In solar-heavy grids, power prices trough around mid-day, then ramp up rapidly as the sun sets. This price distribution over time is known as the duck curve. US power prices are getting 25-30% more ducky each year, based on some forms of measurement. Power prices are clearly linked to the instantaneous share of wind/solar in grids.

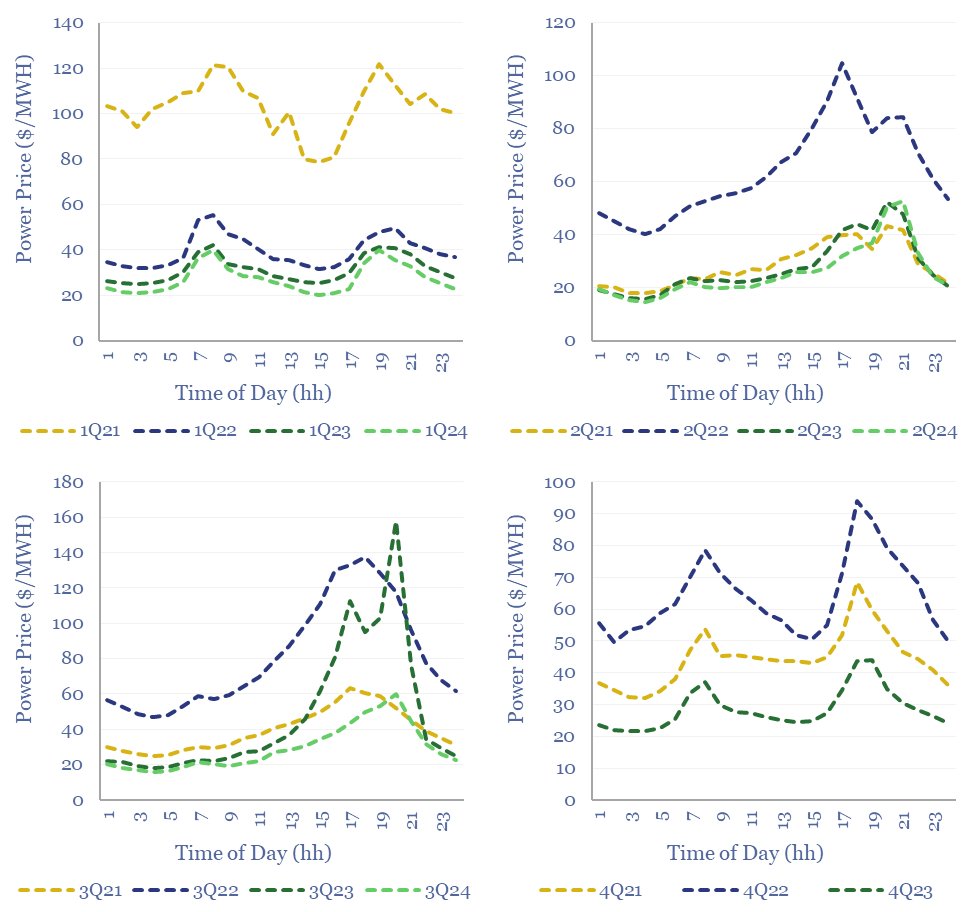

The famous duck curve shows how intra-day power prices are impacted by the rise of solar, rising gently in the morning, troughing in the middle of the day, then rising rapidly in the evenings after the sun has set. Apparently this looks like a duck. But is the duck curve getting more ducky over time, as solar gets built out?

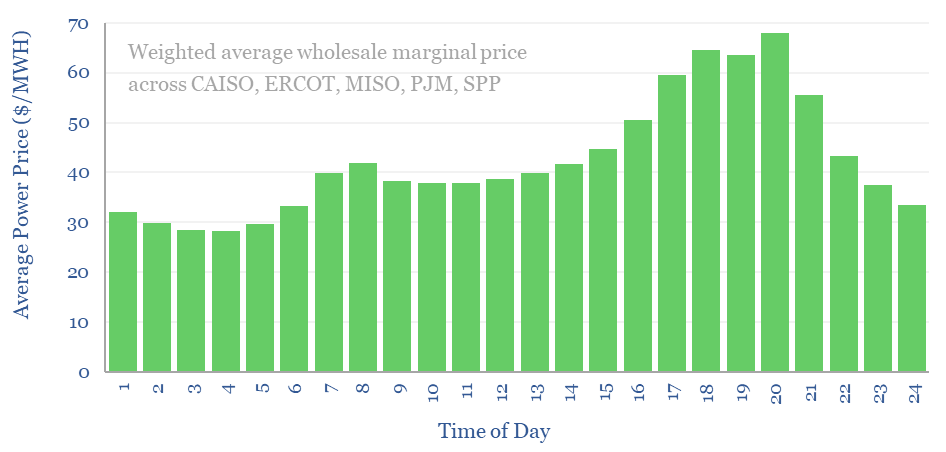

This data-file aims to measure the duckiness of duck curves, over time, across the big five US grid regions: CAISO, ERCOT, MISO, PJM and SPP. On average, over the past 3-years, pricing ramps from c$40/MWH at mid-day to $65/MWH at 6-8pm, partly due to solar generation profiles, and partly due to other demand patterns.

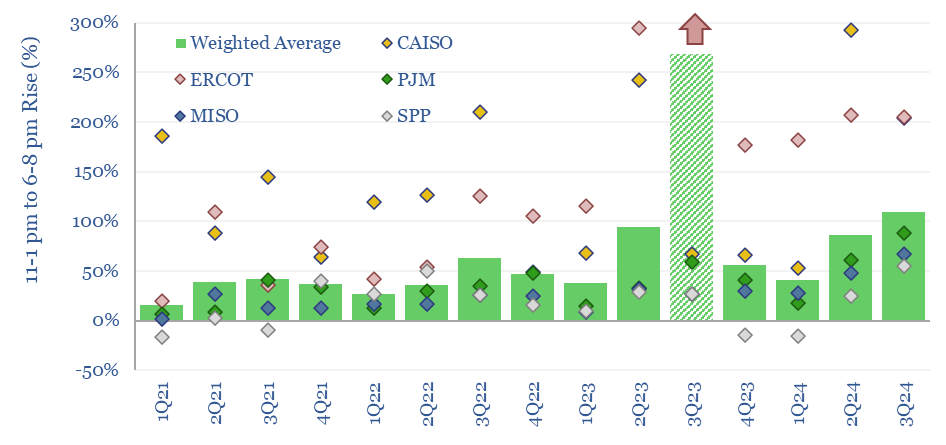

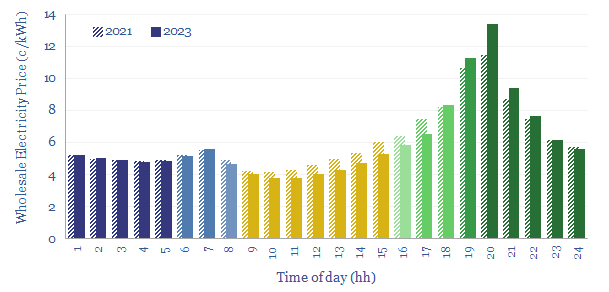

The duckiness of the duck curve has risen over time, across these grid regions, as solar scaled up from 3% of US electricity in 2020 to 6% in 2023. In 2021, power pricing at 6-8pm was 30% higher than at 11am-1pm, in 2022 it was 45% higher, in 4Q23 it was +56%, and in 3Q24 it was +110% higher (chart below).

However, there is a vast amount of volatility in the data. Other cuts show a less clear increase in duckiness, as shown below, averaging across our big-five regions.

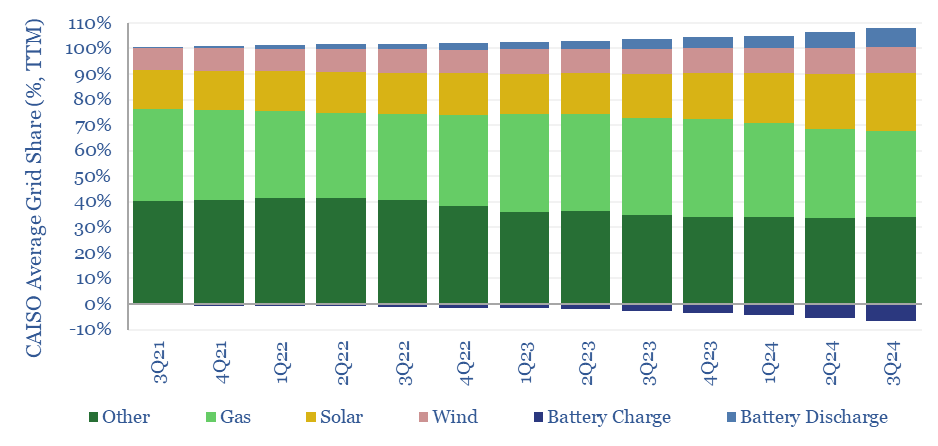

California makes for the most direct case study of duck curves, as utility-scale solar comprises 25% of its electricity mix in 3Q24, up from 15% in 3Q21. In the past, we have looked at individual nodes in California from CAISO, as compared apples-to-apples in individual months, which does appear to show rising duckiness.

But again, other cuts show a more volatile pattern for CAISO, with strong seasonal effects. Perhaps duckiness has also been muted by a large battery build-out, doubling every year, with batteries supplying an average of 3GW from 8-9pm in 3Q23 and an average of 6GW from 8-9pm in 3Q24 (chart below).

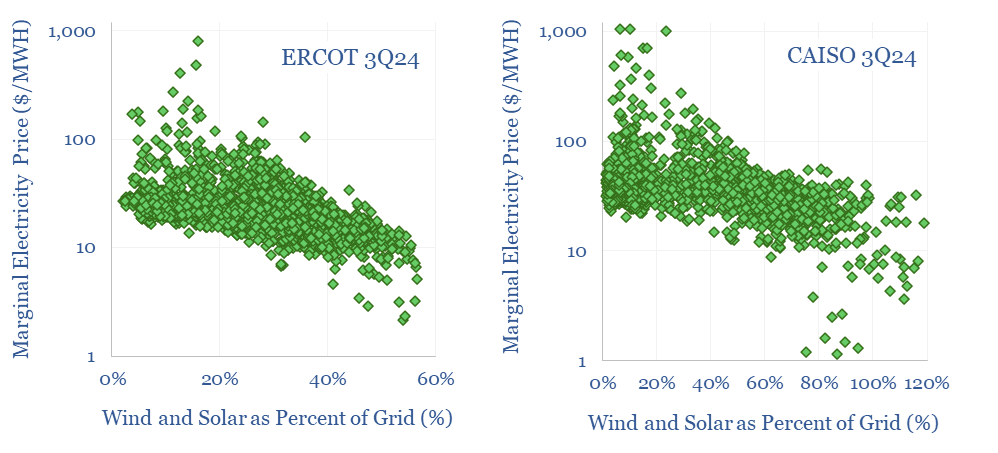

The most significant driver of power prices that we can find in the file is the call on non-wind and non-solar generation. Prices spike when renewables are not generating and markets must be balanced by ramping up gas peakers or disincentivizing demand.

As a simplified rule of thumb, average power prices rise (fall) $2-3/MWH for every 5% decrease (increase) in the share of renewables in the grid. In CAISO, when marginal prices fall below $10/MWH it is almost always associated with wind and solar supplying >80% of the grid, and when prices rise above $100/MWH, wind and solar are usually supplying <10%.

We do think power grids are growing more volatile over time. This is yet another tracker, breaking down the hour-by-hour patterns and duckiness.