Some industries can absorb low-cost electricity when renewables are over-generating and avoid high-cost electricity when they are under-generating. The net result can lower electricity costs by 2-3c/kWh and uplift ROCEs by 5-15% in increasingly renewables-heavy grids. This 14-page note ranges over 10,000 demand shifting opportunities, to identify five industries and fifteen mid-large cap companies that can benefit most.

Power grids are changing with the ramp-up of wind and solar. In particular, power pricing is becoming more volatile, potentially falling near to zero in the windiest and sunniest moments, then spiking to 2-3x normal levels during times of shortages. When input pricing becomes more volatile, there are inevitably winners and losers, as illustrated on pages 2-3.

Different types of power grid volatility range from instant-to-instant, through to year-to-year. But the best economic opportunities for demand shifting, we think, range from minute-by-minute through to several days (pages 3-4).

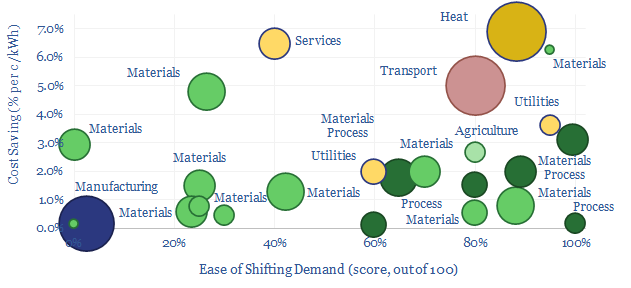

10,000 fold complexity. If you think that the different forms of renewables volatility are complex, then you also need to overlay four different types of demand shifting, available in 300 industries globally, each with 3-30x sub-processes. Complexity “is what it is”. In our view, it is also the reason that demand shifting opportunities have been overlooked and under-discussed as part of other energy transition roadmaps (page 5).

Our goal in this note is to defray the complexity, by drawing on five years of research. We start by laying out a five point framework, which we will use to assess which industries are well-placed for demand shifting, to lower their costs and uplift their margins in more volatile power grids (page 6).

What is the answer? We have spent the last five years, building over 160 economic models, and studying different industrial processes. The goal in this note is not to re-hash all of the workings, which are available to all TSE subscription clients, but simply to present the answers. Which industries and companies will benefit most from demand shifting, as power grids become more volatile? Where? And how much?

Five industries that seem best placed to us to benefit from grid volatility are discussed on pages 10-14. We also note 15 leading, mid-large cap companies across these industries.

Some of these companies have already created internal departments to optimize the timing of their power demand, smooth out renewables and deflate their electricity costs in the process. We will also continue expanding and updating the underlying data-file here.