This data-file aims to screen coal companies, especially fifteen of the largest Western coal producers. This group produced around 500MTpa of thermal coal and 100MTpa of metallurgical coal from the US, Canada, Europe and Australia in 2023. Key trends for the coal industry in 2024+ are drawn out from the companies’ recent disclosures.

In normal times, thermal coal producers have debatable ESG credentials, owing to being the highest carbon fossil fuel, and 2-3x higher CO2 intensity per MWH of useful energy than natural gas.

However, in 2022-25, we could be in a market where deployment of important energy transition technologies is insufficient, resulting in energy shortages and power grid bottlenecks, which pull on the demand for thermal coal.

Energy Transition Insurance. Some decision-makers might even view exposure to thermal coal markets as a kind of insurance policy. If the world fails to achieve sufficient pragmatic progress in the energy transition, the result will be energy under-supply, and sharp price spikes for high-carbon energy. You can rationally buy auto insurance in case of a car accident, while also really not wanting to get into a car accident.

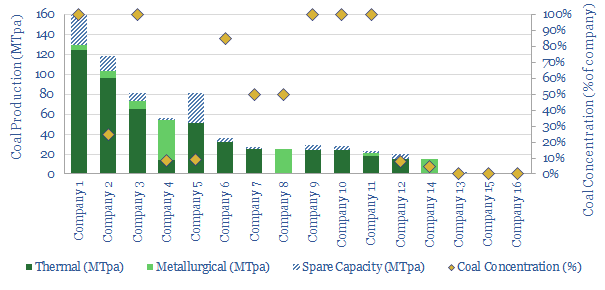

Hence this data-file covers $90bn of coaly market cap across 15 companies. The average company is 50% exposed to coal mining, producing 40MTpa of thermal coal and 7MTpa of metallurgical coal. We have profiled each company, its main assets, and company commentary, in 2021, 2022 and 2023 (the YoYs make a nice comparison).

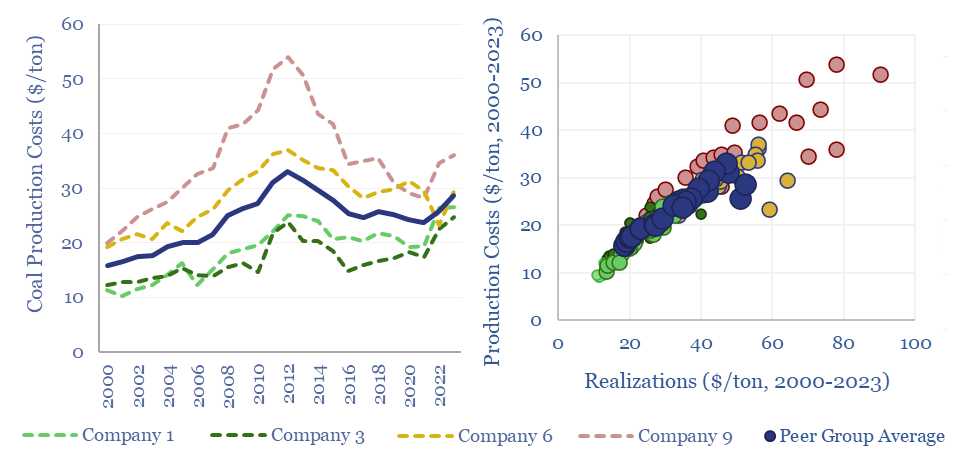

Coal production costs and realizations are also split out for pure-play producers (chart below), dovetailing with our economic models of coal production, and coal power production. Although the numbers do differ by coal types and coal grades.

In 2022, international coal prices spiked to $400/ton and the biggest beneficiaries were coal producers that could access international markets (many companies posted all-time record earnings or zeroed their debt). But in 2024+, we wonder if an ironic reversal benefits landlocked US coal?

Amidst power grid bottlenecks, it costs just 2-4 c/kWh to keep an existing coal power plant running; and longer-term, IRA incentives of $85/ton cover most of the cost of retrofitting CCS to decarbonize these plants. (The IRA’s structure weirdly benefits coal. It produces 2-3x more gross CO2 than gas plants, hence 2-3x more 45Q credits can be collected).

Exits also continue. 80% of the coal producers in the screen want to shift away from thermal coal towards metallurgical coal. TransAlta and Vale already exited all coal in 2021. Anglo American exited thermal coal in January 2022. In 2023, Teck sold its metallurgical coal business, Elk Valley Resources for $9bn to Glenore, Nippon Steel and Posco. CEZ will exit coal production by 2038. So which coal companies remain, if you are going to explore this ‘insurance’ idea?

This data-file aims to screen 15 Western coal producers, picking out three names with material, long-term exposure to seaborne thermal coal prices. Some of these companies are exploring CCS and nature-based solutions, while others are less focused on decarbonization, and simply focusing on production, operations, safety.

The screen highlights each company, its size, concentration to coal, its asset base and other details around its longer-term strategy.

Chinese coal producers are noted in our overview of China’s coal mining industry. Further models and data-files can be found amidst our broader coal research.