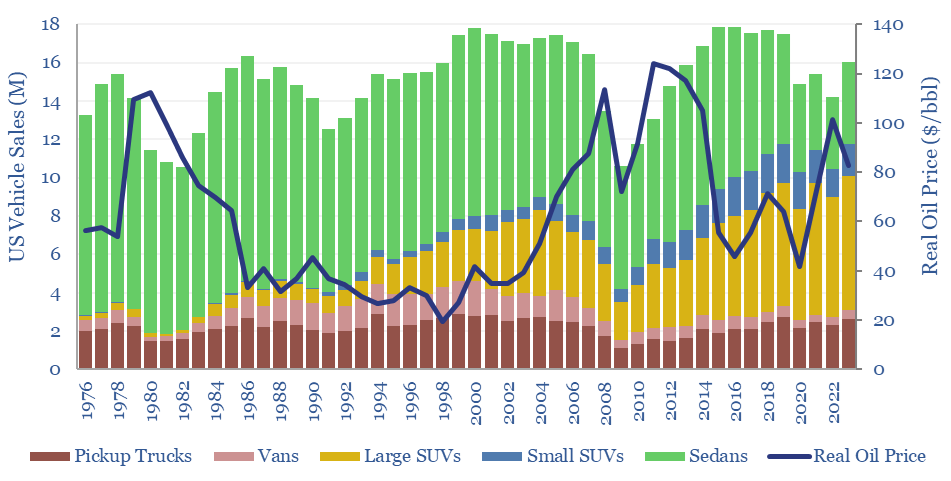

US vehicle ownership and fuel economy?

This data file assesses US vehicle ownership over time. Improving fuel economy has been muted by rebound effects, such as greater mobility and larger vehicles. Oil prices influence the types of vehicles being purchased, their masses and their fuel economy. EV ownership has also been rising and is cross-plotted against incomes and other variables.

-

Oil markets: waiting game?

Oil prices must entrench well above $50/bbl for 2023-25 oil markets to balance. But prices could materially overshoot. This short 4-page note presents our latest conclusions, and top charts on oil supply-demand, including our outlook to 2025.

Content by Category

- Batteries (89)

- Biofuels (44)

- Carbon Intensity (49)

- CCS (63)

- CO2 Removals (9)

- Coal (38)

- Company Diligence (95)

- Data Models (840)

- Decarbonization (160)

- Demand (110)

- Digital (60)

- Downstream (44)

- Economic Model (205)

- Energy Efficiency (75)

- Hydrogen (63)

- Industry Data (279)

- LNG (48)

- Materials (82)

- Metals (80)

- Midstream (43)

- Natural Gas (149)

- Nature (76)

- Nuclear (23)

- Oil (164)

- Patents (38)

- Plastics (44)

- Power Grids (131)

- Renewables (149)

- Screen (117)

- Semiconductors (32)

- Shale (51)

- Solar (68)

- Supply-Demand (45)

- Vehicles (90)

- Wind (44)

- Written Research (356)