Silver demand in energy transition will most likely tighten the global silver market by 10-30% over the course of the 2020s. This reflects upside in solar, electric vehicles, thrifting, and ultimately substitution. Silver is an important bottleneck to debottleneck.

Silver is the most conductive metal used in the energy transition, which combined with its high stability, makes it the most commonly used front contact material in solar cells, which in turn consume around 10% of global silver production today.

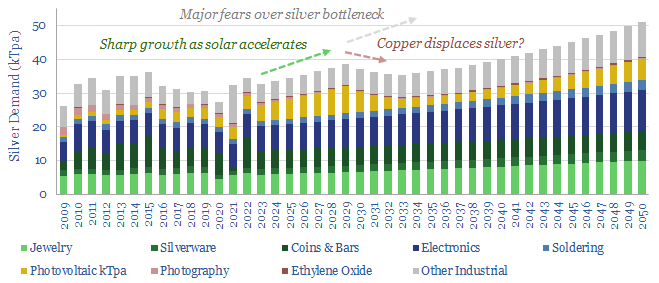

Today’s silver market is 30kTpa, of which two-thirds is used in industry, and one-third is used in jewellery, silver and stores of financial/investment value. 12kTpa is used in electrical equipment and electronics, of which up to 4kTpa is in the solar industry.

Hence our base case forecast without any substitution would see silver demand rising steadily through 2050, including a 10x aspirational increase in annual additions of solar modules and a 20%/decade increase in electrification. Although our own models see a more muted 2-5x further growth in solar capacity additions through 2030-50.

In practice, however, there is an ability to thrift silver from the front surfaces of solar cells (note here) and we think silver will rise to a point where it becomes economical to displace the silver contacts in solar cells with copper contacts, which have 99% lower metals costs, but 3-7x higher manufacturing costs, compared to the easy screen-printing methods used in today’s silver front contacts (note here).

The result may be an upwards trajectory for silver demand in energy transition, culminating in an updwards trajectory for silver prices, occasional spikes above >$50/Oz, followed by a more radical switch in solar manufacturing in the 2030s, helping to moderate or even reverse price rises in the 2020s.