Whale oil was a dominant, albeit barbaric, lighting fuel in the 19th century. But what happened to whale oil prices as the industry was disrupted by kerosene and ultimately by electric lighting? We find whale oil prices maintained a 25x premium to rock oil and outperformed other commodities as the whale oil market collapsed. As whaling declined, the prices of by-products (e.g. whale bone) also rallied very sharply. This 8-page note presents our analysis of the whaling industry from 1805 to 1905 and draws implications for the future of the oil and gas industry.

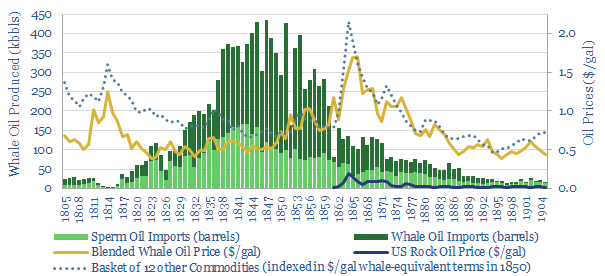

The US whaling fleet peaked at 233k tons in 1846, with 680 ships, 34 brigs and 22 schooners. Capacity remained at a plateau of 200kt until 1859, producing an average of 930bpd of whale oil over this timeframe, predominantly for lighting.

Then the whale oil industry was disrupted, and by 1880, rock oil volumes were 70x larger than whale oil volumes, while by 1902, the US had 18M electric lightbulbs.

The rise and fall of the whale oil industry is put into its historical context on pages 2-3, including data on the industry’s productivity and the timing of its disruption.

The relative pricing performance of whale oil is discussed on pages 4-5, in comparison to rock oil and a basket of long-term commodity prices.

A very important driver of whale oil pricing dynamics was that supply peaked before demand, and the report assesses the productivity of the whaling industry over time.

A rally in whale bone prices (a by-product of whaling) and the premiumization of whale oil supplies were also side-effects of whale oil being disrupted, as detailed on pages 6-7.

Implications for the oil and gas industry are presented on page 8, as the historical analogy shows prices could rise sharply if future oil supply falls faster than future oil demand.

Side-products such as lubricants, plastics and jet fuel could rally if electric vehicles and wind/solar disrupt core oil and gas markets.

The full database underlying our analysis is available for download here. Our long term oil demand model is linked here.