-

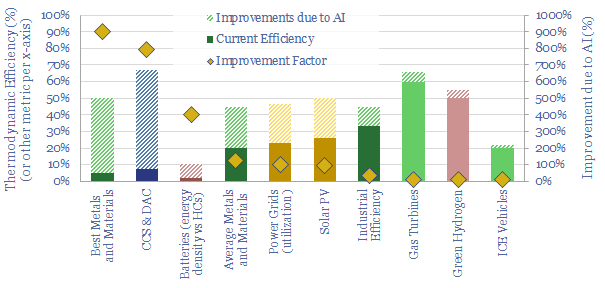

Omniscience: how will AI reshape the energy transition?

AI will be a game-changer for global energy efficiency, saving 10x more energy than it consumes directly, closing ‘thermodynamic gaps’ where 80-90% of all primary energy is wasted today. Leading corporations will harness AI to lower costs and accelerate decarbonization. This 19-page note explores opportunities.

-

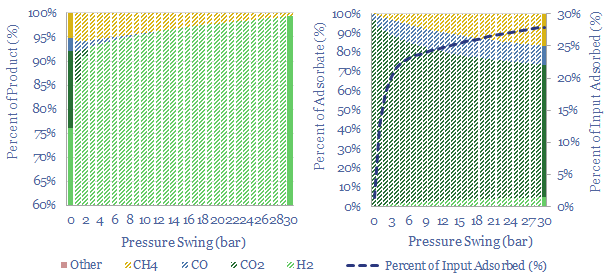

Industrial gas separation: swing producers?

Swing Adsorption separates gases, based on their differential loading onto zeolite adsorbents at varying pressures. Today, tens of thousands of PSA plants purify hydrogen, biogas, polymers, nitrogen/oxygen and possibly in the future, can capture CO2? This 16-page note explores PSA technology for industrial gases.

-

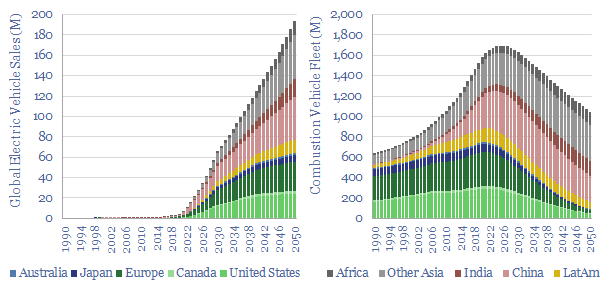

Electric vehicles: breaking the ICE?

Electric vehicles are a world-changing technology, 2-6x more efficient than ICEs, but how quickly will they ramp up to re-shape global oil demand? This 14-page note finds surprising ‘stickiness’. Even as EV sales explode to 200M units by 2050 (2x all-time peak ICE sales), the global ICE fleet may only fall by 40%. Will LT…

-

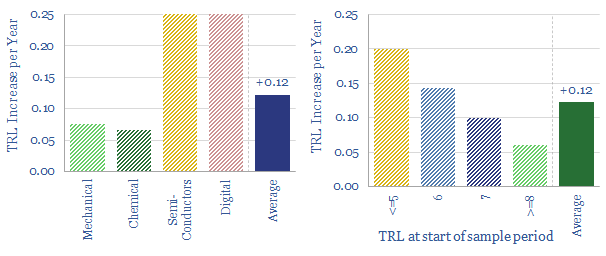

Energy technologies: the pace of progress?

This 12-page note looks back over 5-years of energy technology research. Progress has often been slower than we expected. Maturing early-stage technology takes 20-30 years. Progress slows as work shifts from the lab to the real world. We wonder whether 2050 will look more like 2023 than many expect; or if decarbonization must rely more…

-

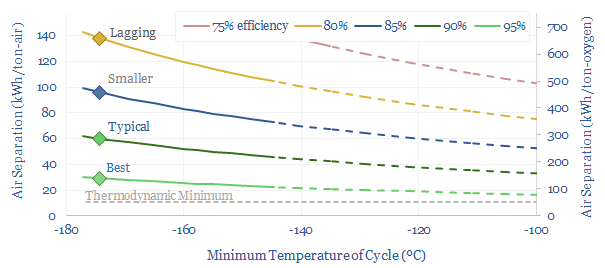

Industrial gases: out of thin air?

Cryogenic air separation is used to produce 400MTpa of oxygen, plus pure nitrogen and argon; for steel, metals, ammonia, wind-solar inputs, semiconductor, blue hydrogen and Allam cycle oxy-combustion. Hence this 16-page report is an overview of industrial gases. How does air separation work? What costs, energy use and CO2 intensity? Who benefits amidst the energy…

-

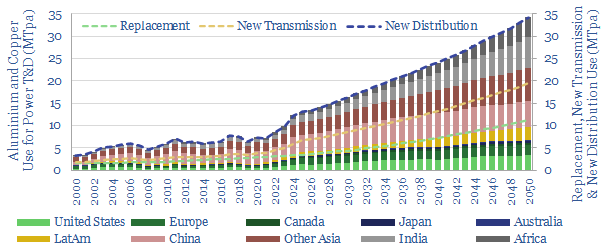

Power grids: down to the wire?

Power grid circuit kilometers need to rise 3-5x in the energy transition. This trend directly tightens global aluminium markets by over c20%, and global copper markets by c15%. Slow recent progress may lead to bottlenecks, then a boom? This 12-page note quantifies the rising demand for circuit kilometers, grid infrastructure, underlying metals and who benefits?

-

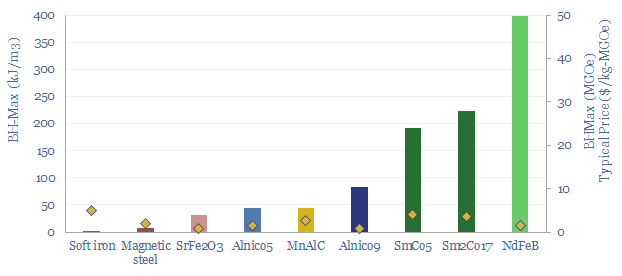

Magnets and energy: fundamental attraction?

Electric currents create magnetic fields. Moving magnets induce electric currents. These principles underpin 95% of global electricity. 50% of wind turbines and 95% of electric vehicles use permanent magnets with Rare Earth metals. This 15-page overview of magnets covers key concepts and controversies for energy transition.

-

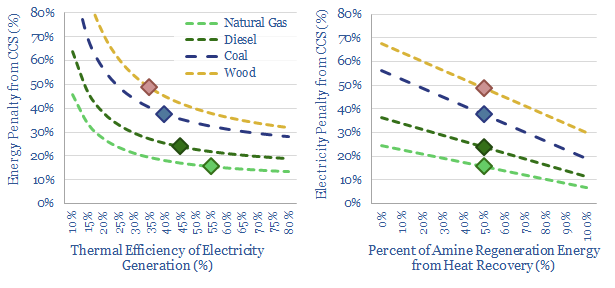

Post-combustion CCS: what energy penalties?

A thermal power plant converts 35-45% of the chemical energy in coal, biomass or pellets into electrical energy. So what happens to the other 55-65%? Accessing this waste heat can mean the difference between 20% and 60% energy penalties for post-combustion CCS. This 10-page note explores how much heat can be recaptured.

-

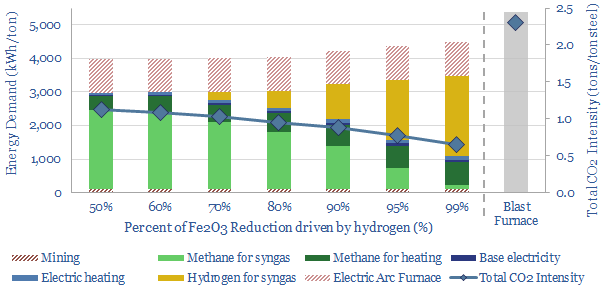

Blue steel: construction boom?

The DRI+EAF steel pathway already underpins 6% of global steel output, with 50% lower CO2 than blast furnaces. But could IRA incentives encourage another boom here? Blue hydrogen can reduce CO2 intensity to 75% below blast furnaces, and unlock 20% IRRs at $550-600/ton steel? This 13-page report explores who benefits.

-

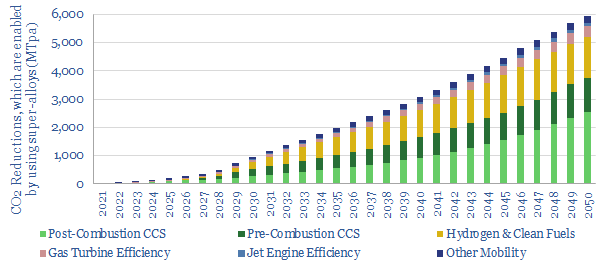

Super-alloys: what role in energy transition?

Super-alloys have exceptionally high strength and temperature resistance. They enable 6GTpa of decarbonization, across efficient gas turbines, jet engines (whether fueled by oil, hydrogen or e-fuels), vehicle parts, CCS, and geopolitical resiliency. Hence this 15-page report explores nickel-niobium super-alloys’ role in energy transition.

Content by Category

- Batteries (89)

- Biofuels (44)

- Carbon Intensity (49)

- CCS (63)

- CO2 Removals (9)

- Coal (38)

- Company Diligence (94)

- Data Models (838)

- Decarbonization (160)

- Demand (110)

- Digital (59)

- Downstream (44)

- Economic Model (204)

- Energy Efficiency (75)

- Hydrogen (63)

- Industry Data (279)

- LNG (48)

- Materials (82)

- Metals (80)

- Midstream (43)

- Natural Gas (148)

- Nature (76)

- Nuclear (23)

- Oil (164)

- Patents (38)

- Plastics (44)

- Power Grids (130)

- Renewables (149)

- Screen (117)

- Semiconductors (32)

- Shale (51)

- Solar (68)

- Supply-Demand (45)

- Vehicles (90)

- Wind (44)

- Written Research (354)