-

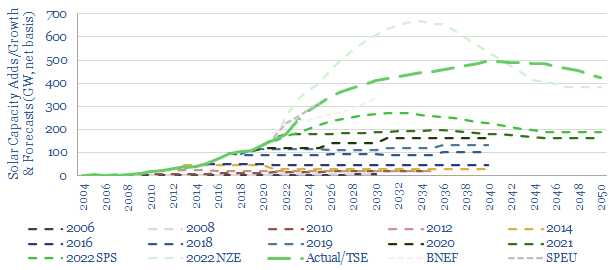

Solar capacity: growth through 2030 and 2050?

Forecasts for future solar capacity growth have an unsatisfyingly uncertain range, varying by 3x. Hence this 15-page note discusses the future of solar. Solar capacity additions likely accelerate 3.5x by 2030 and 5x by 2040. But this creates bottlenecks, including for seven materials; and requires >$1trn pa of additional power grid capex plus $1trn pa…

-

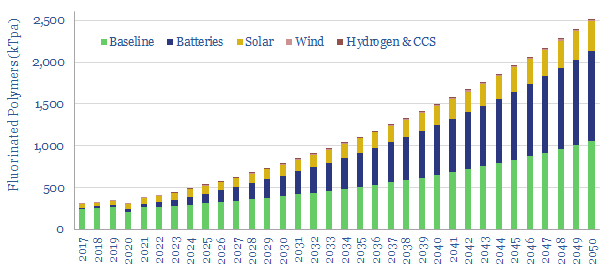

Fluorinated polymers: flying under the radar?

Fluorinated polymers are a stealth bottleneck for the energy transition: used in solar back-sheets, battery binders/separators, wind blades, and across the hydrogen chain. They are easily overlooked. This 400kTpa market grows 6x by 2050. Markets are already tight. And the ‘CO2 curve’ is very steep. Our 15-page report explores the market, the upside and who…

-

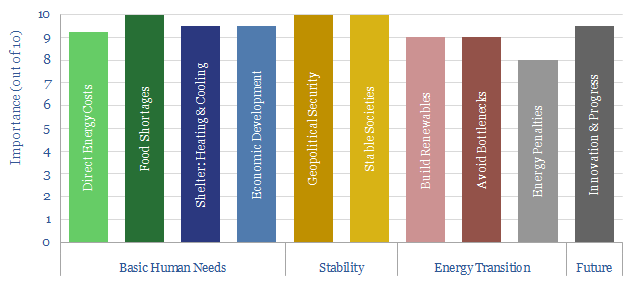

Energy shortage: fear in a handful of dust?

Should restoring the world’s energy surplus be seen as the most important ESG goal of the 2020s? This 12-page note outlines our top ten considerations, as our energy balances have deteriorated even further in the last year. Under-supply could persist through 2030. Shortages have cruel consequences. And unexpected ripple effects. Energy surplus also helps energy…

-

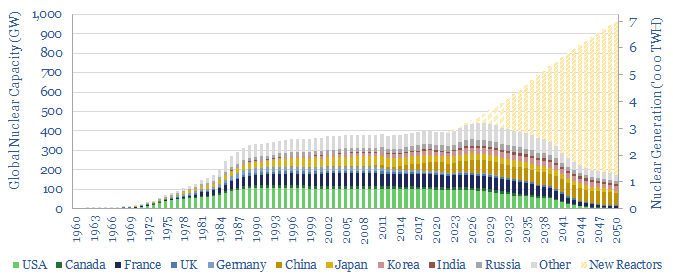

Reaching criticality: nuclear re-accelerates?

400 GW of nuclear reactors produce 2,800TWH of zero carbon electricity globally each year. But the numbers have been stagnant for two decades. This is now changing. This 14-page note explains why. We expect a >3% CAGR through 2030, and hope for a 2.5x ramp through 2050. A ‘nuclear renaissance’ helps the energy transition.

-

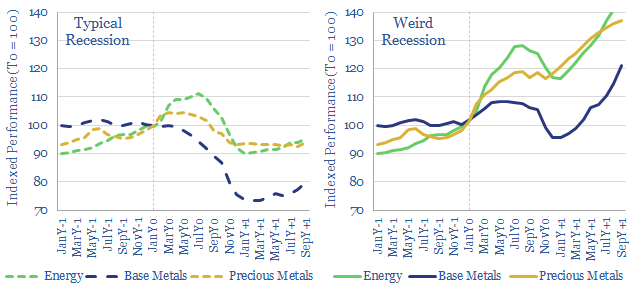

Weird recessions: can commodities de-couple from GDP?

In a ‘weird recession’, GDP growth turns negative, yet commodity prices continue surprising to the upside. This 10-page note explores three reasons that 2022-24 may bring a ‘weird recession’. There is historical precedent, prices must remain high to attract new investment, and buyers may stockpile bottlenecked materials. How will this affect different industries?

-

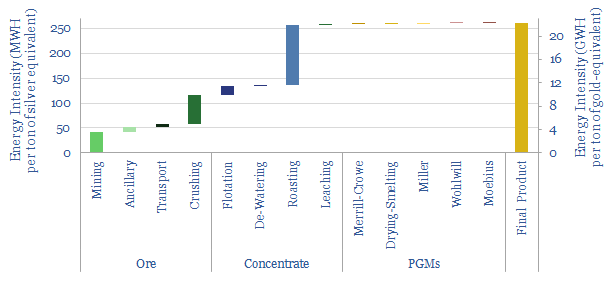

Silver and gold: medal winners?

Gold and silver are stores of value, especially in a world of persistently high inflation and low rates. Silver is also likely to be the main bottleneck for solar in the 2020s. Hence our 18-page note models the end-to-end mining and refining of these metals. We find very steep energy/CO2 curves, and fear supply shortages.…

-

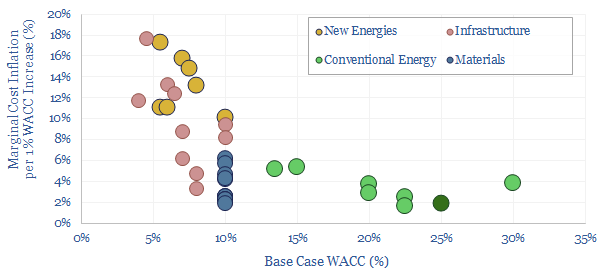

Runaway train: energy, interest rates and inflation?

In the under-supplied world of 2022-30, raising interest rates might not mute inflation, but could actually deepen it. By deterring the investments needed to cure inflation itself. Each 1% increase in capital costs re-inflates new energies 10-20%, infrastructure 2-20%, materials 2-6%, and conventional energy 2-5%. What implications?

-

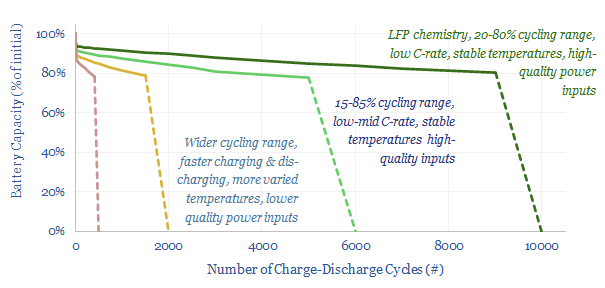

Battery degradation: causes, effects & implications?

This 14-page note offers five rules of thumb to maximize the longevity of lithium-ion batteries, in grid-scale storage and electric vehicles. The data suggest hidden upside in the demand for batteries, for lithium and high-quality power electronics, especially if batteries are to backstop renewables.

-

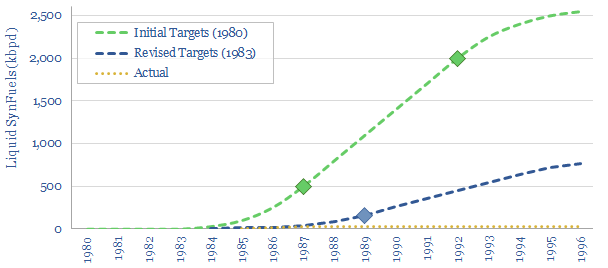

Energy policy: unleashing new technologies?

Does policy de-risk new technology? This 10-page note is a case study. The Synthetic Fuels Corporation was created by the US Government in 1980. It was promised $88bn. But it missed its target to unleash 2Mbpd of next-generation fuels by 1992. There were four challenges. Are they worth remembering in new energies today?

-

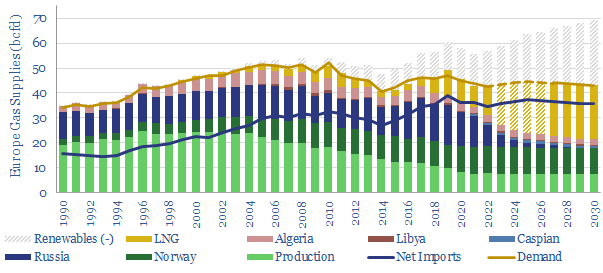

Global gas: five predictions through 2030?

Modelling Europe’s gas balances currently feels like grasping at straws. Yet this 10-page note makes five predictions through 2030. We have revised our views on how fast new energies ramp, which gas gets displaced first, which energy sources are no longer ‘in the firing line’, and gas pricing.

Content by Category

- Batteries (89)

- Biofuels (44)

- Carbon Intensity (49)

- CCS (63)

- CO2 Removals (9)

- Coal (38)

- Company Diligence (94)

- Data Models (838)

- Decarbonization (160)

- Demand (110)

- Digital (59)

- Downstream (44)

- Economic Model (204)

- Energy Efficiency (75)

- Hydrogen (63)

- Industry Data (279)

- LNG (48)

- Materials (82)

- Metals (80)

- Midstream (43)

- Natural Gas (148)

- Nature (76)

- Nuclear (23)

- Oil (164)

- Patents (38)

- Plastics (44)

- Power Grids (130)

- Renewables (149)

- Screen (117)

- Semiconductors (32)

- Shale (51)

- Solar (68)

- Supply-Demand (45)

- Vehicles (90)

- Wind (44)

- Written Research (354)