Gold hydrogen could be recovered from the Earth’s subsurface, with costs ranging from $0.3-10/kg, and CO2 intensities of 0.2-5.0 kg/kg. This data-file models the economic costs of gold hydrogen, and its sub-variants such as white hydrogen and orange hydrogen.

Gold hydrogen denotes a constellation of possible hydrogen resources, that could be recovered from the Earth’s subsurface, analogous to the production of natural gas, with an upfront development capex, production profile, opex and other purification costs.

This data-file models the costs of gold hydrogen, and sub-variants such as white hydrogen and orange hydrogen. We have drawn on our models of shale gas production, other gas field production, pressure swing adsorption, gas dehydration, gas sweetening, gas pipelines, shale CO2 and broader CO2 of producing natural gas.

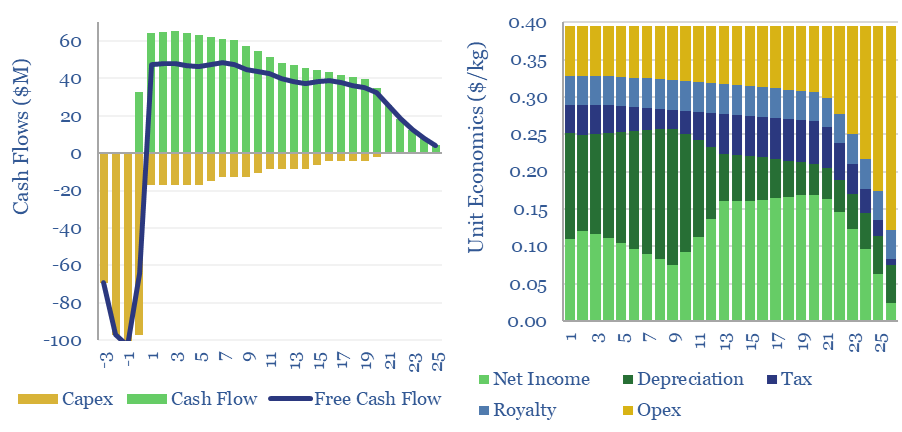

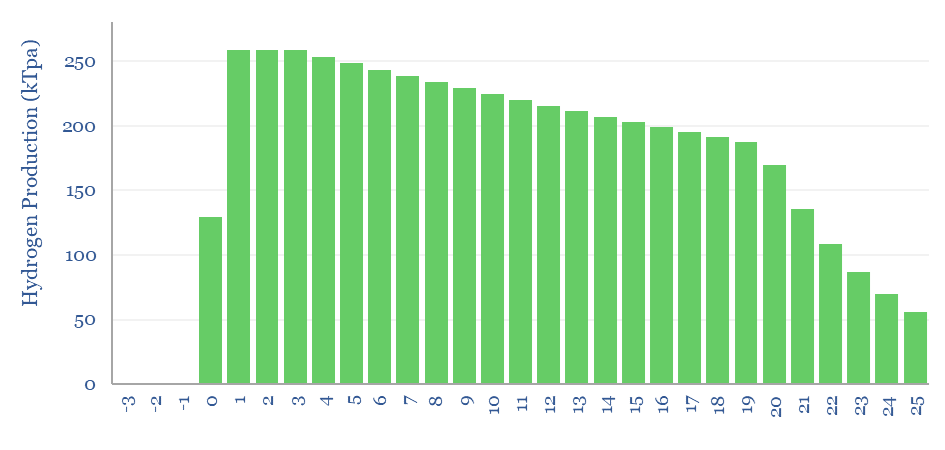

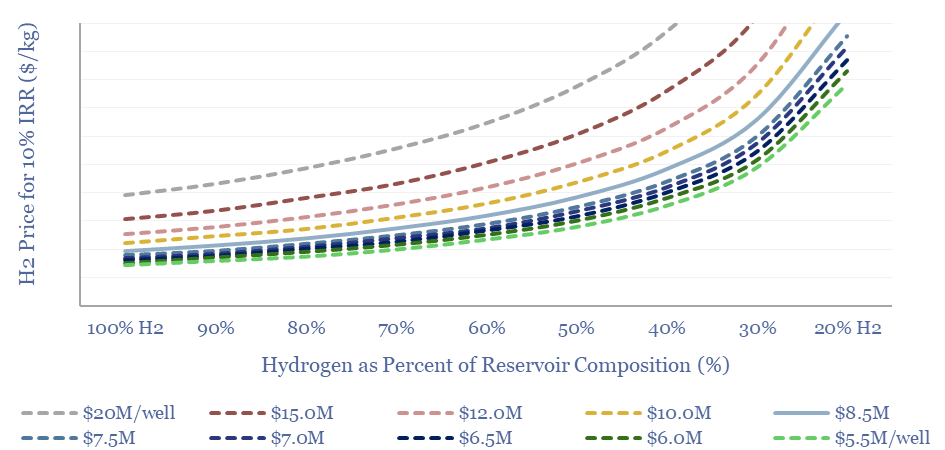

White hydrogen denotes the recovery of hydrogen from a natural hydrogen reservoir, via drilling and completing production wells, then separating gases at the surface. The best white hydrogen resources could cost $0.4/kg with a CO2 intensity below 0.4 kg/kg. This is materially better than today’s grey hydrogen from steam methane reforming. Although the numbers inflate with higher-cost wells and lower-purity hydrogen (sensitivity analysis below).

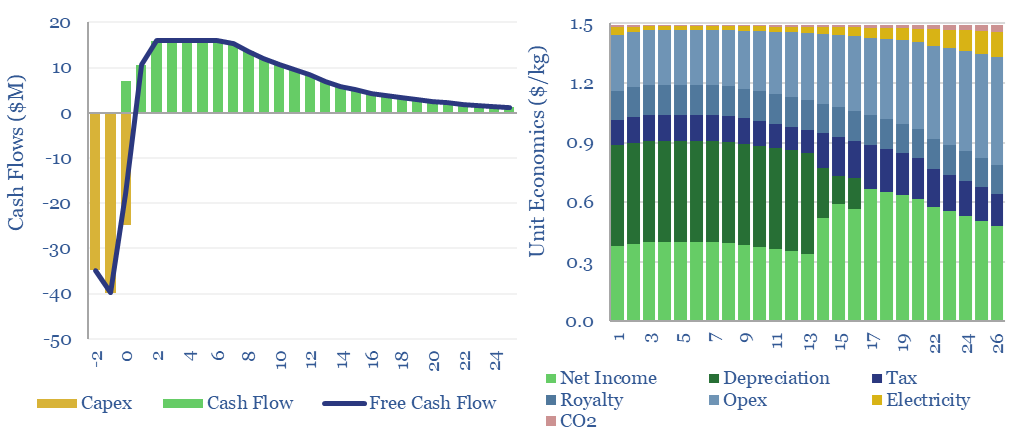

Orange hydrogen denotes an engineered approach, where water is injected into fractured reservoirs of ultra-mafic peridotites, where Fe(II) oxidizes into Fe(III), and thereby reduces water into hydrogen, which in turn can be recovered back to the surface. Orange hydrogen could be recovered at a cost of $1.5/kg, in extensive and naturally-fractured greenstones. The economics depend on the ratio of hydrogen resources to total project capex, at $0.4/kg in our base case.

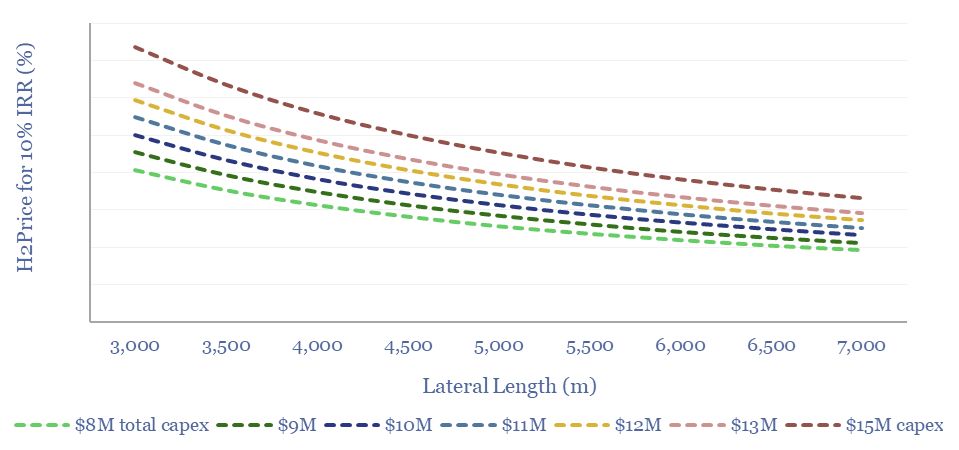

A shale-type approach to orange hydrogen is also modelled, where a horizontal well is drilled into ultra-mafic peridotites, then fractured, then flowed back. Costs are higher here, likely in the range of $2-7/kg. Lower costs are possible in theory, but hinge on extensive fracturing along very long laterals, which would simultaneously need to be lower-cost than equivalent horizontal wells in today’s shale industry.

The costs of gold hydrogen can be stress-tested in the model, to interrogate the relationships between input variables and hydrogen economics. For all of the tabs in the model, you can vary the capex, purity and flow-rates of hydrogen wells. For the orange hydrogen play-types, you can vary ten variables into the composition of the peridotites.

For further discussion, please see our 19-page report into gold hydrogen opportunities, costs, CO2 intensities and challenges.