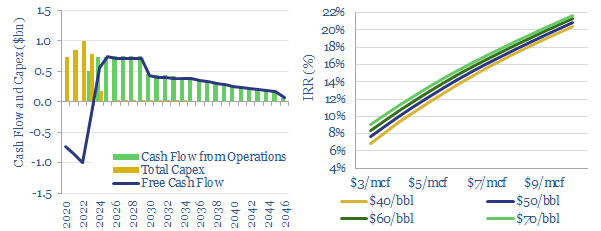

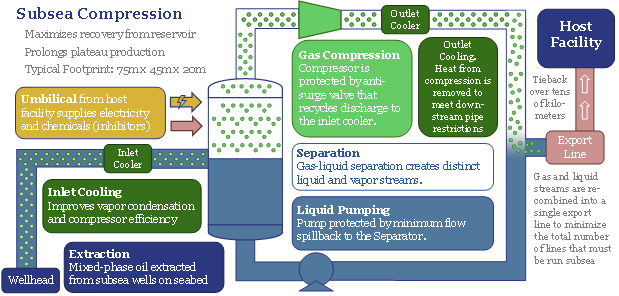

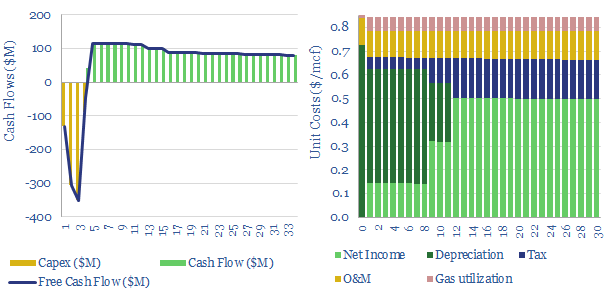

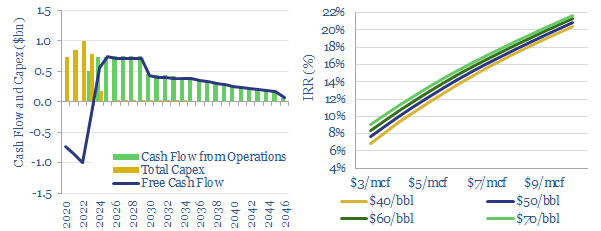

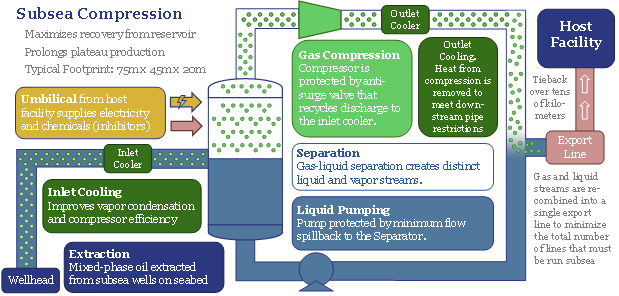

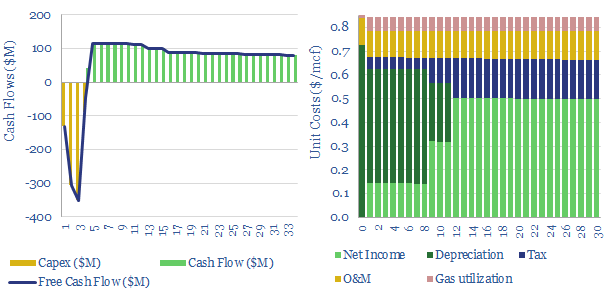

This model presents the economic impacts of developing a typical, 625Mboe offshore gas condensate field using a fully subsea solution, compared against installing a new production facility. $599.00 – Purchase Checkout Added…

…theme supports the ascent of low-carbon natural gas, which should treble in the energy mix by 2050. This 22-page note presents the opportunity. $589.00 – Purchase Checkout Added to cart The offshore…

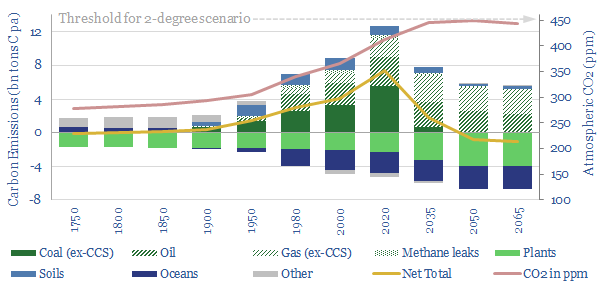

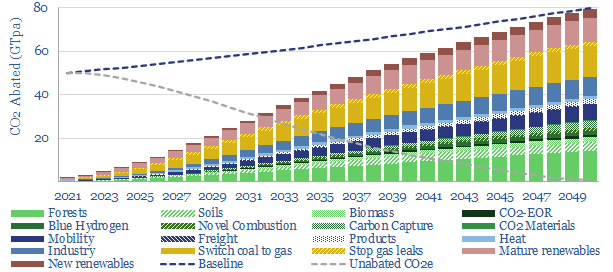

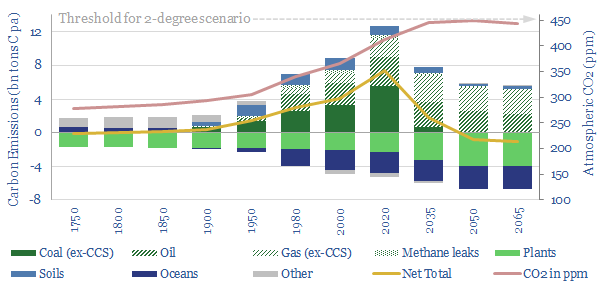

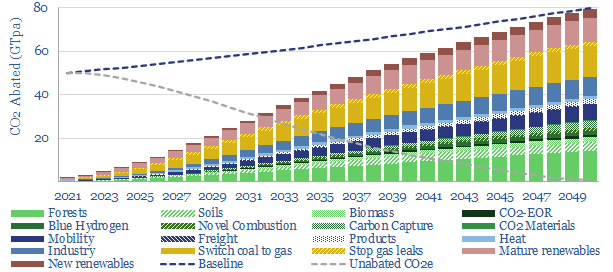

…usual. But we do think there are routes to net zero that see continued use of oil and gas. Especially if the need for coal, oil and gas can be…

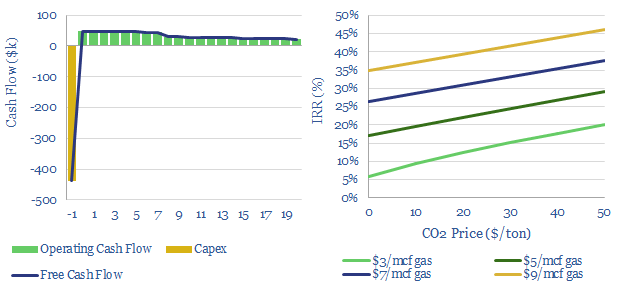

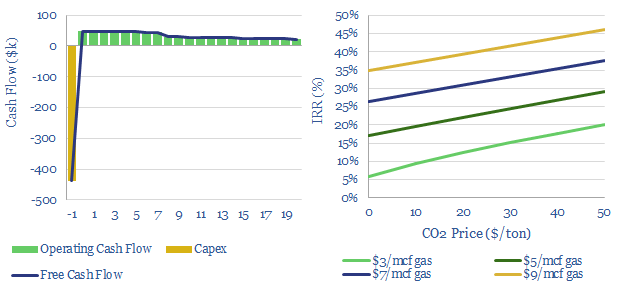

…natural gas. IRRs are uplifted to above 20%, either if we assume higher gas prices ($6/mcf) or a $50/ton CO2 price. IRRs can reach 40% with both. High IRRs may…

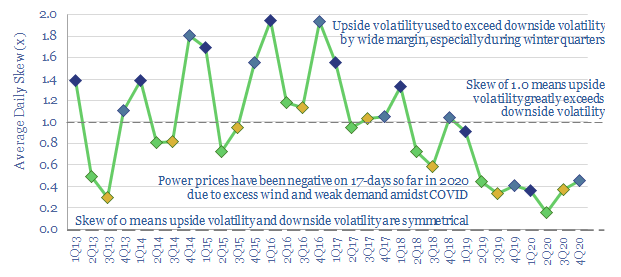

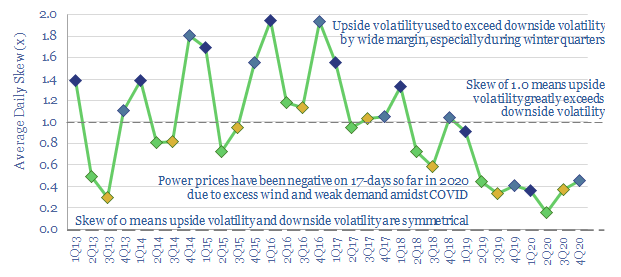

…hour-by-hour data from 2020. EV charging and smart energy systems screen as the best new opportunities. Gas-fired backups also remain crucial to ensure grid stability. The outlook for grid-scale batteries…

…estimate in December-2019. The fully decarbonized energy system still contains 85Mbpd of oil and 375TCF per year of natural gas. https://thundersaidenergy.com/2020/12/10/decarbonizing-global-energy-the-route-to-net-zero/ (9) Oil and gas are heading for devastating under-supply…

…“emitting” (which in this case applies to the car) and a type or class called “CO2” which represents all molecules with the chemical structure O=C=O. My car runs on gasoline…

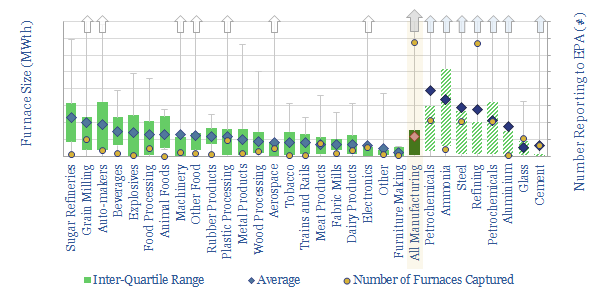

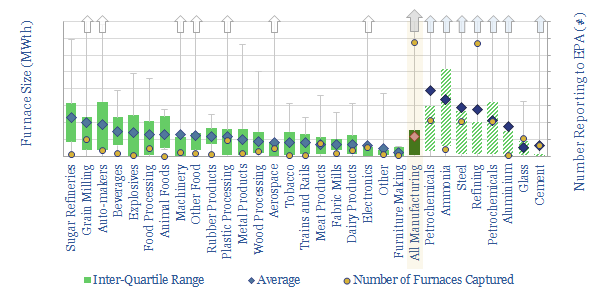

…are 1,500 industrial furnaces in the US manufacturing sector, with a mean average capacity of 60MWth, c90% powered by natural gas, and thus explaining over 3.5-4 bcfd of total US…

…technically ready. The resulting energy mix and costs for the global economy are spelled out on pages 7-8, including changes to our long-term forecasts for oil, gas, renewables and nuclear….

This data-file captures the economics for a typical LNG regas facility. We estimate that a fixed plant with 75-80% utilization requires a spread near to $0.8/mcf on its gas imports,…