-

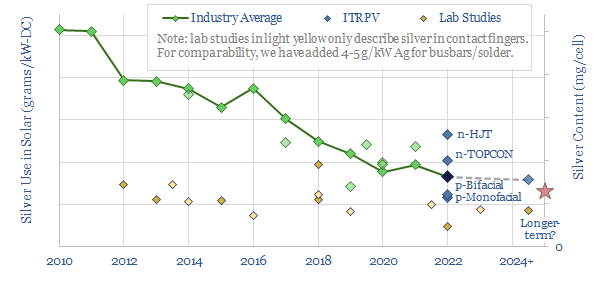

Solar surface: silver thrifting?

Ramping new energies is creating bottlenecks in materials. But how much can material use be thrifted away? This 13-page note is a case study of silver use in solar. Silver intensity halved in the past decade, and could halve again? Conclusions matter for solar companies, silver markets, other bottlenecks.

-

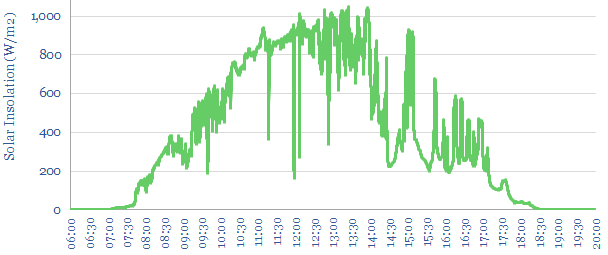

Solar volatility: tell me lies, tell me sweet little lies?

This 20-page note quantifies the statistical distribution of short-term volatility at solar power plants. Solar output typically flickers downwards by over 10%, around 100 times per day. Can industrial processes truly be ‘powered by solar’? What are the best opportunities to buffer the volatility and what are their costs?

-

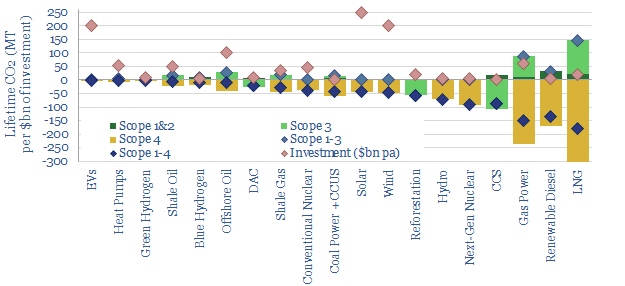

Scope 4 emissions: avoided CO2 has value?

Scope 4 CO2 emissions reflect the CO2 avoided by an activity. This 11-page note argues the metric warrants more attention. It yields an ‘all of the above’ approach to energy transition, shows where each investment dollar achieves most decarbonization and maximizes the impact of renewables.

-

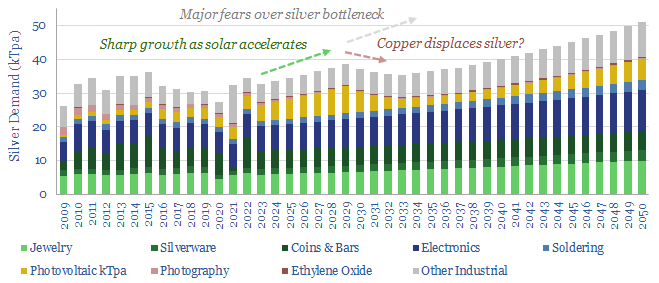

Solar contacts: silver bullet?

The front contacts in today’s solar cells are made of screen-printed silver, absorbing 11% of 2021’s silver market. Silver can be substituted with copper, but manufacturing is c5x more costly. So we expect a silver spike, then a switch. This 16-page note explains our outlook, and who benefits?

-

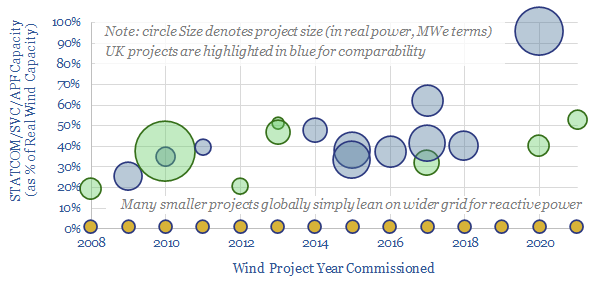

FACTS of life: upside for STATCOMs & SVCs?

Wind and solar have so far leaned upon conventional power grids. But larger deployments will increasingly need to produce their own reactive power; controllably, dynamically. Demand for STATCOMs & SVCs may thus rise 30x, to over $25-50bn pa. This 20-page note outlines the opportunity and who benefits?

-

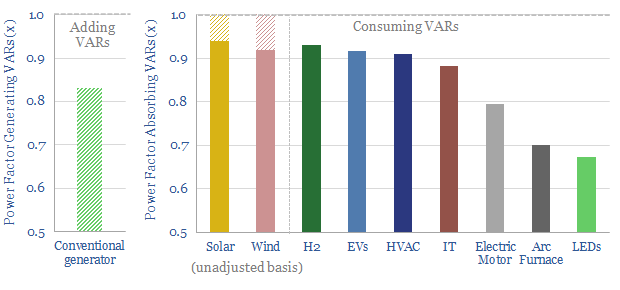

Capacitor banks: raising power factors?

Power factor corrections could save 0.5% of global electricity, with $20/ton CO2 abatement costs in normal times, and 30% pure IRRs during energy shortages. They will also be needed to integrate more new energies into power grids. This note outlines the opportunity in capacitor banks, their economics and leading companies.

-

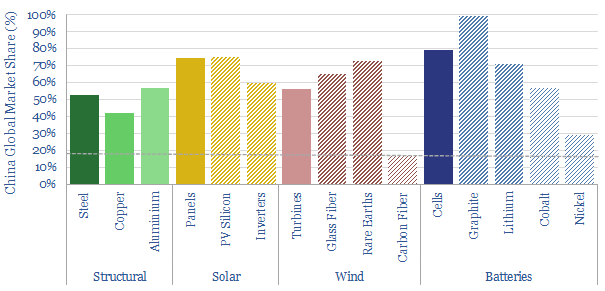

East to West: re-shoring the energy transition?

China is 18% of the world’s people and GDP. But it makes c50% of the world’s metals, 60% of its wind turbines, 70% of its solar panels and 80% of its lithium ion batteries. Re-shoring is likely to be a growing motivation after events of 2022. This 14-page note explores resultant opportunities.

-

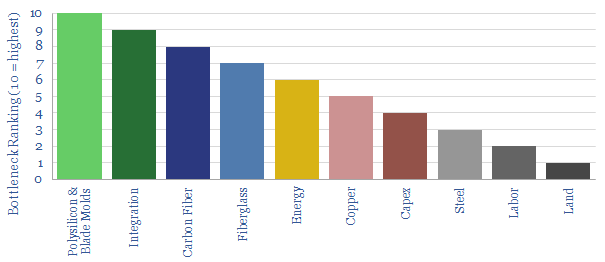

Renewables: can they ramp up faster?

How fast can wind and solar accelerate, especially if energy shortages persist? This 11-page note reviews the top ten bottlenecks. Seven value chains will tighten enormously in the coming years. Paradoxically, however, ramping renewables could exacerbate near-term energy shortages.

-

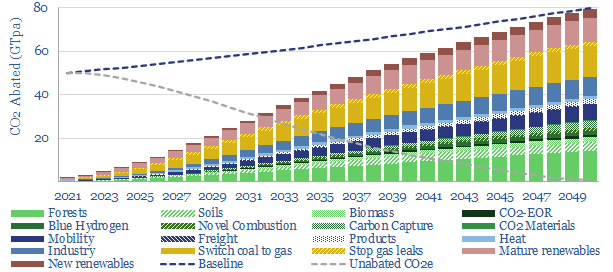

Decarbonizing global energy: the route to net zero?

This 18-page report revises our roadmap for the world to reach ‘net zero’ by 2050. The average cost is still $40/ton of CO2, with an upper bound of $120/ton, but this masks material mix-shifts. New opportunities are largest in efficiency gains, under-supplied commodities, power-electronics, conventional CCUS and nature-based CO2 removals.

-

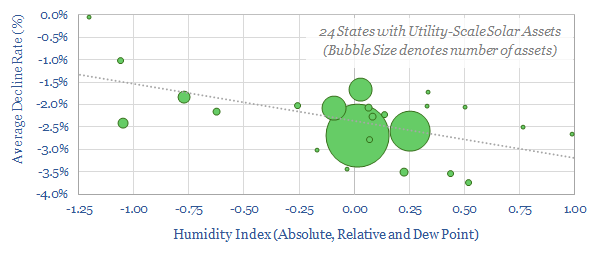

Solar decline rates: causes and solutions?

The average solar asset declines at 2.5% per year. This 14-page note reviews the causes. We find humid climates moderate Potential Induced Degradation, adding a relative headwind in coastal geographies and floating solar. But an exciting way to mitigate declines is emerging via smaller inverters.

Content by Category

- Batteries (89)

- Biofuels (44)

- Carbon Intensity (49)

- CCS (63)

- CO2 Removals (9)

- Coal (38)

- Company Diligence (95)

- Data Models (840)

- Decarbonization (160)

- Demand (110)

- Digital (60)

- Downstream (44)

- Economic Model (205)

- Energy Efficiency (75)

- Hydrogen (63)

- Industry Data (279)

- LNG (48)

- Materials (82)

- Metals (80)

- Midstream (43)

- Natural Gas (149)

- Nature (76)

- Nuclear (23)

- Oil (164)

- Patents (38)

- Plastics (44)

- Power Grids (130)

- Renewables (149)

- Screen (117)

- Semiconductors (32)

- Shale (51)

- Solar (68)

- Supply-Demand (45)

- Vehicles (90)

- Wind (44)

- Written Research (354)