Fuel retailers have a game-changing opportunity seeding new forests, outlined in our 26-page note, then commercializing CO2 neutral fuels with carbon offsets.

Nature based solutions could offset c15bn tons of CO2 per annum, enough to accommodate 85Mbpd of oil and 400TCF of annual gas use in a fully decarbonized energy system. The cost is competitive, well below c$50/ton. It is natural to sell carbon credits alongside fuels and earn a margin on both. Hence, we calculate 15-25% uplifts in the value of fuel retail stations, allaying fears over CO2.

The advantages of forestry projects are articulated on pages 2-7, explaining why fuel-retailers may be best placed to commercialize genuine carbon credits.

Current costs of carbon credits are assessed on pages 8-10, adjusting for the drawback that some of these carbon credits are not “real” CO2-offsets.

The economics of future forest projects to capture CO2 are laid out on 11-14, including opportunities to deflate costs using new business models and digital technologies. We find c10% unlevered IRRs well below $50/ton CO2 costs.

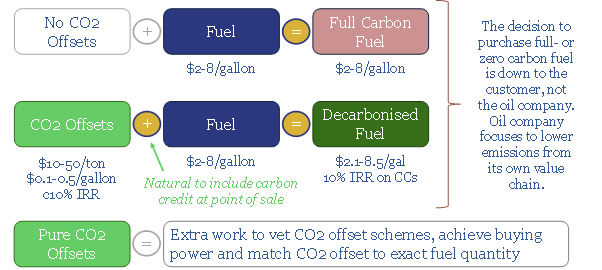

What model should fuel-retailers use, to collect CO2 credits at the point of fuel-sale? We lay out three options on pages 15-18. Two uplift NPVs 15-25%. One could double or treble valuations, but requires more risk, and trust.

The ultimate scalability of forest projects is assessed on pages 19-25, calculating the total acreage, total CO2 absorption and total fossil fuels that can thus be preserved in the mix. Next-generation bioscience technologies provide upside.

What is crucial is to do this right. Cutting corners and flogging low-quality offsets will be a trust-destroying disaster. Hence it is important to screen for high-quality nature-based CO2 removals.

A summary of different companies forest/retail initiatives so far is outlined on page 26.

Our 3 key points on how CO2 neutral fuels with carbon offsets could reshape the oil industry are also highlighted in the short article sent out to our distribution list.