-

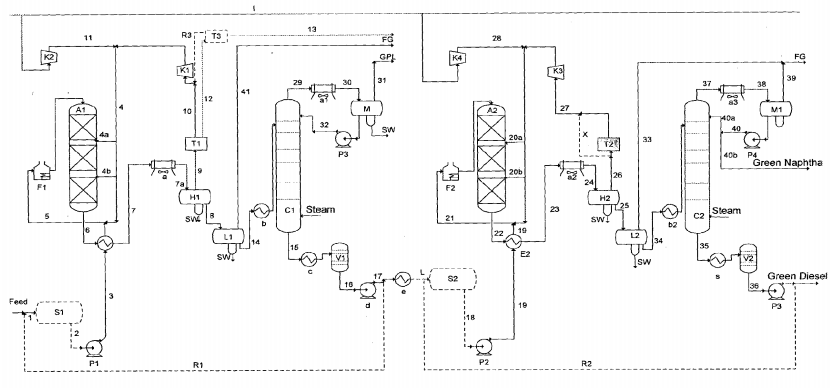

Do refineries become bio-refineries?

Will the future of refineries be to convert to bio-refineries, in order to meet a growing need for decarbonised fuels? This note reviews the opportunities and challenges, based on patent filings from Eni: the industry leader in bio-refinery technology. Costs are 80% below newbuilds, but we question ultimate scale and the ability to lower palm…

-

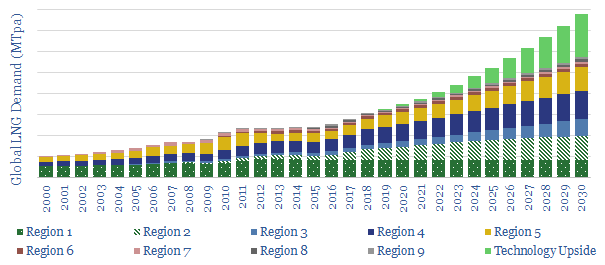

The Ascent of LNG?

This note outlines 200MTpa of potential upside to consensus LNG demand, due to emerging technologies, in power and transportation. LNG use could thus compound at an 8% CAGR to 800MTpa by 2030, justifying greater investment in unsanctioned LNG projects.

-

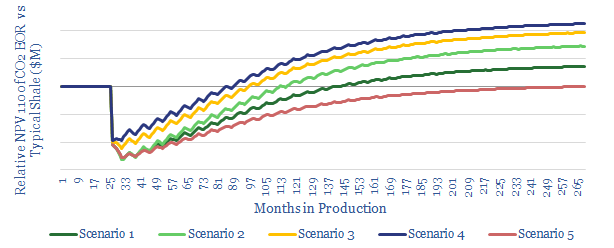

CO2-EOR in shale: the holy grail?

What if there were a technology to sequester CO2, double shale productivity, earn 15-30% IRRs and it was on the cusp of commercialization? Promising momentum is building, at the nexus of decarbonised gas-power and Permian CO2-EOR. This short note highlights the economic opportunity.

-

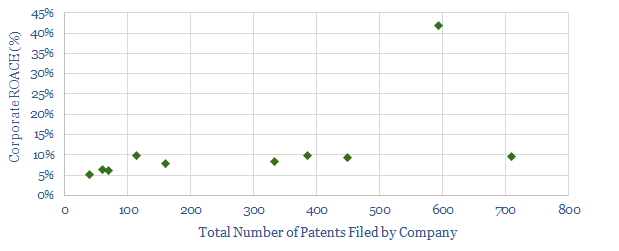

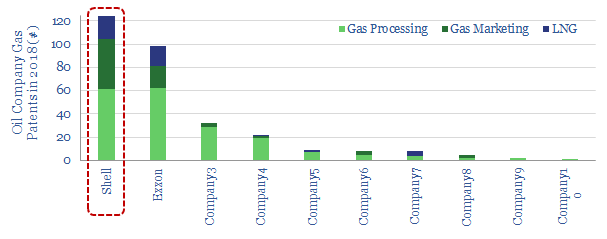

Does Technology Drive Returns?

30-60% of Oil Majors’ ROACE is explained by their technologies. This is our finding from correlating 3,000 oil patents versus returns on capital. Technology leaders can generate 2x higher corporate ROACEs. Downstream segments are most sensitive.

-

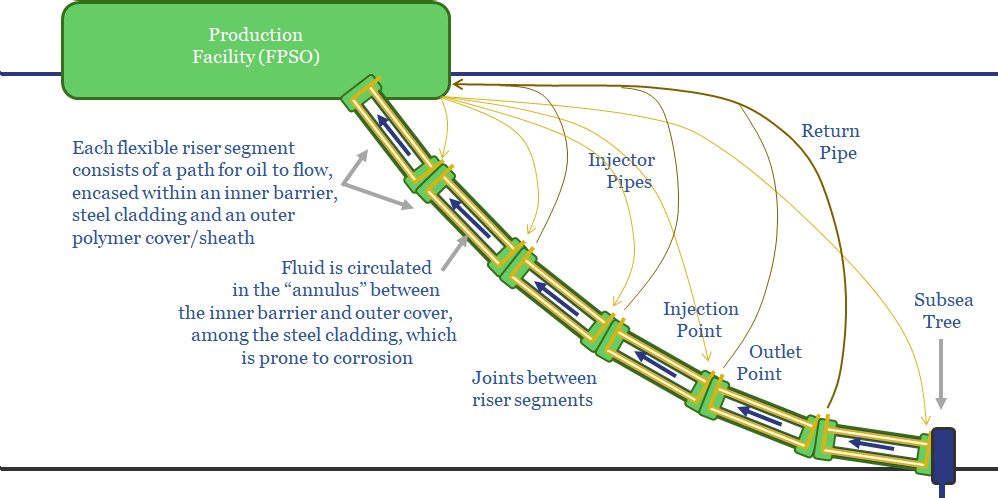

New Risers for pre-salt Brazil?

Petrobras has patented next-generation riser designs, to handle sour-service crude from pre-salt Brazil. This is needed after riser-failures at Lula. But complexity is an order of magnitude higher for Petrobras’s new solution. A simpler alternative is the growing potential from thermo-plastic composite pipe.

-

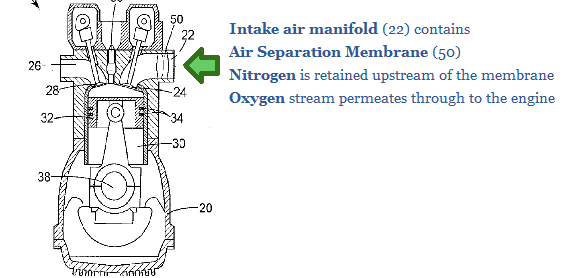

De-Carbonising Cars. Can Oxy-Combustion Save Gasoline?

Could next-generation combustion technologies be used to decarbonise oil-fired transportation, raising the trajectory of long-term oil demand? We review a leading oil company’s patents to commercialise oxy-combustion in vehicles, along with the challenges. The outlook remains more positive for gas than for oil.

-

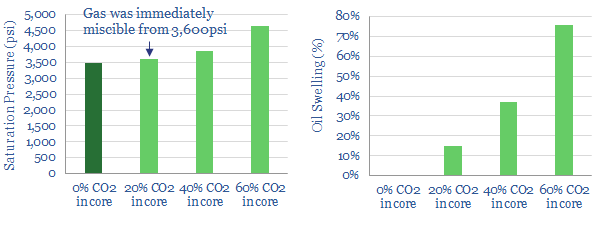

Permian CO2-EOR: pushing the boundary?

We see enormous opportunity in CO2-EOR in the Permian basin. Occidental Petroleum has now published laboratory analysis, informing its models and de-risking the technique. This short note profiles our “top five” conclusions from the paper.

-

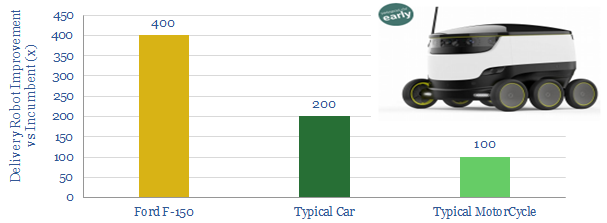

Robot delivery: Unbelievable fuel economy…

Small delivery robots can achieve 100-400x higher fuel economies than conventional, oil-powered vehicles. We profile Starship, whose fleet is now covering c400km/day. Energy demand in transportation is evolving.

-

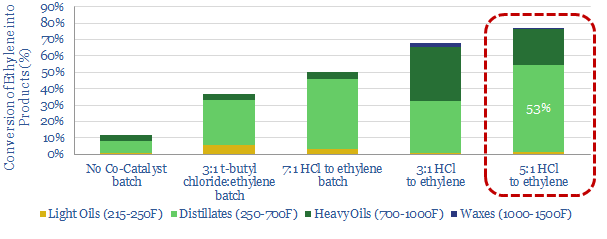

Shale: restoring downstream balance? New opportunities in ethylene and diesel.

Shale’s light mix is often criticised for distorting oil product markets. But distortions create opportunities for Integrateds. This note explores one opportunity, patented by Chevron, to convert ethylene into diesel.

-

Shell drives LNG in transport?

Shell is the most active Major in driving new LNG demand. In 2019, it patented a new sub-cooler to improve the ascent of LNG in transportation. Our note explains the challenges of boil-off and gas-weathering, how they are addressed by Shell’s new technology, and eight resulting advantages.

Content by Category

- Batteries (87)

- Biofuels (44)

- Carbon Intensity (49)

- CCS (63)

- CO2 Removals (9)

- Coal (38)

- Company Diligence (92)

- Data Models (829)

- Decarbonization (159)

- Demand (110)

- Digital (58)

- Downstream (44)

- Economic Model (203)

- Energy Efficiency (75)

- Hydrogen (63)

- Industry Data (277)

- LNG (48)

- Materials (82)

- Metals (77)

- Midstream (43)

- Natural Gas (146)

- Nature (76)

- Nuclear (23)

- Oil (164)

- Patents (38)

- Plastics (44)

- Power Grids (126)

- Renewables (149)

- Screen (114)

- Semiconductors (30)

- Shale (51)

- Solar (67)

- Supply-Demand (45)

- Vehicles (90)

- Wind (43)

- Written Research (350)