Vast quantities of gold hydrogen are produced in the Earth’s subsurface, via the serpentinization of iron-containing Peridotite rocks. Gold, white and orange hydrogen variations aim to harness this hydrogen. This 19-page note explores opportunities, costs and challenges for harvesting H2 out of natural seeps, hydrogen reservoirs or fracking/flooding Peridotites.

110MTpa of global hydrogen is produced today, emitting 1.3GTpa of CO2, costing $0.8/kg. The market grows to 220MTpa by 2050, mostly blue H2, at $1.2-1.5/kg, per our hydrogen outlook, which is re-capped on page 2.

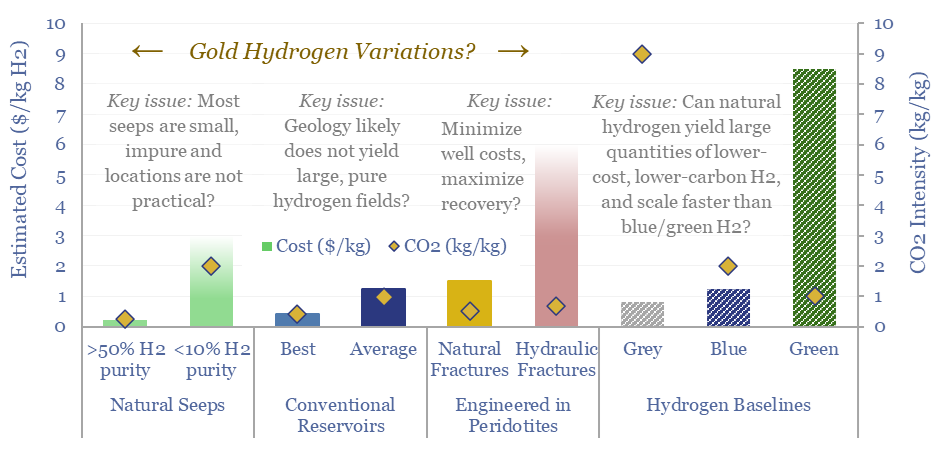

But what if gold hydrogen could be recovered from the subsurface of the Earth, analogous to the development of natural gas? Could the volumes, costs and CO2 intensities re-shape the future of hydrogen?

What is gold hydrogen? We have reviewed the geology from first principles, in two concise pages, covering the famous Bourakebougou hydrogen field in Mali, iron oxidation in ultra-mafic Peridotites, and radiolysis of water energized by the natural decay of Uranium, Thorium and Potassium. Details are on pages 4-5.

Hydrogen seeps offer the simplest way to access gold hydrogen. The main costs would be for gas separation. Hence we review the costs and CO2 intensities for cryogenics, swing adsorption and membranes, to derive some conclusions on this opportunity, on pages 6-9.

White hydrogen is the second broad opportunity and involves finding and producing hydrogen from reservoirs akin to conventional natural gas production. We model the costs of white hydrogen, CO2 intensities and their sensitivities on pages 10-12. But there are also reasons to question the geological risks for white hydrogen, per pages 13-14.

Orange hydrogen is the third broad opportunity, which engineers the production of hydrogen in the subsurface, by injecting water into fractured Peridotites. These could either be naturally fractured akin to waterflood projects, or hydraulically fractured akin to shales. We model the costs of orange hydrogen, CO2 intensities and sensitivities on pages 15-17.

Companies and conclusions are discussed in the final 2-pages of the report. Majors and Services are gearing up in gold hydrogen. But specifically, we profile ten earlier stage companies, from private companies to listed Australian equities, on pages 18-19.

The 19-page report is intended as a concise overview of all the key issues in gold hydrogen, focusing on the costs, CO2 intensities and challenges for each broad approach. For further details, please see our broader hydrogen research.