-

Decarbonized supply chains: first invent the universe?

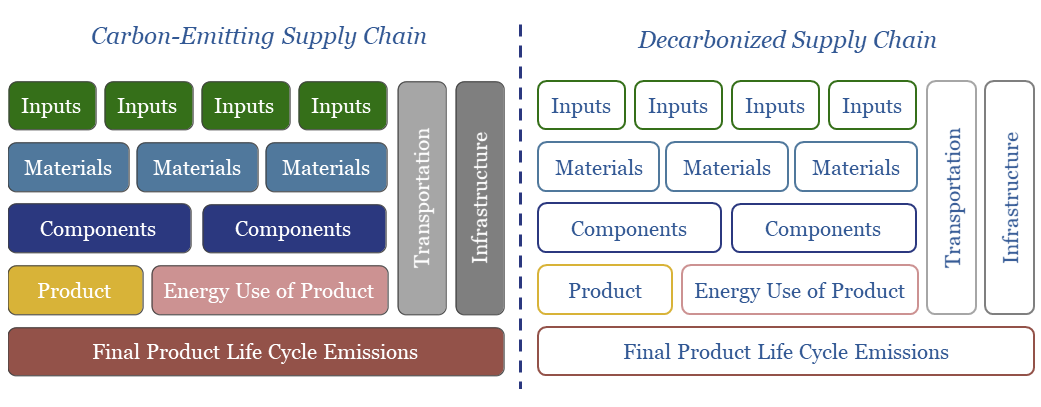

“If you wish to make an apple pie from scratch, first you must invent the universe”. This captures the challenge of decarbonizing complex global supply chains. This note argues for each company in a supply chain to drive its own Scope 1&2 CO2 emissions towards zero on a net basis. Resulting products can be described…

-

Energy transition: grand masters?

Energy transition is like a game of chess: impossible to get right, unless you are looking at the entire board. Rigid coverage models do not work. This video explores the emergence of energy strategist roles at firms that care about energy transition, and how to become a ‘grand master’ in 2022.

-

Established technologies: hiding in plain sight?

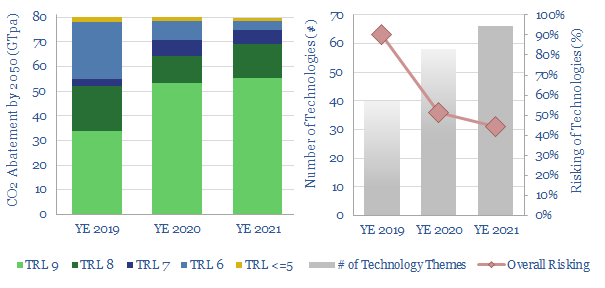

Decision-makers are possibly over-indexing their attention on game-changing new technologies, at the expense of over-looking pre-existing ones. Hence the purpose of this short note will be to re-cap our ‘top ten’ most overlooked, established technologies that can cost-effectively help the world reach net zero.

-

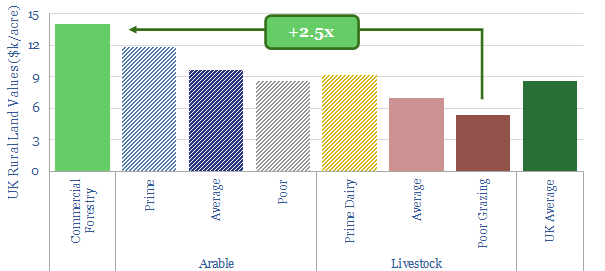

Reforestation in Estonia: six months in?

This short note is a progress update, including videos and drone footage, on our aspirations to undertake a series of reforestation projects in Estonia. It covers considerations for selecting land; and our first small investment to plant spruce in 2022.

-

Sustainable forestry: a new listed entity?

For the first time, in November-2021, a moderate-sized company has gone public with a mandate to generate CPI + 5% returns, by investing in forestry and nature-based afforestation projects. This short article summarizes the key points from the 216-page prospectus.

-

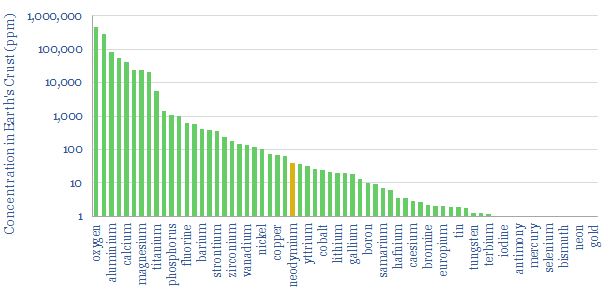

Neodymium market: our top ten facts?

Neodymium is a crucial Rare Earth metal, used in permanent magnets for the ramp-up of wind turbines and electric vehicles. The market is small, but fast-growing. This could create opportunities, as bottlenecks and cost-inflation need to be kept in check. Hence this short note outlines our ‘top ten facts’.

-

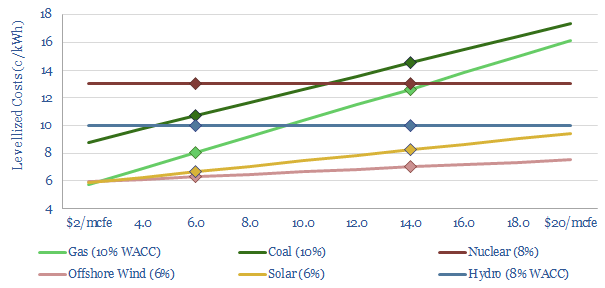

Power functions: how would gas shortages change the cost curve?

This note evaluates how sustained gas shortages could re-shape power markets (chart above). Nuclear is the greatest beneficiary, as its cost premium narrows. The balance also includes more renewables, batteries and power-electronics; and less gas, until gas prices normalized. Self-defeatingly, we would also expect less short-term decarbonization via coal-to-gas switching.

-

Energy transition: old Soviet jokes?

After six months living in Tallinn, Estonia, the history of the Baltic States has been swirling around in my mind. Especially a list of old jokes, told during Soviet times, about persistent industrial shortages, propaganda, the suppression of dissent and the ridiculousness of planned economies. This video explores whether there is any overlap with energy…

-

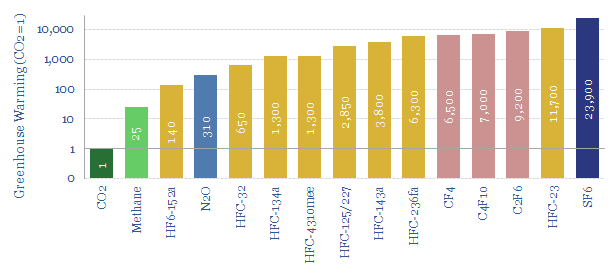

Switching gears: the most potent GHG in the world?

SF6 is an unparalleled dielectric material, used to quench electric arcs in medium- and high-voltage switchgear. There is only one problem. It is the most potent GHG in the world. Therefore, it may be helpful to find replacements for SF6, amidst the ascent of renewables and electrification. This note discusses resultant opportunities in capital goods…

-

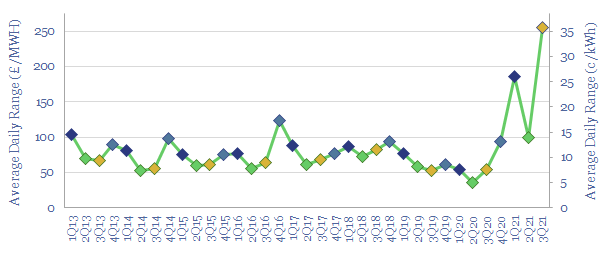

Grid volatility: are batteries finally in the money?

UK power price volatility has exploded in 2021. The average daily range has risen 4x from 2019-20, to 35c/kWh in 3Q21. At this level, grid-scale batteries are strongly ‘in the money’. So will the high volatility persist? This is the question in today’s 6-page note.

Content by Category

- Batteries (89)

- Biofuels (44)

- Carbon Intensity (49)

- CCS (63)

- CO2 Removals (9)

- Coal (38)

- Company Diligence (94)

- Data Models (838)

- Decarbonization (160)

- Demand (110)

- Digital (59)

- Downstream (44)

- Economic Model (204)

- Energy Efficiency (75)

- Hydrogen (63)

- Industry Data (279)

- LNG (48)

- Materials (82)

- Metals (80)

- Midstream (43)

- Natural Gas (148)

- Nature (76)

- Nuclear (23)

- Oil (164)

- Patents (38)

- Plastics (44)

- Power Grids (130)

- Renewables (149)

- Screen (117)

- Semiconductors (32)

- Shale (51)

- Solar (68)

- Supply-Demand (45)

- Vehicles (90)

- Wind (44)

- Written Research (354)