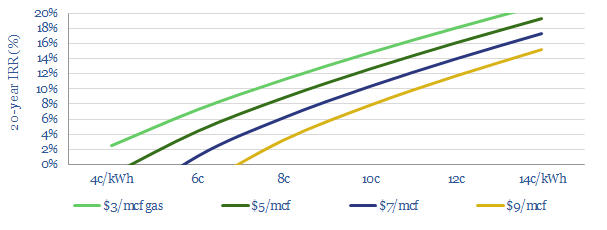

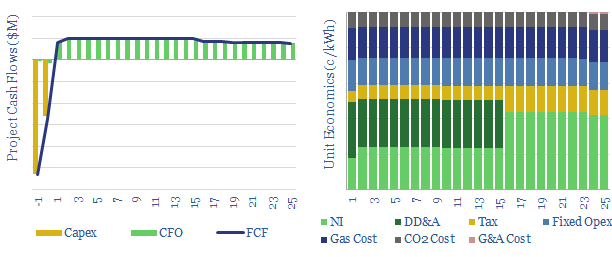

Oxycombustion is a next-generation power technology, burning fossil fuels in an inert atmosphere of CO2 and oxygen. It is easy to sequester CO2 from its exhaust gases, helping heat and power to decarbonise. We model that IRRs can compete with conventional gas-fired power plants and base case oxycombustion costs are 6-8c/kWh.

This data-file models oxycombustion costs, which is a next-generation power generation technology, burning natural gas (CH4) in a pure atmosphere of oxygen, so that the power generation cycle yields an output of pure CO2 and H2O.

We have built up our economic assumptions by reviewing technical papers, public information from leader NET Power, and based on thermodynamic modelling, from the power cycle through to super-critical CO2 compression.

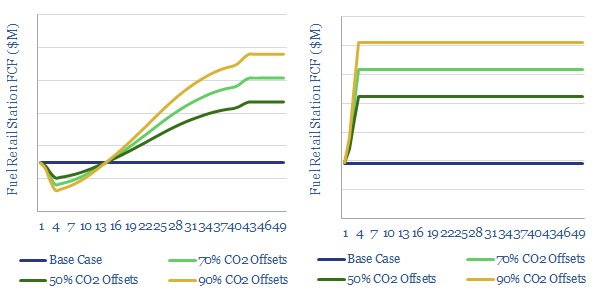

Our model of oxycombustion costs, averaging 6-8c/kWh in our base case, is based on assumptions for capex, opex, utilization, efficiency, gas prices, oxygen costs and CO2 disposal.

We first looked at NET Power in a research note in 2019, exploring how next-generation combustion technologies could facilitate easier capture of CO2 (note here). However, we updated the model in 2022-23, with further disclosures, released as the technology has progressed, and as Rice Acquisition Corp acquired NET Power.

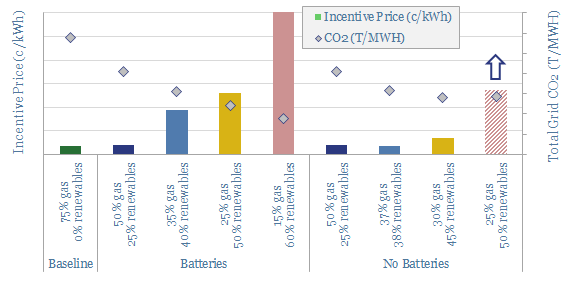

Reliable and low-carbon baseload power are increasingly important in our power grid research. We estimate CO2 intensities of 0.04-0.08 kg/kWh for oxycombustion, including the embedded CO2 of cryogenic oxygen production.

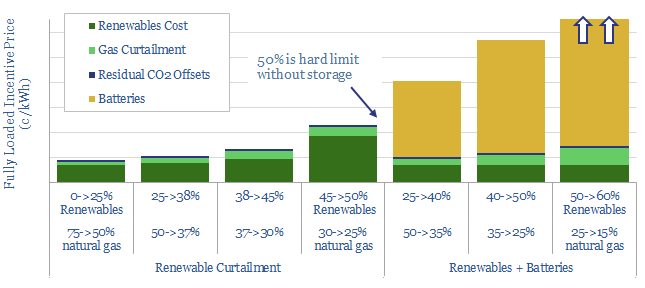

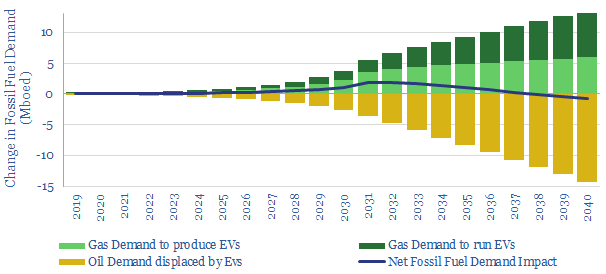

Competition? It is also under-appreciated that the utilization rates of developed world power grids have progressively been falling, inflating unit costs, which generates a growing incentive to self-generate clean and reliable power (note here).

Another key debate is how the reliability of oxycombustion power cycles will compete with smaller-scale CHPs and fuel cells. Fuel cells have historically had high decline rates, averaging 5% per year, but recent fuel cells are slowly improving.

Input assumptions that impact oxycombustion costs can be stress-tested by downloading the model. Further discussion here.