-

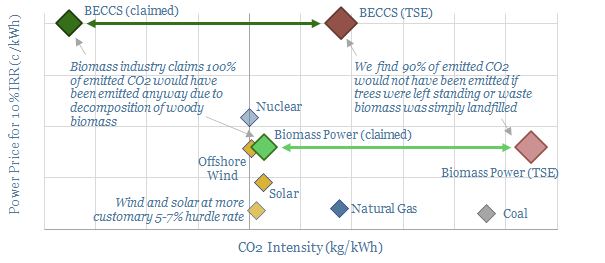

Biomass and BECCS: what future in the transition?

20% of Europe’s renewable electricity currently comes from biomass, mainly wood pellets, burned in facilities such as Drax’s, 2.6GW Yorkshire plant. But what are the economics and prospects for biomass power as the energy transition evolves? This 18-page analysis leaves us cautious.

-

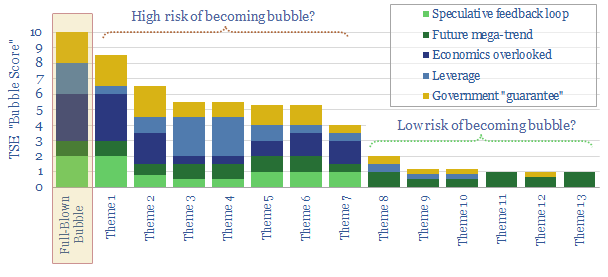

Energy transition: is it becoming a bubble?

Investment bubbles in history typically take 4-years to build and 2-years to burst, as asset prices rise c815% then collapse by 75%. There is now a frightening resemblance between energy transition technologies and prior investment bubbles. This 19-page note aims to pinpoint the risks and help you defray them.

-

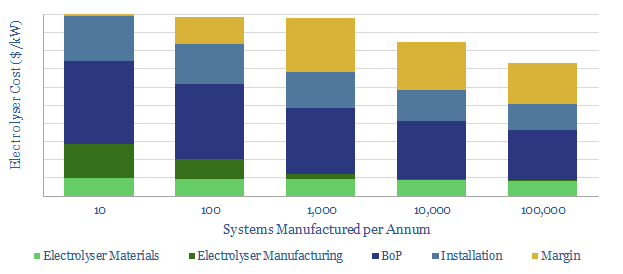

Electrolysers: how much deflation ahead for hydrogen?

For green hydrogen to become competitive, total electrolyser costs must deflate by over 75% from current levels around $1,000/kW. This 14-page note breaks down the numbers and the challenges, based on patents and technical papers. We argue 15-25% total cost deflation may be more realistic if manufacturers also strive to make a margin.

-

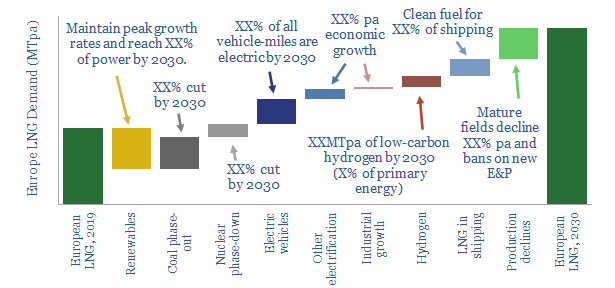

Decarbonization in Europe: but is there enough gas?

A lack of gas is likely to slow down Europe’s energy transition in the 2020s. This is the conclusion in our new 12-page note, which captures basic EU policy objectives. An incremental 85MTpa of LNG must be sourced by 2030, absorbing one third of new global LNG supplies and stoking shortages.

-

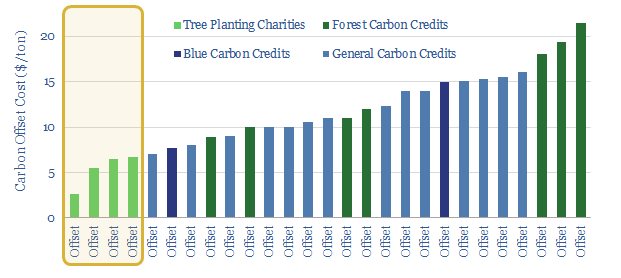

Planting a seed: will new forests disrupt new energies?

Tree planting charities are emerging as the best means to offset CO2. They will displace other ‘new energies’ from the cost curve. Abatement costs are $3-10/ton. The solution is available today. It also restores nature. This 18-page note presents the advantages, pushbacks, implications, and profiles charities we have supported.

-

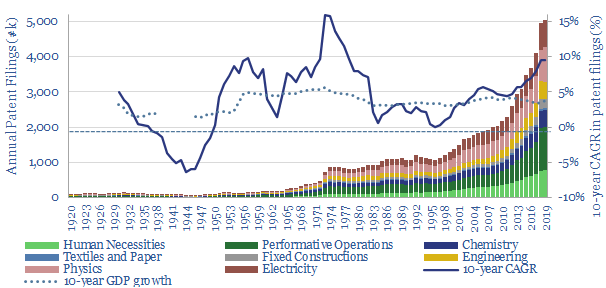

Patent review: six ways to gain an edge?

Our research identifies economic opportunities in the energy transition. To do this, we have now drawn upon 20M patents. This 14-page note illustrates the six ways patent analysis can give decision-makers an edge. Detailed examples are given in renewables, electric vehicles, capital goods, conventional energy and hydrogen.

-

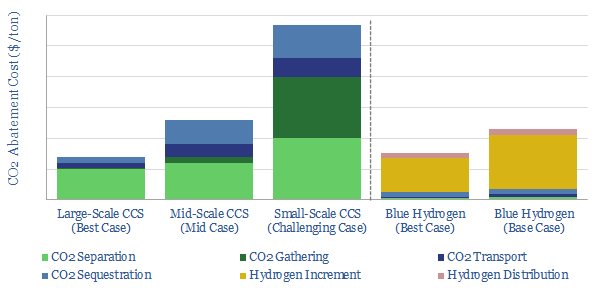

Deep blue: cracking the code of carbon capture?

Carbon capture is cursed by colossal costs at small scale. But blue hydrogen may be its saviour. Crucial economies of scale are guaranteed by deploying both technologies together. The combination is a dream scenario for gas producers. This 22-page note outlines the opportunity and costs.

-

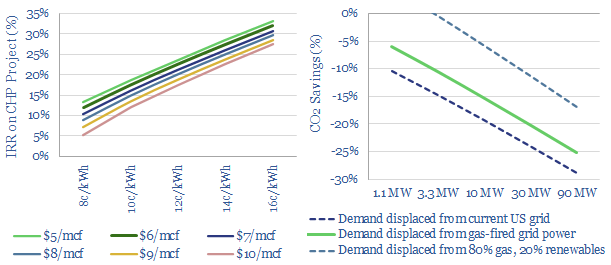

A new case for gas: what if renewables get overbuilt?

Overbuilding renewables makes power grids more expensive and less reliable. Hence more businesses may generate their own power behind the meter, installing combined heat and power systems fuelled by natural gas. IRRs reach 20-30%. Efficiency is 70-80%. Total CO2 falls by 6-30%. This 17-page note outlines the opportunity.

-

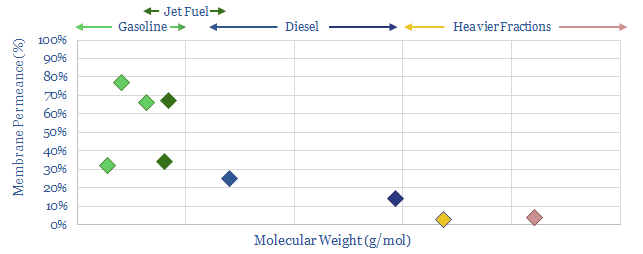

Low-carbon refining: insane in the membrane?

1% of global CO2 comes from distilling crude oil at refineries. An alternative uses precisely engineered polymer membranes to separate crude fractions, eliminating 50-80% of the costs and 97% of the CO2. We reviewed 1,000 patents, including a major breakthrough in 2020. This 14-page note presents the opportunity.

-

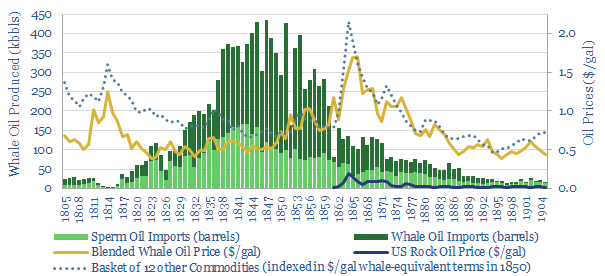

Great white whales: what happened to whale oil prices?

Whale oil was a dominant, albeit barbaric, lighting fuel in the 19th century. But what happened to pricing as the industry was disrupted by kerosene and ultimately by electric lighting? We find whale oil pricing outperformed and whaling by-products rallied very sharply as the industry declined. Implications are drawn for oil and gas.

Content by Category

- Batteries (89)

- Biofuels (44)

- Carbon Intensity (49)

- CCS (63)

- CO2 Removals (9)

- Coal (38)

- Company Diligence (94)

- Data Models (838)

- Decarbonization (160)

- Demand (110)

- Digital (59)

- Downstream (44)

- Economic Model (204)

- Energy Efficiency (75)

- Hydrogen (63)

- Industry Data (279)

- LNG (48)

- Materials (82)

- Metals (80)

- Midstream (43)

- Natural Gas (148)

- Nature (76)

- Nuclear (23)

- Oil (164)

- Patents (38)

- Plastics (44)

- Power Grids (130)

- Renewables (149)

- Screen (117)

- Semiconductors (32)

- Shale (51)

- Solar (68)

- Supply-Demand (45)

- Vehicles (90)

- Wind (44)

- Written Research (354)