-

Renewable-heavy grids: dividing the pie?

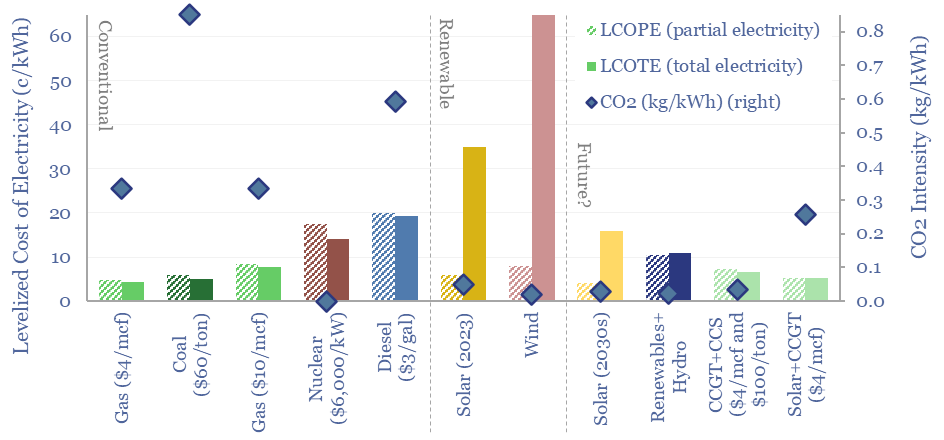

The levelized cost of partial electricity (LCOPE) is very different from the levelized cost of total electricity (LCOTE). This 21-page note explores the distinction. It suggests renewables will peak at 30-60% of power grids? And gas is particularly well-placed as a back-up, set to surprise, by entrenching at 30-50% of renewables-heavy grids?

-

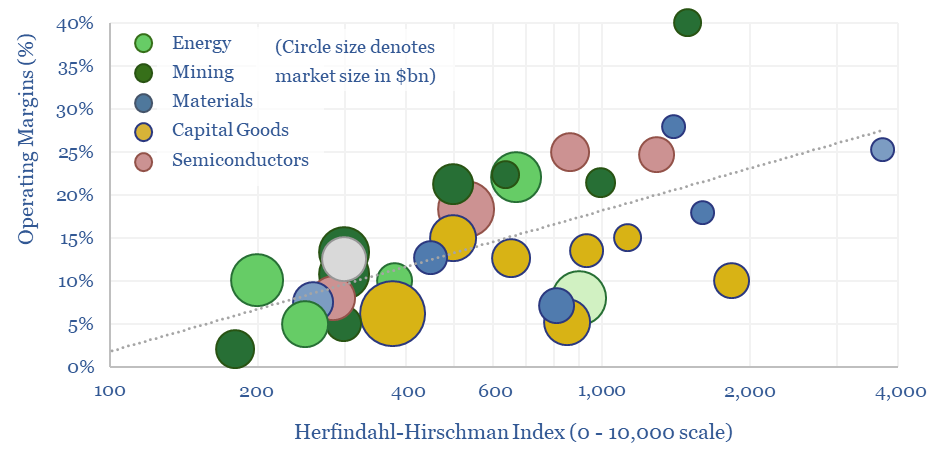

Market concentration: what impacts on margins?

We have assessed over 100 markets in energy, materials, manufacturing and decarbonization across our research. More concentrated industries achieve higher margins across the cycle. But not always. This 10-page report draws out seven rules of thumb around market concentration to help decision-makers.

-

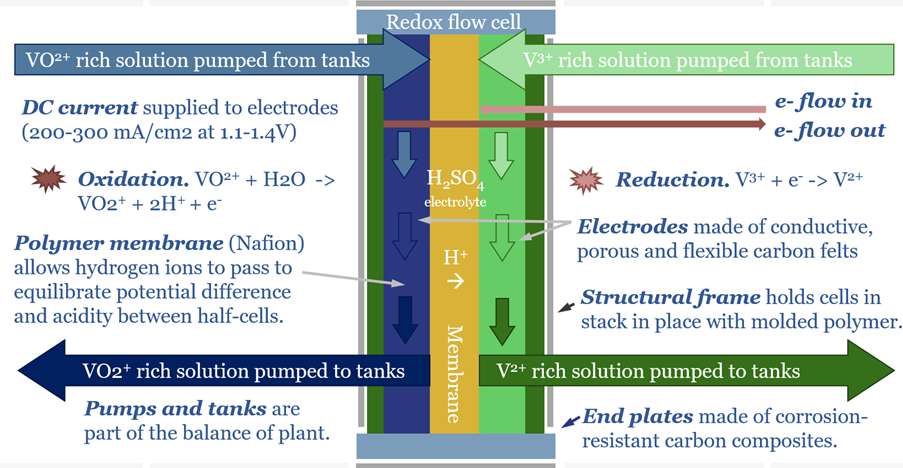

Redox flow batteries: for the duration?

Redox flow batteries have 6-24 hour durations and require 15-20c/kWh storage spreads. They will increasingly compete with lithium ion batteries in grid-scale storage. Does this unlock a step-change for peak renewables penetration? Or create 3-30x upside for total global Vanadium demand? This 15-page note is our outlook.

-

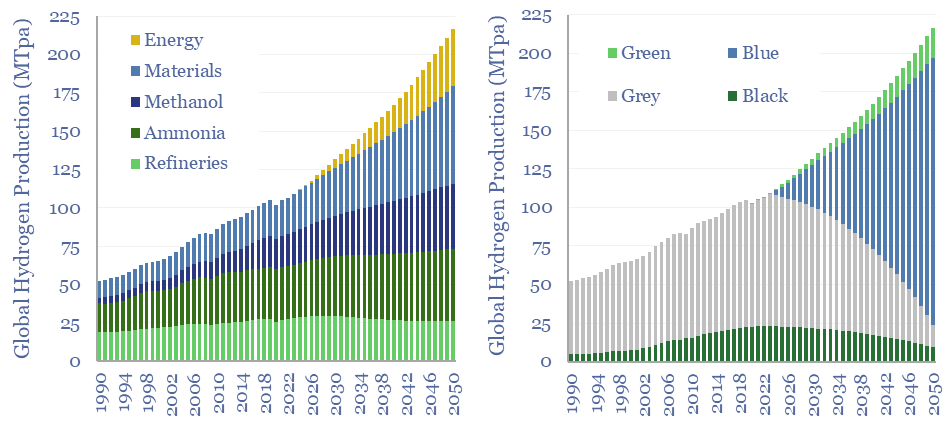

Hydrogen evolution: outlook for industrial gases?

110MTpa of hydrogen is produced each year, emitting 1.3GTpa of CO2. We think the market doubles to 220MTpa by 2050. This is c60% ‘below consensus’. Decarbonization also disrupts 80% of today’s asset base. Our outlook varies by region. This 17-page note explores the evolution of hydrogen markets and implications for industrial gas incumbents?

-

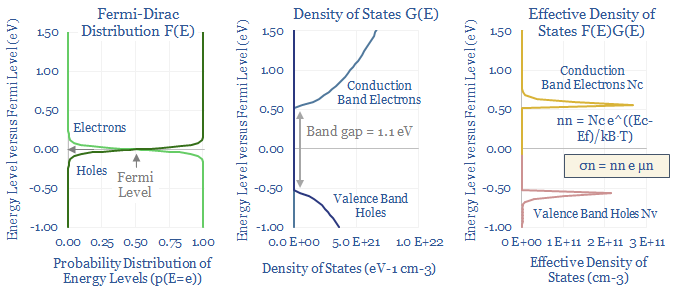

Semiconductor physics: pièce de resistance?

Semiconductors underpin solar panels, electric vehicles and electronics. Hence this 20-page note aims to explain semiconductor physics from first principles: their conductivity and resistance, their use in devices, plus implications for materials value chains and the energy transition itself?

-

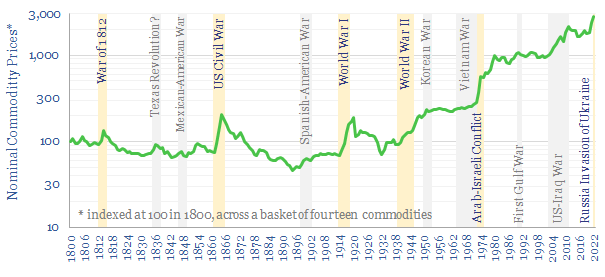

War and commodities: how do conflicts impact prices?

This 10-page note charts how fourteen commodities were affected, across a dozen conflicts, going back to 1800. During major conflicts, 95% of commodities saw higher prices. The average commodity doubled. There is a strong role for commodities hedging portfolios and even entire nations against conflicts.

-

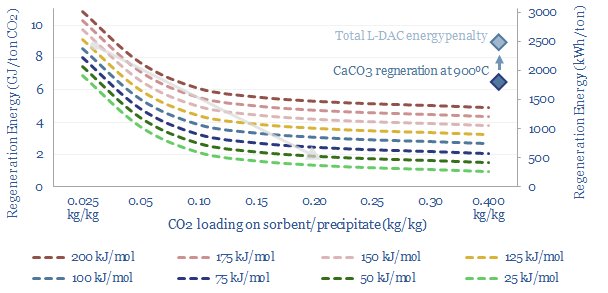

DAC to the future?

A new wave of DAC companies has been emerging rapidly since 2019, targeting 50-90% lower costs and energy penalties than incumbent S-DAC and L-DAC, potentially reaching $100/ton and 500kWh/ton in the 2030s. Five opportunities excite us and warrant partial de-risking in this 19-page report. Could DAC even beat batteries and hydrogen in smoothing renewable-heavy grids?

-

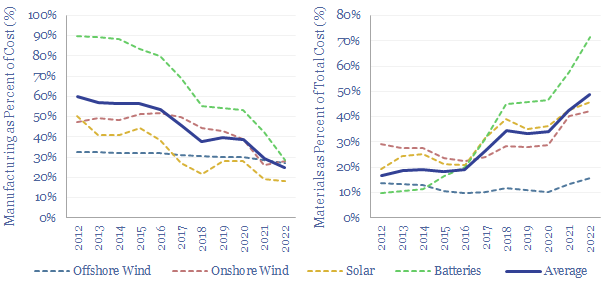

New energies: the age of materials?

Over the past decade, costs have deflated by 85% for lithium ion batteries, 75% for solar and 25% for onshore wind. Now new energies are entering a new era. Future costs are mainly determined by materials. Bottlenecks matter. Deflation is slower. Even higher-grade materials are needed to raise efficiency. This 14-page note explores the new…

-

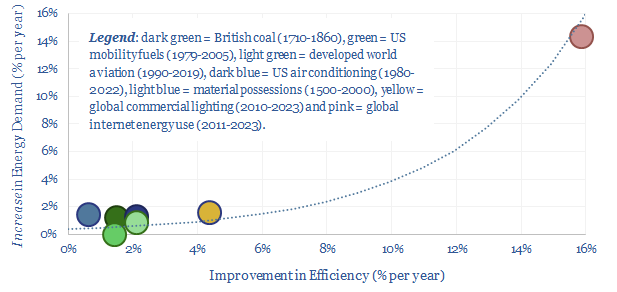

Jevons Paradox: what evidence for energy savings?

Using a commodity more efficiently can cause its demand to rise not fall, as greater efficiency opens up unforeseen possibilities. This is Jevons’ Paradox. Our 16-page report finds it is more prevalent than we expected. Efficiency gains underpin 25% of our roadmap to net zero. To be effective, commodity prices must also rise and remain…

-

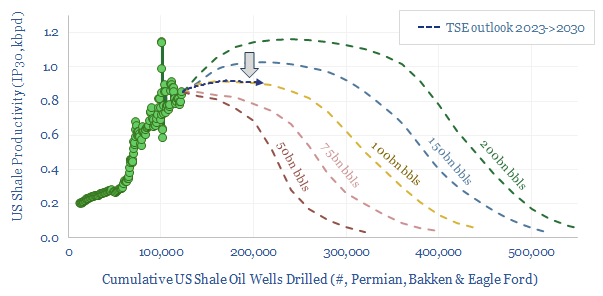

Shale oil: fractured forecasts?

This 17-page note makes the largest changes to our shale forecasts in five years, on both quantitative and qualitative signs that productivity growth is slowing. Productivity peaks after 2025, precisely as energy markets hit steep undersupply. We still see +1Mbpd/year of liquids potential through 2030, but it is back loaded, and requires persistently higher oil…

Content by Category

- Batteries (89)

- Biofuels (44)

- Carbon Intensity (49)

- CCS (63)

- CO2 Removals (9)

- Coal (38)

- Company Diligence (94)

- Data Models (838)

- Decarbonization (160)

- Demand (110)

- Digital (59)

- Downstream (44)

- Economic Model (204)

- Energy Efficiency (75)

- Hydrogen (63)

- Industry Data (279)

- LNG (48)

- Materials (82)

- Metals (80)

- Midstream (43)

- Natural Gas (148)

- Nature (76)

- Nuclear (23)

- Oil (164)

- Patents (38)

- Plastics (44)

- Power Grids (130)

- Renewables (149)

- Screen (117)

- Semiconductors (32)

- Shale (51)

- Solar (68)

- Supply-Demand (45)

- Vehicles (90)

- Wind (44)

- Written Research (354)