The average major economy produces 70% of its own energy and imports the other 30%. This 12-page note explores energy self-sufficiency by country. We draw three key conclusions: into US isolationism; Europe’s survival; and the pace of EV adoption, both in China and in LNG-importing nations.

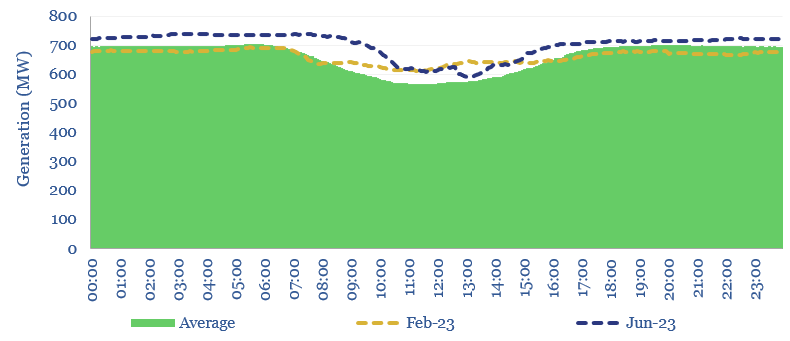

Coal power generation: minute-by-minute flexibility?

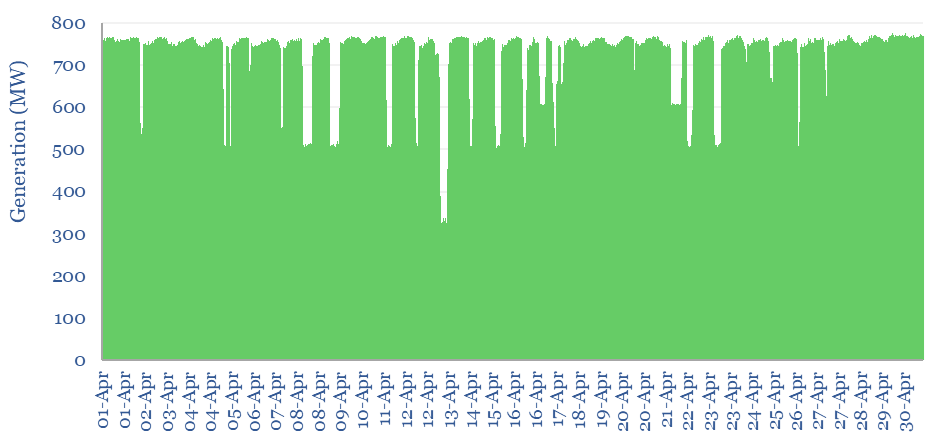

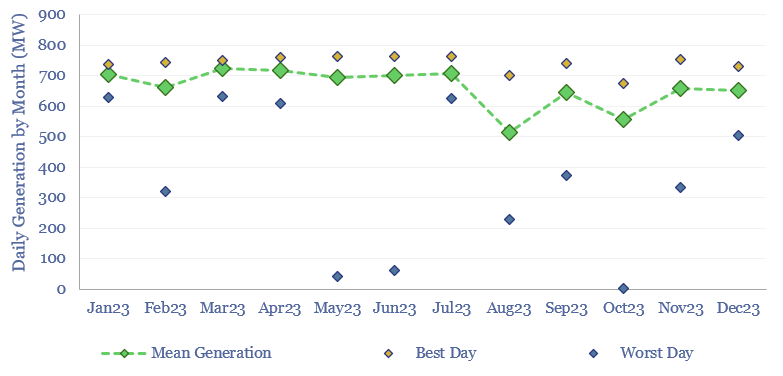

Coal power generation is aggregated in this data-file, at the largest single-unit coal power plant in Australia, across five-minute intervals, for the whole of 2023. The Kogan Creek coal plant produces stable baseload power, with an average utilization rate of 85%. But it exhibits lower flexibility to backstop renewables than gas-fired generation.

Kogan Creek is a coal-fired power plant in Brigalow, Queensland, Australia, located 230km west of Brisbane. It has a nameplate capacity of 787MW. It is thus the largest single coal unit in Australia.

The Kogan Creek coal plant uses supercritical steam in its power cycle, working at pressures of 250 bar and temperatures of 560°C, and a total system efficiency of 40%.

As a case study for the flexibility of large-scale coal generation, we have evaluated this coal plant’s output, every 5-minutes over 2023 (105,000 data-points!), using data from AEMO.

Average utilization for the Kogan Creek coal plant in 2023 was 85%, varying remarkably little over the year, as coal provides low-cost baseload to the grid. The plant’s high utilization was mainly hampered by shutdowns, including a two-day outage in October and a five-day outage in August, lowering monthly utilizations to 71% and 66% respectively.

Volatility for a coal plant is low by design. The average 5-minute-by-5-minute volatility of Kogan Creek is +/-1%, while a typical large solar or wind installation is +/- 5%. For wind and solar, this is true volatility. But for coal, it is mostly flexibility, i.e., intentional variation in output levels in response to grid demand and grid pricing.

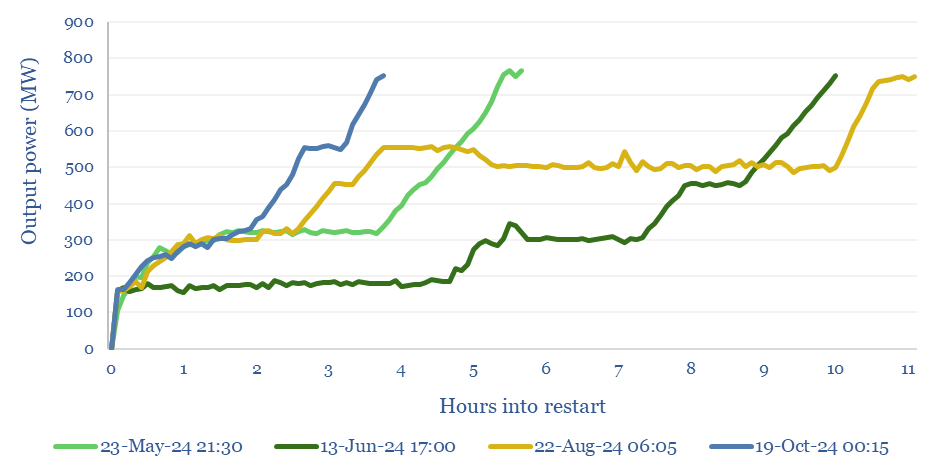

Several outages occurred at Kogan Creek in 2023, ranging from a couple of hours to several days. Ramping up to full capacity from a cold start appears to take 4-8 hours (chart below). This fits our broader data into power plants’ ramp rates from a cold start.

Solar power has a clear impact on the daily profile of coal generation. Similarly to Stockyard Hill wind farm, output at Kogan Creek was 10-20% lower than average between 8am and 3pm over the whole year. Coal ramps down in the middle of the day to make room for solar but still provides 60% of all electricity produced in Queensland.

This is yet another entry in our series analyzing the generation profiles of different electricity sources using data from the Australian grid. Previously we have looked at gas, solar, wind, and battery storage. Our key conclusion remains that gas-fired generation will entrench as the leading backstop for volatile renewables.

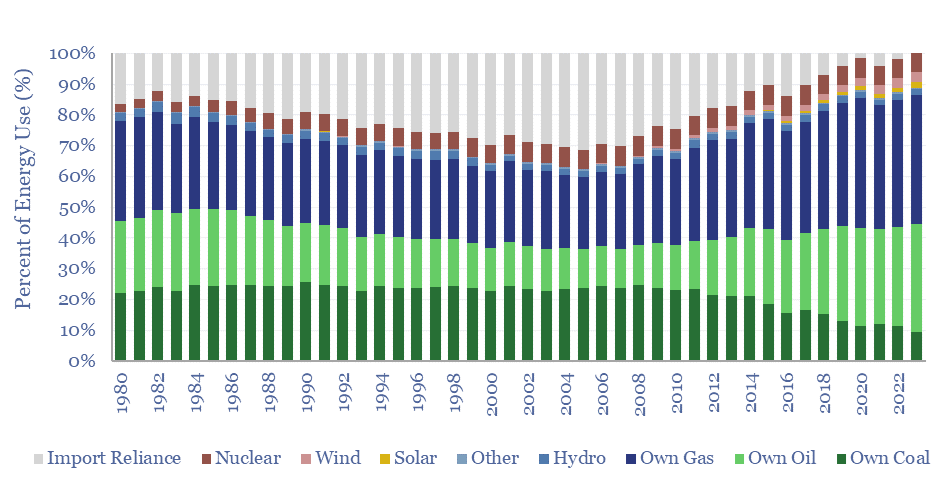

Energy self-sufficiency by country and over time?

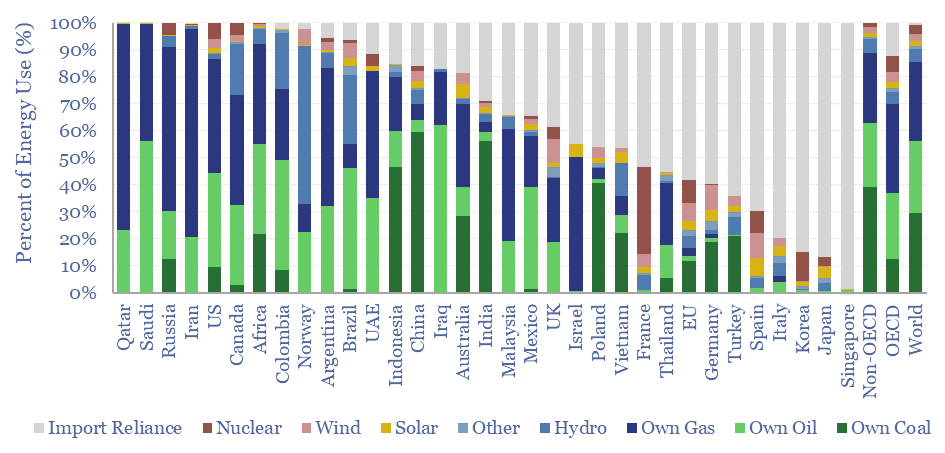

This data-file tabulates energy self-sufficiency by country, over time, across 30 of the largest economies in the world. Among this sample, the median country generates 70% of its energy domestically, and is reliant on imports for 30% of the remainder. Energy self-sufficiency varies vastly by country.

Energy self-sufficiency can be estimated by on a gross basis by dividing total primary energy production by total primary energy consumption. Leading countries include Norway (6x more energy produced than consumed), Qatar (4x), Iraq (3x), Australia (3x), Saudi Arabia (2x), Indonesia (2x), Russia (1.7x), Canada (1.7x).

Energy self-sufficiency can also be estimated on a net basis, by summing up the share of total useful energy consumption, by resource, that is met domestically versus from import reliance. Most import-reliant countries include Singapore (99%), Japan (87%), South Korea (85%), Italy (80%), Spain (70%) and Turkey (65%).

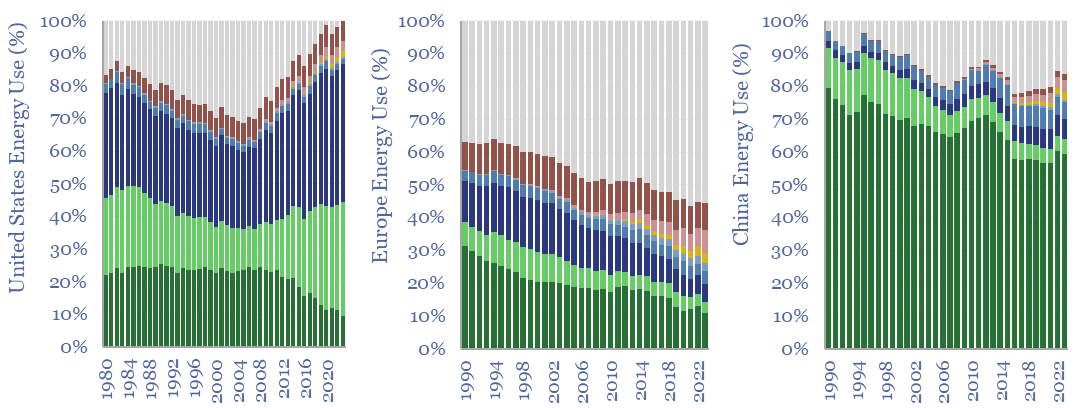

Energy self-sufficiency in the US declined from 1982 to 2005, at which point, the US was importing over 30% of its total energy needs. Amazingly, in the past twenty years since 2005, the US has ramped up its oil production by 3x, its gas production by 2x and now also produces 5% of its energy from new energies such as wind and solar. This means the US produces 1.1x more primary energy than it needs. And, for the first time in 50-years, the US has no net energy import reliance (chart below).

Some commentators have noted a streak towards isolationism among recent US political candidates. The reality is that the US is less reliant on a stable world for its energy security than it was 20-30 years ago.

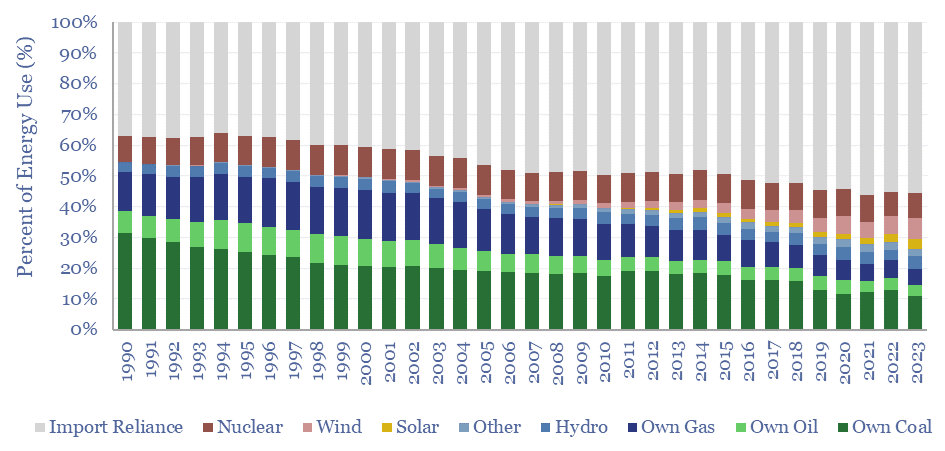

Energy self-sufficiency in Europe, on the other hand, has been a disaster, and dangerous for geopolitical security. Europe was 65% self-sufficient for its own energy supplies, 30-years ago, in 1994. Today it is 45% self-sufficient in its energy supplies (chart below).

Wind and solar do provide 7% and 3% of Europe’s energy needs, respectively. However, domestic production of gas, oil and coal have all fallen by 60-70% in the past 30-years, and countries such as Germany have enacted kamikaze energy policies such as shutting down their nuclear industries (which formerly supplied 9% of Germany’s energy needs).

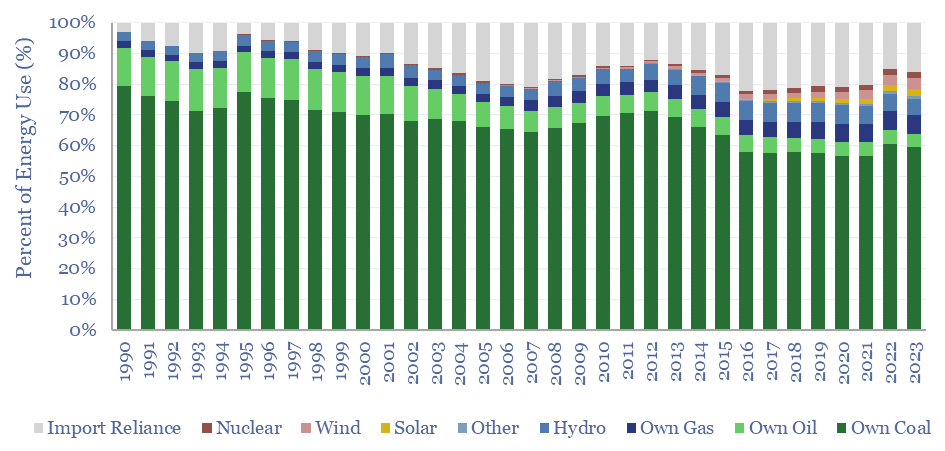

Energy self-sufficiency in China is a major policy goal. Import reliance peaked in 2006, at 20% of China’s energy needs. China’s need to import oil is the largest import reliance in our entire data-set. Hence China has been electrifying its vehicle fleet faster than any other nation, while also ramping up coal production and renewables for electricity.

The full data-file shows our calculations, for transparency, with data into the energy self-sufficiency by country in Argentina, Australia, Brazil, Canada, China, Colombia, the EU, France, Germany, India, Indonesia, Iran, Iraq, Israel, Italy, Japan, Malaysia, Mexico, Norway, Poland, Qatar, Russia, Saudi Arabia, Singapore, South Korea, Spain, Thailand, Turkey, UAE, the United Kingdom, the US, and Vietnam. Underlying data are from the Energy Institute.

Energy economics: an overview?

This data-file provides an overview of energy economics, across 175 different economic models constructed by Thunder Said Energy, in order to put numbers in context. This helps to compare marginal costs, capex costs, energy intensity, interest rate sensitivity, and other key parameters that matter in the energy transition. Our top five facts follow below.

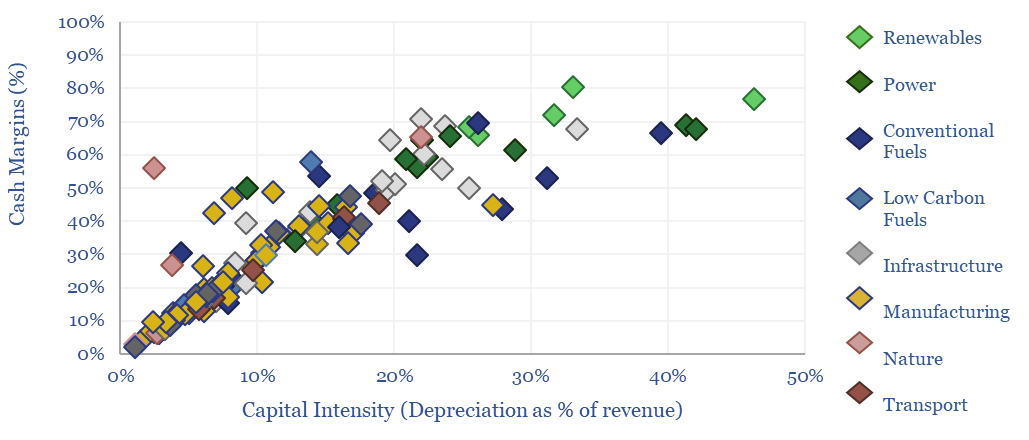

This data-file model provides summary economic ratios from our different economic models across conventional fuels, conventional power, renewables, lower-carbon fuels, manufacturing processes, infrastructure, transportation and nature-based solutions.

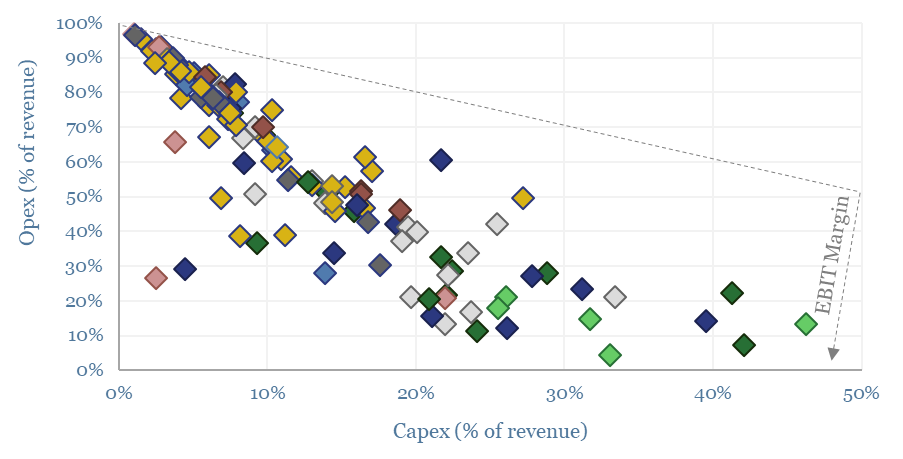

For example, EBIT margins range from 3-70%, cash margins range from 4-80% and net margins range from 2-50%, hence you can use the data-file to ballpark what constitutes a “good” margin, sub-sector by sub-sector; and to screen different industries, according to the capital intensity, opex costs and resultant profitability (chart below).

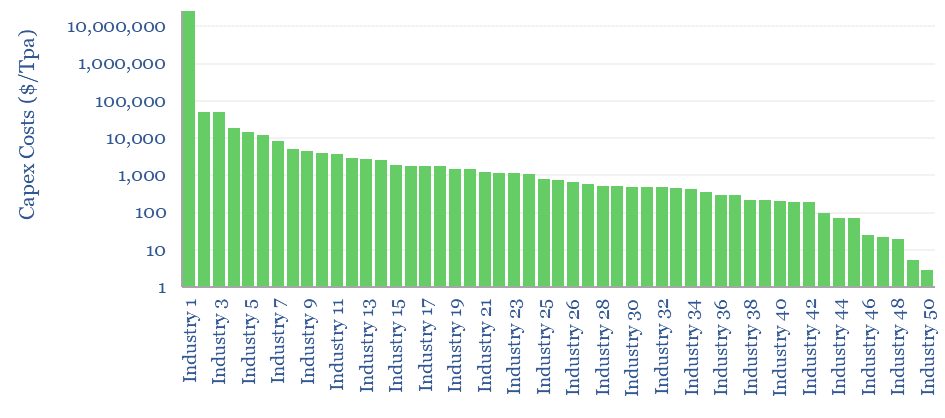

Capital intensity ranges from $300-9,000kWe, $5-7,500/Tpa and $4-125M/kboed. So if you are trying to ballpark a cost estimate you can compare it with the estimated costs of other processes. The median average industry has a capex cost of $750/Tpa (chart below).

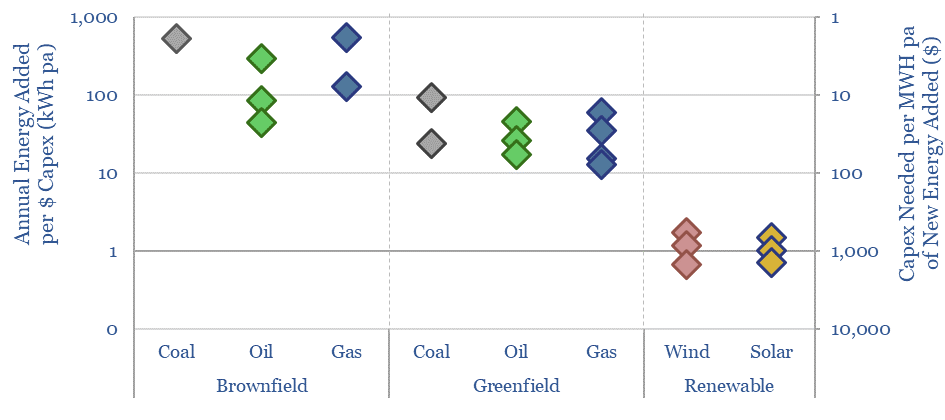

Capital intensity of different energy sources also varies by an order of magnitude (chart below). Each $1 dollar that is disinvested from new hydrocarbon capex ideally needs to be replaced by $25 invested in wind and solar, in order to add the same amount of primary energy to the global energy system (chart below, note here).

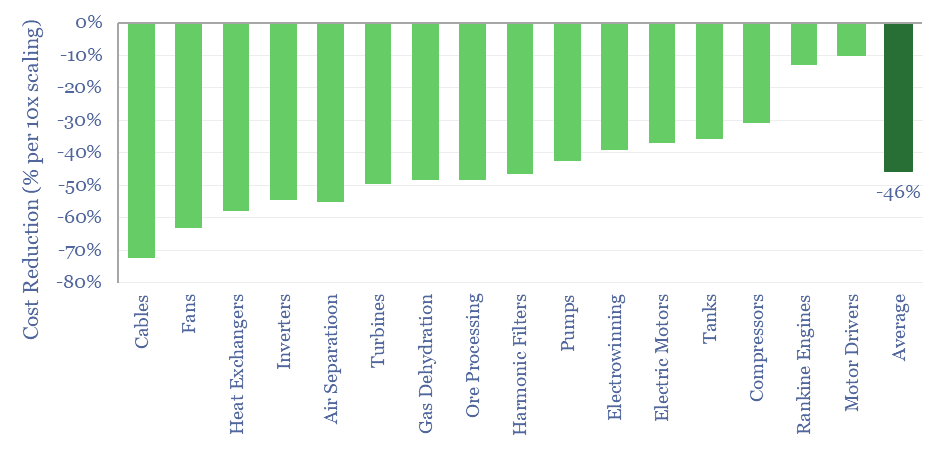

Economies of scale are visible in the data-file, across our models of Air Separation, Cables, Comminution, Compressors, Electric Motors, Electrowinning, Fans, Flotation, Gas Dehydration, Harmonic Filters, Heat Exchangers, Inverters, Motor Drivers, Pumps, Rankine Engines, Tanks and Turbines. Generally, making these units 10x larger reduces their unit costs by around 45%.

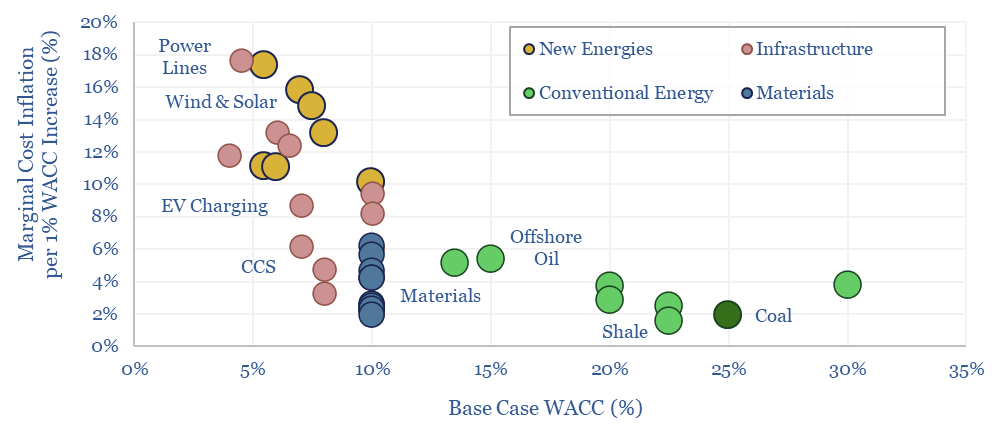

Interest rate sensitivity is visible in our overview of energy economics. Each 1% increase in capital costs re-inflates new energies 10-20%, infrastructure 2-20%, materials 2-6%, and conventional energy 2-5% (chart below, note here).

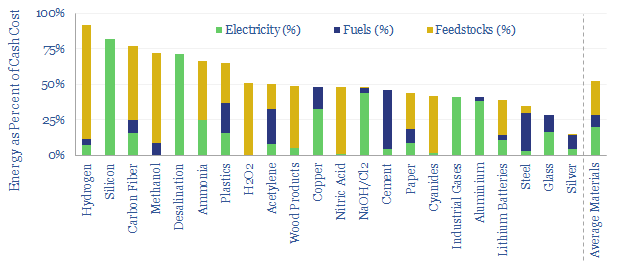

The energy intensity of materials is visible across our models of Acetylene, Aluminium, Ammonia, Carbon Fiber, Cement, Copper, Cyanides, Desalination, Glass, H2O2, Hydrogen, Industrial Gases, Lithium Batteries, Methanol, NaOH/Cl2, Nitric Acid, Paper, Plastics, Silicon, Silver, Steel, Wood Products. As a rule of thumb, energy is 50% of the cash cost of typical materials.

Renewables stand out. Despite high capital intensity (35% of revenues, 2x the average), once constructed, they also have the highest cash margins (75%, also 2x the average). The rise of wind, solar and electrification make capex costs and capital costs increasingly important.

The full data are available in the data-file below. However, please be aware that this is simply a compilation of headline figures across our library of 175 economic models. Access to all of the underlying models is covered by a Thunder Said Energy subscription.

Hydrogen: overview and conclusions?

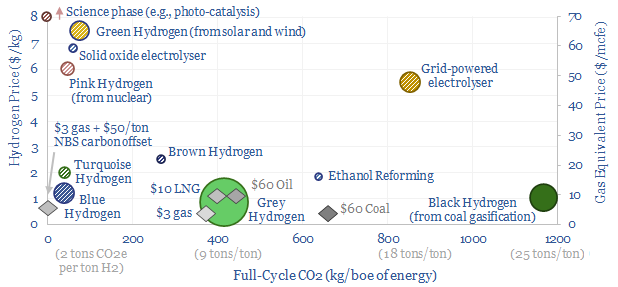

The best opportunities for hydrogen in the energy transition will be to decarbonize gas at source via blue and turquoise hydrogen, displacing ‘black hydrogen’ that currently comes from coal, and to produce small-scale feedstock on site via electrolysis for select industries. Some see green hydrogen becoming widespread in the future energy system. We think there may be options elsewhere, to drive more decarbonization, with lower costs, lower losses and higher practicality.

(1) Green hydrogen economy? Our main question mark is over “economy”. Costs are modeled at $7/kg, equivalent to $70/mcf natural gas, after generating renewable electricity, electrolysing water into hydrogen and storing the hydrogen. Levelized costs of electricity then reach 60-80c/kWh, for generating clean electricity in a fuel cell power plant, yielding a CO2 abatement cost of $600-1,200/ton (note here). We think costs matter in the energy transition and the entire world can be decarbonized via other means, for an average cost of $40/ton in the TSE roadmap to net zero.

(2) Fuels derived from green hydrogen are by definition going to be more expensive than the hydrogen itself. We have evaluated electro-fuels, green methanol, sustainable aviation fuels, hydrogen trucks, again finding CO2 abatement costs above $1,000/ton. Again, we think transportation can be decarbonized cost-effectively via other means.

(3) How much can capex costs come down? There is an aspiration for electrolyser costs (presently around $1,000/kW on a full, installed basis) to deflate by over 75%. However, we have reviewed electrolyser costs line by line and wonder whether 15-25% deflation is more realistic (note here). Alkaline electrolysers vs PEMs are contrasted here. We have recently screened NEL’s patents to explore future cost deflation in electrolysers.

(4) Efficiency: the second law of thermodynamics. The absolute magic of renewables and electrification is their thermodynamics. These technologies can be 85-95% efficient end-to-end, precisely controlled, and ultra-powerful. A world-changing improvement on heat engines and an energy mega-trend for the 21st century. However, the thermodynamics of hydrogen depart from the trend, converting high-quality electricity back into a fuel. The maximum theoretical efficiency of water electrolysis is 83% (entropy increases). Real world electrolysers will be c65% efficient. End-to-end hydrogen value chains will be c30-50% efficient. We want to decarbonize the global energy system. It therefore seems strange to take 100MWH of usable, high-grade, low-carbon electricity, and convert it into 40MWH of hydrogen energy, when you could have displaced 100MWH of high-carbon electricity directly (e.g., from coal). And all the more so, amidst painful energy shortages.

(5) Backing up renewables? It is often argued that renewables will eventually become so abundant, especially during windy/sunny moments, that the inputs to hydrogen electrolysers will become free. We think this is a fantasy. Instead, industrial facilities and consumers will demand shift. Conversely, we are not even sure an electrolyser can run off of a volatile renewables input feed without incurring 5-10% pa degradation, or worse (if you read one TSE note on green hydrogen, we recommend this one).

(6) Operations, transport, logistics all feel strangely challenging. Our studies of patents suggest that electrolysers and fuel cells can be the Goldilocks of energy equipment. Past installations have declined at over 5% per year. Due to its small molecular size, 35-75% of hydrogen produced in today’s reformers can be lost. Some vehicles seek to store hydrogen fuel at 10,000 psi, which is 1.5x the pressure of hydraulic fracturing. Even in the space industry, rocket makers have been de-prioritizing hydrogen in favor of LNG (!) because of logistical issues. The costs of hydrogen transport will be 2-10x higher than comparable gas value chains, while up to 50% of the embedded energy may be lost in transportation: our overview into hydrogen transport is here, covering cryogenic trucks, hydrogen pipelines, pipeline blending, ammonia and toluene. Is a hydrogen truck really comparable with a diesel truck? (note here, models here). Finally, the gas industry is bending over backwards to stem methane leaks, due to methane’s GWP of 25x CO2, but hydrogen itself may have a GWP as high as 13x CO2.

(7) Will policy help? We are not sure. We are tempted to draw analogies to the Synthetic Fuels Corporation, bequeathed $88bn of US government money in 1980 amidst the oil shocks, which in today’s money is similar to the $325bn Inflation Reduction Act. It completely missed its targets of unleashing 2Mbpd of synfuels by 1992, due to challenging economics, thermodynamics, technical issues, logistical issues. What evidence can we find that green hydrogen will prove different to this historical case study?

(8) Niche applications can however be very interesting, where clean hydrogen is used as an industrial feedstock. An overview of today’s 110MTpa hydrogen market is here and underlying data are here. At large scale, we are currently most excited by using clean hydrogen in ammonia value chains and steel value chains, as the technology is fully mature and looking highly economical. It is also booming in the US. Elsewhere, an excellent large-scale application is to displace black hydrogen (made from coal), which is 20% of today’s hydrogen market and has a staggering CO2 intensity of 25 tons/ton. At smaller scale, there is also a weird and wonderful industrial landscape, using hydrogen to make products such as margarine or automotive glass. Putting an electrolyser on site beats shipping in hydrogen via cryogenic trucks. But these are also quite niche applications.

(9) Blue hydrogen is the most economical, low-carbon hydrogen concept we have found. Effectively this is decarbonizing natural gas at source, by reforming the methane molecule into H2 and CO2, the latter of which is sent directly for CCS. Our best overview of the topic is linked here. There are still c15% energy penalties. Costs are $1-1.5/kg in our models, to eliminate c90% of natural gas CO2.

(10) Turquoise hydrogen is also among the more interesting concepts, pyrolysing the methane molecule at 600-1,200◦C into H2 and carbon black. Our base case cost is $2/kg, with a $500/kg price for carbon black. But if you can realize $1,000/kg for the carbon black, you could give the hydrogen away for free. We have screened patents from Monolith and expect others to come to market with technologies and projects.

Around 40 reports and data-files into hydrogen have led us to these conclusions above; listed in chronological order on our hydrogen category page. The best way to access our PDF reports and data-files is through a subscription to TSE research.

Energy storage: top conclusions into batteries?

Thunder Said Energy is a research firm focused on economic opportunities that drive the energy transition. Our top ten conclusions into batteries and energy storage are summarized below, looking across all of our research.

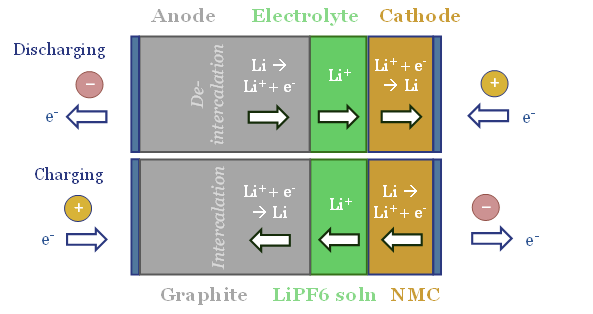

(1) Transportation: a revolution. Gasoline and diesel vehicles are 15-25% efficient, on a wagon to wheel basis, due to immutable laws of thermodynamics. Electric vehicles using lithium ion batteries are 75-95% efficient. The technology is only getting better, including via power electronics and electric motors. So this is a game changer for light transportation, which becomes >70% electric in our oil models by 2050.

(2) Bottlenecks in battery materials will set the limit on the scale up. Numerically, the largest bottlenecks are in lithium; followed by fluorinated polymers and battery-grade nickel; then graphite and copper. We are less worried about cobalt. Our best data-file into materials used in a lithium ion battery, and their costs, is linked here.

(3) Power grids: efficiency drawbacks. Amidst materials bottlenecks, we think vehicle applications will generally outcompete grid applications. While an EV is 3-4x more efficient than what it replaces, grid scale storage usually has a 10%+ energy penalty. Thus the 65kWh battery in a typical EV saves 2-4x more energy and 25-150% more CO2 each year than a typical grid battery (note here).

(4) Power grids: the best battery is no battery. All batteries have a cost, usually $1,000-2,000/kW, which is re-couped through a storage spread, usually around 20c/kWh for daily charging-discharging (model here). Conversely, there are many loads in the power grid that can shift their demand (e.g., to the times when grids are over-saturated with renewables). This often has no cost. And no efficiency losses. Some of our favorite examples are catalogued here.

(5) Power grids: short-term first. The biggest challenges for ramping up wind and solar stem from short-term volatility (inertia, reactive power compensation, frequency regulation, <1-minute power drops). This requires short-term energy storage first, in the 2020s and 2030s. Many short term batteries can also earn their keep through recuperative energy savings. But note short term energy storage favors capacitor banks, STATCOMs, flywheels, synchronous condensers, supercapacitors. It is debatable whether lithium ion is well suited to short-term smoothing. Eaton has even recently started integrating supercapacitors into its industrial batteries, amidst increasing customer demand for short-term performance (case studies here).

(6) Long-term storage is for the 2040s, if at all. If you cycle your battery 10 times per day, you amortize its capex across 3,650 cycles per year, and the cost per cycle is <1c/kWh. Cycle 1 time per day, and it is 10-20c/kWh. Cycle 1 time per month and you are well above 200c/kWh. The maths are reviewed here. You can also stress test numbers in our pumped hydro model, other battery models. So we do not think long term storage (via batteries or hydrogen) will ever come into the money. We see more opportunity in long-distance power transmission, decarbonized gas, next-gen nuclear; fully decarbonizing future grids while keeping costs below 10-20c/kWh.

(7) Density will improve, but not enough for mass deployment of battery trucks, ships or planes. Today’s lithium ion batteries store 200Wh/kg. In a best case scenario, this could reach 1,250 Wh/kg. Oil products contain 12,000Wh/kg. Thus a battery-powered Class 8 truck will have 70-80% lower range than a diesel truck. And a battery-powered airliner has a range of c60-miles. We do not currently see battery powered trucks, ships or planes going mainstream.

(8) Next-gen batteries: can we de-risk them? There is constant progress and innovation in batteries, to improve density, duration, chemistry, longevity, cost, charging speeds. So we are constantly screening patent libraries. As a general rule we have found incremental innovations easier to de-risk. But we have been less able to de-risk big changes. Replacing lithium with sodium has issues with ionic radius. Solid state batteries often have issues with dendrites and longevity. Redox flow likely works but has 70-75% efficiency.

(9) End-of-life is most unresolved. If there is one TSE research note on batteries, which we think decision-makers should read it is this one, explaining battery degradation, the best antidotes and their implications (lithium upside?, manufacturer upside?). This matters, because despite some interesting inroads, we still do not think the industry has really cracked battery recycling, a potential $100bn pa market in the 2040s.

(10) Which battery companies? We have been most impressed by manufacturing technologies from 24M and CATL, followed by integrated battery offerings from Eaton, Stem and Powin. There are some interesting innovations from Amprius, Enovix, Quantumscape. But so far, we have found it more challenging to entirely de-risk concepts from Sila, Form Energy, Solid Power, Storedot. Please email us if there are any battery technologies you would like us to explore.

Around 60 reports and data-files into batteries and energy storage have led us to these conclusions above; listed in chronological order on our batteries category page. The best way to access our PDF reports and data-files is through a subscription to TSE research.

LNG: top conclusions in the energy transition?

Thunder Said Energy is a research firm focused on economic opportunities that drive the energy transition. Our top ten conclusions into LNG are summarized below, looking across all of our research.

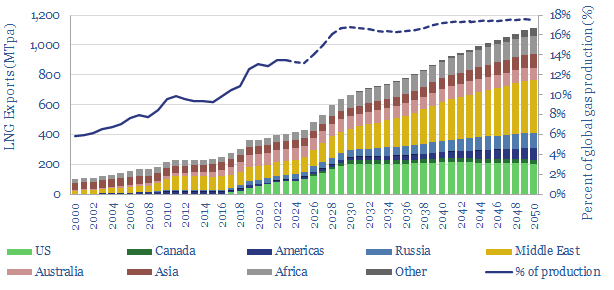

(1) LNG markets treble in our energy transition roadmap, rising from 400MTpa today to 1,100MTpa by 2050, for a c4% CAGR. The main reason is to displace coal, which is 2x more CO2 intensive. This LNG growth rate is 1.5x faster than total global natural gas supply growth, which “merely doubles” from 400bcfd to 800bcfd, for a 2.5% CAGR. The world needs $20bn of new liquefaction capex per year. Our LNG outlook through 2050 is modeled here.

(2) Marginal cost is $10/mcf as a rule-of-thumb for the 2020s. This is summing up the economics across the entire value chain for gas production, gas processing, pipeline transportation, LNG liquefaction, LNG shipping and LNG regasification. The best projects work at $7/mcf. But prices will run well above marginal cost amidst under-supply.

(3) Under-supply in 2023-28 in our supply model augurs for $15-40/mcf spot global LNG prices. After adding +20MTpa of new LNG supplies each year from 2015 to 2022, we think the world will be lucky to add +10MTpa in 2023 and 2024. There is always a further risk of supply disruptions. Meanwhile, Europe’s 15bcfd of Russian gas imports, volumetrically equivalent to 110MTpa of LNG, are shifting. The best note covering our gas outlook is linked here and our European gas models are linked here.

(4) The key challenge is CO2. Liquefying natural gas at -160C requires 300-400kWh/ton of energy, depending on the LNG plant design. This results in 3-4 kg/mcf of Scope 1+2 CO2. Across the value chain, LNG will have 7-10kg/mcf of Scope 1+2 CO2. Adding the Scope 3 from combustion, we reach total CO2 intensity of 60-65kg/mcf. Coal is 130kg/mcfe. Yet it feels like we could die of energy shortages before gas critics listen to “relative CO2” reasoning and countenance long-term LNG contracts.

(5) Rising to the challenge. The LNG industry can satisfy its skeptics. This is earnestly happening. It includes measuring CO2 in LNG supply chains. Then offsetting it via nature-based CO2 removals. Or capturing CO2 from combustion, then sharing regas terminal infrastructure to liquefy it, and ship it away for disposal. We have written a full note on back-carrying CO2 here. CO2 abatement costs range from $50-125/ton, or $3.0-7.5/mcfe. This scores well on our cost curves.

(6) 2020s supply growth will be dominated by the US, which is particularly well placed to assuage gas shortages in Europe. US LNG can treble from 70MTpa in 2021 to 200MTpa by 2030. It requires an extra 17bcfd of gas (c18% total US gas supply growth), which in turn pulls on E&P activity in the Haynesville, Permian and Marcellus.

(7) Longer term supply growth will be dominated by the Middle East, which is particularly well placed to phase out China’s coal. These numbers are mind-blowing. As an idea, if China directly substituted all 4GTpa of its coal (10GTpa of CO2 emissions!), this would require 1,600 MTpa of LNG, i.e., 4x more than today’s entire global LNG market. If you read one note, to understand this topic, we would recommend this one.

(8) Smaller-scale LNG and transport upside? We have reviewed opportunities in LNG in transport, smaller-scale LNG, LNG-fueled trucks, LNG-fueled ships, eliminating methane slip, LNG fuelling stations, small fixed LNG plants, floating LNG plants. There are some interesting concepts, especially for specific applications. But we have not materially de-risked smaller-scale LNG upside in our numbers yet.

(9) Cyclical industries reward counter-cyclical behaviours, and LNG is deeply cyclical. The title chart above shows this nicely, with spurts of growth, punctuated by plateaus, once per decade. It always feels uncomfortable to sanction projects when others are not. But our view is that bravery gets rewarded. “If you build it, the demand will come”.

(10) Companies. Incumbents benefit most from under-supply in the 2020s. Upcoming projects and their sponsors are summarized in our LNG supply model. We have also screened LNG shipping companies. But the question that fascinates us most is whether upcoming project sponsors can avoid the cost inflation that marred the past cycle, with some interesting evidence from patents in our note here.

Around 45 reports and data-files into LNG have led us to these conclusions above; listed in chronological order on our LNG category page. The best way to access our PDF reports and data-files is through a subscription to TSE research.

Power grids: opportunities in the energy transition?

This article summarizes our conclusions into power grids and power electronics, across all of Thunder Said Energy’s research. Where are the best power grid opportunities in the energy transition?

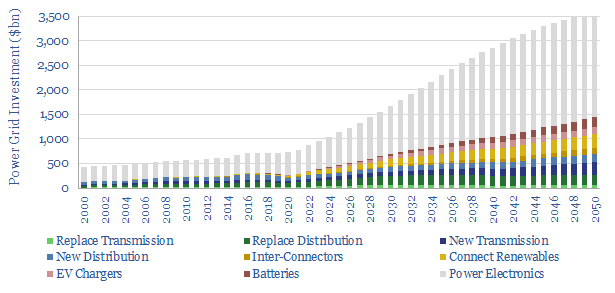

Power grids move electricity from the point of generation to the point of use, while aiming to maximize power quality, minimize costs and minimize losses. Broadly defined, global power grids and power electronics investment must step up 5x in the energy transition, from $750bn pa to over $3.5trn pa. This theme gets woefully overlooked. This also means it offers up some of the best opportunities in the energy transition.

(1) Electrification is going to be a major theme in the energy transition, a mega-trend of the 21st century, as the efficiency and controllability of electrified technology is usually 3-5x higher than comparable heat engines. It is analogous to the shift from analogue to digital. 40% of the world’s useful energy is consumed as electricity today, rising to 60% by 2050 (note here — our best overview of the upside in grids) propelling the efficiency of the primary global energy system from 45% today to 60% by 2050 (note here). Power demands of a typical home will also double from 10kW to 20kW in the energy transition (data here). Electricity demands of industrial facilities are aggregated here.

(2) Electricity basics are often misunderstood? If we have one salty observation about power markets, it is that many commentators seem to love making sweeping statements without understanding much at all. It is the energy market equivalent of wandering in off the street to an operating theater, and without any medical training at all, simply picking up a scalpel. This is a little bit sad. But it also means there will be opportunities for decision makers that do understand electricity and power systems. As a place to start, our primer on power, voltage, current, AC, DC, inertia and power quality is here.

(3) Power generation costs 5-15c/kWh. But variations within each category are much wider than between categories (note here). So generation will not be a winner takes all market, where one “energy source to rule them all” pushes out all the others. This view comes from stress testing IRR models of wind, solar, hydro, nuclear, gas, coal, biomass, diesel gensets and geothermal. And from 400-years of energy history. The average sizes of power generation facilities are here, and typical ramp rates are here.

(4) Transmission is becoming the key bottleneck on renewables and electrification in the energy transition. Each TWH pa of global electricity demand is supported by 275km of power transmission and 4,000km of distribution (data here). Connecting a new project to the grid usually costs $100-300/kW over 10-70km tie-in distances (data here). But bottlenecks are growing. The approval times to connect a new power plant to the grid have already increased 2.5x since the mid-2000s, averaging 3-years, especially for wind and solar, which take 30% and 10% longer than average (data here). Avoiding these bottlenecks requires power grids to expand. Spending on power grids alone will rise from $300bn pa to over $1.2trn pa, which is actually larger than the spending on all primary energy production today (data here).

(5) Power transmission also beats batteries as a way of maximizing renewable penetration in future grids. Rather than overcoming intermittency — solar output across Europe is 60-90% inter-correlated, wind output is 50-90% inter-correlated — by moving power across time, you can solve the same challenge by moving them over a wider space. A key advantage is that a large and extensive power grid smooths all forms of renewables volatility, from a typical facility’s 100 x sub-10-second power drops per day to the +/- 6% annual variations in solar insolation reaching a particular point of the globe. By contrast, different batteries tend to be optimized for a specific time-duration, while at long durations, the economics become practically unworkable. A new transmission line usually costs 2-3c/kWh per 1,000km (model here). Additional benefits for expanded power grids accrue in power quality, reliability and resiliency against extreme weather. These benefits will be spelled out further below…

(6) Upside for transmission utilities and suppliers? Our overview of how power transmission works is here. Operating data for high voltage transmission cables are here. Leading US transmission and distribution utilities are screened here. Leading companies in HVDCs are here. Offshore cable lay vessels are screened here. We have also screened Prysmian patents here. But the opportunity space is also much broader, which becomes visible by delving into how power grids work…

(7) Cabling materials. As a general rule, overhead power lines are made of aluminium, due to its light weight and high strength. Conversely, HVDC cables and household wiring are made of copper, which is more conductive. HVDCs are also encased in specialized plastics. New power transmission lines add 3-5MTpa of demand to aluminium markets, or 5-7% upside (note here). But we are more worried about bottlenecks in copper (where total global demand trebles) and silver.

(8) Transformers and specialized switchgear are needed to step the voltage up or down to a precise and prescribed level at every inter-connection point in the grid. The US transmission network operates at a median voltage of 230kV, which keeps losses to around 7%. Energy transition could double the transformer market in capacity terms and increase it by 30x in unit count (note here, costs and companies screened here), surpassing $50bn pa by 2035. Downstream of these transformers, the power entering industrial and commercial facilities will often remain at several kV, which requires specialized switchgear to prevent arcing. We see the MV switchgear market trebling to over $100bn pa by 2035.

(9) AC and DC. Wind and solar inherently produce DC power, but most transmission lines are AC. Hence they must be coupled with inverters and converters. At the ultimate point of use, AC power also usually needs to be rectified back to DC and bucked/boosted to the right voltage for each machine or appliance. The same goes for EV charging and EV drive trains. DC-DC conversion, AC-DC rectification and DC-AC inversion are effectively consolidating around MOSFETs. And we think one of the most interesting incremental jolts for the energy transition is the 1-10pp higher efficiency and rising market share of SiC MOSFETs. Leading companies in SiC and MOSFETs are screened here.

(10) Inertia and frequency regulation. All of the AC power generators in the grid are running in lockstep, ‘synchronized’ at around 50 Hertz in Europe and 60 Hz in the US. But the frequency of all the power generators in the grid changes second by second. If there is a slight under-supply of power, then what prevents the grid from collapsing is that energy can be harvested from the rotational energy of massive turbines weighing up to 4,000 tons and spinning at 1,500 – 6,000 rpm, as they all slow down very slightly. This sorcery is called ‘inertia’. Wind and solar do not inherently have any inertia (no synchronized spinning). But there are ways of partially mimicking inertia or adding synthetic inertia to the grid through flywheels, supercapacitors, synchronous condensers, batteries, smart energy. Our grid models reflect growing demand for infrastructure in all of these categories.

(11) Reactive power compensation. Apparent power (in kVA) consists of two components: real power (in kW) and reactive power (in kVAR). Inductive loads consume reactive power as the creation of magnetic fields draws the current behind the voltage in an AC wave. This lowers power factor in the grid, amplifies the current that must flow per unit of real power, and thus amplifies I2R losses. Large spinning generators have historically provided reactive power to energize transmission lines and compensate for inductive loads. Again, wind and solar do not inherently provide reactive power compensation and have historically leaned on the rotating generators. Renewable heavy grids will need to add reactive power compensation, expanding this market by a factor of 30x. The best opportunities are in STATCOMs and SVCs (leading companies screened here), capacitor banks at industrial facilities and Volt-VAR optimization at the grid edge.

(12) Electric vehicle charging: find the shovel-makers? Each 1,000 EVs will likely require 40 Level 2 chargers (30-40kW) and 3 Level 3 fast-chargers (100-200kW), so our numbers ultimately have $100bn pa being spent on EV charging in 2025-50. But we wonder whether EV chargers will ultimately become over-built, and the best opportunities will be in supplying components and materials to these chargers, rather than owning the infrastructure itself. Our best single note on this topic is here. Economics of EV charging stations and conventional fuel retail stations make a nice comparison.

(13) Motor drivers are another huge efficiency opportunity. There are 50bn electric motors in the world, consuming half of all global electricity. But most motors are inefficient, rotating at fixed speeds determined by the frequency of the AC power grid, rotating faster than they need to, which matters as power consumption is a cube function of rotating speed. One of the best efficiency opportunities in the grid expands the role of variable frequency drives to optimize motors (note here). Economics are screened here and leading companies are covered here. All of our work into electric motor efficiency and reliability is linked here.

(14) Without reliable and high-quality power grids, frankly, things will break. This is a statement made in patents and technical papers, again and again, discussing how lagging power quality enhances maintenance and breakage costs of expensive equipment. Fundamentally, this is why we think that commercial and industrial power consumers will increasingly invest more in power electronics, and there are so many hidden power grid opportunities in the energy transition.

(15) Power electronics is the broad category of capital goods that encompasses effectively everything discussed on this page. And this summary has hardly even scratched the surface. We think pure power electronics spending trebles from $300bn pa to $1trn pa by 2035 (model here). It is the same group of companies coming up again and again in this space (best note here). For example, we have attempted to break down Eaton’s revenues across 10,000 SKUs in 200 different categories here. We do think that the complexity in power grids and power electronics creates opportunity for decision makers that can grasp it.

All of our research — PDF research reports, data-files, economic models and company screens — into power grid opportunities in the energy transition is summarized below, in chronological order of publication.

TSE Patent Assessments: a summary?

New technologies for the energy transition range across renewables, next-gen nuclear (fission and fusion), next-gen materials, EV charging, battery designs, CCS technologies, electronics, recycling, vehicles, hydrogen technologies and advanced bio-fuels. But which companies and technologies can we de-risk?

One way to appraise new technologies for the energy transition is to lock yourself in a room with a stack of patents from publicly available patent databases, read the patents, and then score them all on an apples-to-apples framework.

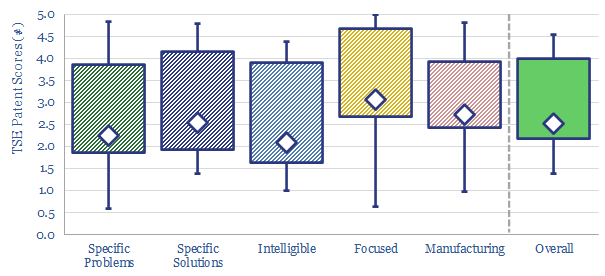

Our technology assessment framework is derived from 15-years experience evaluating energy technologies, from the best of the best world-changing technologies, to companies that ultimately turned out to have over-promised. The framework includes five areas:

(1) Specific problems. We find it easier to de-risk patents that pinpoint specific problems that have hampered others, and set about to solve these problems.

(2) Specific solutions. We find it easier to de-risk patents that pose specific solutions, whereas it is harder to de-risk technologies that are more vague.

(3) Intelligibility. We find it easier to de-risk patents that explain why their inventions work, often including empirical data and underlying scientific theory.

(4) Focused. We find it easier to de-risk patents that all point towards commercializing a common invention, and different aspects of that invention. Conversely, patenting 10 totally different solutions might suggest that a company has not yet honed in upon a final product.

(5) Manufacturing details. We find it easier to de-risk patents that explain how they plan to manufacture the inventions in question. Sometimes, very specific details can be given here. Otherwise, it may suggest the invention is still at the ‘science stage’.

The purpose of this data-file is to aggregate all of our patent assessments in a single reference file, so different companies’ scores can be compared and contrasted. The average score in our patent assessment framework is 3.5 out of 5.0, although there is wide variability in each category.

In each case, we have tabulated the scores we ascribed each company on our five different screening criteria, metrics on the companies’ size and technical readiness and a short description of our conclusion. You can also view all of our individual patent assessments chronologically.

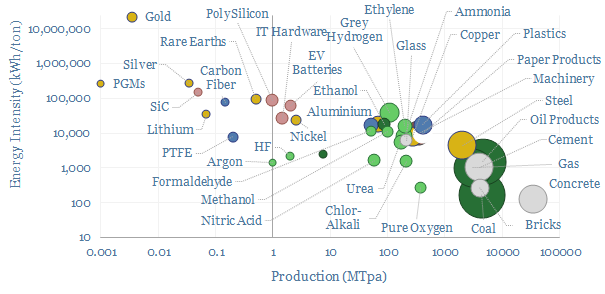

CO2 intensity of materials: an overview?

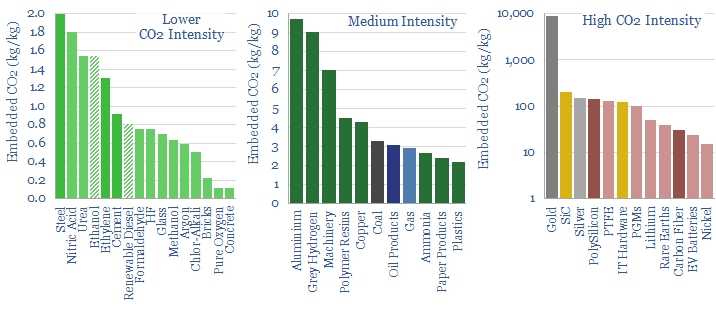

This data-file tabulates the energy intensity and CO2 intensity of materials, in tons/ton of CO2, kWh/ton of electricity and kWh/ton of total energy use. The build-ups are based on 160 economic models that we have constructed, and the data-file is intended as a helpful summary reference. Our key conclusions on the CO2 intensity of materials are below.

Human civilization produces over 60 bn tons per year of ‘stuff’ across 40 different material categories, accounting for 40% of all global energy use and 35% of all global emissions.

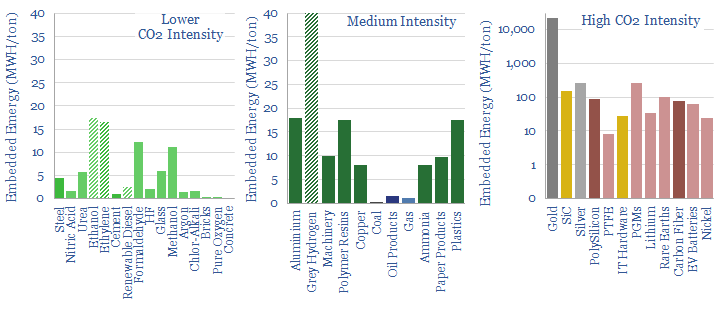

Rules of thumb. Producing the average material in our data-file consumes 5,000 kWh/ton of primary energy and emits 2 tons/ton of CO2.

Energy breakdowns. As another rule of thumb, 30% of the energy inputs needed to make a typical material are electricity, 25% are heat and 45% are other input materials.

Ranges. All of these numbers can vary enormously (chart below). Energy intensity of producing materials ranges from 300 kWh/ton (bottom decile) to 150,000 kWh/ton (upper decile).

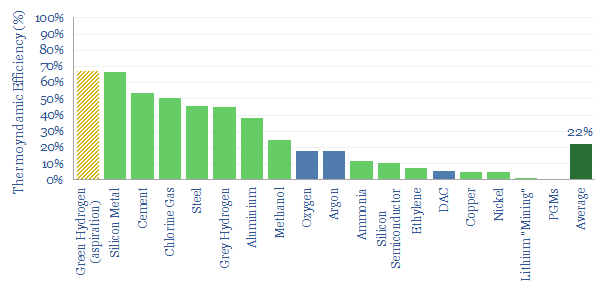

The average thermodynamic efficiency of producing these industrial materials is quantified at c20%, with an interquartile range from 5% to 50%. This is shown in the chart below and discussed in more detail here.

CO2 intensity of producing different materials also ranges from 0.5 tons/ton (bottom decile) to 140 tons/ton (upper decile).

Strictly, many of the largest contributors to global CO2 emissions, such as steel and cement, are not ‘carbon intensive’ (i.e., emissions are <2 tons/ton), they are simply produced in very large volumes.

Ironically, while we want to achieve an energy transition, it does require ramping up production of materials value chains that truly are CO2 intensive (i.e., emissions are above 20 tons/ton or even 100 tons/ton). This includes PV silicon and silver for solar panels; carbon fiber and rare earths for wind turbines; and lithium and SiC MOSFETs for electric vehicles. Ultimately these value chains also need to decarbonize in some non-inflationary way, which is a focus in our research.

Scope 4 CO2. Another complexity is that everything has a counterfactual. SiC MOFSETs might be energy intensive to produce but they earn their keep in long-term efficiency savings. Hence we recommend that the best way to evaluate total CO2 intensity is on a Scope 1-4 basis (note here).

Simplifications. Please note that in order to make this file remotely useful, we are guilty of simplifying and averaging quite complex and broad-ranging industries. More detail is available on different oil value chains (including oil sands and Permian shale in detail), gas value chains, coal grades, industrial boilers and burners by industry, construction materials and different plastics.

CO2 screening. In some industries, we have been able to aggregate CO2 curves, plotting the different CO2 intensities or energy intensities of different companies. The best example is looking at acreage position by position in the US oil and gas industry, refiners, gas pipelines, gas gathering, gas distribution, ethanol plants.

Other data-files on our website have aimed to tabulate the CO2 intensity of other value chains, but due to quirks of those value chains, we cannot plot the data in kWh/ton or CO2/ton. This includes the CO2 of different forms of transportation, digital processes, or hydrogen.

Agricultural commodities are also not captured in the data-file. We have estimated separately the CO2 intensity of different wood fuels, crop production, how it varies with fertilizer application, palm oil. All of our biofuels research is here.