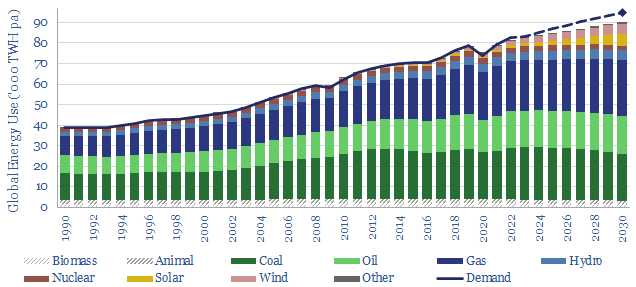

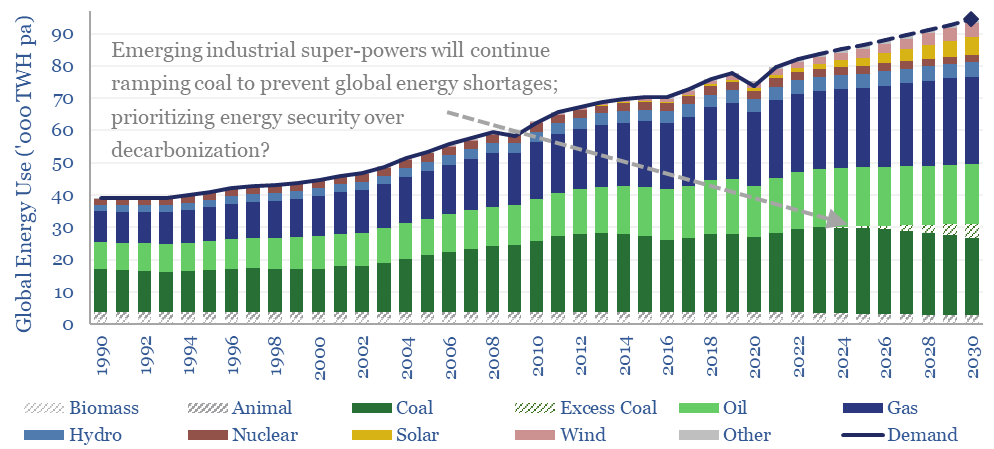

This global energy supply-demand model combines our supply outlooks for coal, oil, gas, LNG, wind and solar, nuclear and hydro, into a build-up of useful global energy balances in 2023-30. We fear chronic under-supply if the world decarbonizes, rising to 5% shortages in 2030. Another scenario is that emerging world countries bridge the gap by ramping coal. Numbers can be stress-tested in the model.

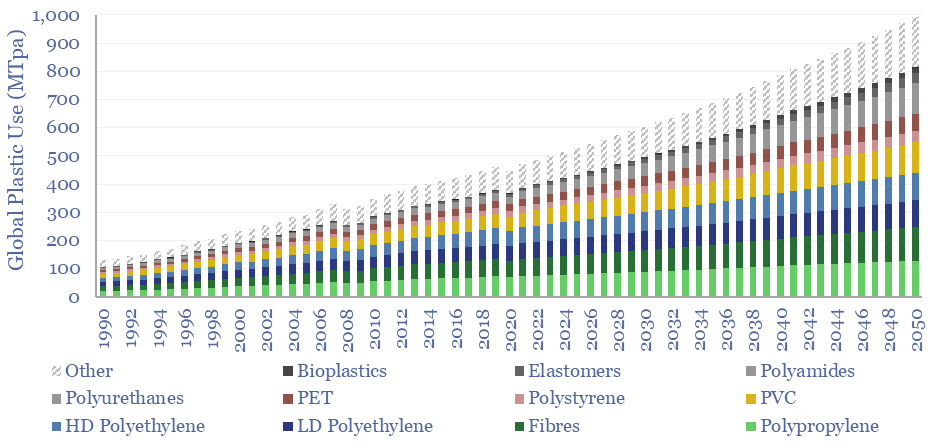

Useful global energy demand grew at a CAGR of +2.5% per year since 1990, and +3.0% per year since 2000. Demand would ‘want’ to grow by +2% per year through 2030, due to rising populations and rising living standards (model here). We have pencilled in +1.75% pa growth to this model to be conservative.

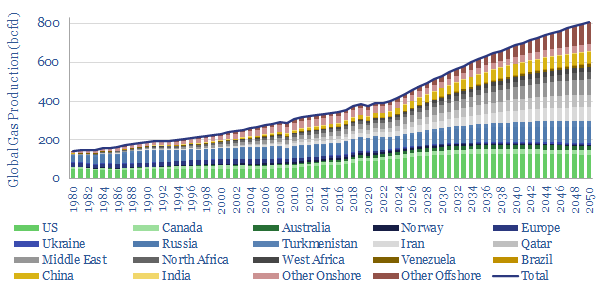

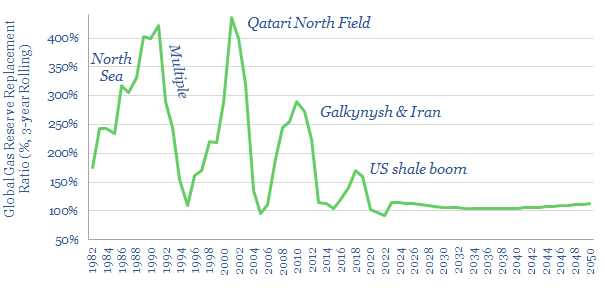

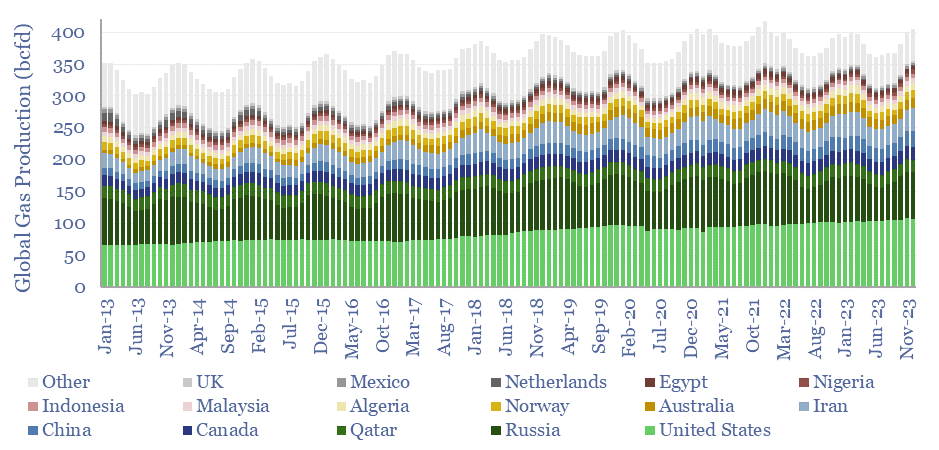

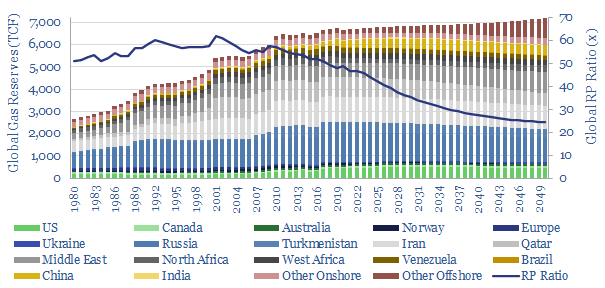

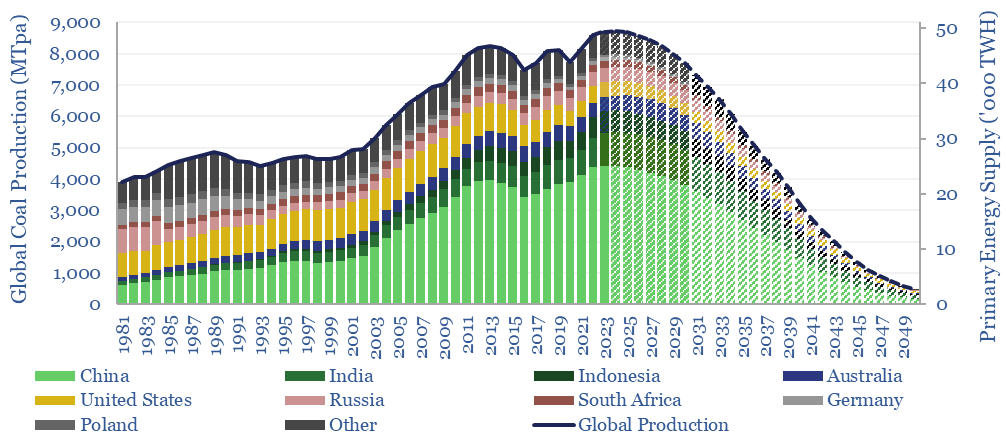

Combustion energy is seen flat-lining in our net zero scenario. This includes global coal use peaking at 8.4GTpa in 2024 then gently easing to 2010 levels by 2030 (model here). It includes oil demand, rising to 102Mbpd in 2024 (data here), then plateauing (model here) as OPEC and US shale (model here) offset the decline rate impacts of conventional under-investment. It includes risked LNG supplies rising +70% from 400MTpa in 2022 to almost 700MTpa by 2030 (model here). While our roadmap to net zero would need to see global gas growing at +2.5% per year through 2050 (model here), this data-file has pencilled in flat production in 2022->30, as we think that latter scenario currently looks more likely to transpire.

Renewable energy is exploding. Our model of wind and solar capacity additions is linked here and discussed here. In our roadmap to net zero, solar more than doubles from c220GW of new adds in 2022 to 500GW by 2030, while wind rises from c100GW of new adds in 2022 to 150GW by 2030.

Other variables in the model include rising energy efficiency (note here), the need for a nuclear renaissance (note here) and other variables that can be flexed.

What is wrong with this balance is that it does not balance. The assumptions pencilled into the model see an under-supply of global energy of about 3% in 2025, rising to 5% in 2030. I.e., by 2030, the world will be “half a Europe” short of energy. The first law of thermodynamics dictates that energy demand cannot exceed supplies. So what would it take to restore the balance? Well, pick your poison…

(1) Slower demand growth could re-balance the model. Very high energy prices might mute demand growth to only +1.25% per year, although this would be the slowest pace of demand growth since the Great Depression, lower even than during the oil shocks (useful data here). Unfortunately, our view is that pricing people out of the global energy system in this way is in itself an ESG catastrophe.

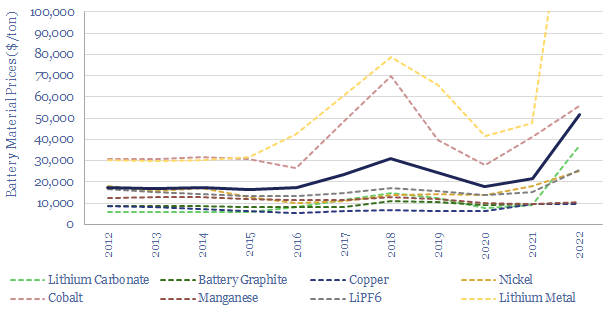

(2) Ramping renewables faster could re-balance the model, although it would require an average of 1 TW pa of wind and solar capacity additions each year in 2024-30, and over 2 TW pa of wind and solar additions by 2030 itself, which is 3x higher than in our roadmap to net zero (discussion here). For perspective, this +2TWpa solution requires primary energy investment to quadruple from $1trn pa to at least $4trn pa, which all needs to be financed in a world of rising rates. It means that global wind and solar projects will consume over 200MTpa of steel, which is 2x total US steel production, and yet steel would not even qualify as a ‘top ten’ bottleneck, in our wind bill of materials or solar bill of materials. This scenario also requires a 3x faster expansion of power grids and power electronics than our base case estimates (see the links). Is any of this remotely possible?

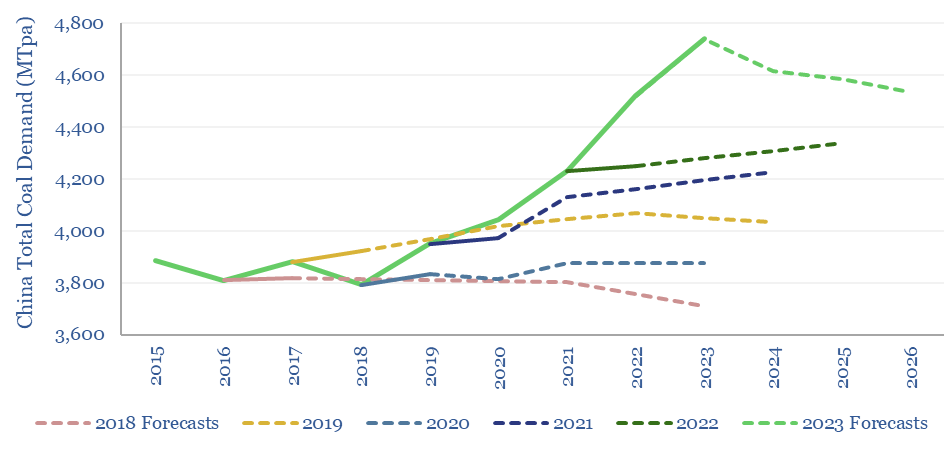

(3) Continue ramping coal? The main source of global energy demand growth is the emerging world. The emerging world is more likely to favor cheap, dirty coal. Or worse, deforestation for firewood. Thus another way to ameliorate under-supply in our global energy supply-demand balance is if global coal continues growing, reaching a new peak of 9GTpa in 2030. Unfortunately, this scenario also sees global CO2 hitting a new peak of 54GTpa in 2030.

(4) Pragmatic gas? Another means of re-balancing the global energy system is if global gas production rises at 2.5% per year, which is the number required, and that is possible, on the TSE roadmap to net zero (model here). This scenario does see global CO2 falling by 2030. The main problem here is that pragmatic natural gas investment has become stranded in no man’s land, within a Manichean duality of fantasies and crises.

(5) Some combination? The world is complex. It is unlikely that a single lever will be pulled to resolve under-supply in our global energy supply-demand balance. In 2023, we think economic weakness will mask energy under-supply, mute energy prices, and lure many decision makers into looking at spot pricing and thinking “everything is fine”. Please download the model to stress-test the numbers, and different re-balancing solutions…