-

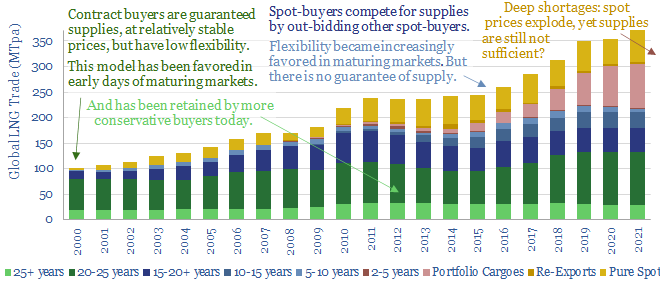

Energy security: the return of long-term contracts?

Spot markets have delivered more and more ‘commodities on demand’. But is this model fit for energy transition? Many markets are now short, causing explosive price rises. Sufficient volumes may still not be available at any price. This note considers a renaissance for long-term contracts.

-

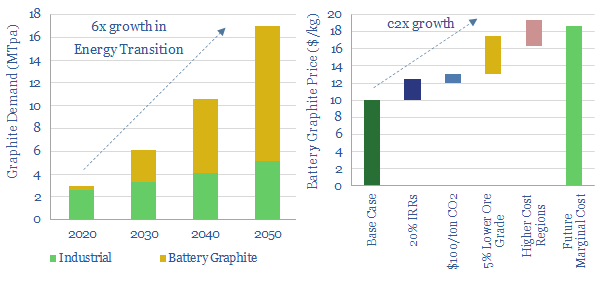

Graphite: upgrade to premium?

Global graphite volumes grow 6x in the energy transition, mostly driven by electric vehicles. We see the industry moving away from China’s near-exclusive control. The future favors a handful of Western producers, integrated from mine to anode, with CO2 intensity below 10kg/kg. This 10-page note outlines the opportunity.

-

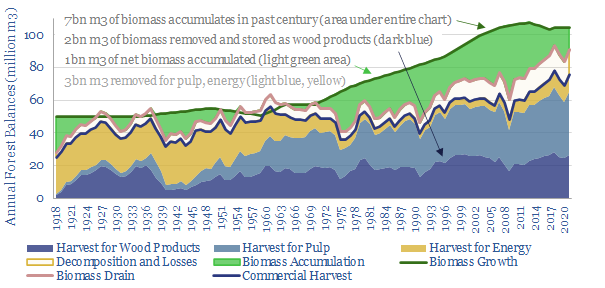

Finnish forests: a two billion ton CO2 case-study?

Can forests absorb CO2 at multi-GTpa scale? This 19-page note is a case study from Finland, where detailed data goes back a century. 70% of the country is forest. It is managed sustainably, equitably, economically. And forests have sequestered 2GT of CO2 in the past century, offsetting two-thirds of the country’s fossil emissions.

-

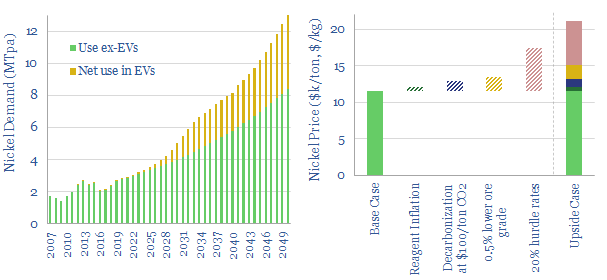

Nickel solutions: unblocking a battery bottleneck?

The global nickel market will grow from $30bn pa to $300bn in the energy transition, including a 5x increase in volumes and 2x increase in price. This 15-page note evaluates the nickel supply chain for electric vehicle battery cathodes. Deficits are looming. Hence we end by screening nickel names.

-

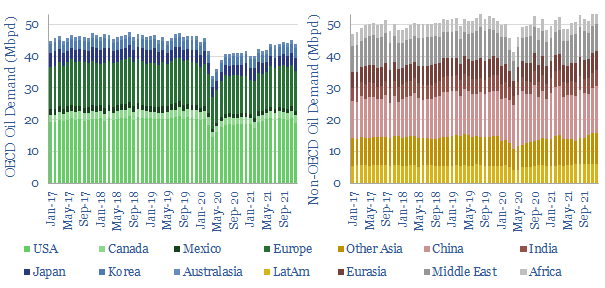

Global oil demand: rumors of my death?

‘Rumors of my death have been greatly exaggerated’. Mark Twain’s quote also applies to global oil consumption. This note aggregates demand data for 8 oil products and 120 countries over the COVID pandemic. We see 3.5Mbpd of pent-up demand ‘upside’, acting as a floor on medium-term oil prices.

-

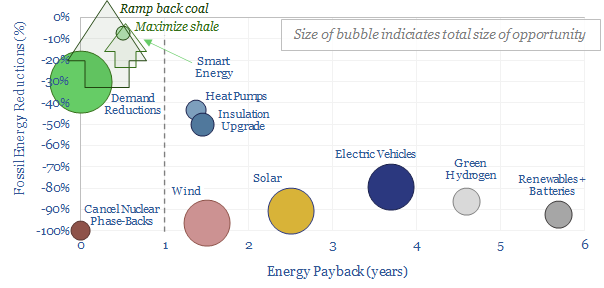

Energy transition: the world turned upside down?

Energy shortages are now the second largest problem in the world. Hence this 14-page note evaluates short- and medium-term options to alleviate them. Despite a lot of posturing, we see ‘new energies’ slowing down in 2022-23. The world is upside down and somehow coal is going to be an unexpected savior.

-

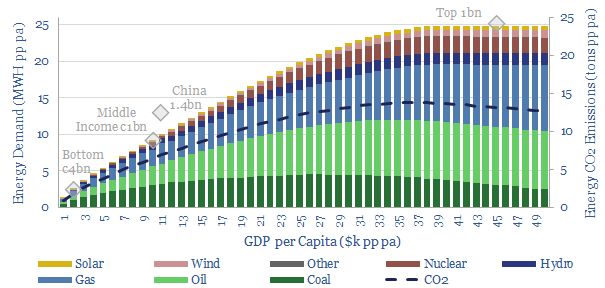

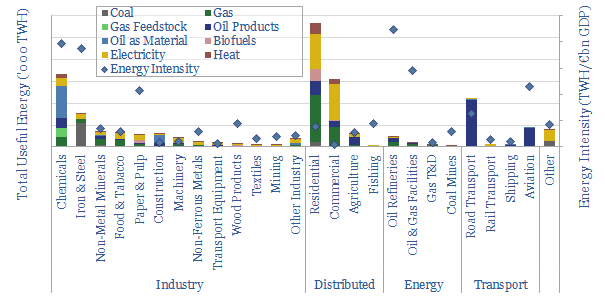

Energy shortages: priced out of the world?

Deepening energy shortages in 2022-30 could devastate low-income countries, geopolitically isolate the West, and de-rail decarbonization. This 13-page note evaluates the linkage between energy consumption and income over the past half century and quantifies what a ‘just transition’ would look like.

-

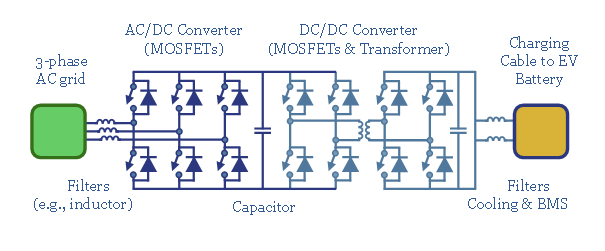

EV fast charging: opening the electric floodgates?

This 14-page note explains the crucial power-electronics in an electric vehicle fast-charging station that runs at 150-350kW. Most important are power-MOSFETs, comprising c5-10% of charger costs. The market trebles by the late 2020s.

-

Falling towers: how will energy shortages play out?

If global energy supplies run short, then someone has to curtail demand. Europe is in the firing line, with 7% of the world’s people, using 17% of its energy, of which 65% is imported. So this 13-page note searches for the least bad options to cut European energy demand. Energy intensive industries may shutter and…

-

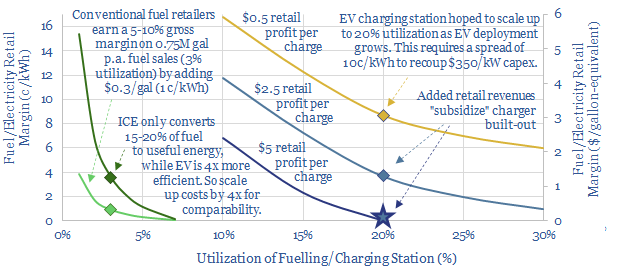

Electric vehicles: chargers of the light brigade?

This 14-page note compares the economics of EV charging stations with conventional fuel retail stations. Our main question is whether EV chargers will ultimately get over-built. Hence prospects may be best for charging equipment and component manufacturers.

Content by Category

- Batteries (89)

- Biofuels (44)

- Carbon Intensity (49)

- CCS (63)

- CO2 Removals (9)

- Coal (38)

- Company Diligence (95)

- Data Models (840)

- Decarbonization (160)

- Demand (110)

- Digital (60)

- Downstream (44)

- Economic Model (205)

- Energy Efficiency (75)

- Hydrogen (63)

- Industry Data (279)

- LNG (48)

- Materials (82)

- Metals (80)

- Midstream (43)

- Natural Gas (149)

- Nature (76)

- Nuclear (23)

- Oil (164)

- Patents (38)

- Plastics (44)

- Power Grids (130)

- Renewables (149)

- Screen (117)

- Semiconductors (32)

- Shale (51)

- Solar (68)

- Supply-Demand (45)

- Vehicles (90)

- Wind (44)

- Written Research (354)