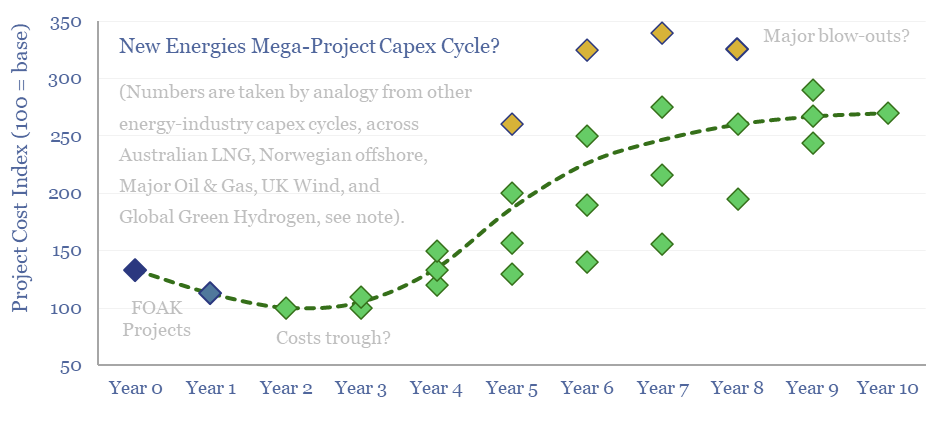

Energy transition is the largest construction project in human history. But building in boom times is associated with 2-3x cost inflation. This 10-page note reviews five case studies of prior capex booms, and argues for accelerating FIDs, even in 2024. The outlook for project developers depends on their timing? And who benefits across the supply chain?

A key challenge in our roadmap to net zero is the sheer amount of investment needed, stepping up from $3trn per year to $9trn per year. Where we see the biggest boom times ahead is summarized on page 2.

The thing about all of these booms is that no one seems to be in a rush. Especially amidst the political and geopolitical limbo of 2024.

Mega-projects have a checkered reputation among investors. Some commentators seem to despise them! But frankly, there is no other way to build world-changing infrastructure at a reasonable overall cost. We illustrate the economies of scale on pages 3-4.

In this note, we challenge the notion that it is better to wait. Building in boom times almost always rewards being early or counter-cyclical.

Our first case study for building in boom times is the Australian LNG industry, where projects later in the queue cost 2x more (page 5).

Our second case study comes from the costs of developing 130 oil and gas fields, developed offshore Norway in 1975-2024 (page 6).

Other case studies include Energy Majors’ development capex (page 7), UK offshore wind projects (page 8) and recent green hydrogen projects (page 9). Peak costs are 2-3x trough costs.

For project developers, the key conclusion is to target the front of the queue. Early projects are likely to achieve materially better outcomes than later projects. Conclusions for investors, the energy service supply chain and policymakers are on page 10.