There has never been more controversy over the fair values of power generation assets, which hinge on their remaining life, utilization, flexibility, power prices, rising grid volatility and CO2 credentials. This 16-page guide covers the fair value of generation assets, hidden opportunities and potential pitfalls.

What is the fair value of a portfolio of power generation assets? This question increasingly matters, for the valuations of independent power producers, for assessing deal flow in the utility sector, for renewable energy developers, and for those looking to secure reliable power for new loads amidst grid bottlenecks.

Hence this 16-page report is a guide to the fair value of generation assets, drawing on over 100 notes, models and data-files, published over the past five-years, and available to TSE subscription clients.

The work is informed by transaction prices for generation assets and replacement costs, but most of all by NPV calculations for onshore wind, offshore wind, solar, hydro, nuclear, gas CCGTs, gas peakers, coal, biomass and diesel gensets.

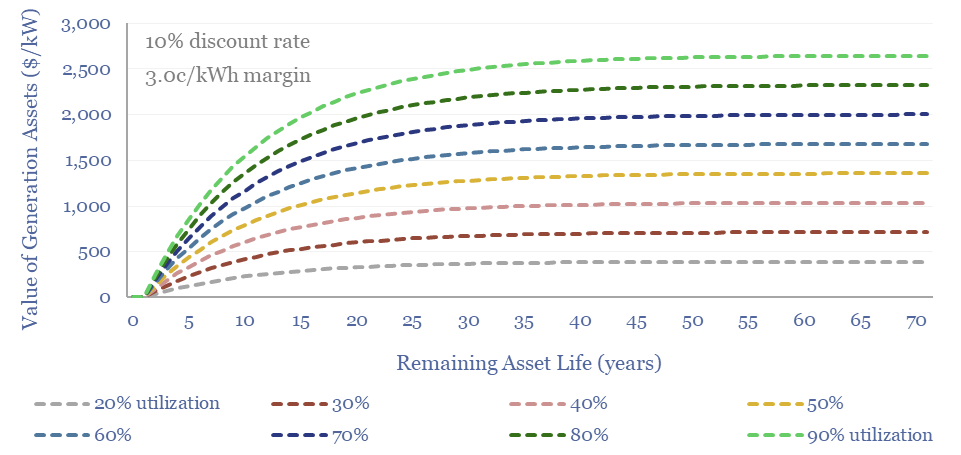

A good general ballpark for the fair value of any generation asset, in $/kW terms, is spelled out as a function of three variables on pages 4-5.

A crucial consideration is that power grid volatility is rising, which in turn affects the pricing and margins that can be achieved by different generation assets, as shown on pages 6-7.

As a result, we see rising fair values for gas peaker plants and grid-scale batteries, as quantified on pages 8-9, but looming PPA cliffs for maturing solar and wind assets, considered on pages 10-12.

Carbon credentials are another dimension which can sway the value of generation assets, especially amidst rising RECs prices, and changing regulations. Our valuation framework is on pages 13-14.

Immediacy is yet another variable that can sway the perceived value of generation assets, and could lead to unprecedently high future deal prices for low-carbon baseload assets, such as nuclear and hydro generation facilities, per pages 15-16.

The next few years will yield some fascinating deal prices for generation assets, amidst rising grid volatility and CO2 considerations.