Search results for: “small scale LNG”

-

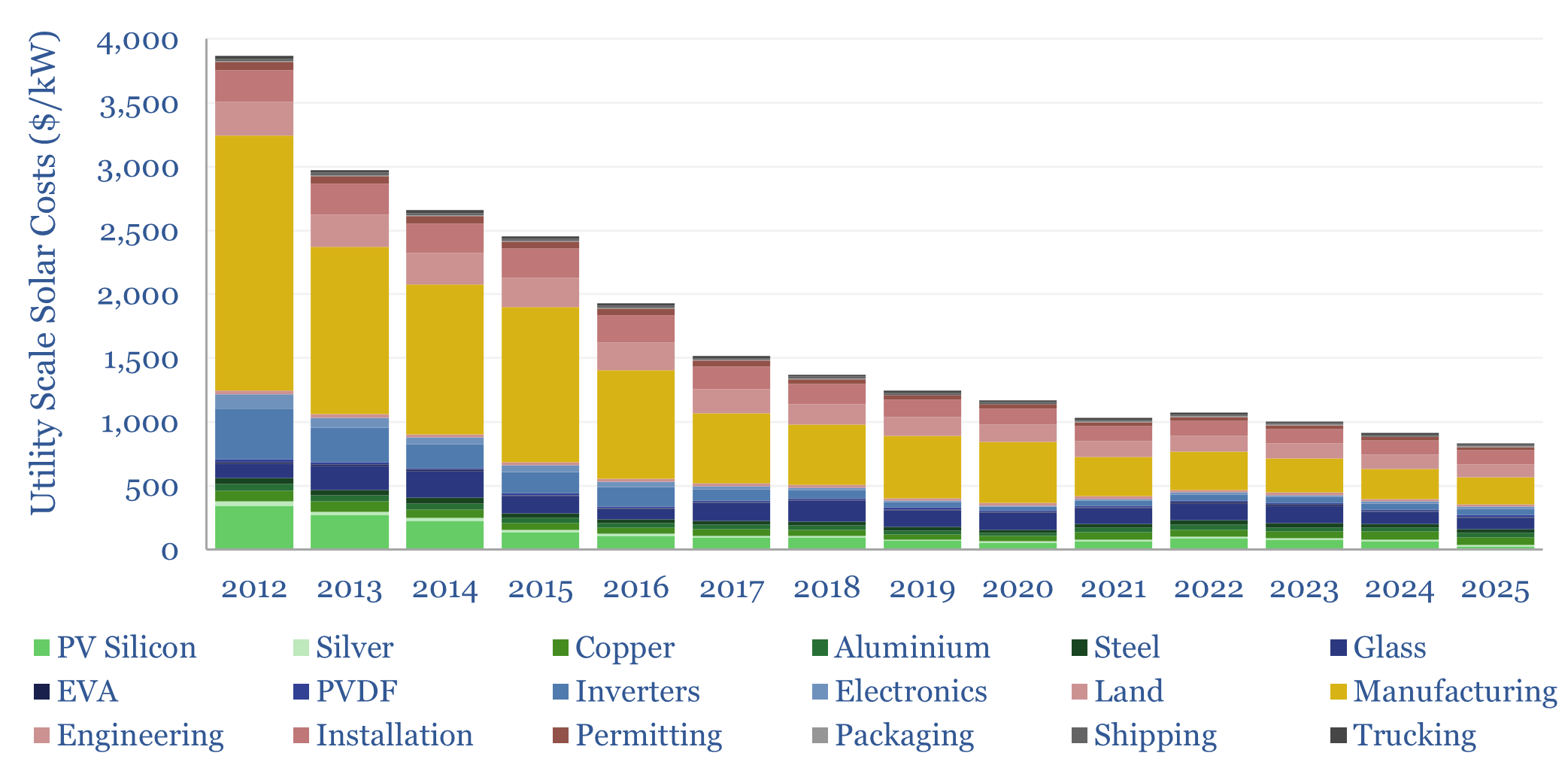

Solar costs: a breakdown over time?

Solar costs have deflated by 70% in the past decade to $800/kW in 2025. 60% has been the scale-up to mass manufacturing, and 40% has been rising efficiency of solar modules. Doubling the efficiency, and thereby the output of solar modules, can halve costs again.

-

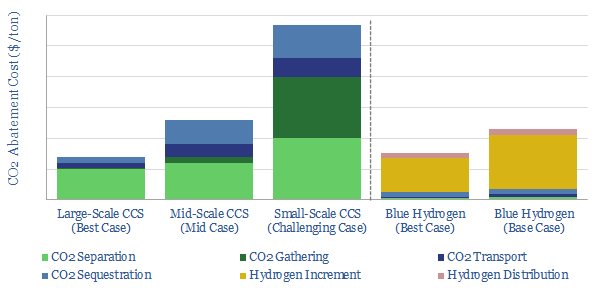

Deep blue: cracking the code of carbon capture?

Carbon capture is cursed by colossal costs at small scale. But blue hydrogen may be its saviour. Crucial economies of scale are guaranteed by deploying both technologies together. The combination is a dream scenario for gas producers. This 21-page note outlines the opportunity and costs.

-

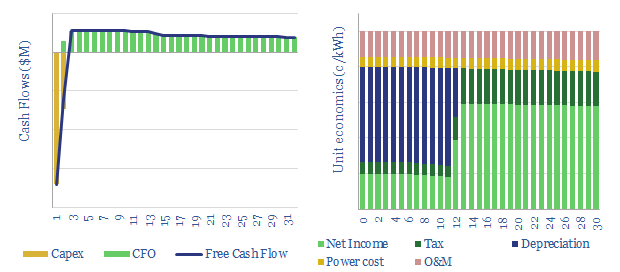

Geothermal energy: costs and economics?

Geothermal energy costs are modelled from first principles in this data-file. LCOEs of 6c/kWh are available in geothermal hotspots. Outside of the hotspots, enhanced geothermal heat can cost 2-14c/kWh-th for a 10% IRR on $500-5,000/kW-th capex, while a rule of thumb is that geothermal electricity costs 5x geothermal heat.

-

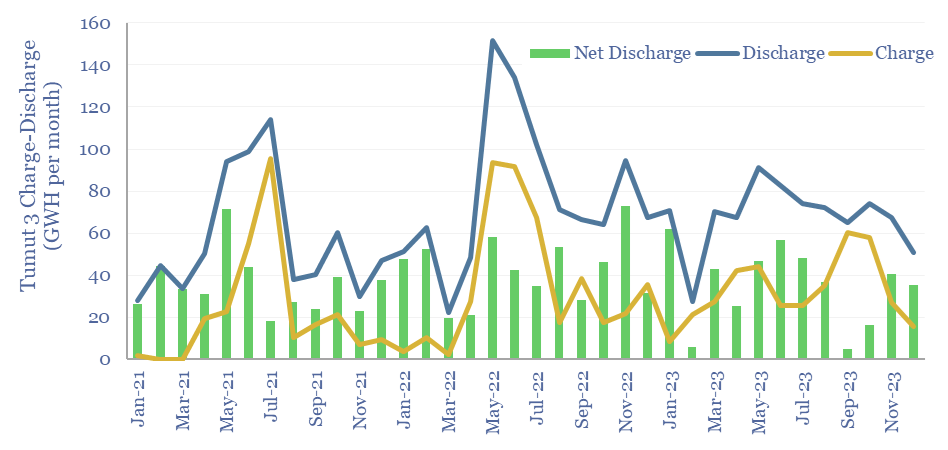

Pumped hydro: generation profile?

Pumped hydro facilities can provide long-duration storage, but the utilization rate is low, and thus the costs are high, according to today’s case study within the Snowy hydro complex in Australia. Tumut-3 can store energy for weeks-months, then generate 1.8 GW for 40+ hours, but it is only charging/dischaging at 12% of its nameplate capacity.

-

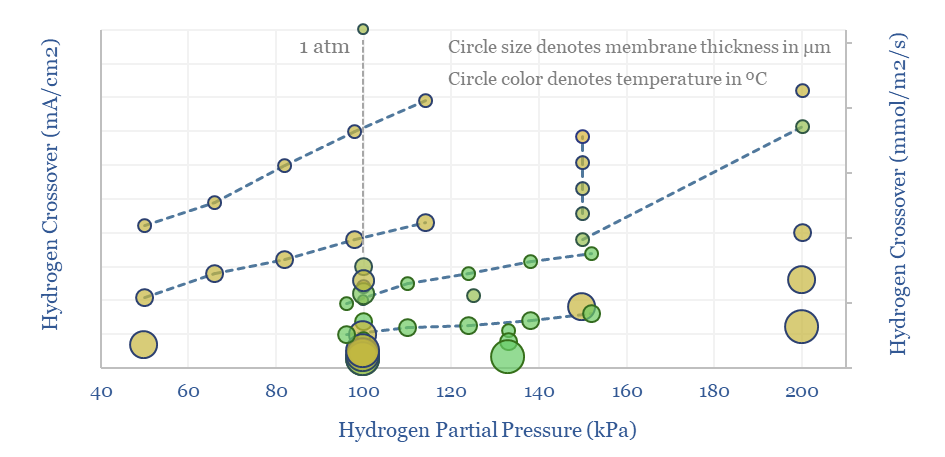

Nafion membranes: costs and hydrogen crossover?

Perfluorinated sulfonate (PFSA) membranes, such as Nafion, are the crucial enabler for PEM electrolyzers, fuel cells and other industrial processes. The market is worth $750M pa. The key challenges are costs, longevity and hydrogen crossover, which are tabulated in this data-file.

-

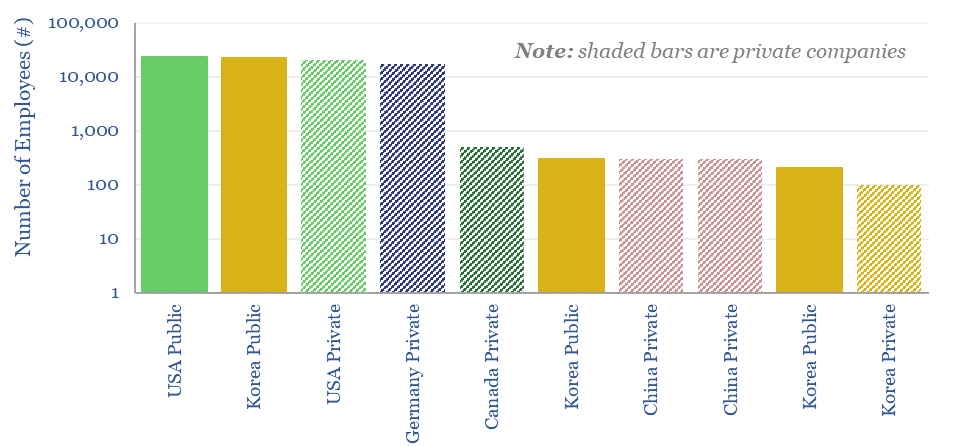

Silver pastes for solar contacts?

50 companies make conductive silver pastes to form the electrical contacts in solar modules. This data-file tabulates the compositions of silver pastes based on patents, averaging 85% silver, 4% glass frit and 11% organic chemicals. Ten companies stood out, including a Korean small-cap specialist.

-

Oklo: fast reactor technology?

Oklo is a next-generation nuclear company, based in California, recently going public via SPAC at a $850M valuation, backed by Sam Altman, of Y-Combinator and OpenAI fame. Oklo’s fast reactor technology absorbs high energy neutrons in liquid metal and targets ultimate costs of 4c/kWh. What details can we infer from assessing Oklo’s patents, and can…

-

Investment casting: the economics?

Investment casting is fast and scalable, especially when producing hundreds-thousands of metal parts. $5/kg unlocks a 10% IRR on a 70% utilized metal-casting plant with $2,000/Tpa of capex, producing a typical 10kg aluminium product. This data-file captures the costs of investment-cast products, which can be stress-tested. 115MTpa of metals are cast every year, of which…

Content by Category

- Batteries (89)

- Biofuels (44)

- Carbon Intensity (49)

- CCS (63)

- CO2 Removals (9)

- Coal (38)

- Company Diligence (95)

- Data Models (840)

- Decarbonization (160)

- Demand (110)

- Digital (60)

- Downstream (44)

- Economic Model (205)

- Energy Efficiency (75)

- Hydrogen (63)

- Industry Data (279)

- LNG (48)

- Materials (82)

- Metals (80)

- Midstream (43)

- Natural Gas (149)

- Nature (76)

- Nuclear (23)

- Oil (164)

- Patents (38)

- Plastics (44)

- Power Grids (130)

- Renewables (149)

- Screen (117)

- Semiconductors (32)

- Shale (51)

- Solar (68)

- Supply-Demand (45)

- Vehicles (90)

- Wind (44)

- Written Research (354)