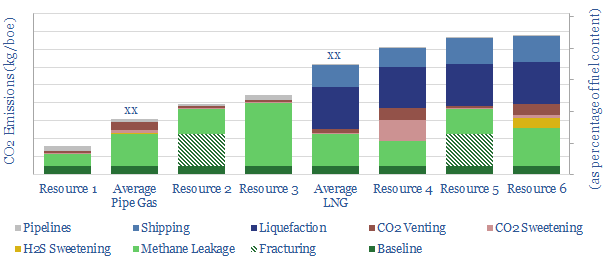

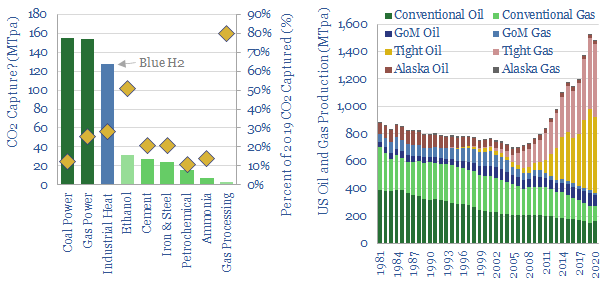

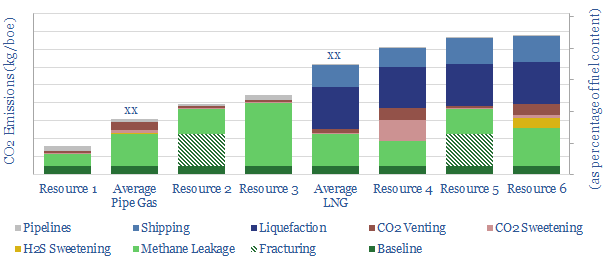

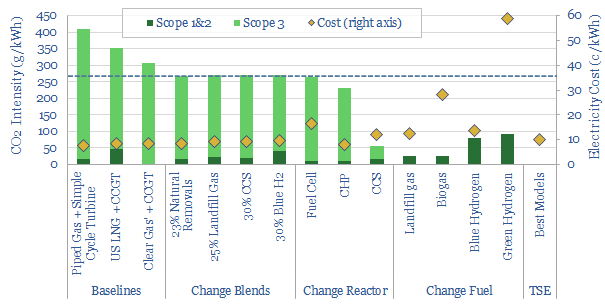

…LNG, including via CCS, blue hydrogen and nature-based CO2 removals. Download the model and you can quickly compute the CO2 intensity of natural gas, including the emissions profiles of other resources….

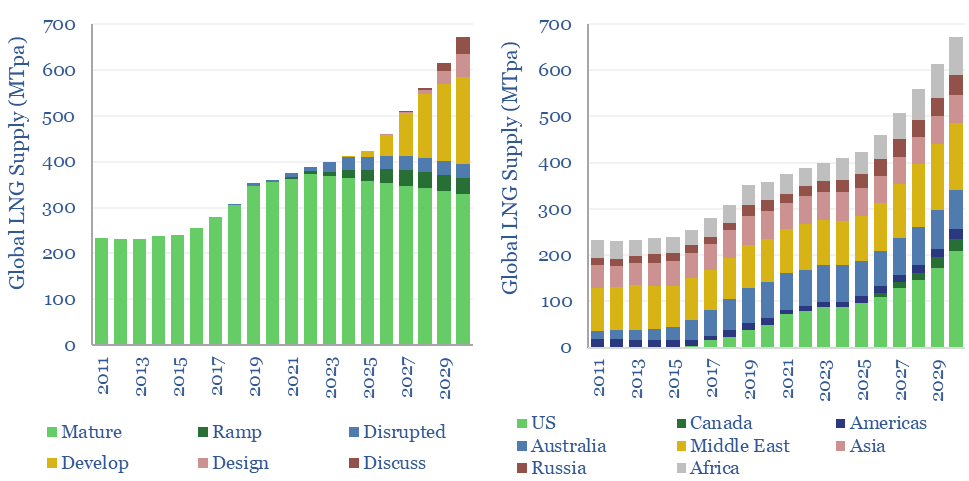

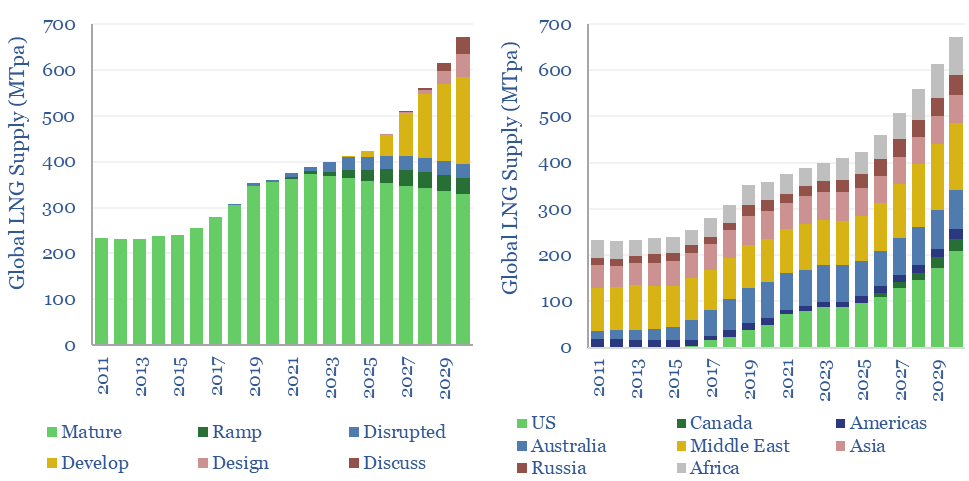

…because 90MTpa of US LNG is already under development. We do see risk to pre-FID US LNG projects, especially as blue hydrogen value chains in the US increasingly compete for…

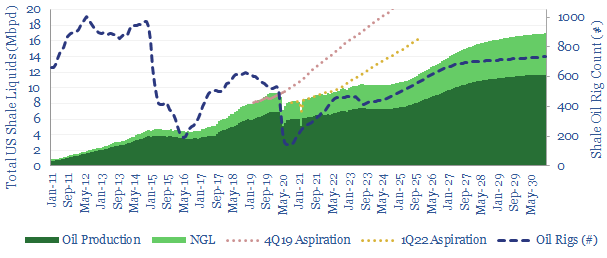

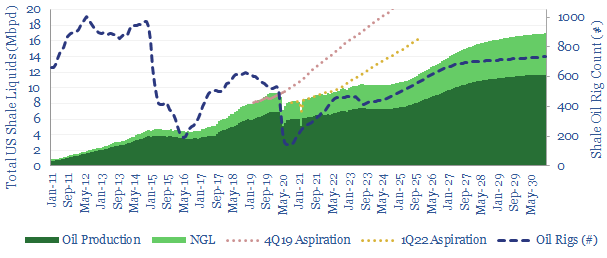

…20-50 additional rigs. Although recently we wonder whether the US blue hydrogen boom will absorb more gas and outcompete LNG, especially as the US Gulf Coast becomes the most powerful…

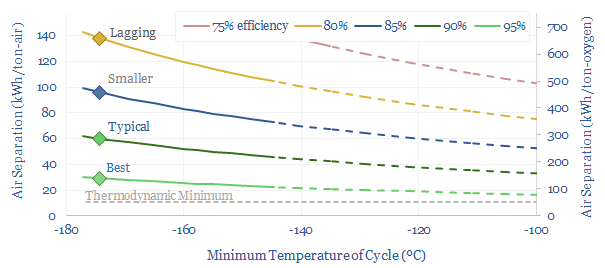

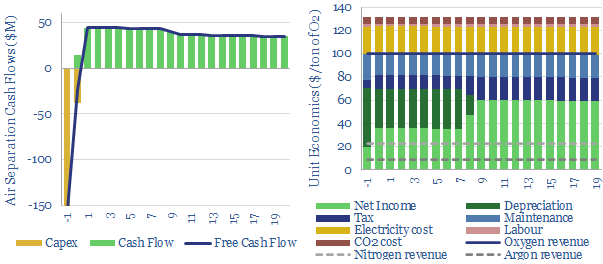

Cryogenic air separation is used to produce 400MTpa of oxygen, plus pure nitrogen and argon; for steel, metals, ammonia, wind-solar inputs, semiconductor, blue hydrogen and Allam cycle oxy-combustion. Hence this…

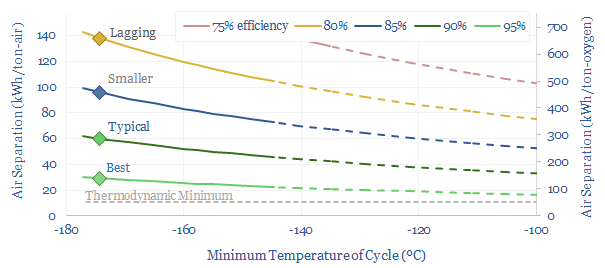

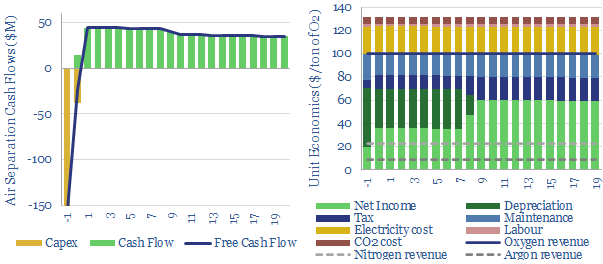

…blue hydrogen. Good base cases are $100/ton oxygen, $20/ton nitrogen, $200/Tpa capex and 60kWh/ton of electricity (on an input air basis). $499.00 – Purchase Checkout Added to cart Cryogenic air separation was…

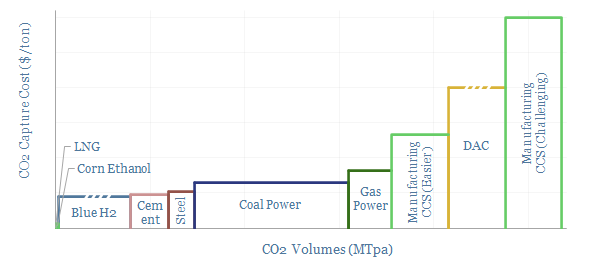

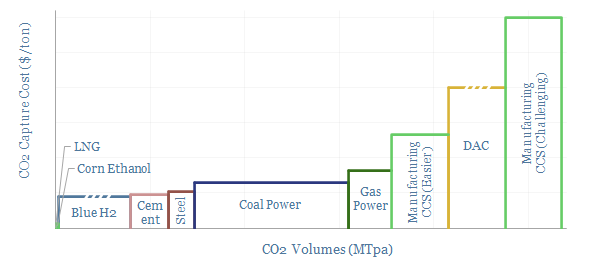

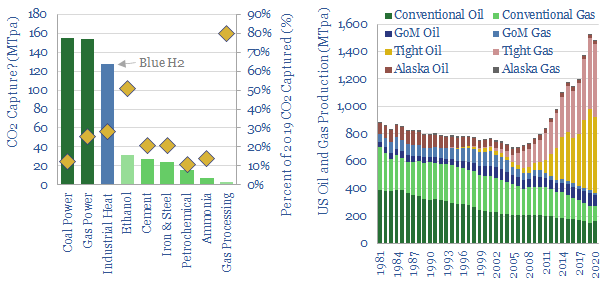

…that are simply being vented at present, such as from the ethanol or LNG industries, but the ultimate running-room from this opportunity set is <200MTpa. Blue hydrogen, steel and cement…

…help CCS scale by c25x, accelerating over 500MTpa of projects in the next decade, which could prevent almost 10% of the US’s current CO2 emissions. Our numbers include blue hydrogen…

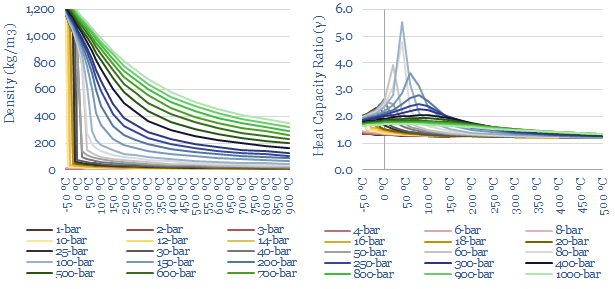

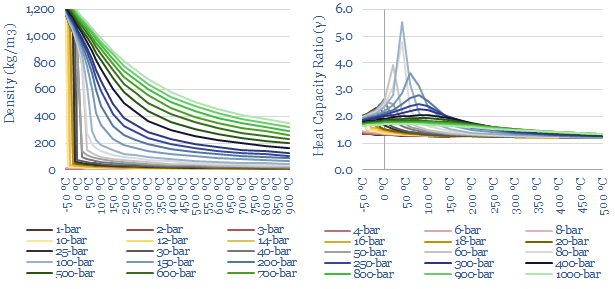

…properties, which helps to fine-tune appropriate risking factors for vanilla CCS, blue hydrogen, CO2-EOR, CO2 shipping, super-critical CO2 power cycles. There is also a wide moat around leading turbomachinery companies….

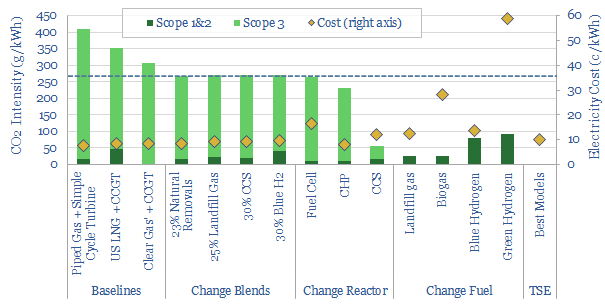

…conventional gas plus landfill gas (c25%), nature-based CO2 removals (20-25%), blue hydrogen (30%) and CCS (c33%). Generally these blends do not look too bad on costs, inflating a marginal cost…