Search results for: “industrial heat”

-

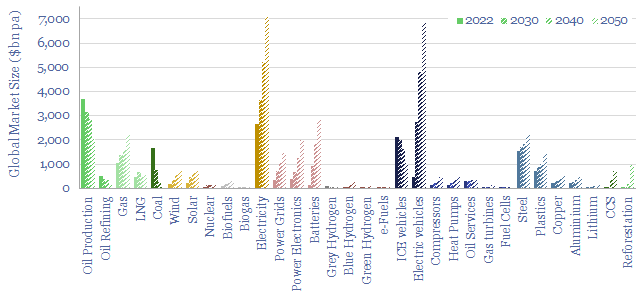

Energy transition market sizing: hydrocarbon, new energies, capital goods and materials?

This data-file contains energy transition market sizing analysis, for hydrocarbons, new energies, capital goods and materials in $bn pa, integrating over 1,000 items of energy transition research and our latest roadmap to net zero. In aggregate, energy, materials and transition-related markets double from $25 trn pa to $50 trn pa.

-

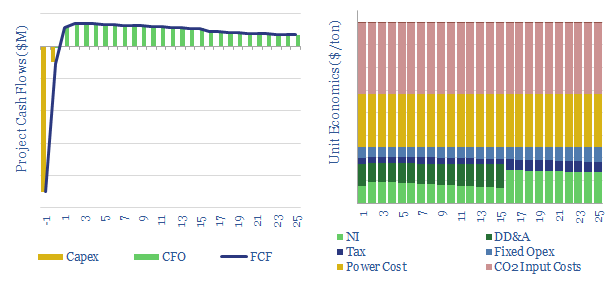

CO2 electrolysis: the economics?

Carbon monoxide is an important chemical input for metals, materials and fuels. Could it be produced by capturing CO2 from the atmosphere or using the amine process, then electrolysing the CO2 into CO and oxygen? We find 10% IRRs could be achievable at $800/ton, competitive with conventional syngas.

-

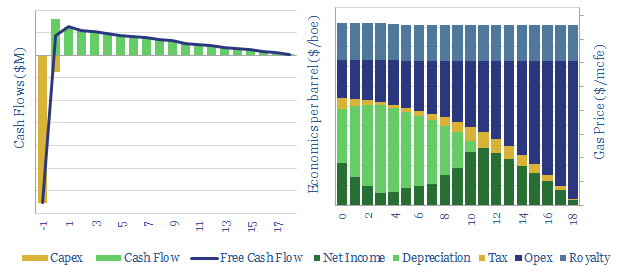

US shale gas: the economics?

This data-file breaks down the economics of US shale gas, in order to calculate the NPVs, IRRs and gas price breakevens. There is a perception that the US has an infinite supply of gas at $2/mcf, but rising hurdle rates and regulatory risk may require higher prices.

-

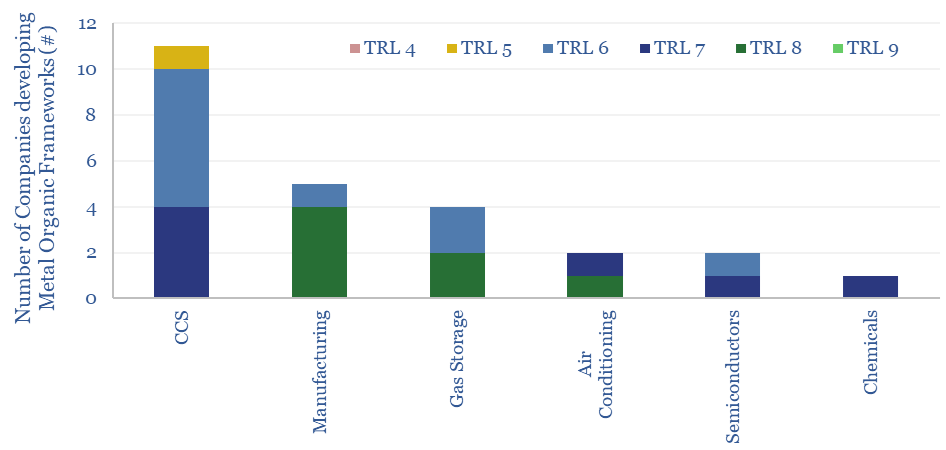

Metal organic frameworks: challenges and opportunities?

Metal organic frameworks (MOFs) are an exciting class of materials, which could reduce the energy penalties of CO2-separation by c80%, and reduce the cost of carbon capture to $20-40. This data-file screens companies developing metal organic frameworks, where activity has been accelerating rapidly, especially for CCS applications.

-

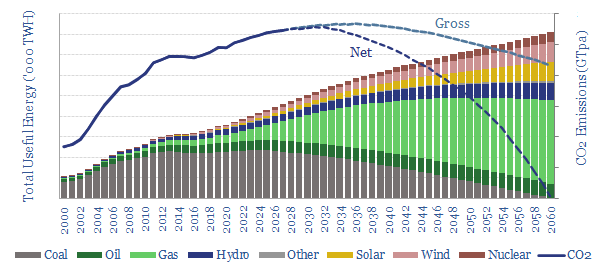

China: can the factory of the world decarbonize?

China now aspires to reach ‘net zero’ CO2 by 2060. But is this compatible with growing an industrial economy and attaining Western living standards? The best middle-ground sees China’s coal phased out and gas rising by a vast 10x to 300bcfd. The biggest challenges are geopolitics and sourcing enough LNG.

-

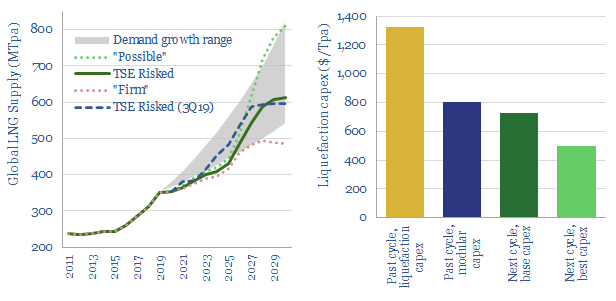

LNG in the energy transition: rewriting history?

A vast new up-cycle for LNG is in the offing, to meet energy transition goals, by displacing coal. 2024-25 LNG markets could by 100MTpa under-supplied, taking prices above $9/mcf. But emerging technologies are re-shaping the industry, so well-run greenfields may resist the cost over-runs that marred the last cycle.

-

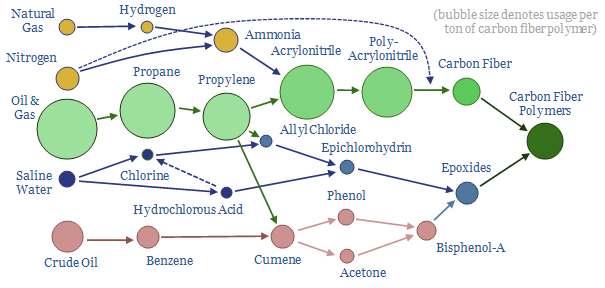

Carbon fiber: the miracle material?

Energy transition will catapult carbon fiber demand upwards from today’s 120kTpa baseline, across wind turbine blades, more efficient vehicles and hydrogen tanks. Hence this 16-page note explores opportunities, economics, CO2 intensity and leading companies.

-

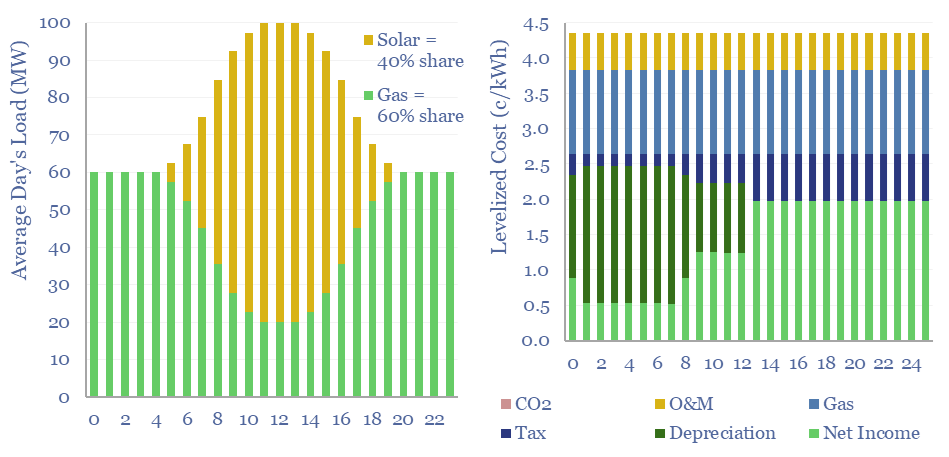

Renewables+gas LCOEs versus standalone gas turbines?

Levelized costs of electricity depend as much on the system being electrified as the energy sources used to electrify it. This data-file captures solar+gas LCOEs (in c/kWh), when meeting different load profiles, as a function of solar capex (in $/kW), gas prices (in $/mcf), and the relative utilization of solar vs gas.

-

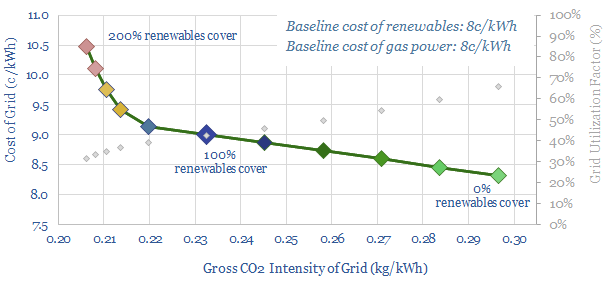

Integrated energy: a new model?

This 14-page note lays out a new model to supply fully carbon-neutral energy to a cluster of commercial and industrial consumers, via an integrated package of renewables, low-carbon gas back-ups and nature based carbon removals. This is remarkable for three reasons: low cost, high stability, and full technical readiness.

Content by Category

- Batteries (89)

- Biofuels (44)

- Carbon Intensity (49)

- CCS (63)

- CO2 Removals (9)

- Coal (38)

- Company Diligence (95)

- Data Models (840)

- Decarbonization (160)

- Demand (110)

- Digital (60)

- Downstream (44)

- Economic Model (205)

- Energy Efficiency (75)

- Hydrogen (63)

- Industry Data (279)

- LNG (48)

- Materials (82)

- Metals (80)

- Midstream (43)

- Natural Gas (149)

- Nature (76)

- Nuclear (23)

- Oil (164)

- Patents (38)

- Plastics (44)

- Power Grids (131)

- Renewables (149)

- Screen (117)

- Semiconductors (32)

- Shale (51)

- Solar (68)

- Supply-Demand (45)

- Vehicles (90)

- Wind (44)

- Written Research (356)