-

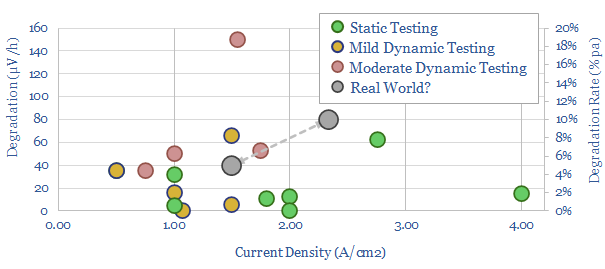

Green hydrogen: can electrolysers run off renewables?

What degradation rate is expected for a green hydrogen electrolyser, if it is powered by volatile wind and solar? This 15-page note reviews past projects and technical papers. 5-10% pa degradation rates would raise green hydrogen costs by $1/kg. Avoiding degradation justifies higher capex, especially on power-electronics and even batteries?

-

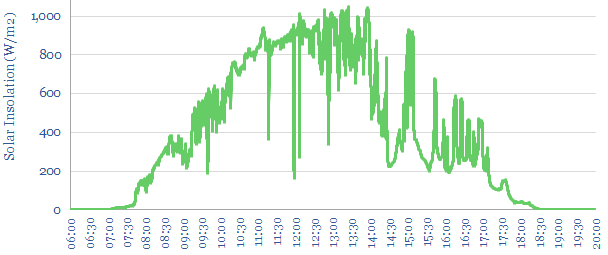

Solar volatility: tell me lies, tell me sweet little lies?

This 20-page note quantifies the statistical distribution of short-term volatility at solar power plants. Solar output typically flickers downwards by over 10%, around 100 times per day. Can industrial processes truly be ‘powered by solar’? What are the best opportunities to buffer the volatility and what are their costs?

-

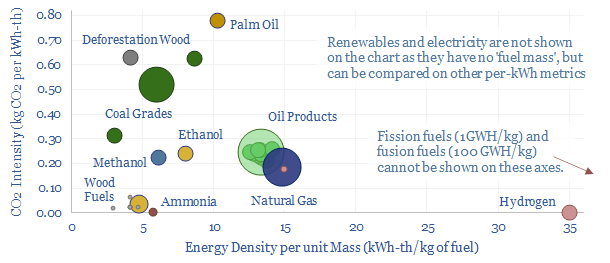

Energy units: life, the universe and everything?

Energy is the glue of our universe. Literally everything is at some level an energy flow – from viewing this text to matter itself – which can be expressed in Joules and kWh. Hence this 16-page overview is a useful reference, to translate from any energy units to any others; for comparisons; and to understand…

-

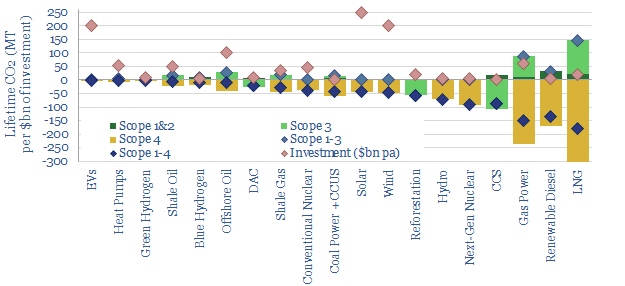

Scope 4 emissions: avoided CO2 has value?

Scope 4 CO2 emissions reflect the CO2 avoided by an activity. This 11-page note argues the metric warrants more attention. It yields an ‘all of the above’ approach to energy transition, shows where each investment dollar achieves most decarbonization and maximizes the impact of renewables.

-

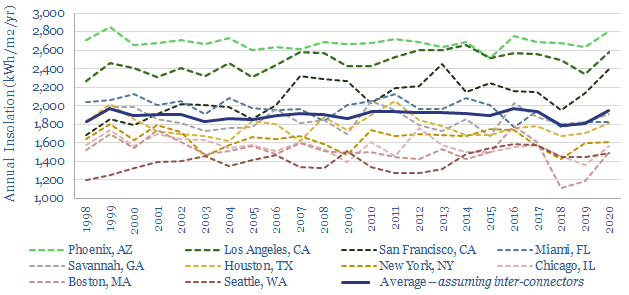

Solar volatility: interconnectors versus batteries?

The solar energy reaching a given point on Earth’s surface varies by +/- 6% each year. Fluctuations are 96% correlated over tens of miles. And no battery can economically smooth them. Our 17-page note outlines this challenge, and finds the best solutions are to construct high-voltage interconnectors and keep power grids diversified.

-

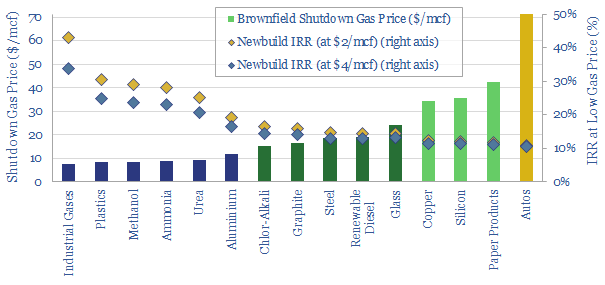

Gas diffusion: how will record prices resolve?

Dispersion in global gas prices has hit new highs in 2022. Hence this 17-page note evaluates two possible solutions. Building more LNG plants achieves 15-20% IRRs. But shuttering some of Europe’s gas-consuming industry then re-locating it in gas-rich countries can achieve 20-40% IRRs, lower net CO2 and lower risk? Both solutions should step up. What…

-

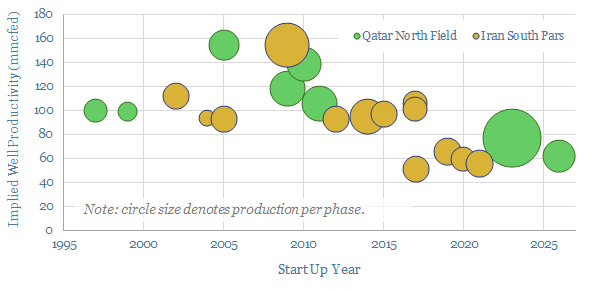

North Field: sharing the weight of the world?

The North Field is now the most important conventional energy asset on the planet. It produces 4% of world energy, 20% of global LNG and aims to ramp another 50MTpa of low-carbon LNG by 2028. But what if Qatar’s exceptional reliability gets disrupted by unforeseen conflict with Iran?

-

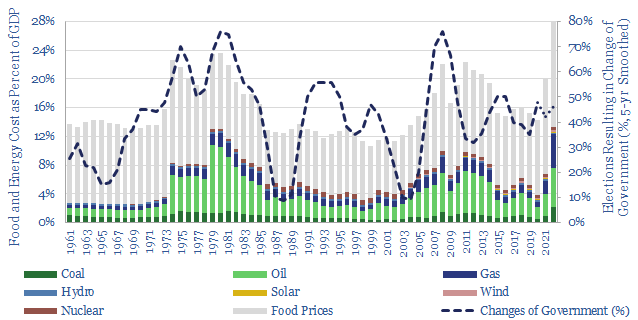

Political shifts: do energy shortages cause revolutions?

We tabulated data from 138 elections over 60 years in 7 countries. When food and energy prices spike, there is a 75% chance of government change. Revolutions can be triggered by food-energy shortages too. Hence this 14-page note evaluates whether major policy changes are coming?

-

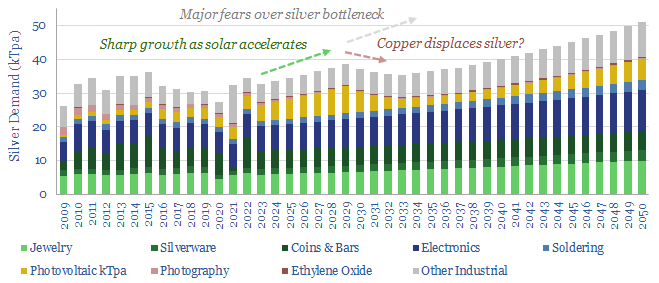

Solar contacts: silver bullet?

The front contacts in today’s solar cells are made of screen-printed silver, absorbing 11% of 2021’s silver market. Silver can be substituted with copper, but manufacturing is c5x more costly. So we expect a silver spike, then a switch. This 16-page note explains our outlook, and who benefits?

-

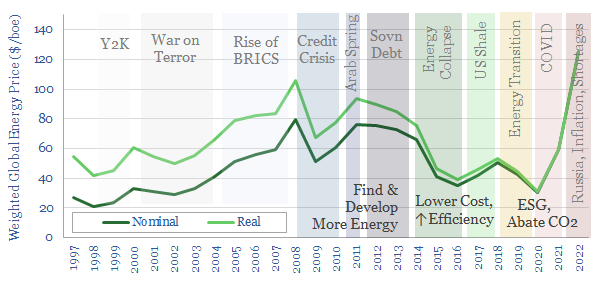

Energy transition: wheel of time?

This 15-page note reflects on the last 15-years of energy, the world and our own experiences. Mega-trends do not move in straight lines. The world has often changed direction, getting waylaid by unexpected crises. We wonder if energy transition goals, policies and solutions may be shifting?

Content by Category

- Batteries (89)

- Biofuels (44)

- Carbon Intensity (49)

- CCS (63)

- CO2 Removals (9)

- Coal (38)

- Company Diligence (94)

- Data Models (838)

- Decarbonization (160)

- Demand (110)

- Digital (59)

- Downstream (44)

- Economic Model (204)

- Energy Efficiency (75)

- Hydrogen (63)

- Industry Data (279)

- LNG (48)

- Materials (82)

- Metals (80)

- Midstream (43)

- Natural Gas (148)

- Nature (76)

- Nuclear (23)

- Oil (164)

- Patents (38)

- Plastics (44)

- Power Grids (130)

- Renewables (149)

- Screen (117)

- Semiconductors (32)

- Shale (51)

- Solar (68)

- Supply-Demand (45)

- Vehicles (90)

- Wind (44)

- Written Research (354)