Search results for: “renewables”

-

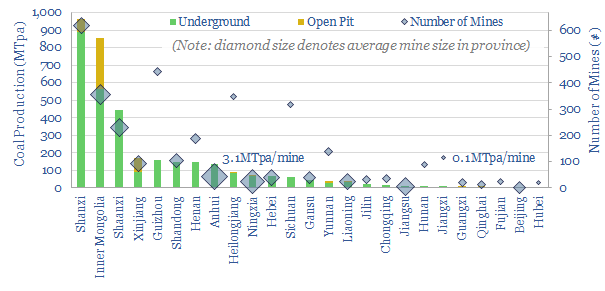

All the coal in China: our top ten charts?

Chinese coal provides 15% of the world’s energy, equivalent to 4 Saudi Arabia’s worth of oil. Global energy markets may become 10% under-supplied if this output plateaus per our ‘net zero’ scenario. Alternatively, might China ramp its coal, especially as Europe bids harder for renewables and LNG post-Russia? This note presents our ‘top ten’ charts.

-

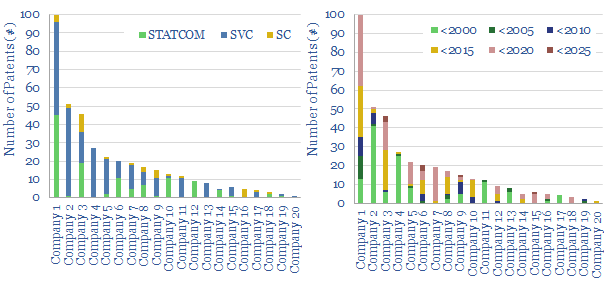

STATCOMs and SVCs: leading companies?

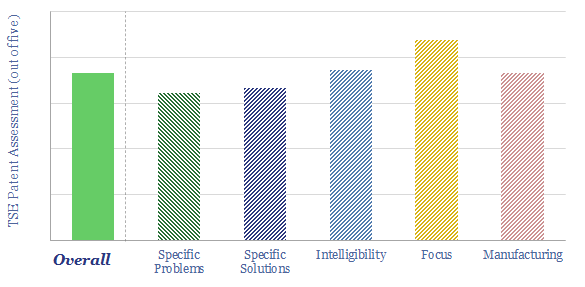

This data file looks for leading companies in STATCOMs and SVCs by aggregating all Western patents that refer in their title, abstract or claims to “STATCOMs”, “Static VAR Compensators”, or similar. ABB (now part of Hitachi), Siemens Energy and GE stand out as Western leaders in a concentrated space, although competition is growing.

-

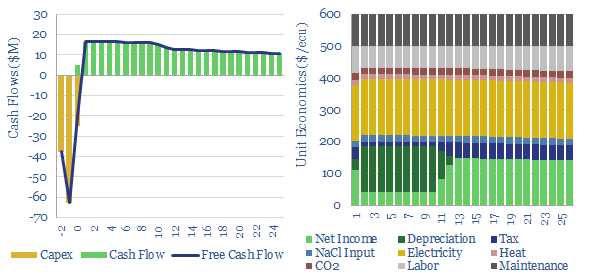

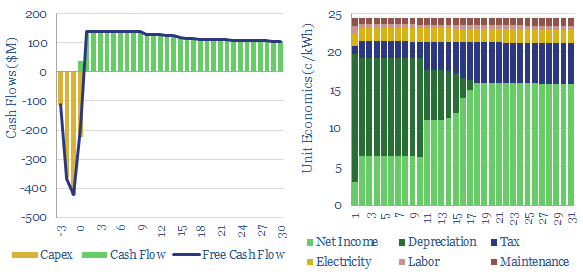

Chlor-alkali process: the economics?

This data-file captures chlor-alkali process economics, to produce 80MTpa of chlorine and 90MTpa of caustic soda. Our base case requires $600 per ecu for a 10% IRR and a growth project costing $600/Tpa. Electricity is 45% of cash cost. CO2 intensity is 0.5 tons/ton. Interestingly, chlor-alkali plants can demand shift.

-

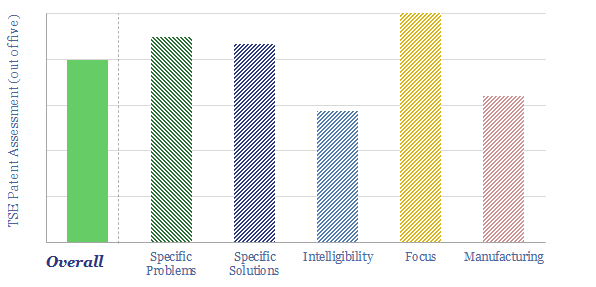

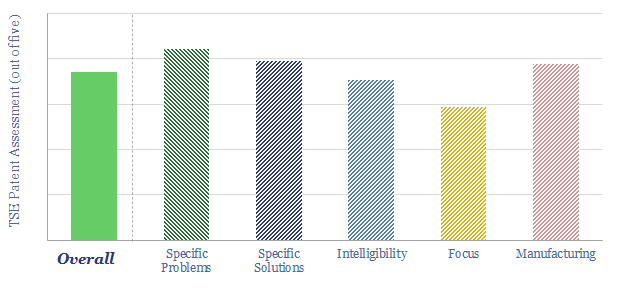

Terrestrial Energy: small modular reactor breakthrough?

Terrestrial Energy is a next-generation nuclear fission company, aiming to build a small modular reactor: specifically a 2 x 195MWe Integral Molten Salt Reactor with ultimate costs below $3,000/kWe, yielding levelized costs of 5-7c/kWh. 80 patents lock up 8 core innovations in a high-quality library that helps de-risk the potential.

-

Pumped hydro: the economics?

This data-file assesses pumped hydro costs, to back up wind and solar. A typical project has 0.5GW of capacity, 12-hours storage duration, 80% efficiency, and capex costs of $2,250/kW. Thus it requires a 25c/kWh storage spread, in order to generate a 10% IRR.

-

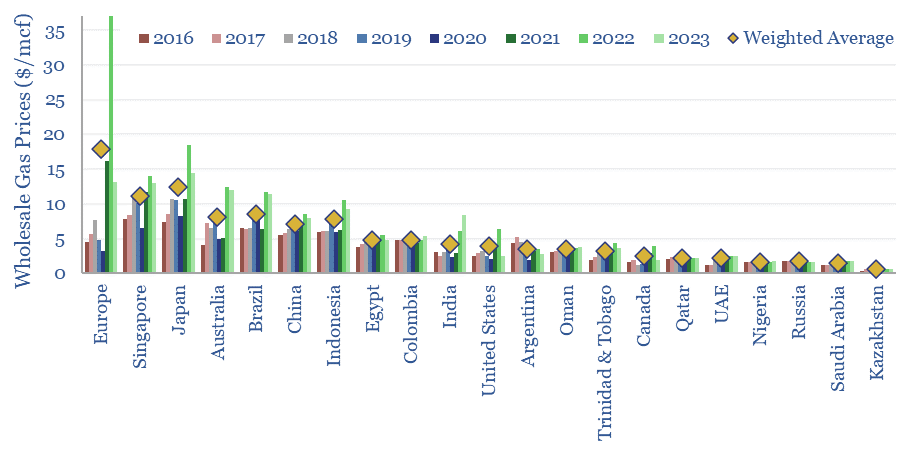

Global gas prices: by country?

Global gas prices by country are often measured at the world-famous delivery points for liquids futures contracts, such as Henry Hub and the Netherlands’ TTF. This data-file takes a broader approach, aggregating the annual gas prices by country across twenty geographies.

-

Prysmian: power cable technology breakthroughs?

Prysmian scores well on our patent assessment framework. We conclude an array of incremental improvements and industry specializations confer a partial moat and helps to de-risk future installation work.

-

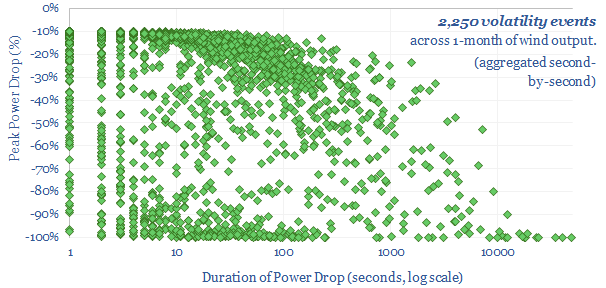

Wind volatility: second by second output data?

We have evaluated the second-by-second data on the power output of a 25MW onshore wind farm in Germany. A typical day sees 75 volatility events. Compared to solar, wind power drops slightly less frequently, but more extensively (often >90%) and for longer (often several hours or days). Both wind and solar show high short-term volatility.

-

Powin: grid-scale battery breakthrough?

Powin commercializes energy storage hardware and software. Its LFP battery system is 30% more compact than peers, at 200 MWH/acre, and modular, meaning it may be 50% faster to install. Our patent review finds a moat around specific process improvements, to help back up the short-term volatility of solar and wind.

-

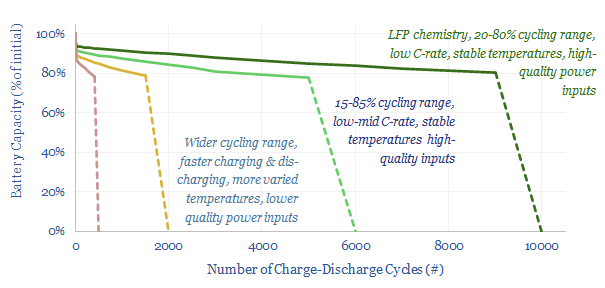

Battery degradation: causes, effects & implications?

This 14-page note offers five rules of thumb to maximize the longevity of lithium-ion batteries, in grid-scale storage and electric vehicles. The data suggest hidden upside in the demand for batteries, for lithium and high-quality power electronics, especially if batteries are to backstop renewables.

Content by Category

- Batteries (89)

- Biofuels (44)

- Carbon Intensity (49)

- CCS (63)

- CO2 Removals (9)

- Coal (38)

- Company Diligence (95)

- Data Models (839)

- Decarbonization (160)

- Demand (110)

- Digital (60)

- Downstream (44)

- Economic Model (204)

- Energy Efficiency (75)

- Hydrogen (63)

- Industry Data (279)

- LNG (48)

- Materials (82)

- Metals (80)

- Midstream (43)

- Natural Gas (148)

- Nature (76)

- Nuclear (23)

- Oil (164)

- Patents (38)

- Plastics (44)

- Power Grids (130)

- Renewables (149)

- Screen (117)

- Semiconductors (32)

- Shale (51)

- Solar (68)

- Supply-Demand (45)

- Vehicles (90)

- Wind (44)

- Written Research (354)