How sensitive is global commodity demand to GDP growth? This 15-page report runs regressions for 25 commodities. Slower GDP growth matters most for oil markets, which are entering a new, more competitive, era. China is also slowing. But we still see bright spots in gas, metals, materials in our 2025 commodity outlook.

Some commentators see global GDP growth decelerating in 2025-30. Some see an outright recession. So how sensitive is commodity demand to global GDP? The growing importance of this question is discussed on pages 2-3.

Presently each $M of global GDP is associated with 80 tons of coal use, 350 bbls of oil, 1,360 mcf of gas, 285 MWH of electricity, 19 tons of steel, 19 tons of wood, 5 tons of plastics, 1.8 tons of ammonia, 1 ton of hydrogen, 0.7 tons of aluminium, 0.3 tons of copper. Charts tracing the commodity intensity of GDP for 15 metals and materials, and 15 oil products, are re-capped on pages 4-5.

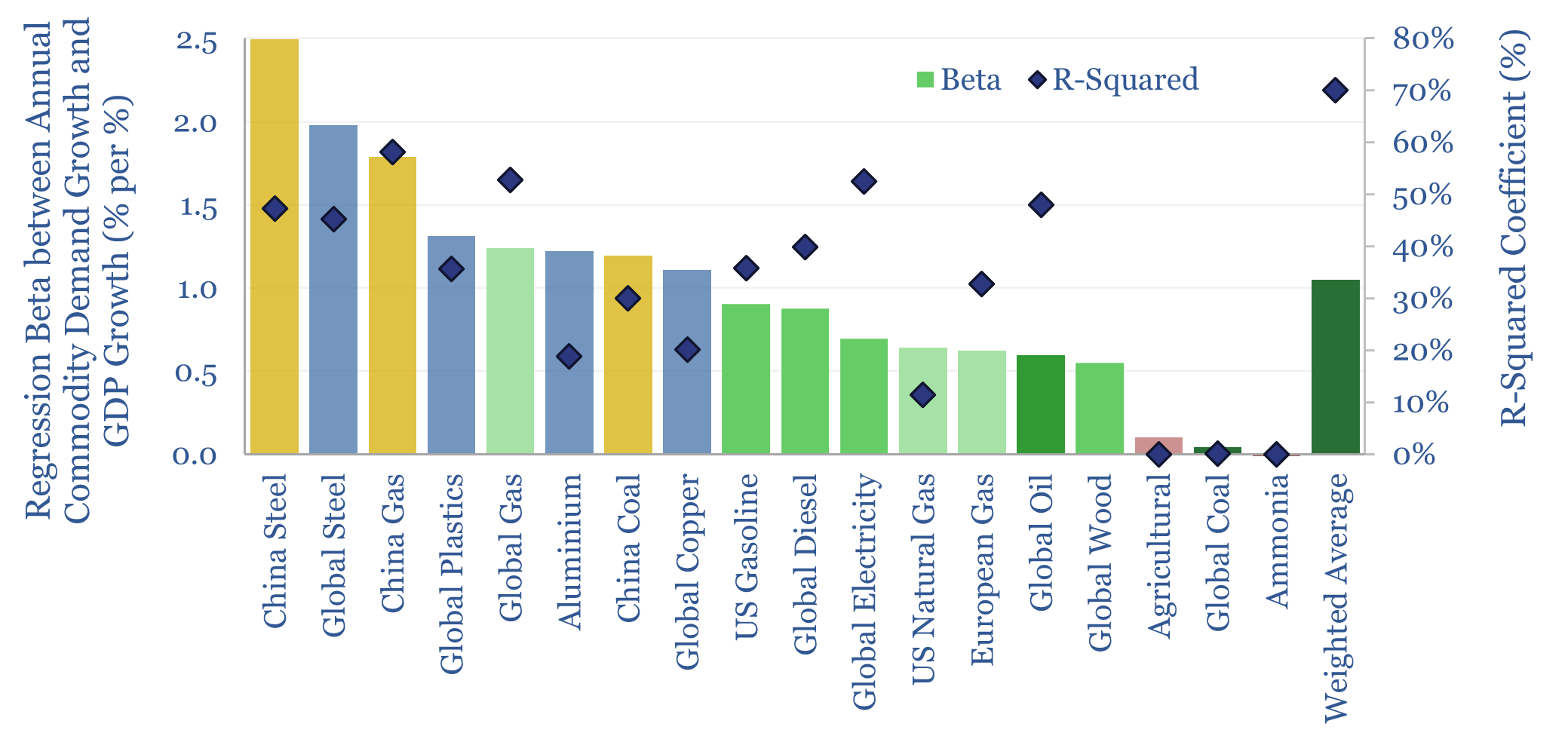

A better way to quantify the relationship between YoY commodity demand and GDP growth is via running regressions. Hence we have constructed a database for commodity demand sensitivity to GDP. Methodology is discussed on page 6.

Regression relationships are backwards-looking. Hence, they need to be adjusted to exclude timeframes that are no longer representative, or have been distorted by one-off events (e.g,. COVID). Our adjustments are discussed on page 7, especially in the context of global oil demand.

Oil markets are entering a new era of structurally slower demand growth. One reason is the rise of EVs. But slower GDP growth forecasts would also have a similarly large impact in 2025-27. Hence we are revising our outlook for global oil demand, as discussed on pages 9-10.

We have undertaken regression analysis for c25 different commodities and commodity-country pairs in our database. Metals such as steel, copper and aluminium all have beta factors above 1.0x, as discussed on pages 11-12.

Natural gas demand is also geared to GDP, and more so in the emerging world than the developed world, as discussed on page 13. We still think the US gas outlook is the stuff of dreams.

China’s real GDP growth is seen slowing from 5% pa in 2022-23 to 4% pa in 2029-30. How material is this for commodity demand? In our 2025 commodity outlook, we remain more constructive than ever on some metals and materials, for the reasons discussed on pages 14-15.