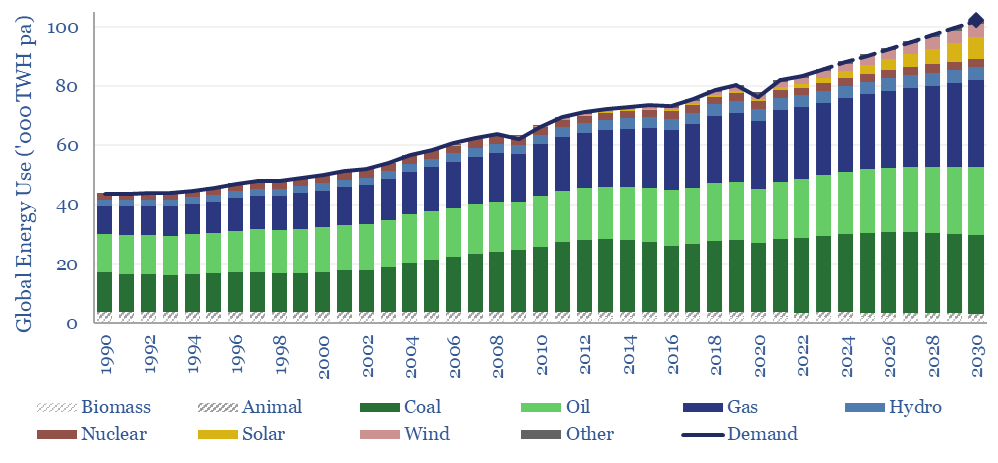

This global energy supply-demand model combines our supply outlooks for coal, oil, gas, LNG, wind and solar, nuclear and hydro, into a build-up of useful global energy balances in 2023-30. Energy markets can be well-supplied from 2025-30, barring and disruptions, but only because emerging industrial superpowers will continuing using high-carbon coal.

Useful global energy demand grew at a CAGR of +2.1% per year since 1990, and +3.0% in 2015-19. Demand ‘wants’ to grow by +2% per year through 2030, due to higher populations and rising living standards (model here), but the dawn of the AI age increases the CAGR to 2.5% pa.

Renewables are exploding, especially solar additions, per our model here. Our latest numbers, updated again in early 2025, see solar module installations (on a DC basis) rising from 450GW in 2023, to 600 GW-DC in 2024, 700GW in 2025 and a full 1TW pa by 2028. This takes wind and solar from 5% of total useful global energy in 2024 to 12% by 2030.

Demand for hydrocarbons nevertheless increases too, in order to satisfy rising energy demand. Global coal use hit a new all time high of 8.8GTpa in 2024 and is seen rising mildly through 2027 (model here).

Oil plateaus at 104Mbpd in 2026-30 (model here) as OPEC and US shale (model here) offset decline rates elsewhere.

LNG supplies rise from 400MTpa in 2023 to 660MTpa by 2030 (risked) but the increases are mainly 2027+ (model here) while the call on US shale gas now looks like the stuff of dreams.

Other variables in the model include rising energy efficiency (note here), the need for a nuclear renaissance (note here), ideally scaling back the use of deforestation wood (model here) and others that can be flexed.

What is important about this balance is that it must balance. The first law of thermodynamics dictates that energy demand cannot exceed supplies. In the short-medium term, recent evidence suggests that emerging world coal is the balancing line, as China and India have consistently prioritized self-sufficient energy over decarbonization.

All of the other lines in the model can be stress-tested. Our own preferences would see more solar and more natural gas to meet more energy demand, which can genuinely improve human outcomes, both in energy transition and beyond. However our predictions for what will happen now make 1.5-2C climate targets feel challenging, and we are trying to do a better job of objectively forecasting what will happen.