Our mission is to find economic opportunities that can drive the energy transition, substantiated by transparent data and modelling. Therefore, we have looked extensively for opportunities in hydrogen, but somewhat failed to find very many.

More pessimistically stated, we fear that the ‘green hydrogen economy’ may fail to be green, fail to deliver hydrogen, and fail to be economical. We see greater opportunities elsewhere in the energy transition.

This short note summarizes half-a-dozen deep-dive research notes, plus over a dozen models and data-files into the commercialization of hydrogen. There may be opportunities in the space, but they must be chosen very carefully.

An overview of different hydrogen pathways?

We start with an overview of hydrogen pathways. In 2019, c70MT of hydrogen was produced globally. 95% of it was grey, meaning it was derived from steam-methane reforming of natural gas. The cost of this process is around $1.3/kg ($11.5/mcf-gas- equivalent) and efficiency is c70%, which means that replacing 1 kWh of gas with 1kWh of hydrogen actually increases both gas demand and CO2 emissions.

Capture 80-100% of the CO2 from SMR using CCS and you have ‘blue hydrogen’, a fuel that costs c$2/kg ($18/mcfe), with a production efficiency of c60%, and a CO2 content that is 75-100% lower CO2 than combusting the natural gas it is derived from.

Finally, use renewable energy to hydrolyse water, and you have ‘green hydrogen’, which is truly zero carbon. But it currently costs $6-8/kg ($55-70/mcfe) and has 60-90% production efficiency, which is far worse than the best batteries we have researched.

Can hydrogen be economic: in heat, power or transportation?

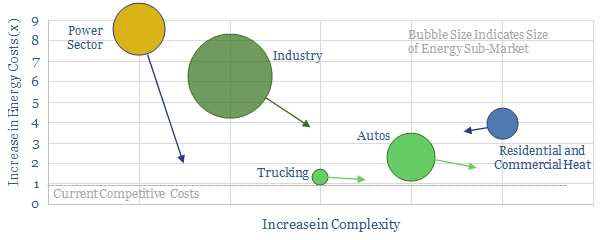

Costs matter for consumers in the energy transition. For example, we estimate that using blue hydrogen to decarbonize heat would raise an average household’s heating bill by c$670 per year, while green hydrogen would increase it by c$2,600. By contrast, our preferred solution of nature based solutions and efficient natural gas decarbonizes home heating at an incremental cost of $50 per household per year.

Green hydrogen in the power sector does not look viable to us. We have modelled the green hydrogen value chain: harnessing renewable energy, electrolysing water, storing the hydrogen, then generating usable power in a fuel cell. Today’s end costs are very high, at 64c/kWh. Even by 2040-2050, our best case scenario is 14c/kWh, which would elevate average household electricity bills by $440-990/year compared with the superior alternative of decarbonizing natural gas.

This is despite heroic assumptions in our 2040s numbers, such as a 1.5x improvement in round trip energy efficiency, 80% cost deflation, c40% “free” renewable energy, in situ hydrogen production and use, and nearby salt caverns for low cost storage (so green H2 retails at $3/kg). All of this analysis is based on transparent data and modelling, as shown below. We welcome pushbacks and challenges if you have different numbers.

Challenges are raised about green hydrogen in our work. First, processes fuelled purely by renewables (i.e., electrolysis reactors) will tend to have 30-40% utilization rates at best (half the US industrial average), which amortizes high capital costs over less generation. Second, storage is complex and could be 4-10x more expensive than we assumed, if salt caverns are not nearby. Finally, beware of ‘magic mystery deflation’ that is baked into the estimates of some commentators.

Economizing comes with trade-offs. This is particularly visible when we look at the cost of electrolysers, where lower capex may come at the cost of lower efficiency, reliability, longevity and even safety. Some forecasters are calling for 80% deflation, but we see 15-25% as more likely, if manufacturers wish to make a margin in the future, and as many of the cost components are technically mature.

Green hydrogen in trucking may offer more promising inroads, particularly in well-chosen niches. Trucking consumes 10Mbpd of diesel globally and emits c1.5bn tons of CO2 per year, which is 3.5% of the global total. Current full-cycle costs of hydrogen trucks are c30% higher than diesels. This is based on $150k higher truck costs, 85% higher maintenance and $7/kg green hydrogen plus $1.5/kg retail margins.

But a full and rapid switch to hydrogen trucks in Europe would cost an incremental $50bn per year (equivalent to a 0.3% off Europe’s GDP, plus multipliers). 2040s green hydrogen truck costs could become competitive with diesel, in Europe, but again, this is incorporating some heroic assumptions. In particular, fuel retail margins for hydrogen may need to be c20x higher than for conventional fuels in remote locations with little traffic.

Immutable midstream issues: an anomalous commodity?

All of the value chains and models above assumed hydrogen was generated in situ, via electrolysis, at its point of use. However, in order for hydrogen to scale up, it would need to be transported, like other commodities.

Transporting hydrogen may be more challenging than any other commodity ever commercialised in the history of global energy. Costs are 2-10x higher than gas value chains. Up to 50% of hydrogen’s embedded energy may be lost in transit. We find these challenges are relatively immutable. They are due to physical and chemical properties of H2, plus the laws of fluid mechanics, which cannot be deflated away through greater scale.

For example a hydrogen pipeline will inherently cost 2-10x more than a comparable gas pipeline. This is down to fluid dynamics, as the hydrogen line, all else equal, will flow 25% less energy (due to the gravity, energy density and compressibility of hydrogen gas), but require c30% more expensive reinforcement and materials (due to hydrogen’s lower molecular mass and proneness to causing embrittlement and stress cracking in high-pressure lines).

Moving hydrogen as ammonia is another option. Air Products recently sanctioned a $7bn project to produce green hydrogen in Saudi Arabia, convert it to ammonia, then ship the ammonia to Europe or Japan. Its guidance implies hydrogen could be imported at $10/kg while earning a 10% IRR. But we needed to assume several cost lines are budgeted at 50% below recent comparison-points to match this guidance. Our sense is that a comparably complex LNG project might warrant a 20% hurdle rate. Thus to be excited by this project, we would want to see a hydrogen sales price closer to $15/kg.

Is Magic Mystery Deflation a Cure All?

The pushback to our hesitations is that deflation will prevail, costs will fall and green hydrogen will ultimately become economic in ways that are hard to model ex-ante. This is possible, but it is not borne out by our work reviewing over 1M patents. The ‘average’ topic in the energy transition is seeing c600 patents filed per year (ex-China) and accelerating at a 5% CAGR. Hydrogen fuel cells saw 222 in 2019 and are declining at a -10% CADR. Hydrogen trucks and fuelling stations saw c300 patents in 2019 which is flat on 2013.

The patents also flag complexities. How do you safely prevent explosions in the event of a crash? How do you keep a fuel cell hydrated in dry climates, cool under thermal loads and starting smoothly in very cold climates? How do you add odorants to hydrogen to lower the risk of undetected leaks, if odorants poison fuel cells? Who is legally liable if a fuel cell is poisoned by inadvertently selling contaminated hydrogen?

We would be wary of companies that have made extensive promises, especially around future economics, but without having developed the underlying technologies being promised. This creates a high degree of risk.

To help identify technology leaders, we have assessed the patents filed in fuel cells, electrolyers, hydrogen vehicles and in fuelling infrastructure.

Conclusion. Policymakers are currently aiming to accelerate the development of green hydrogen. Our own work into the economics and technical challenges make us nervous that these policies may need to be walked back over time. There may be some interesting use cases for hydrogen in the energy transition (especially blue hydrogen). But the history of technology transitions does not suggest to us that a green hydrogen economy could emerge and have any meaningful impact on climate within the required 20-30 year timeframe.