Search results for: “refining”

-

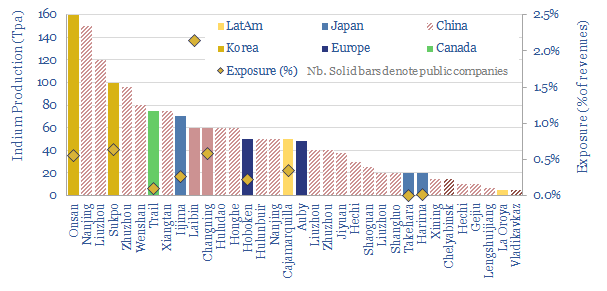

Indium producers: companies and market outlook?

35 indium producers are screened in this data-file, as our energy transition outlook sees primary demand rising 4x from 900 tons in 2022 to over 3.5ktons in 2050, for uses in HJT solar cells and digital devices. 60% of global supply is produced by 20 Chinese companies. But five listed materials companies in Europe, Canada,…

-

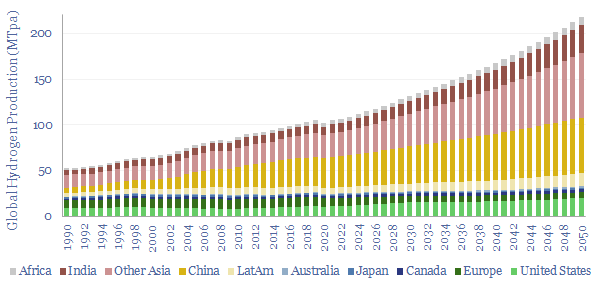

Global hydrogen supply-demand: by region, by use & over time?

Global production of hydrogen is around 110MTpa in 2023, of which c30% is for ammonia, 25% is for refining, c20% for methanol and c25% for other metals and materials. This data-file estimates global hydrogen supply and demand, by use, by region, and over time, with projections through 2050.

-

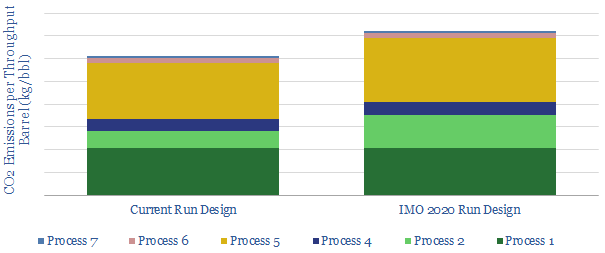

Carbon Costs of IMO 2020?

CO2 intensity of oil refineries could rise by 20% due to IMO 2020 sulphur regulations, if all high-sulphur fuel oil is upgraded into low-sulphur diesel, we estimate. The drivers are an extra stage of cracking, plus higher-temperature hydrotreating, which will also increase hydrogen demands. This one change could undo 30-years of efficiency gains.

-

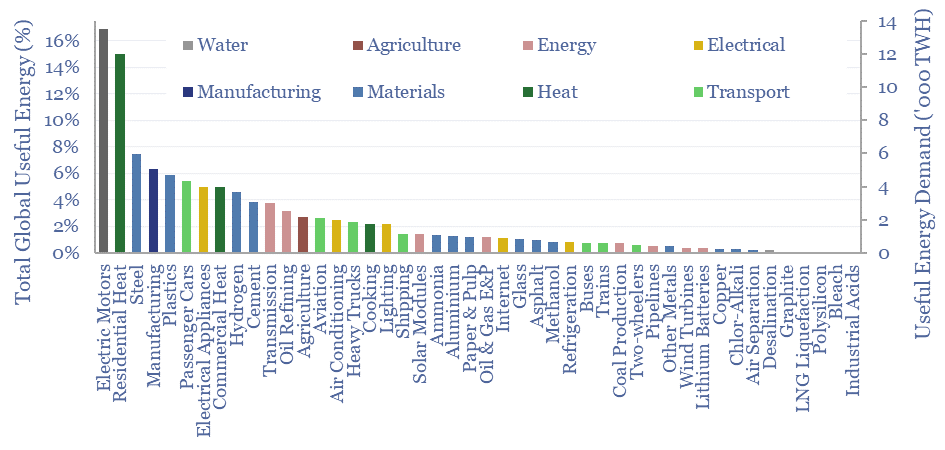

Global energy demand by end use?

This data-file is a breakdown of global energy demand by end use, drawing across our entire research library, to disaggregate the global energy system across almost 50 applications, across transportation, heat, electricity, materials and manufacturing. Numbers, calculations, efficiencies and heating temperatures are in the data-file.

-

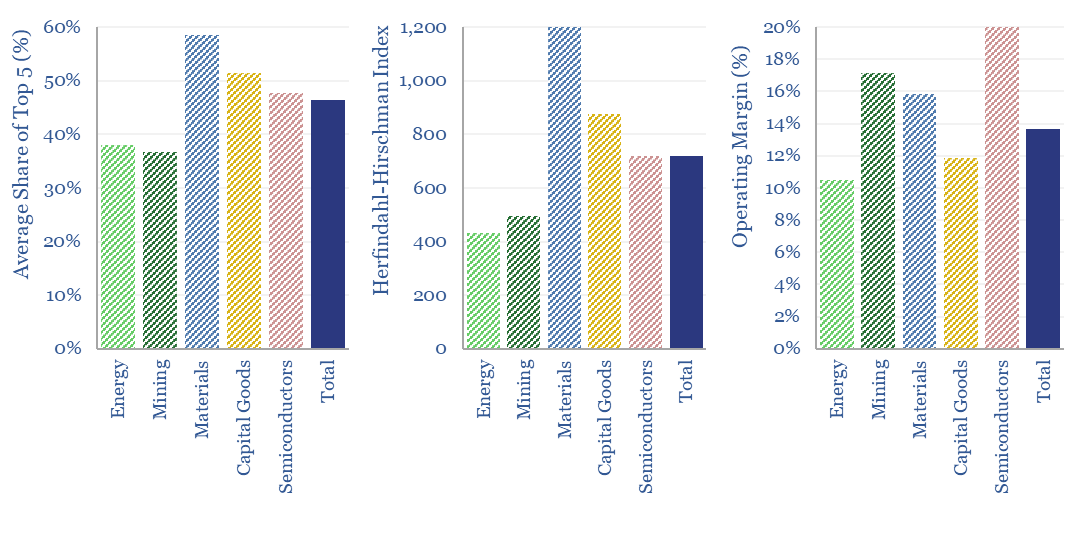

Market concentration by industry in the energy transition?

What is the market concentration by industry in energy, mining, materials, semiconductors, capital goods and other sectors that matter in the energy transition? The top five firms tend to control 45% of their respective markets, yielding a ‘Herfindahl Hirschman Index’ (HHI) of 700.

-

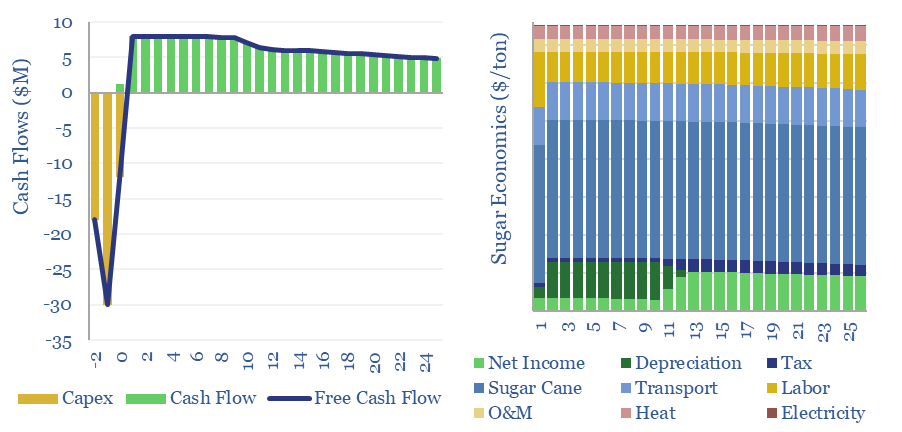

Sugar production: the economics?

The costs of sugar production are estimated at $260/ton for a 10% IRR at a world-scale sugar refinery, in a major sugar-producing region. Higher returns are achievable at recent world sugar prices, and by valorizing waste streams such as molasses for ethanol and bagasse for cogenerated electricity.

-

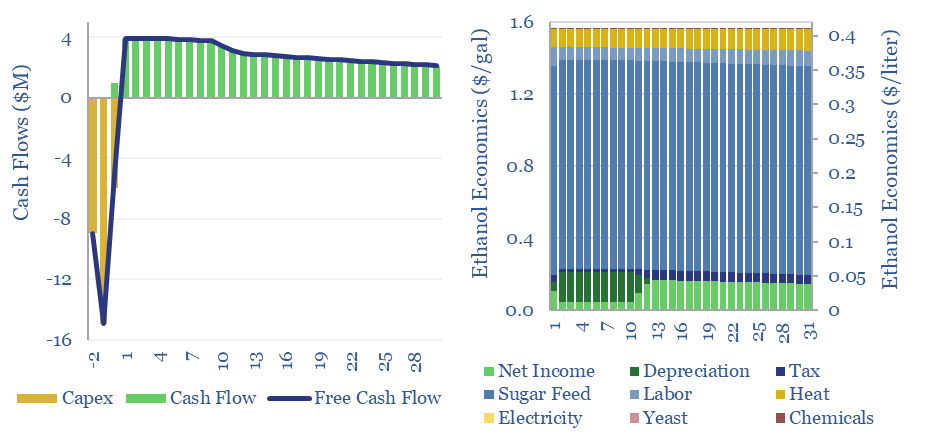

Sugar to ethanol: the economics?

This data-file captures the economics of ethanol production, as a biofuel derived from sugar. A 10% IRR requires $1-4/gallon ethanol, equivalent to $0.25-1/liter, or $60-250/boe. Economics are most sensitive to input sugar prices. Net CO2 intensity is at least 50% lower than hydrocarbons.

-

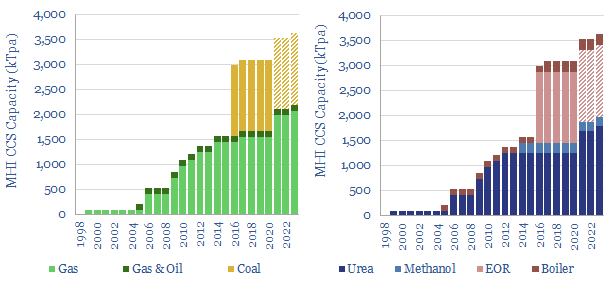

MHI CCS technology: performance, costs and emissions?

MHI has deployed an amine-based CO2 capture technology, in 15 plants globally, going back to 1999. Reboiler duties are around 2.6 GJ/ton on a 10% CO2 feed. Capture rates and capture purity are high. Degradation and amine emissions are controlled, and c80-90% below MEA. CCS costs and complexities remain high. In our view, this is…

Content by Category

- Batteries (89)

- Biofuels (44)

- Carbon Intensity (49)

- CCS (63)

- CO2 Removals (9)

- Coal (38)

- Company Diligence (94)

- Data Models (838)

- Decarbonization (160)

- Demand (110)

- Digital (59)

- Downstream (44)

- Economic Model (204)

- Energy Efficiency (75)

- Hydrogen (63)

- Industry Data (279)

- LNG (48)

- Materials (82)

- Metals (80)

- Midstream (43)

- Natural Gas (148)

- Nature (76)

- Nuclear (23)

- Oil (164)

- Patents (38)

- Plastics (44)

- Power Grids (130)

- Renewables (149)

- Screen (117)

- Semiconductors (32)

- Shale (51)

- Solar (68)

- Supply-Demand (45)

- Vehicles (90)

- Wind (44)

- Written Research (354)