What does it take to move global oil demand by 1Mbpd? This 22-page note ranks fifteen themes, based on their costs and possible impacts, to show what drives global oil demand, where risks lie for oil markets, and where opportunities are greatest to drive decarbonization. We still think global oil demand plateaus around 105Mbpd mid-late in the 2020s, before declining to 85Mbpd by 2050. But the risks now lie to the upside?

Global oil demand will run at 103Mbpd in 2024, growing another 1Mbpd from 2023. Yet the lowest-cost and most practical roadmap to net zero would see oil use plateau around 105Mbpd in the mid-2020s, then decline to 85Mbpd by 2050.

There is huge hubris in these forecasts. We are assuming that after a century of growth, averaging +1Mbpd/year since 1990, oil demand will suddenly start stagnating, then declining. Are we as forecasters really able to outsmart historical precedents, especially given forecasters’ poor track records in predicting the future? (pages 2-3).

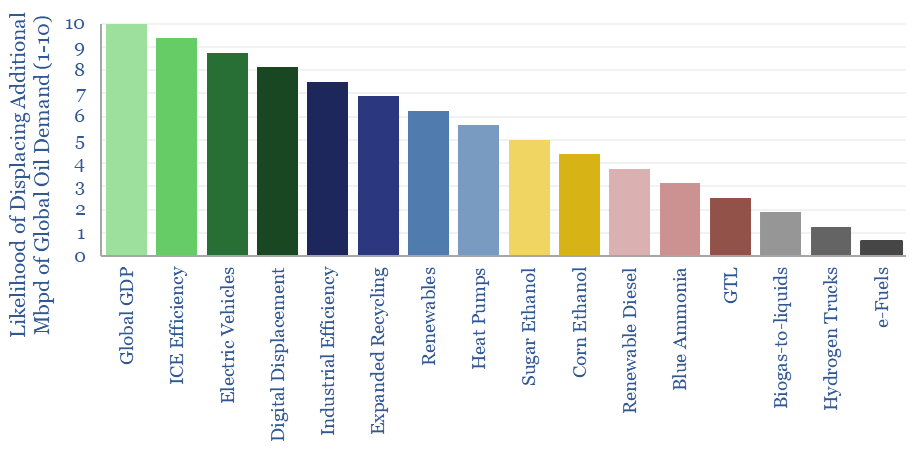

Our methodology in this report is to take fifteen of the most important themes that could sway global oil markets, then to evaluate what it would take for each theme to move global oil markets by 1Mbpd, in terms of capex, ongoing costs, oil price breakevens, resource requirements and land intensities. Thus we have written a 1-2 page snapshot for each theme, covering our favorite facts and figures (pages 4-21).

Covered themes are GDP growth, fuel economy, electric vehicles, going online, industrial efficiency, expanded recycling, wind and solar, heat pumps, corn ethanol and sugar ethanol, renewable diesel, ammonia shipping fuels, biogas to liquids, hydrogen trucks and e-fuels.

What drives global oil demand? Of the fifteen themes, we reach the conclusion that only three themes can really move oil markets by +/- 5Mbpd over the next decade. Another seven themes may have -1Mbpd impacts over the next decade. Some themes stand out as golden opportunities. Realism is needed when assessing other higher-cost options.

Subtle changes in forecasts, such as 0.5% pa faster GDP growth and a slower deployment curve for electric vehicles could see global oil demand continuing to rise, and ramping up to 110Mbpd by 2050 (page 22).