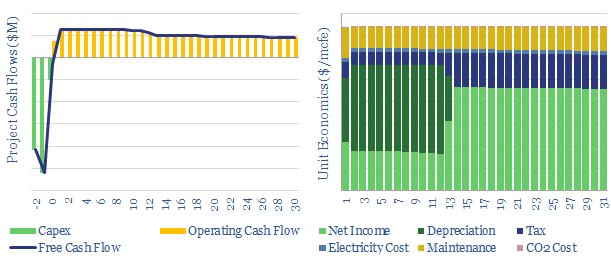

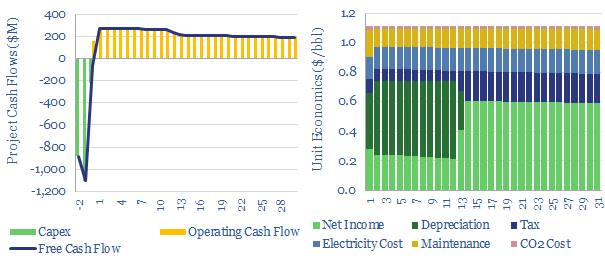

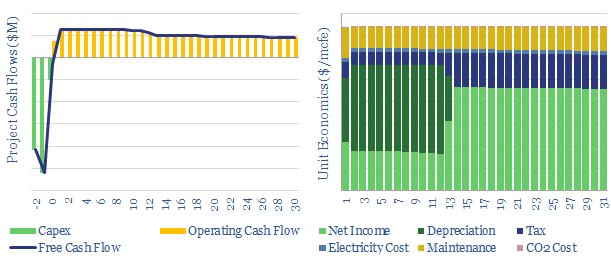

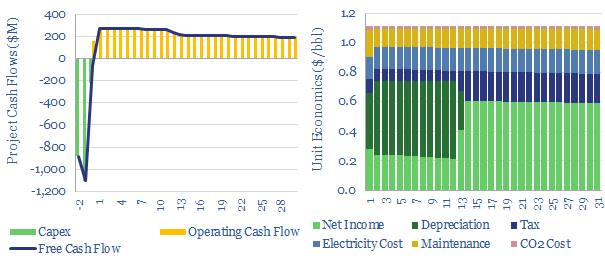

This model captures the energy economics of gas pipelines, CO2 pipelines and hydrogen pipelines. Specifically, we have modelled energy requirements using simple fluid mechanics, and modelled capex costs using past…

…can stress test the economics directly in the model, by varying pipeline tariffs, capex costs, energy costs, CO2 prices, maintenance costs, pipeline diameter, pipeline distance, pipeline elevation, pipeline materials, fluid…

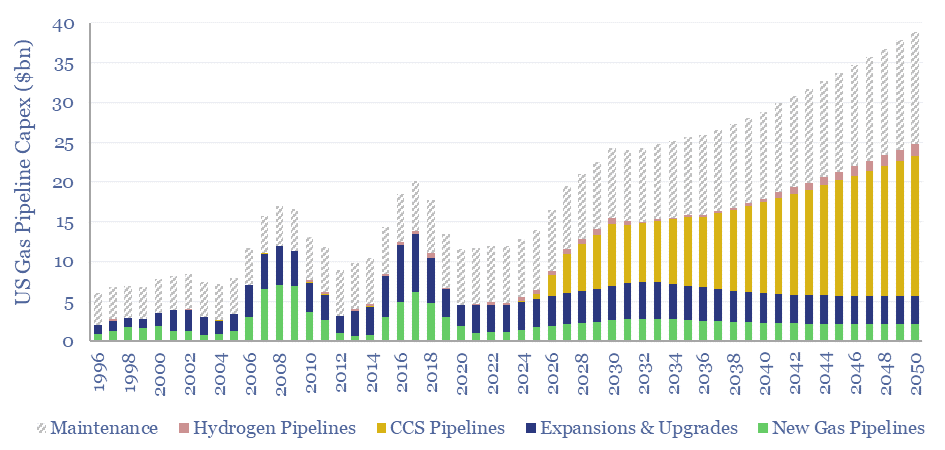

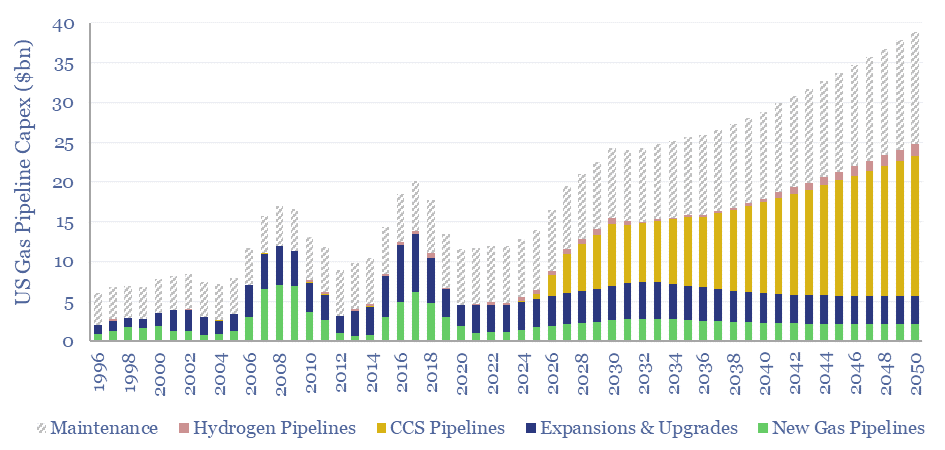

…for new gas pipeline capex, CCS pipeline capex and hydrogen pipeline capex are calculated, in each case, by multiplying incremental volumes x new pipeline diameter-kilometers needed per unit of volume…

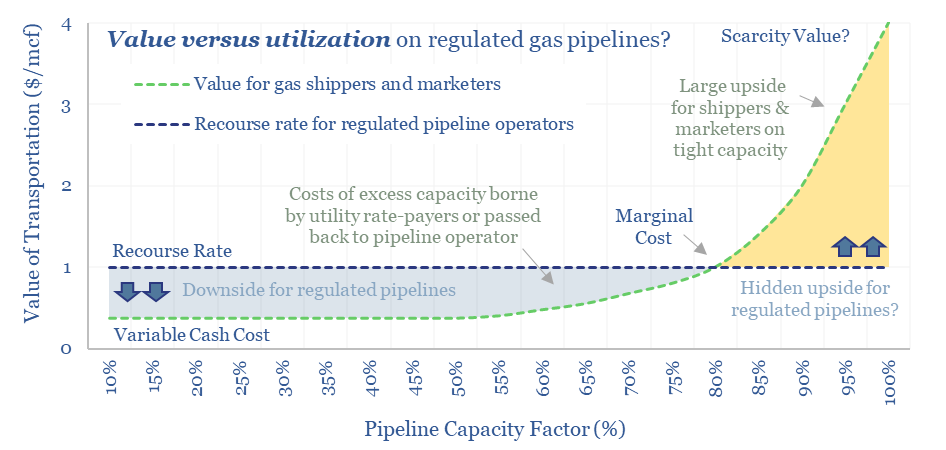

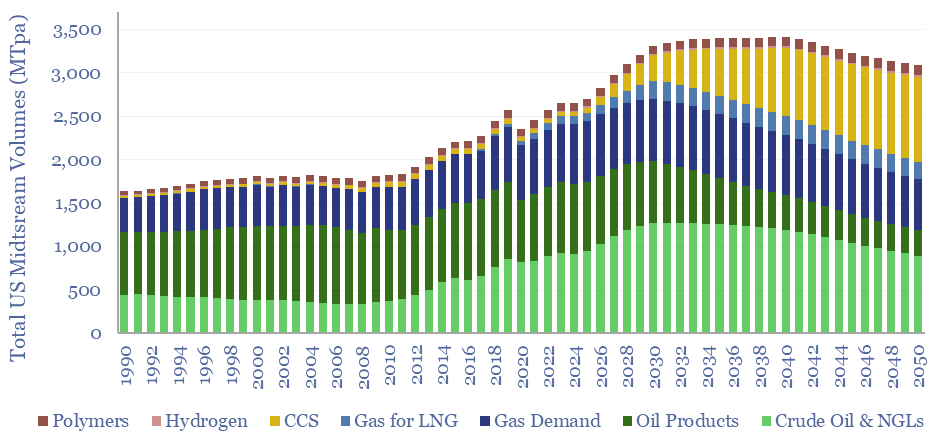

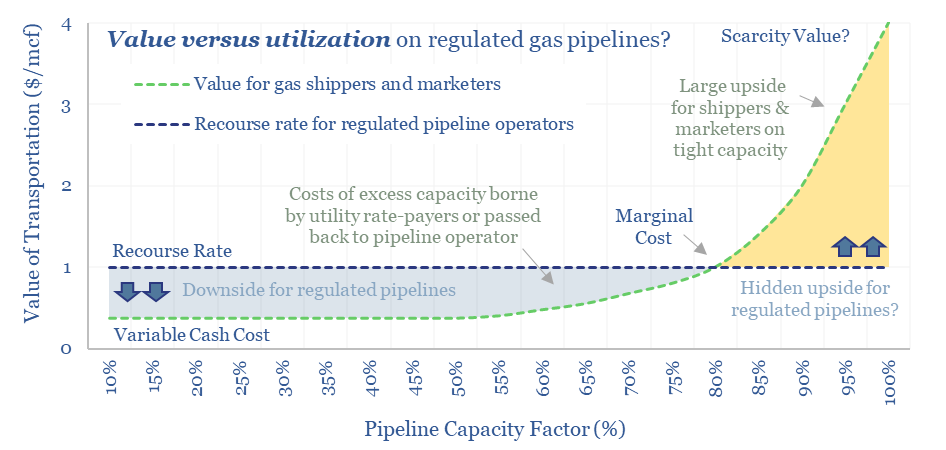

…trends underway for gas pipelines in the energy transition. Demand is rising to backstop renewables and power AI data-centers. Pipeline capacity growth is stagnating due to various roadblocks. And yet…

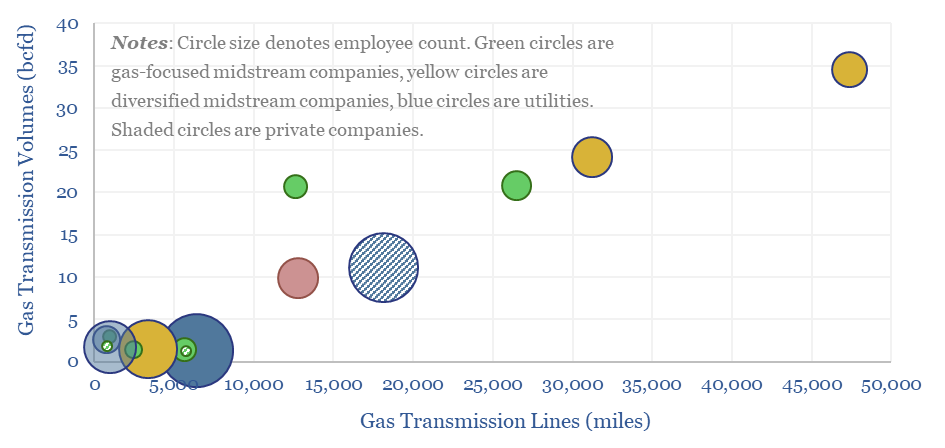

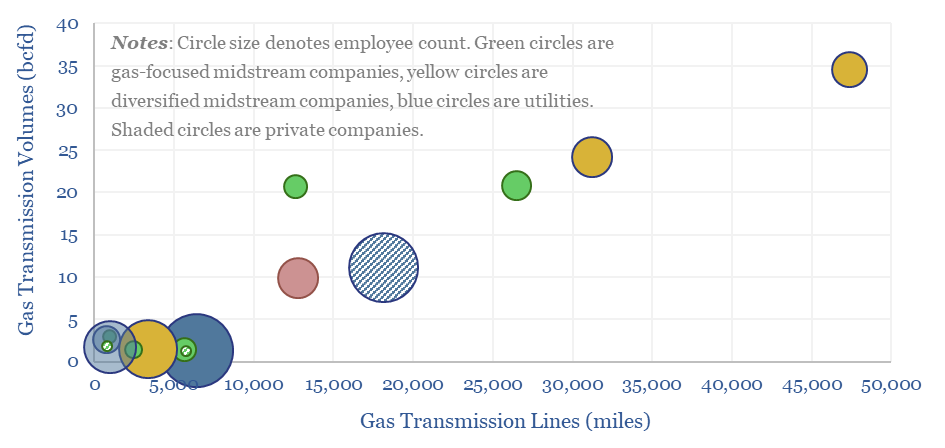

This data-file aggregates granular data into US gas transmission, by company and by pipeline, for 40 major US gas pipelines which transport 45TCF of gas per annum across 185,000 miles;…

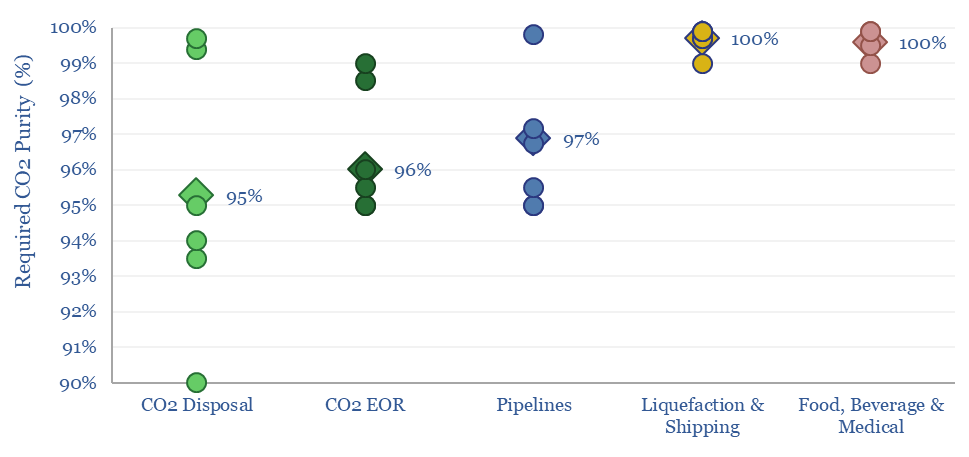

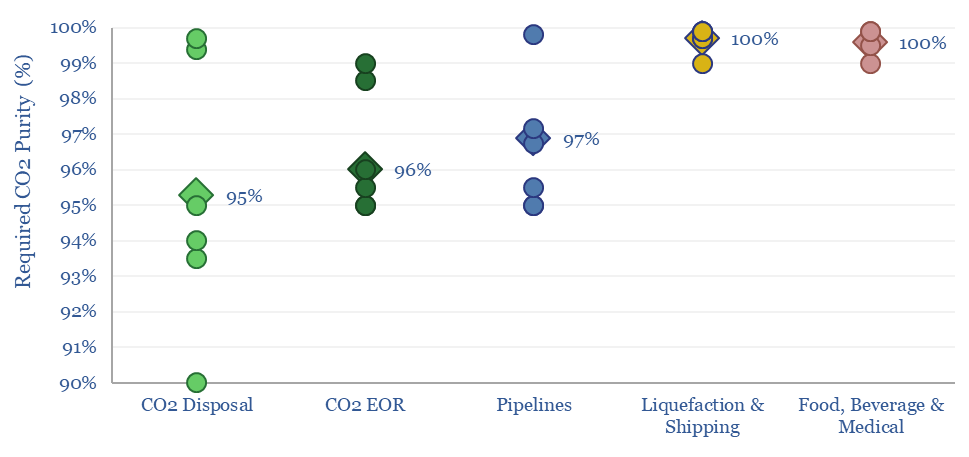

…CO2. But impurities require higher pressures before CO2 reaches supercriticality. Larger pipelines are also required to move larger quantities of gas at higher pressures. This matters because larger pipelines with…

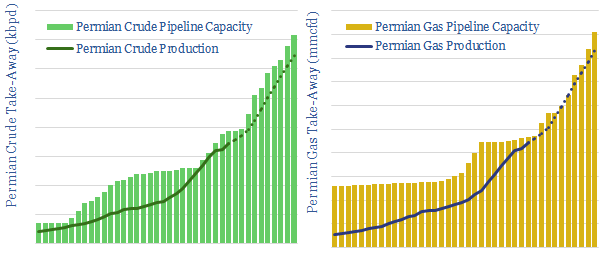

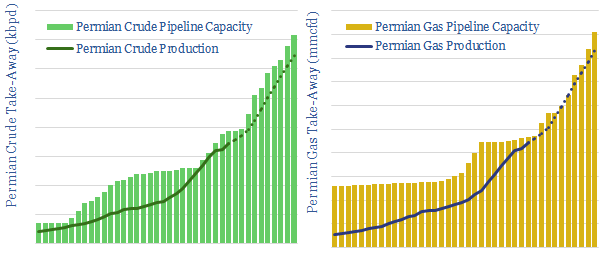

This data-file tracks c50 oil and gas pipelines in the Permian basin — their route, their capacity and their construction progress — in order to assess the severity of pipeline…

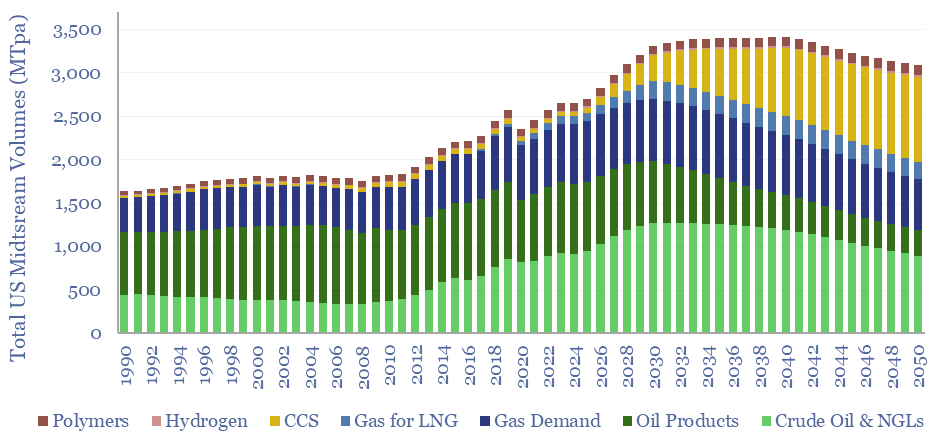

…for midstream companies. (8) Costs of midstream components are quantified in our research, such as oil pipelines at $2/bbl/1,000km, oil storage at $1.5/bbl, gas pipelines at $1/mcf/1,000km, gas fractionation at…

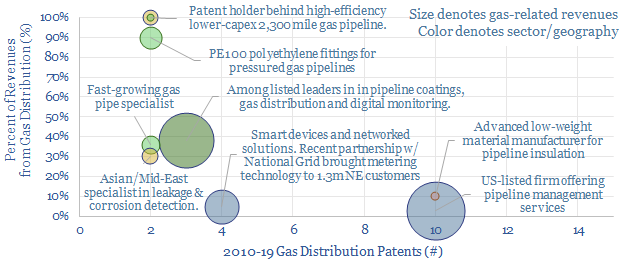

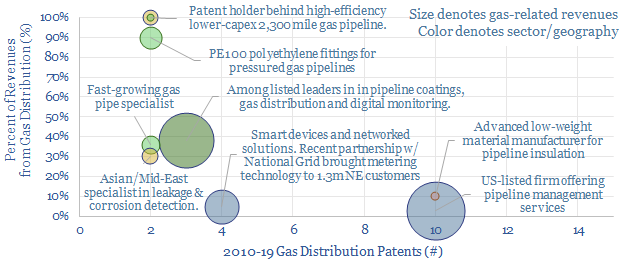

This data-file tracks over 800 ex-China patents for the pipeline transportation of natural gas, filed from 2010 to 2019. The aim is to screen for exciting technologies and companies with…

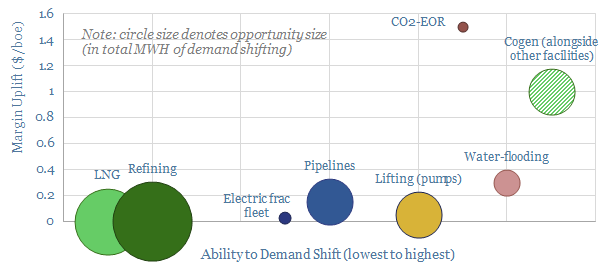

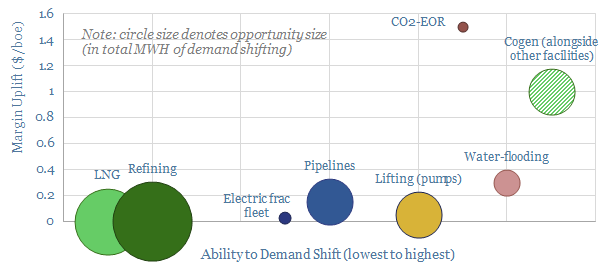

…very material in absolute terms, it could yield a 2-5% uplift, when you think that the average cash margin for a 1,000km pipeline is around $1/mcf. https://thundersaidenergy.com/downloads/gas-and-hydrogen-pipelines-the-energy-economics/ https://thundersaidenergy.com/downloads/pipelines-the-energy-economics/ Co-generation: the…