Search results for: “renewables”

-

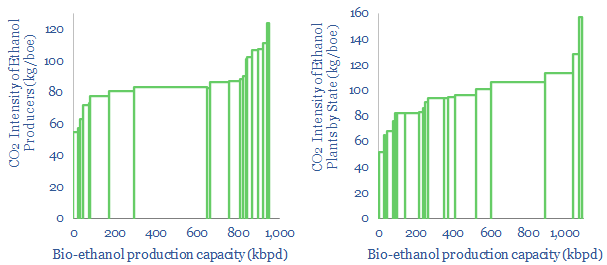

US ethanol plants: what CO2 intensity?

US bioethanol plants produce 1Mbpd of liquid fuels, with an average CO2 intensity of 85kg/boe. Overall, corn-based bioethanol has c40% lower CO2 than oil products. We screened the leaders and laggards by CO2-intensity, covering Poet, Valero, Great Plains, Koch, Marathon and White Energy.

-

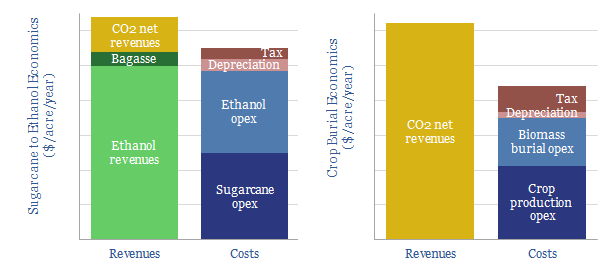

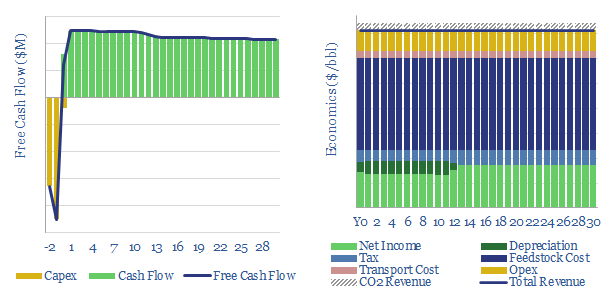

Biomass to biofuel, or biomass for burial?

Greater decarbonization at a lower cost is achievable by burying biomass (such as corn or sugarcane) rather than converting it into bio-ethanol. This model captures the economics. Detailed costs and CO2 comparisons are shown under different iterations.

-

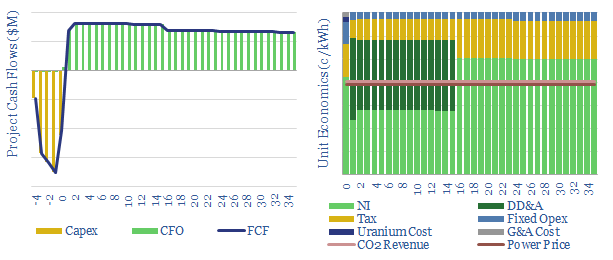

Nuclear Power Project Economics

This data-file models the costs of nuclear power project, based on technical papers and past projects around the industry. An up-front capex cost of $6,000/kW might yield a levelized cost of 15c/kWh. But 6-10c/kWh is achievable via a renaissnace in next-generation nuclear.

-

Renewable diesel: the economics?

Our base case is that a US renewable diesel facility must achieve $4.6/gallon sales revenues (which is c$200/bbl) as it commercializes a product with up to 75% lower embedded emissions than conventional diesel. Similarly, a bio-diesel facility must achieve $3.6/gallon sales on a product with 60% lower embedded emissions.

-

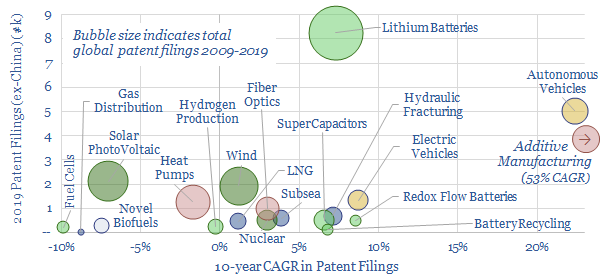

Energy transition technologies: the pace of progress?

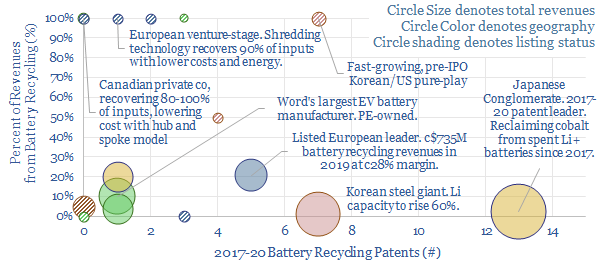

This data-file captures over 250,000 patents (ex-China) to assess the pace of progress in different energy transition technologies, yielding insights into batteries (high activity), autonomous vehicles and additive manufacturing (fastest acceleration), wind and solar (maturing), fuel cells and biofuels (waning) and other technologies.

-

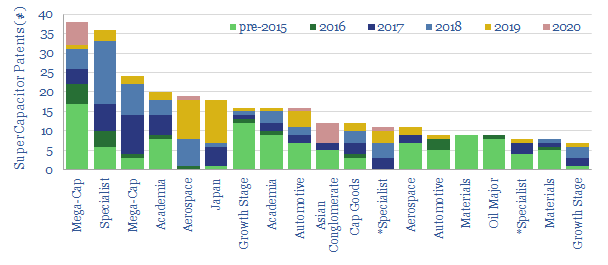

Super-capacitors: technology leaders?

This data-file screens for the ‘top twenty’ technology leaders in super-capacitors, by assessing c2,000 Western patents filed since 2013. The screen comprises capital goods conglomerates, materials companies, an Oil Major with exposure and specialist companies improving SC energy density.

-

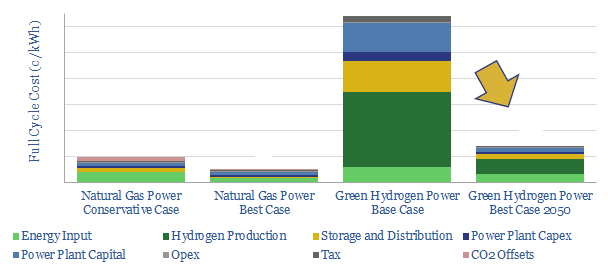

Green Hydrogen Economy: Holy Roman Empire?

We model the green hydrogen value chain: harnessing renewable energy, electrolysing water, storing the hydrogen, then generating usable power in a fuel cell. Today’s costs are very high, at 64c/kWh. Even by 2050, our best case scenario is 14c/kWh, which elevates household electricity bills by $440-990/year compared with decarbonizing natural gas.

-

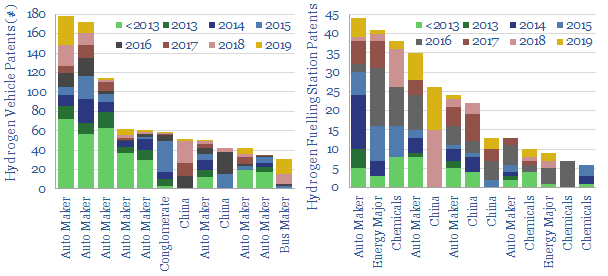

Hydrogen vehicles and fuelling stations: where’s the IP?

We cleaned 18,600 patents into hydrogen vehicles and vehicle fuelling stations. Technology leaders include large auto-makers, industrial gas companies, Energy Majors and hydrogen specialists. Overall, the patents indicate the array of challenges that must be solved to scale up hydrogen fuel in transport.

-

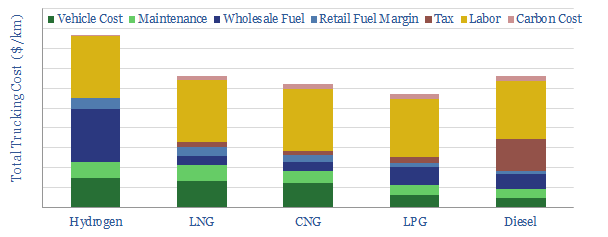

Green hydrogen trucks: delivery costs?

We have modelled full-cycle economics of a green hydrogen value chain to decarbonize trucks. In Europe, at $6/gallon diesel, hydrogen trucks will be 30% more expensive in the 2020s. They could be cost-competitive by the 2040s. But the numbers are generous and logistical challenges remain. Niche adoption is more likely than a wholesale shift.

Content by Category

- Batteries (88)

- Biofuels (44)

- Carbon Intensity (49)

- CCS (63)

- CO2 Removals (9)

- Coal (38)

- Company Diligence (93)

- Data Models (831)

- Decarbonization (159)

- Demand (110)

- Digital (58)

- Downstream (44)

- Economic Model (203)

- Energy Efficiency (75)

- Hydrogen (63)

- Industry Data (278)

- LNG (48)

- Materials (82)

- Metals (77)

- Midstream (43)

- Natural Gas (148)

- Nature (76)

- Nuclear (23)

- Oil (164)

- Patents (38)

- Plastics (44)

- Power Grids (127)

- Renewables (149)

- Screen (114)

- Semiconductors (30)

- Shale (51)

- Solar (67)

- Supply-Demand (45)

- Vehicles (90)

- Wind (43)

- Written Research (351)