-

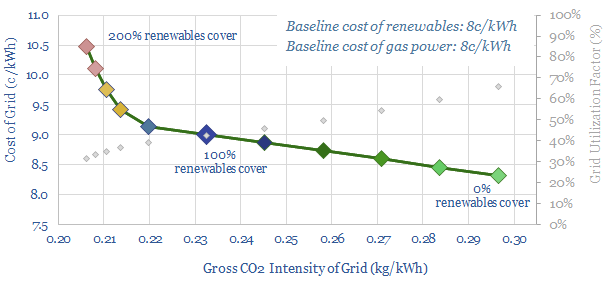

Integrated energy: a new model?

This 14-page note lays out a new model to supply fully carbon-neutral energy to a cluster of commercial and industrial consumers, via an integrated package of renewables, low-carbon gas back-ups and nature based carbon removals. This is remarkable for three reasons: low cost, high stability, and full technical readiness.

-

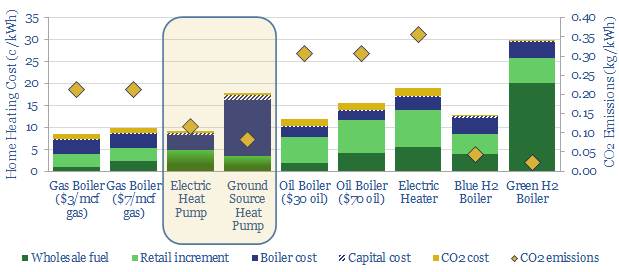

Heat pumps: hot and cold?

Some policymakers now aspire to ban gas boilers and ramp heat pumps 10x by 2050. In theory, the heat pump technology is superior. But in practice, there are ten challenges. It could become a political disaster. The most likely outcome is a 0-2% pullback in European gas by 2030.

-

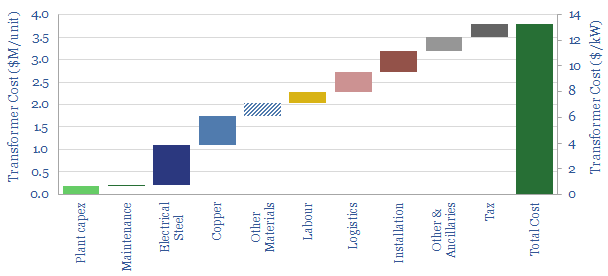

Transformers: rise of the beasts?

A transformer is needed to step the voltage up or down at every inter-connection point in the grid. Hence this 14-page note explores how renewables and EVs will expand future transformer markets. The main challenge is that the need for smaller, simpler units may exacerbate margin pressure in an already competitive industry. So who is…

-

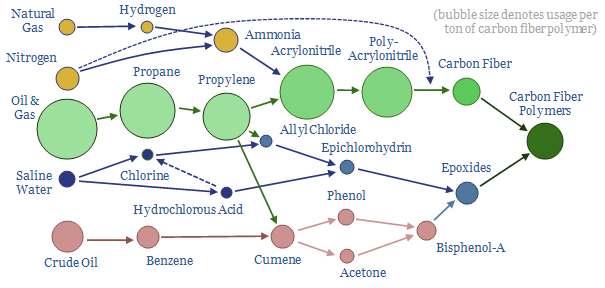

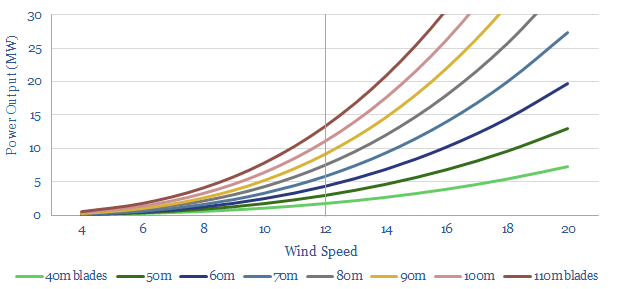

Carbon fiber: the miracle material?

Energy transition will catapult carbon fiber demand upwards from today’s 120kTpa baseline, across wind turbine blades, more efficient vehicles and hydrogen tanks. Hence this 16-page note explores opportunities, economics, CO2 intensity and leading companies.

-

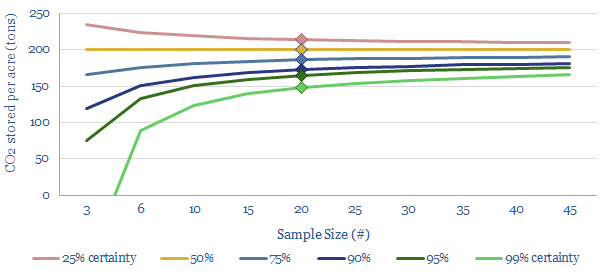

Carbon stocks: measuring the forest from the trees?

Measuring forest carbon is uncertain. Pessimistically, estimation errors could be as high as 25%. So does this disqualify nature based carbon credits? This 12-page note explores solutions, borrowing risk-pricing from credit markets, preferring bio-diversity and looking to drone/LiDAR technology.

-

Offshore wind: will costs follow Moore’s Law?

Some commentators expect the levelized costs of offshore wind to fall another two-thirds by 2050. The justification is some eolian equivalent of Moore’s Law. Our 16-page report draws five contrasts. Wind costs are most likely to move sideways, even as the industry builds larger turbines. Implications are explored for companies.

-

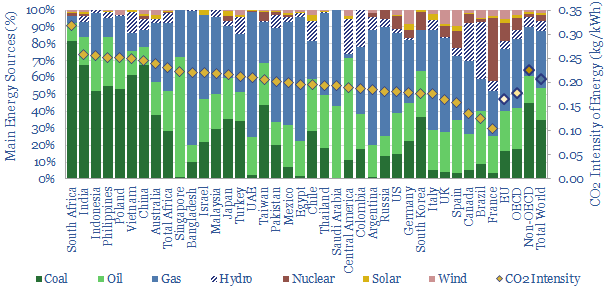

Border taxes: a carbon curtain has descended?

Europe has proposed a ‘border adjustment mechanism’ to mitigate carbon leakage. Its initial formulation is modest. But it will snowball. And ultimately divide the global economy in two. This 15-page report lays out our top five predictions for CO2 border taxes to reshape energy markets and the world.

-

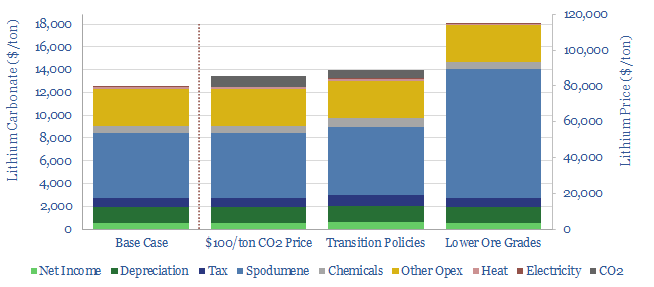

Lithium: reactive?

Lithium demand is likely to rise 30x in the energy transition. So this 15-page note reviews the mined lithium supply chain, finding prices will rise too, by 10-50%. The main reason is lower-grade ores. Second is energy intensity. Low-cost lithium brine producers may benefit from steeper cost curves.

-

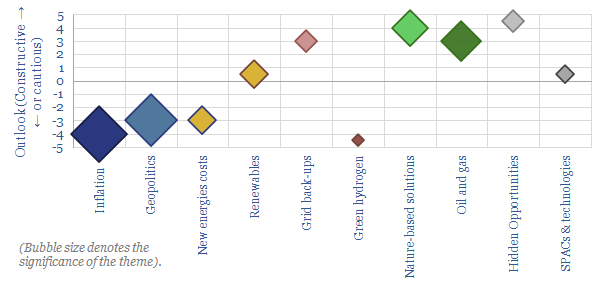

Energy transition: the top ten controversies?

This 11-page note summarizes the ‘top ten’ controversies in the energy transition, based on 2,000 pages of our research to-date, and resultant discussions. Our outlook is increasingly despairing. And inflationary. Yet opportunities do exist to unlock value amidst bizarre and market-distorting policies.

-

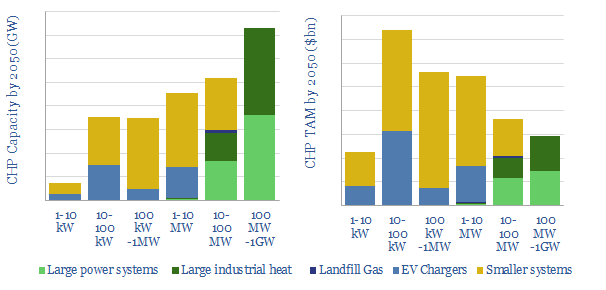

Gas turbines: what market size in energy transition?

CHP systems are 20-30% lower-carbon than gas turbines, as they capture waste heat. They are also increasingly economical to backstop renewables. Amidst uncertain policies, the market size for US CHPs could vary by a factor of 100x. We nevertheless find 30 companies well-placed in a $9trn global market.

Content by Category

- Batteries (88)

- Biofuels (44)

- Carbon Intensity (49)

- CCS (63)

- CO2 Removals (9)

- Coal (38)

- Company Diligence (93)

- Data Models (831)

- Decarbonization (159)

- Demand (110)

- Digital (58)

- Downstream (44)

- Economic Model (203)

- Energy Efficiency (75)

- Hydrogen (63)

- Industry Data (278)

- LNG (48)

- Materials (82)

- Metals (77)

- Midstream (43)

- Natural Gas (148)

- Nature (76)

- Nuclear (23)

- Oil (164)

- Patents (38)

- Plastics (44)

- Power Grids (127)

- Renewables (149)

- Screen (114)

- Semiconductors (30)

- Shale (51)

- Solar (67)

- Supply-Demand (45)

- Vehicles (90)

- Wind (43)

- Written Research (351)