This data-file contains the output from some enormous data-pulls, evaluating UK grid power generation by source, its volatility, and the relationship to hourly traded power prices. We conclude the grid…

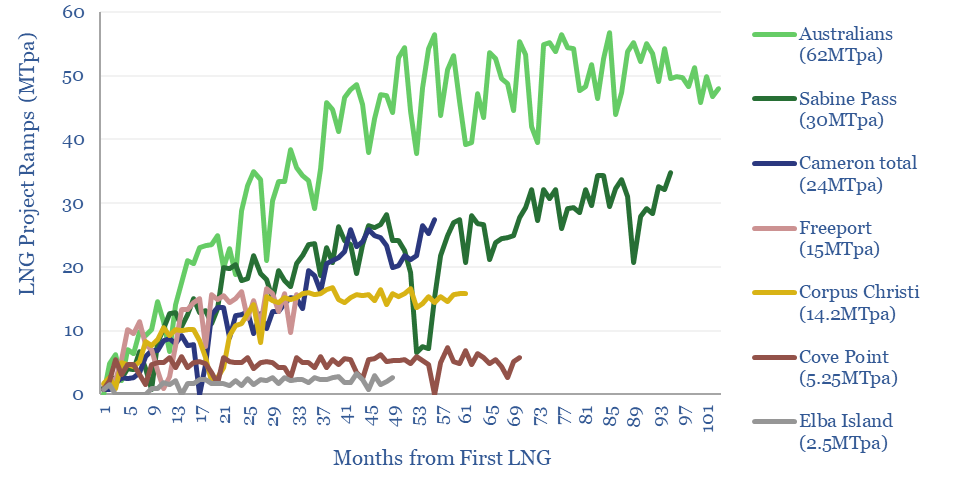

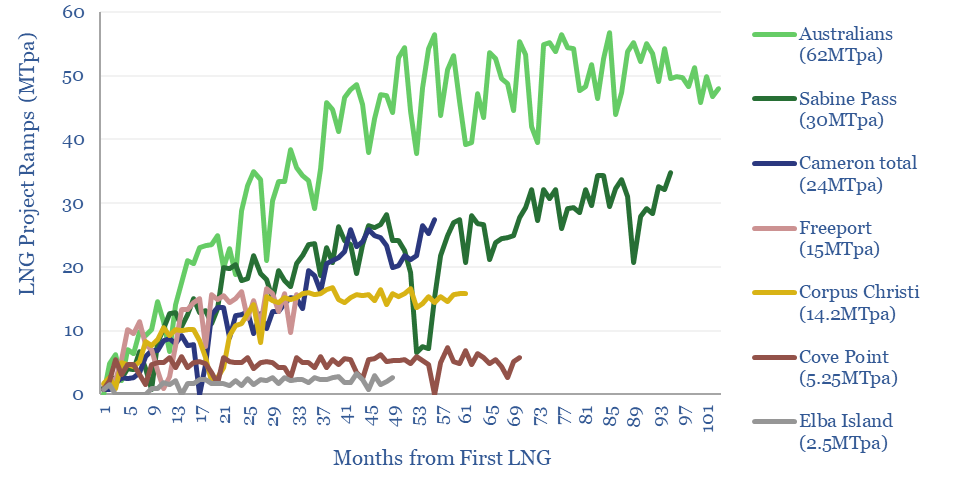

…trains tend to ramp at +0.7MTpa/month, with a +/- 35% monthly volatility around this trajectory. Thus do LNG ramps create upside for energy traders? $899.00 – Purchase Checkout Added to cart Qatar…

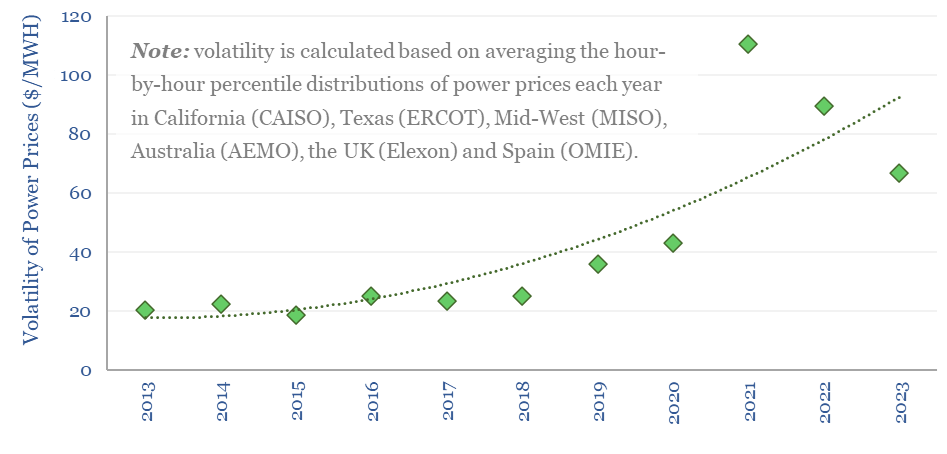

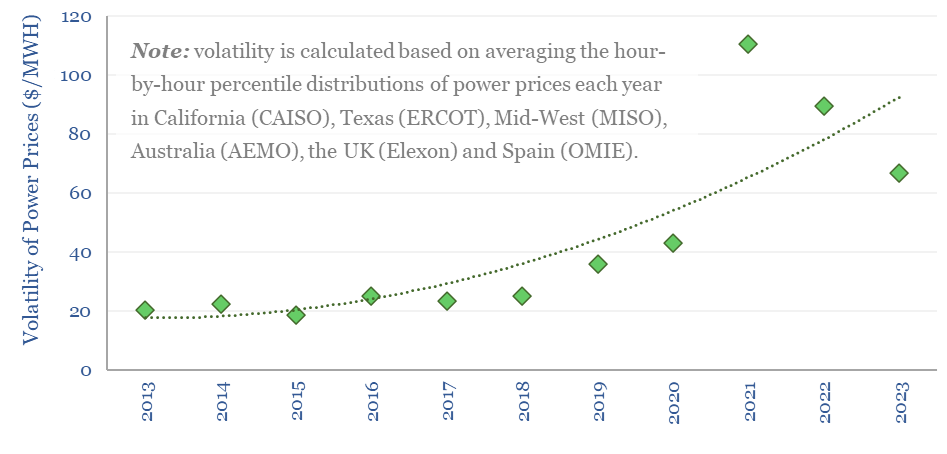

…California, US MidWest, Australia, the UK and Spain), as a way of tracking increases in global power price volatility. $599.00 – Purchase Checkout Added to cart The growing volatility of power grids…

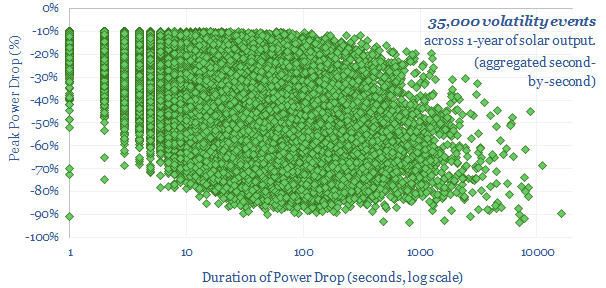

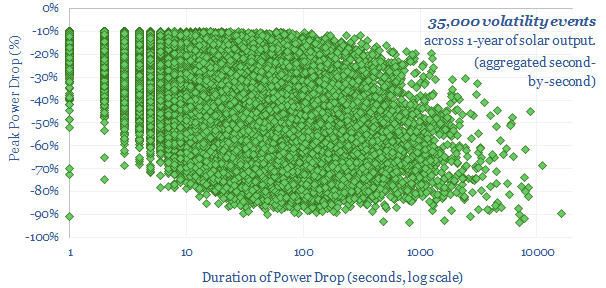

…the power drops due to the sun setting. Then we aggregated all of the second-by-second volatility and power drops. The typical second-by-second volatility of solar power is surprisingly high, with…

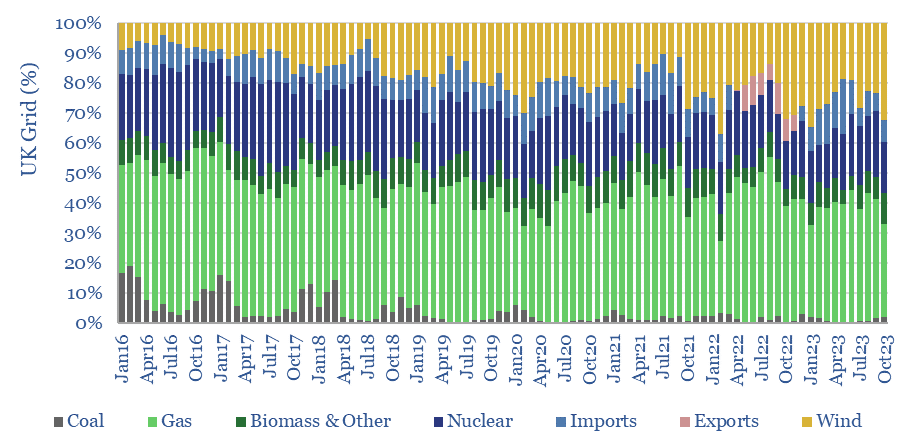

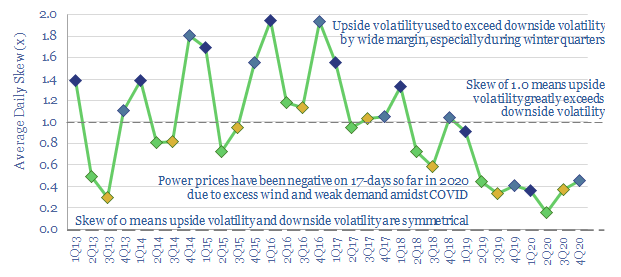

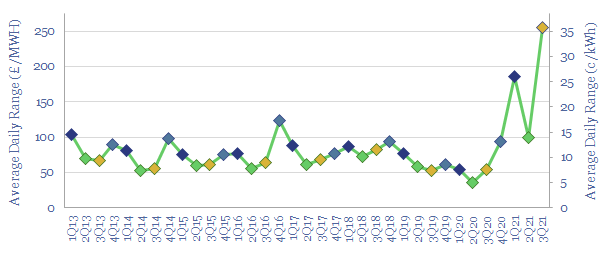

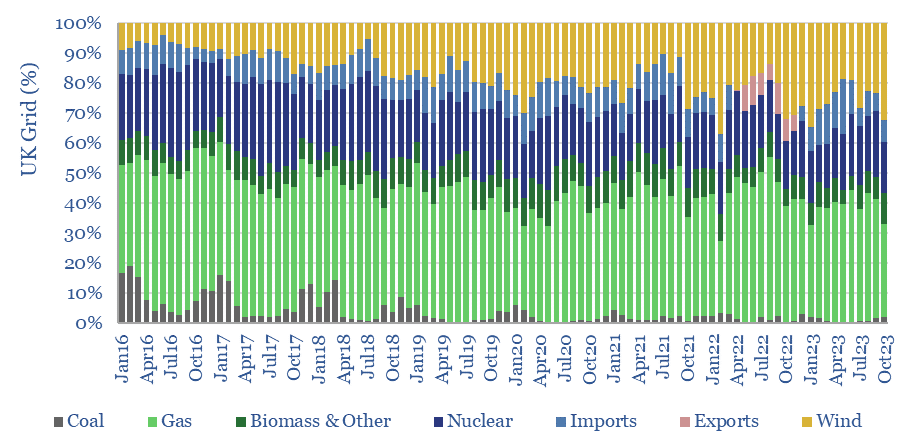

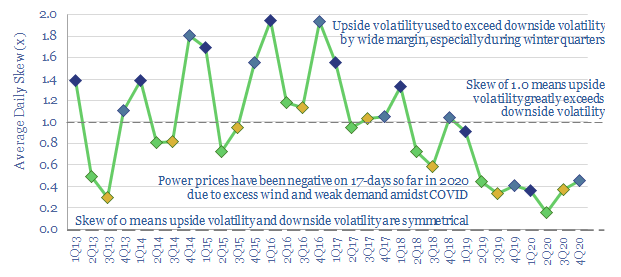

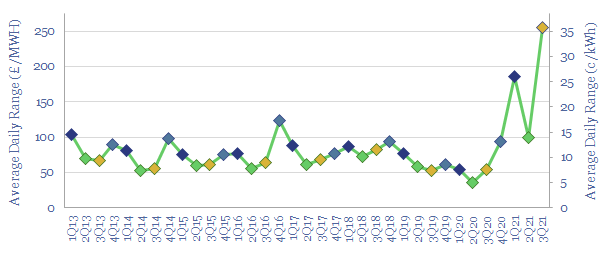

UK wind power has almost trebled since 2016. But its output is volatile, now varying between 0-50% of the total grid. Hence this 14-page note assesses the volatility, using granular,…

…So will the high volatility persist? This is the question in today’s 6-page note. We attribute two-thirds of the volatility gains to gas shortages and high absolute power prices. However,…

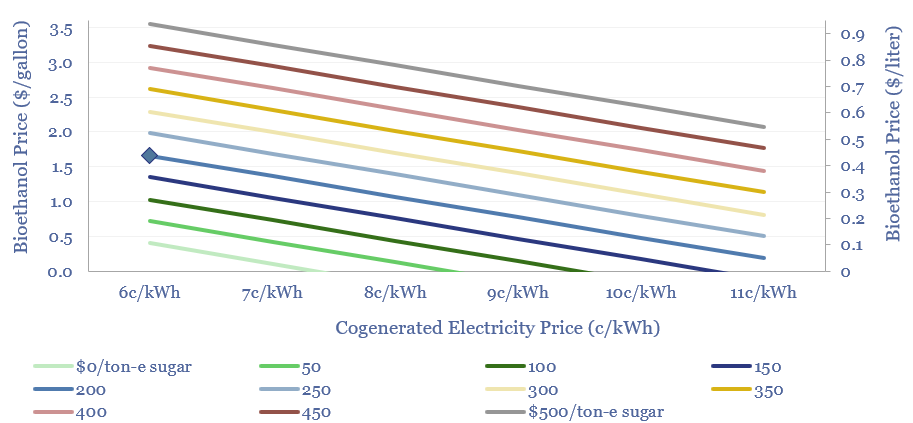

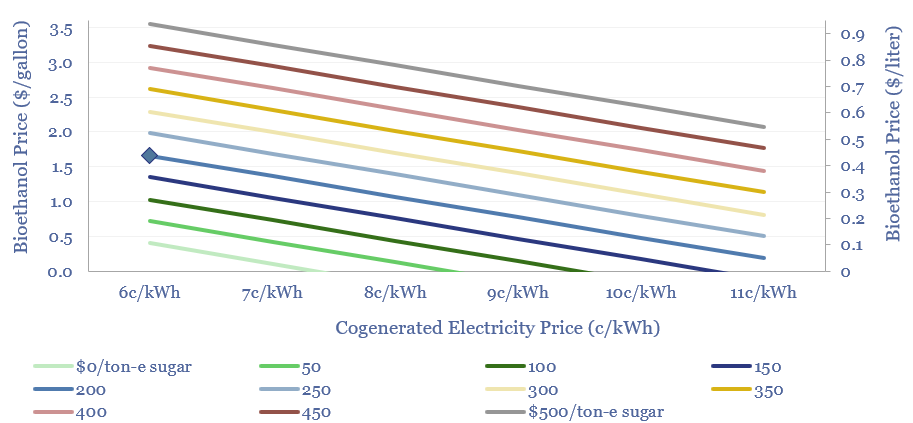

Sugar cane is an amazing energy crop, yielding 70 tons per hectare per year, of which 10-15% is sugar and 20-25% is bagasse. Crushing facilities create value from sugar, sugar-to-ethanol…

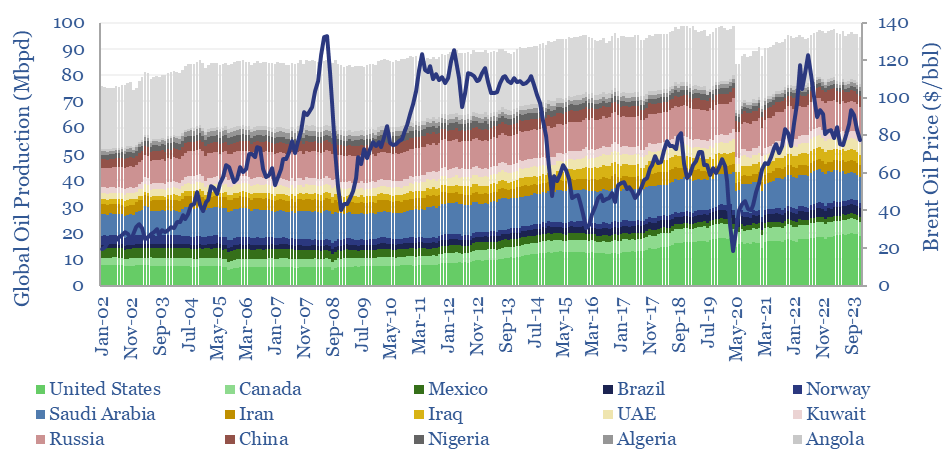

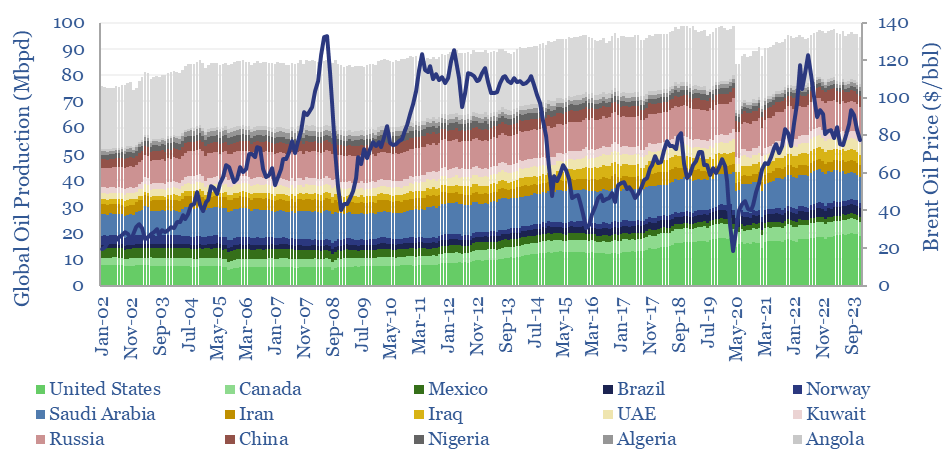

…Arabia, Kuwait, UAE, the US, Canada and Russia very clearly adapt their growth/output to market pricing signals, which actually dampens down supply volatility. Countries with the highest volatility in their…

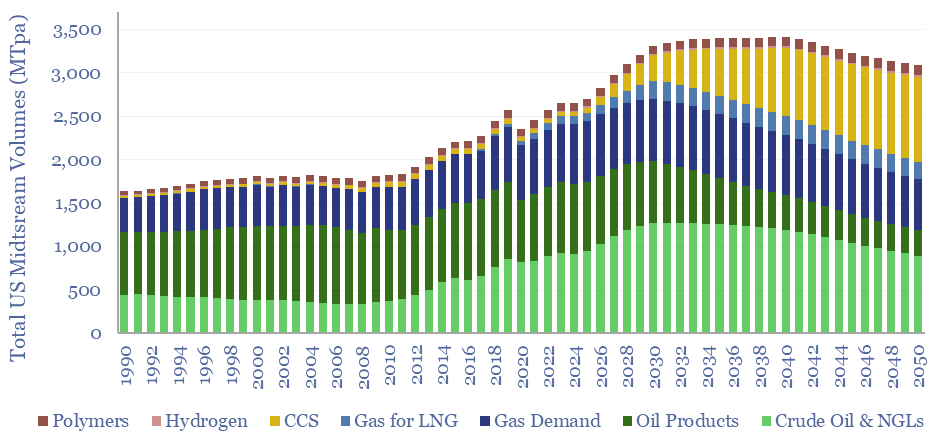

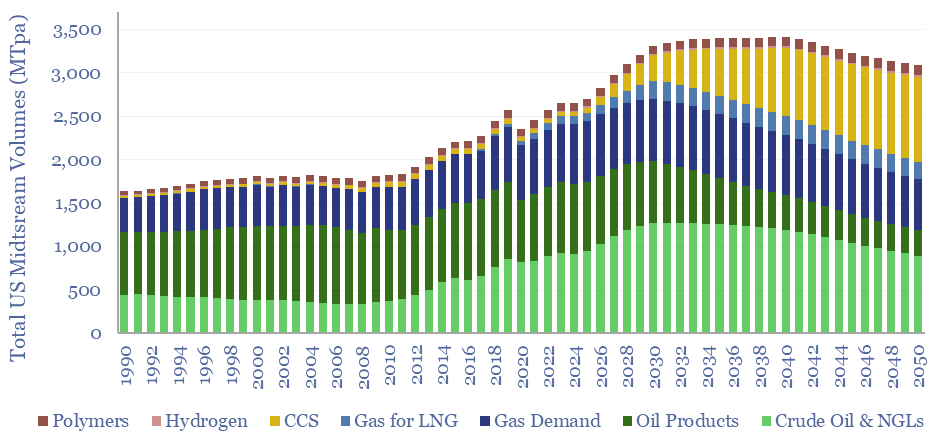

…in the global energy industry, due to the inherent volatility of solar and wind. Rising volatility increases the value of midstream infrastructure, which by definition, can arbitrage the volatility by…

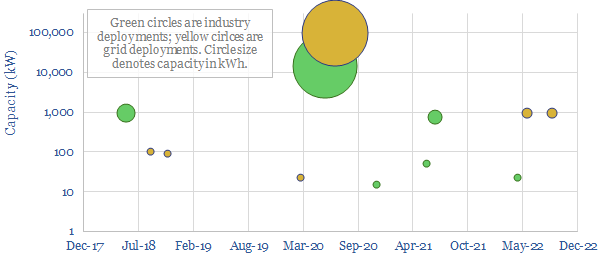

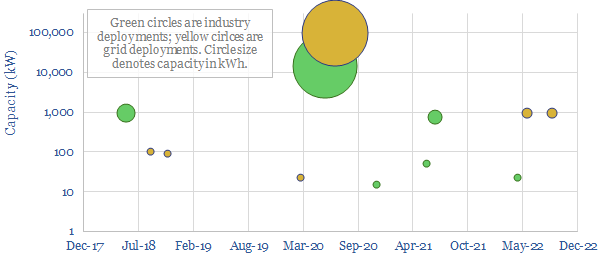

…work is that we recently evaluated the second-by-second volatility of solar and wind output, which incur 80-100 volatility events per day, of which c70-80% last less than 60-seconds. In turn,…