-

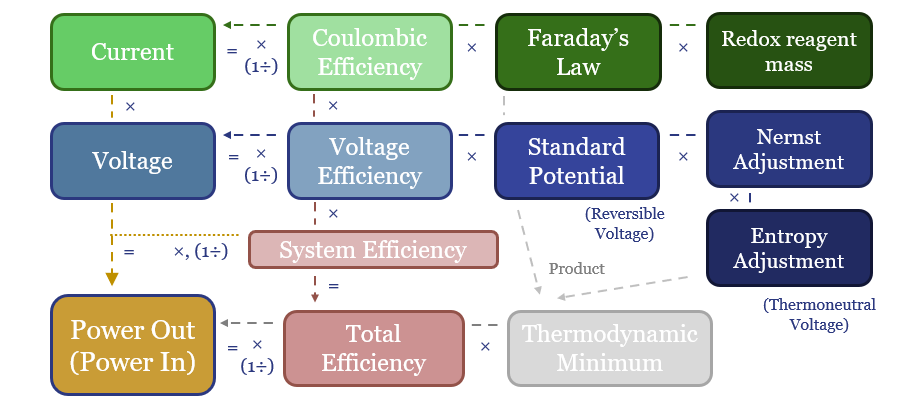

Electrochemistry: redox potential?

Batteries, electrolysers and cleaner metals/materials value chains all hinge on electrochemistry. Hence this 19-page note explains the energy economics from first principles. The physics are constructive for lithium and next-gen electrowinning, but perhaps challenge green hydrogen aspirations?

-

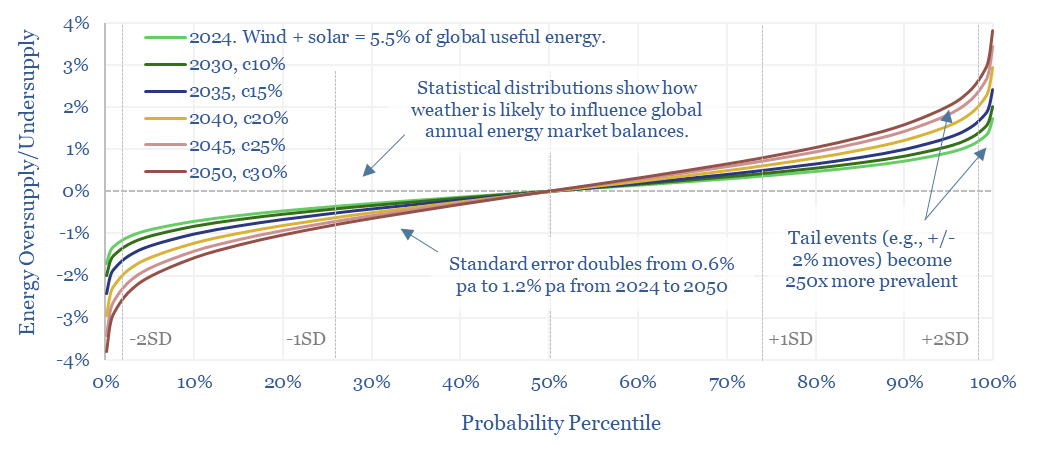

Energy market volatility: climate change?

This 14-page note predicts a staggering increase in global energy market volatility, which doubles by 2050, while extreme events that sway energy balances by +/- 2% will become 250x more frequent. A key reason is that the annual output from wind, solar and hydro all vary by +/- 3-5% each year, while wind and solar…

-

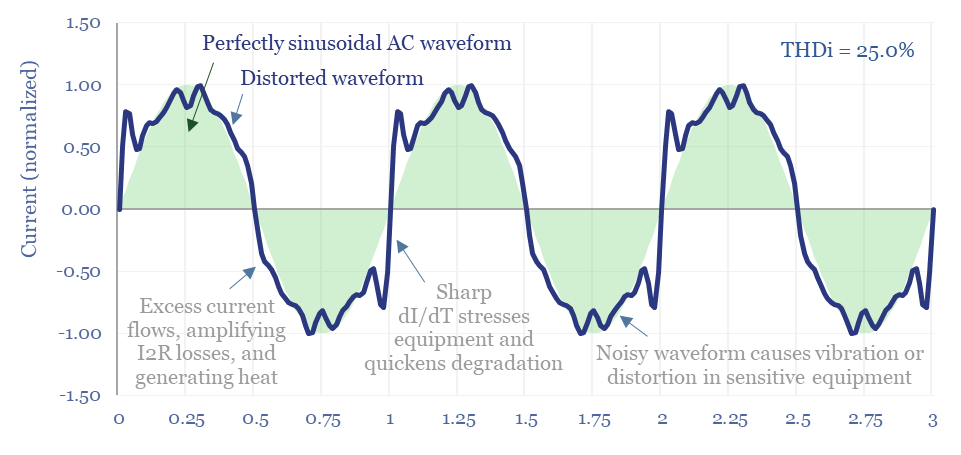

New energies: filter feeder?

The $1bn pa harmonic filter market likely expands by 10x in the energy transition, as almost all new energies and digital technologies inject harmonic distortion to the grid. This 17-page note argues for premiumization in power electronics, including around solar, and screens for who benefits?

-

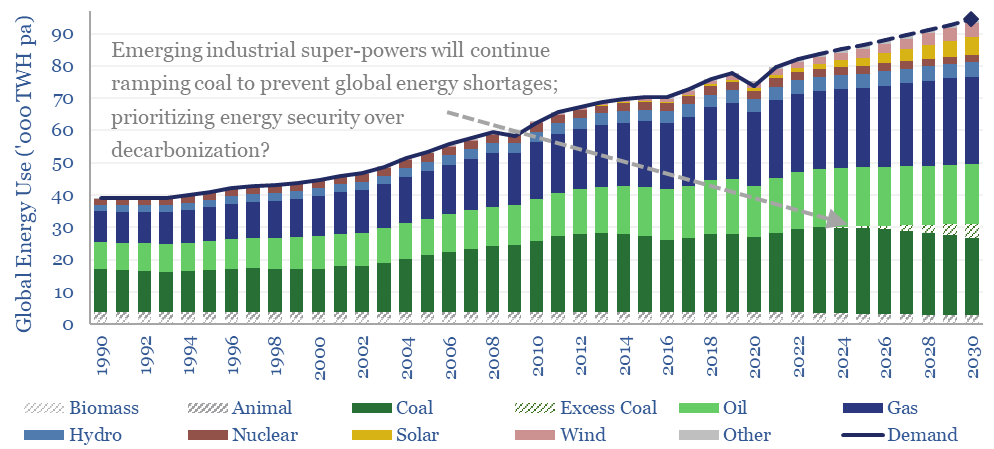

Energy transition: ten themes for 2024?

Navigating the energy transition in 2024 requires focusing in upon bright spots, because global energy priorities are shifting. Emerging nations are ramping coal to avoid energy shortages. Geopolitical tensions are escalating. So where are the bright spots? This 14-page note makes 10 predictions for 2024.

-

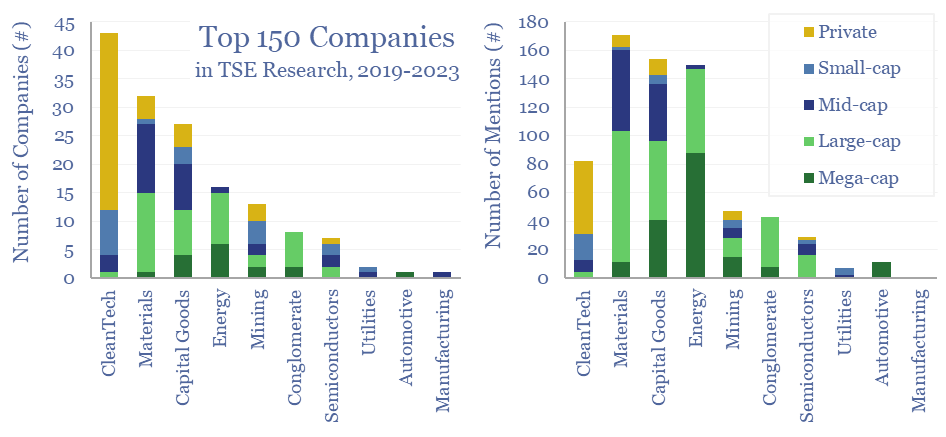

Energy transition companies: a new approach?

150 core companies have been mentioned 700 times across all of our research since 2019; within a broader list of 1,300 total companies exposed to energy transition, diversified by geography, by size and by segment. This 12-page note draws conclusions about the most mentioned companies in our energy transition research.

-

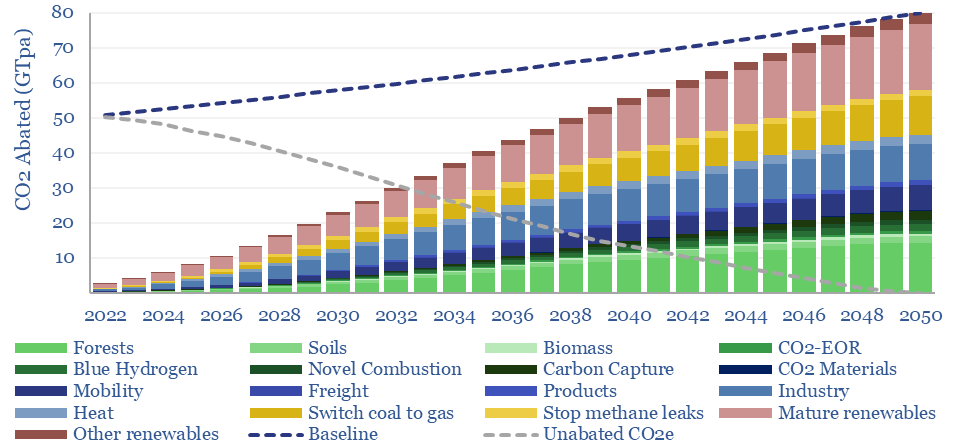

Decarbonizing global energy: the route to net zero?

What is the most likely route to net zero by 2050, decarbonizing a planet of 9.5bn people, 50% higher energy demand, and abating 80GTpa of potential CO2? Net zero is achievable. But only with pragmatism. This 20-page report summarizes the best opportunities, resultant energy mix, bottlenecks for 30 commodities, and changes to our views in…

-

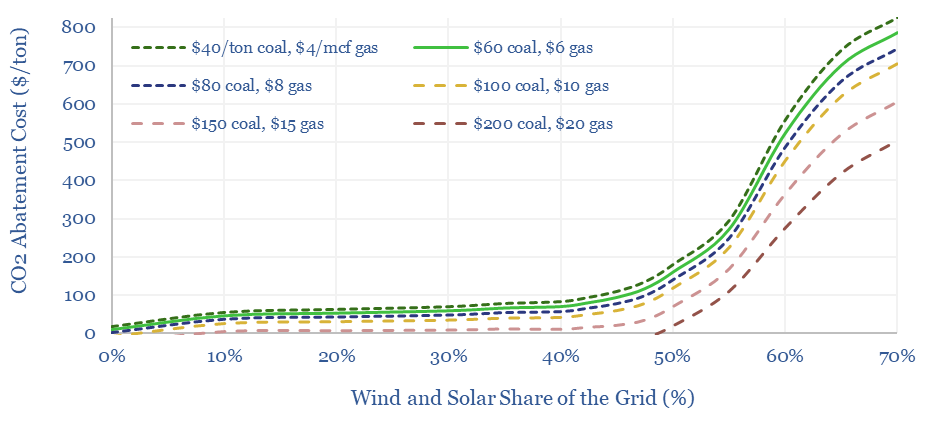

Solar and wind: what decarbonization costs?

The costs of decarbonizing by ramping up solar and wind depend on the context. But our best estimate is that solar and wind can reach 40% of the global grid for a $60/ton average CO2 abatement cost. This is relatively low. Yet it raises retail electricity prices from 10c/kWh to 12c/kWh. This 7-page note explores…

-

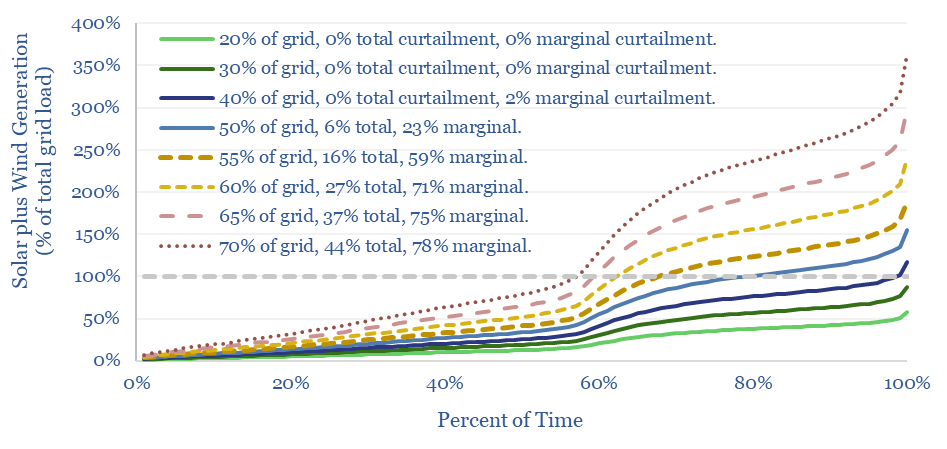

Power grids: when will wind and solar peak?

Wind and solar peak at 50-55% of power grids, without demand-shifting and batteries, before their economics become overwhelmed by curtailment rates and backup costs. More in wind-heavy grids. Less in solar heavy grids. This 12-page note draws conclusions from the statistical distribution of renewables’ generation across 100,000 x 5-minute grid intervals.

-

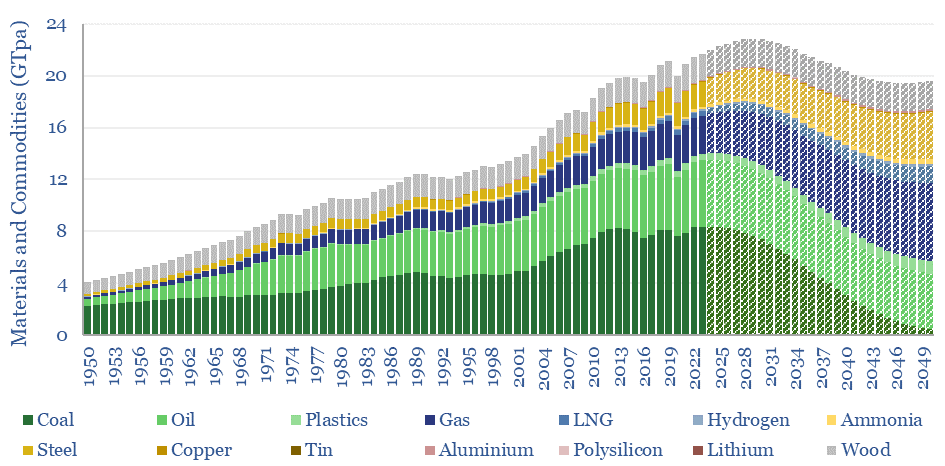

Peak commodities: everything, everywhere, all at once?

This 15-page note evaluates 10 commodity disruptions since the Stone Age. Peak demand for commodities is just possible, in total tonnage terms, as part of the energy transition. But it is historically unprecedented. And our plateau in tonnage terms is a doubling in value terms, a kingmaker for gas, plastics and materials. Outlooks for 30…

-

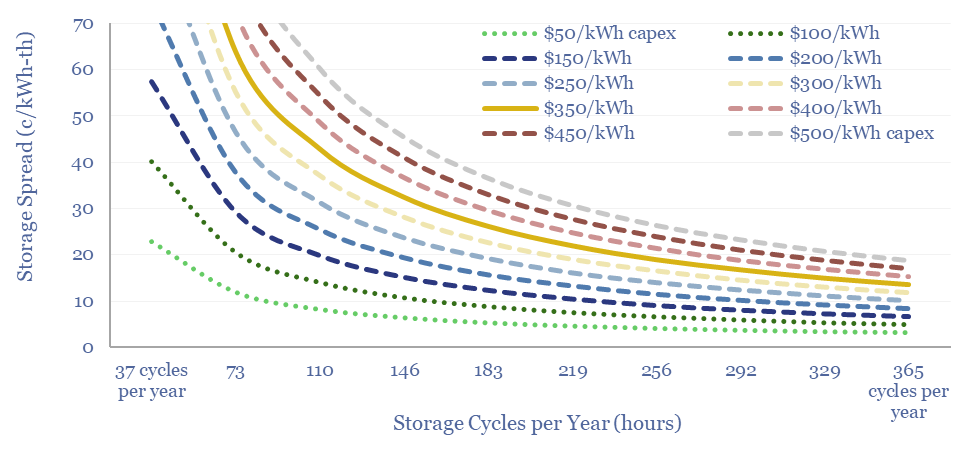

Thermal energy storage: heat of the moment?

Thermal energy storage will outcompete other batteries and hydrogen for avoiding renewable curtailments and integrating more solar? Overlooked advantages are discussed in this 21-page report, plus a fast-evolving company landscape. What implications for solar, gas and industrial incumbents?

Content by Category

- Batteries (89)

- Biofuels (44)

- Carbon Intensity (49)

- CCS (63)

- CO2 Removals (9)

- Coal (38)

- Company Diligence (95)

- Data Models (840)

- Decarbonization (160)

- Demand (110)

- Digital (60)

- Downstream (44)

- Economic Model (205)

- Energy Efficiency (75)

- Hydrogen (63)

- Industry Data (279)

- LNG (48)

- Materials (82)

- Metals (80)

- Midstream (43)

- Natural Gas (149)

- Nature (76)

- Nuclear (23)

- Oil (164)

- Patents (38)

- Plastics (44)

- Power Grids (131)

- Renewables (149)

- Screen (117)

- Semiconductors (32)

- Shale (51)

- Solar (68)

- Supply-Demand (45)

- Vehicles (90)

- Wind (44)

- Written Research (356)